1/ The Rise of Fractional Real Estate: What You Need to Know About This Emerging Trend

Fractional real estate is a way of investing in properties without buying them outright.

You can own a share of a property and earn income from rent or appreciation.

2/ What is fractional real estate?

A form of co-ownership where you buy a fraction of a property

A way to access high-end properties with lower capital and risk

A flexible and diversified investment strategy

3/ What are the benefits of fractional real estate?

You can choose the properties that suit your preferences and goals

You may be able to enjoy tax benefits such as depreciation and deductions

You can avoid the hassle of direct property management and maintenance

4/ What are the risks of fractional real estate?

You need to do your due diligence on the property, the platform, and the co-investors

You need to be aware of the fees, liquidity, and legal issues involved

You need to be prepared for market fluctuations and potential disputes

5/ What kind of properties are available?

Depending on the platform available properties can be residential or commercial

Encompassing the spectrum from Single Family Housing to Strip Malls to Industrial Complexes.

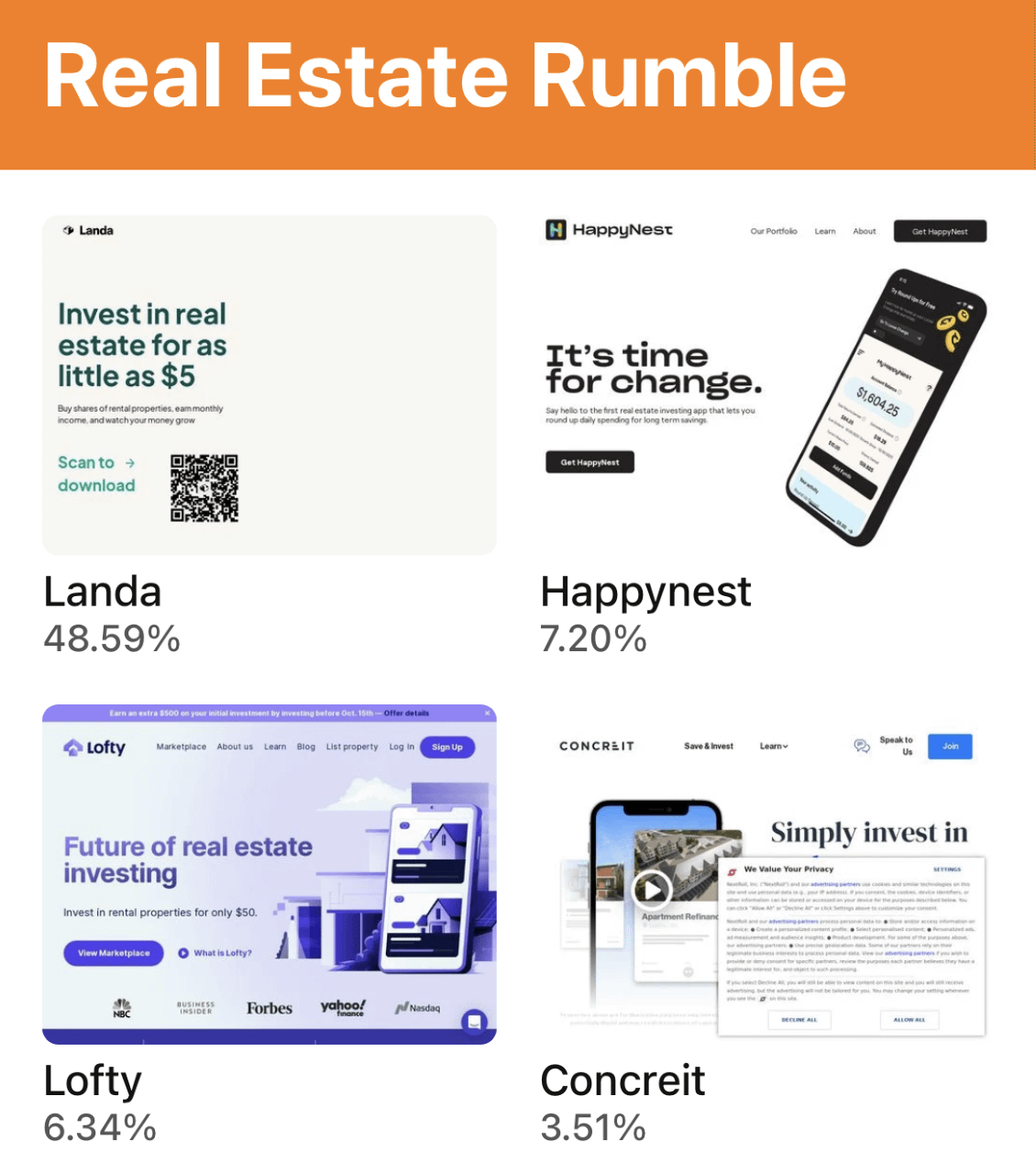

6/ Fractional real estate is an exciting opportunity for investors and owners alike. Multiple fractional real estate platforms have been developed, with more on the way, that provide access to this valuable asset class with a low barrier to entry.

7/ As an adopter of the technology, and an investor in this emerging trend, I track my successes and failures and publish them monthly via updates to my free app - #RealEstateRumble: bit.ly/3yppi1u - download or bookmark now as new updates are slated to begin next week!