Today in @beondeck ODF14, we heard from Ryan O'Conor from @Carta about

2021/22 startup equity trends,

co-founder splits data,

and more insights from Carta's extensive data trove

📝 sharing my notes:

Ryan recently joined Carta to work on business development for VC & Accelerators as well as top partners, like On Deck.

Before Carta, Ryan was the Partnerships Manager at @Doordash and a founder. He's invested and advised in startups.

background about Carta - they are more than just cap table management

What questions employees are asking about equity compensation and the equity basics they should know

Options and equity compensation was first made notorious in 1957 with Fairchild Semiconductor

Today, stock options are common

Employees should know:

type of shares

total no. of shares

strike price

key dates

vesting schedule

You need to think through the tax implications of different types of equity awards.

In later stages, Series D/E - typically companies move from stock options to RSUs.

Vesting Period refers to the time or milestones that need to be met before employees receive their equity awards.

Typical setup is 4 year vesting with a 1 year cliff.

PTE period - how long an employee has to exercise options if they are terminated

Option pool - amount of common stock reserved for employees

On advisor equity, the mean equity grant is 0.25%

Under 0.5% is the sweet spot.

Advisor equity should always have a vesting schedule.

If you do it with performance criteria, think hard about the outcomes and reassess constantly.

Typically advisory equity is on a 2 year vesting schedule.

key lessons for advisor equity:

- align incentives

- be clear with commitment

- be clear on outcomes

- consider asking for investment

How does equity evolve through funding rounds?

median equity plans hovers around 12% for early stage cos

co founder split - the majority of companies do not split 50/50

How to plan for equity allocation when it comes fundraising and compensating the first 10 hires, advisors, and executives?

You need to incentive with equity.

Median - 1% given to first strategic hire.

But if varies by industry. There is no one standard.

Equity comp for exec level hires varies widely by role and function.

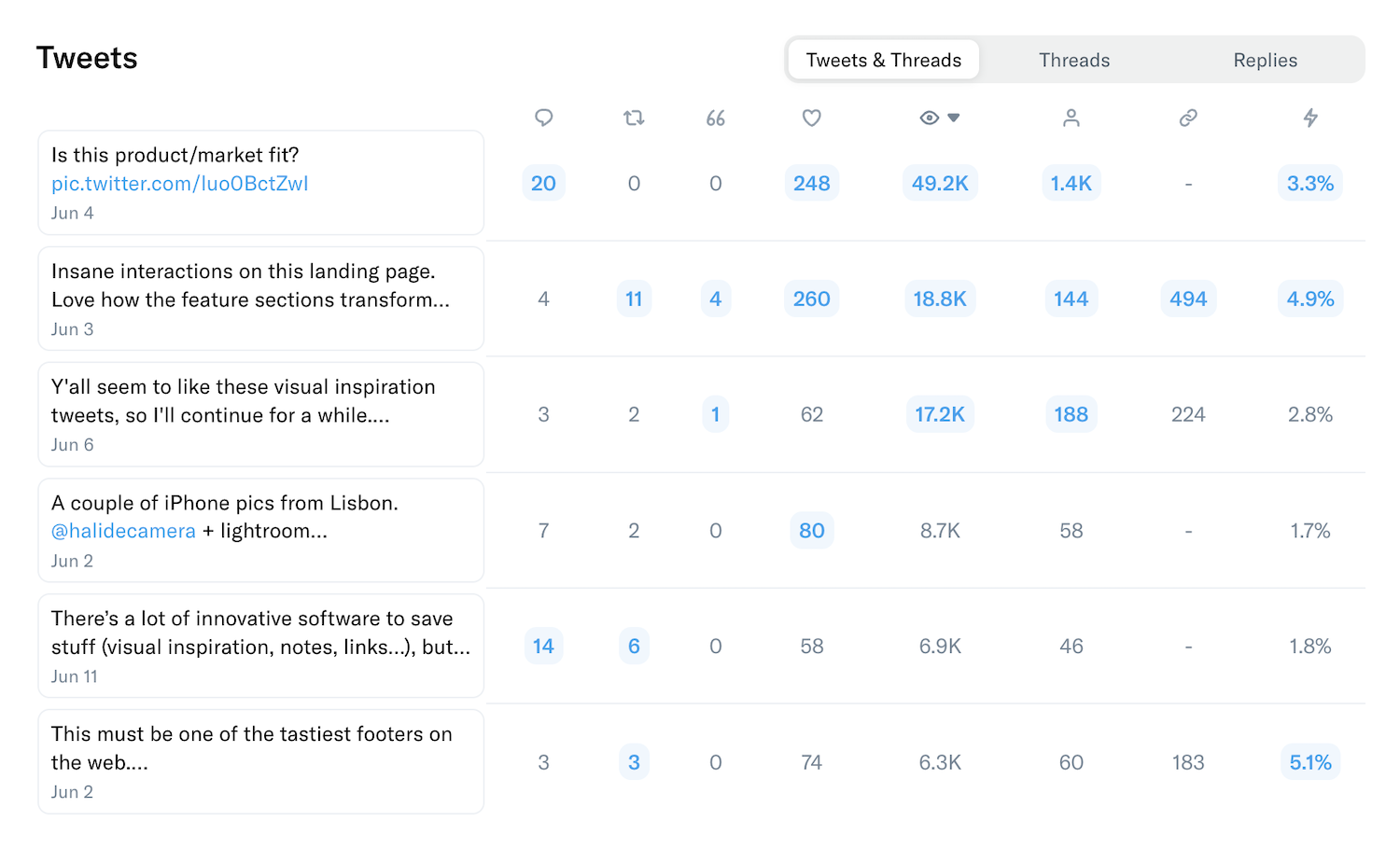

In 2022, layoffs have increased in Q2.

There's a strong pool of talent there that is looking for a new opportunity.

Only 42% of vested options were exercised in Q2.

Fluctuations in markets causes uncertainty around equity.

They're also seeing a trend in post-termination periods. As layoffs happen, employees are offering longer PTE periods. Standard is 90 days.

What happened it 2021 with respect to trends around fundraising valuations, round size, and dilution?

2021 was a banner year for number of rounds and cash raised.

2022 is going to be down.

Seed and Series A are taking larger % of funds raised in 2022.

It's a pull-back at later stage. Longer path to IPO.

Investors are shifting earlier to de-risk portfolios.

H1 2022 saw funding declines in every sector

Data & security was the exception with minimal gain

By US state, the Northeast was hit harder than others.

Rounds by stage

Seed stage valuations have been resilient. Biggest decrease in Series B.

Valuations show a similar trend.

Series B - down 9% YoY

Series A - up 18% YoY

Seed - up 31% YoY

Definitions - Series A is first priced round.

Seed is around SAFEs and convertibles.

Series C/D/E+ round sizes are all down YoY.

Massive drops and down rounds.

Round sizes and valuations are taking a step back.

If you're worried about current market trends, early stage seed / Series A may be better able to weather the storm.

Founders are showing more leverage in negotiations and reducing dilution. There's still a lot of cash chasing fewer deals.

Time between rounds is getting longer.

Median time between A-B and B-C is nearly two years.

Plan accordingly

Market turbulence brings more bridge rounds, especially at later stages.

Keep in mind if your milestones aren't being met for Series A, you may consider a bridge round.

Everything you should know about SAFEs, including structure, price caps, distribution of notes, and dollars raised

Pre seed and post seed companies opt for SAFEs over convertible notes.

Anecdotally, if you're raising below $3m then there is probably a preference for a SAFE as a founder.

For investors, it's hard to value if you're raising less than $3m. So they'll tend to opt for SAFEs.

Price cap, no discount is the most common SAFE type.

People may come in later and ask for different terms. Try to standardize it. It will make your life easier.

The standard YC SAFE is post-money.

Post money is more favorable to investors. Pre money is better for founders.

Median Price Cap is starting to fall from a peak of $15m to $12m.

39% of seed rounds have less than 5 notes.

Total amount raised on SAFEs

That's all the data that was shared today!