While I would love for the pain to be over for the crypto industry, there are still a number of clouds on the horizon.

Here's a comprehensive list of the potential risks you should be keeping an eye on.

This is a must read thread if you're in crypto 🧵

1) @DCGco

@BarrySilbert has built DCG into a crypto empire that's been around since 2015.

Their holding companies include @GenesisTrading, @Grayscale and @CoinDesk.

Cracks have already begun to form with Genesis considering bankruptcy + firing 30% of their workforce.

Right now there's a multi-billion $ hole in Genesis' balance sheet from the crypto contagion.

How that hole is handled could have a massive impact on the industry.

Barry is the largest holder of BTC, if he has to market sell any of it, it could pull the markets down further.

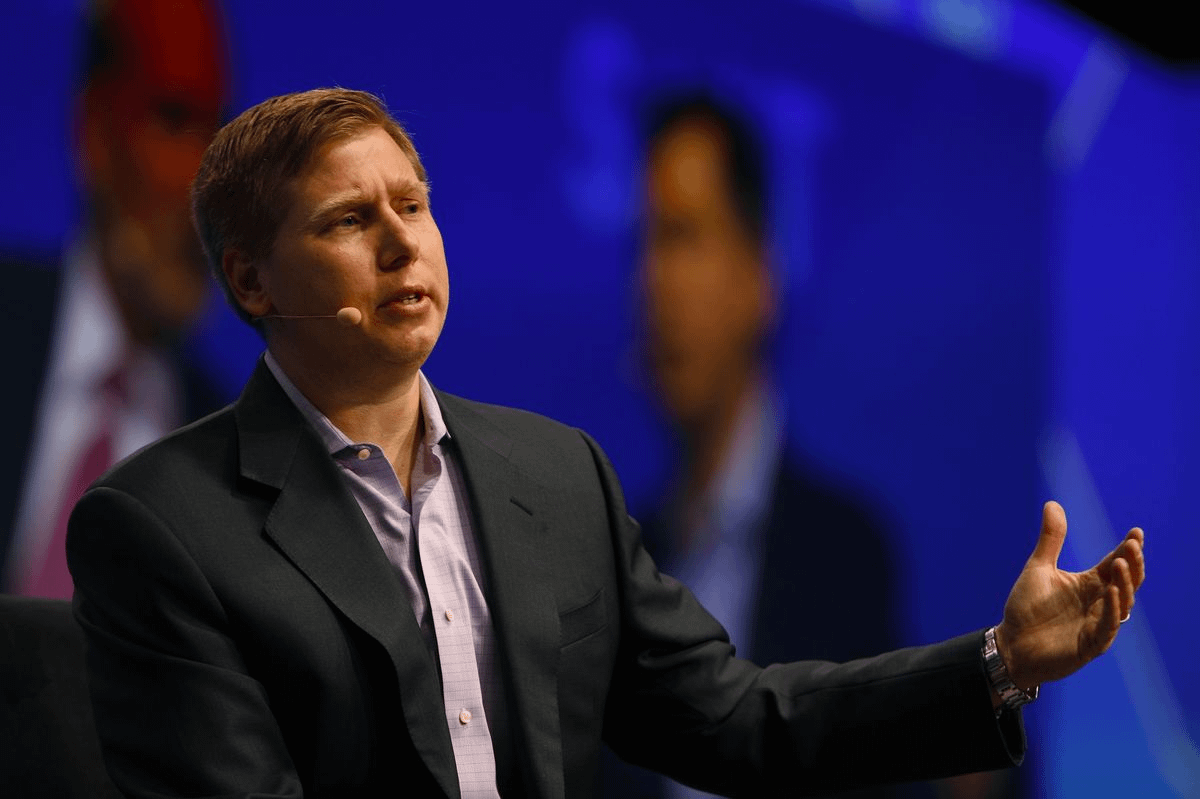

2) @silvergatebank

Silvergate is the crypto-focused bank that connects all of the top crypto CeFi players.

They run the Silvergate Exchange Network, which is crucial to helping move $ around the crypto ecosystem...

twitter.com/alex_valaitis/status/1600206916352757760?s=20&t=jU1RN8D7hUQm1pX6o99fJw

Let's just say things aren't looking good for Silvergate:

-Stock down 91%

-$8 billion in withdrawals in the final months of 2022

-Cut 40% of their workforce

If Silvergate goes under, it's unclear who will step in to fill their role.

3) @justinsuntron projects

Justin Sun is one of the crypto OGs that has somehow managed to avoid the main character arc

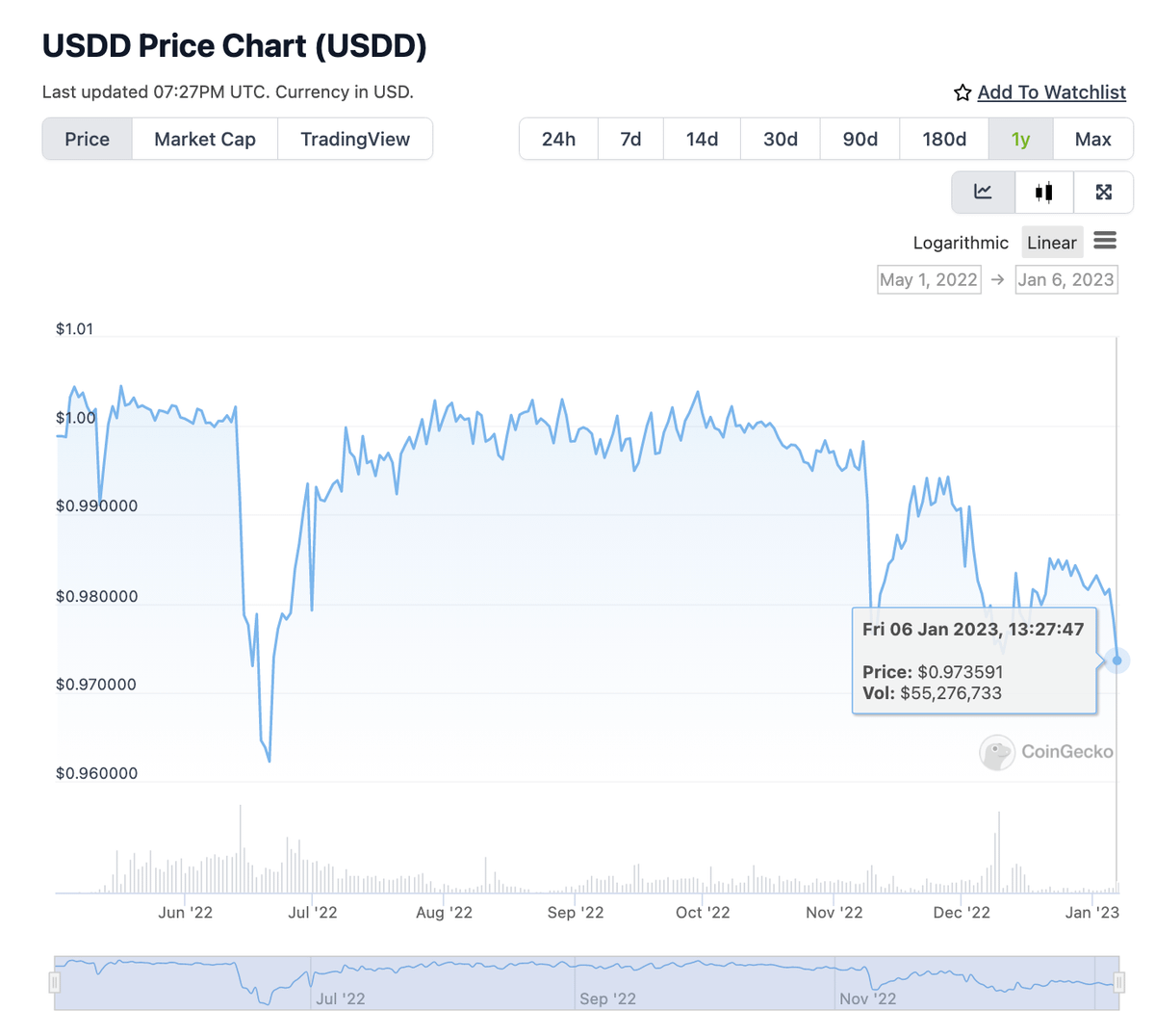

He launched Tron which is in the top 20 by market cap, has a ~$1B stablecoin $USDD and 'advisor' to @HuobiGlobal

This combo has proved dangerous historically

There's a few ways things could go wrong:

-$USDD de-pegs (hasn't been at $1 since Oct.)

-Troubles at Huobi (20% of staff just laid off)

-Funny business with how Justin was using $TRON and/or $USDD.

i.e. Did he use it as collateral in areas he shouldn't have...

There's also the questionable relationship between Justin, @cz_binance, and @tether.

Not enough characters, but consider that Justin has been moving $100s of millions in and out of Binance in recent weeks.

Watch this Chico Crypto video for more context:

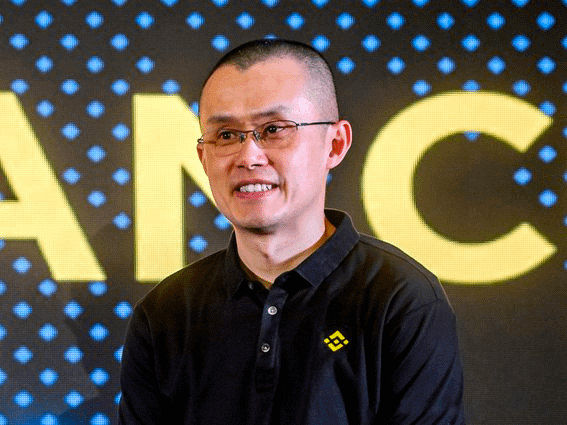

4) @cz_binance and @binance

Speaking of Binance, they've grown even stronger in the wake of the FTX fallout.

They are responsible for 10X the volume of the next largest exchange & many are starting to label them as "too big to fail"

But is this who we want leading our space? Consider:

-CZ has operated from off-shore locations for years (his location is basically unknown)

-Binance is currently under U.S. investigation

-They launched/run the 3rd largest blockchain @BNBCHAIN while pretending it's decentralized

The risk here would be that Binance committed any type of fraud similar to FTX. Such as:

-Commingling customer deposits from different GEOs, market makers, or hedge funds

-Using $BNB or $BUSD as vaporware collateral

-U.S. brings down the hammer super hard on them

5) @Tether_to

Tether remains the largest stablecoin in the world with a market cap of $66B.

It remains a safe harbor for many investors during crypto winters & is deeply integrated into DeFi ecosystems...

However, Tether has a history of not operating from a point of transparency.

For a very long time, it was widely believed that Tether wasn't backing their reserves 1:1.

Tether also has ties to Alameda/FTX & shady characters like Dan Friedberg (just google him + Tether)

The scariest part of all these looming risks is that one or more of them are likely connected to one another. Which would only multiply the contagion if another goes down.

Almost all of the major CeFi players took irresponsible amounts of risk during this last cycle...

Important point:

Notice what I'm NOT concerned about for the future...decentralized protocols & apps

Bitcoin continues to mine blocks, developers continue to launch exciting new use cases

And yet, the irresponsibility of CeFi players risks a negative short term impact on them

Obligatory final point here:

It's time to return to crypto fundamentals. NOT your keys, NOT your coins.

Get off exchanges, manage personal risk and stay focused on the long term vision.

This industry rewards those who do this, and ruthlessly punishes those who don't.