The $ETH Merge is in a week.

It's causing some major ripple-effects.

Here what's going on + some information on how to prepare / profit 👇

The Merge is a BIG event for @ethereum.

If you don't know much about it, we made a primer video + 🧵 explaining the Merge.

twitter.com/0x_illuminati/status/1546581321287286784?s=20&t=r_z3dKm781Aw_0j1P49ogA

Some ripple effects of the Merge:

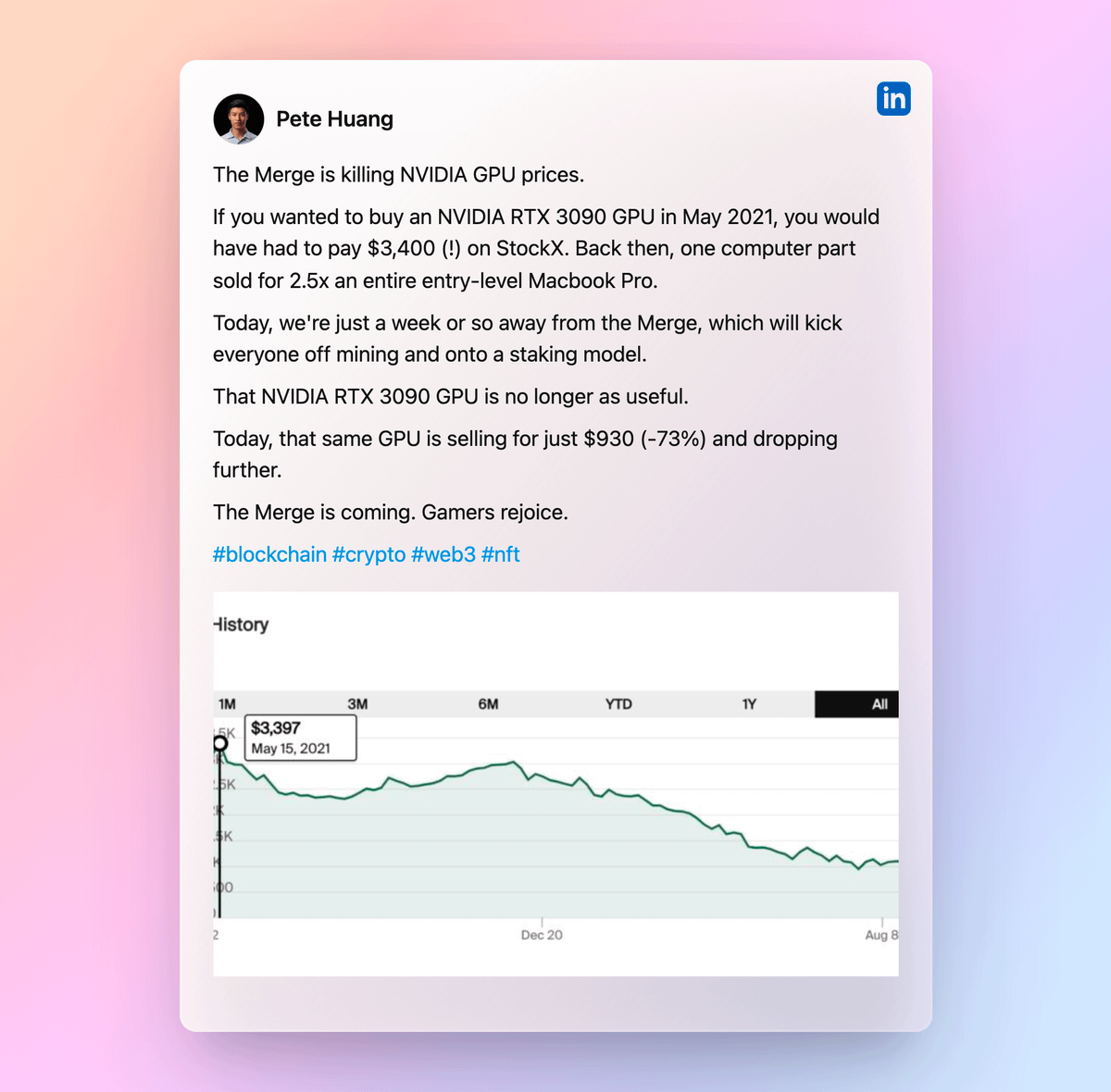

1. GPU prices are plummeting - down 73% as PoW mining will soon become a lot less attractive.

(Credit to Pete Huang from Coinbase - he's a great person to follow on LinkedIn)

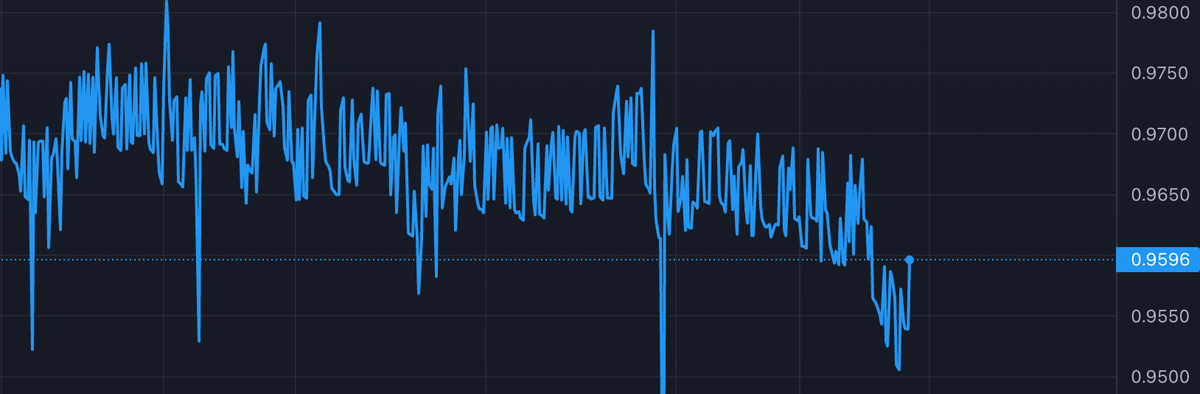

2. $stETH price has fallen to 0.9596 $WETH.

Likely because people are trying to stack native ETH for the ETH PoW snapshot.

(Source: @dexscreener)

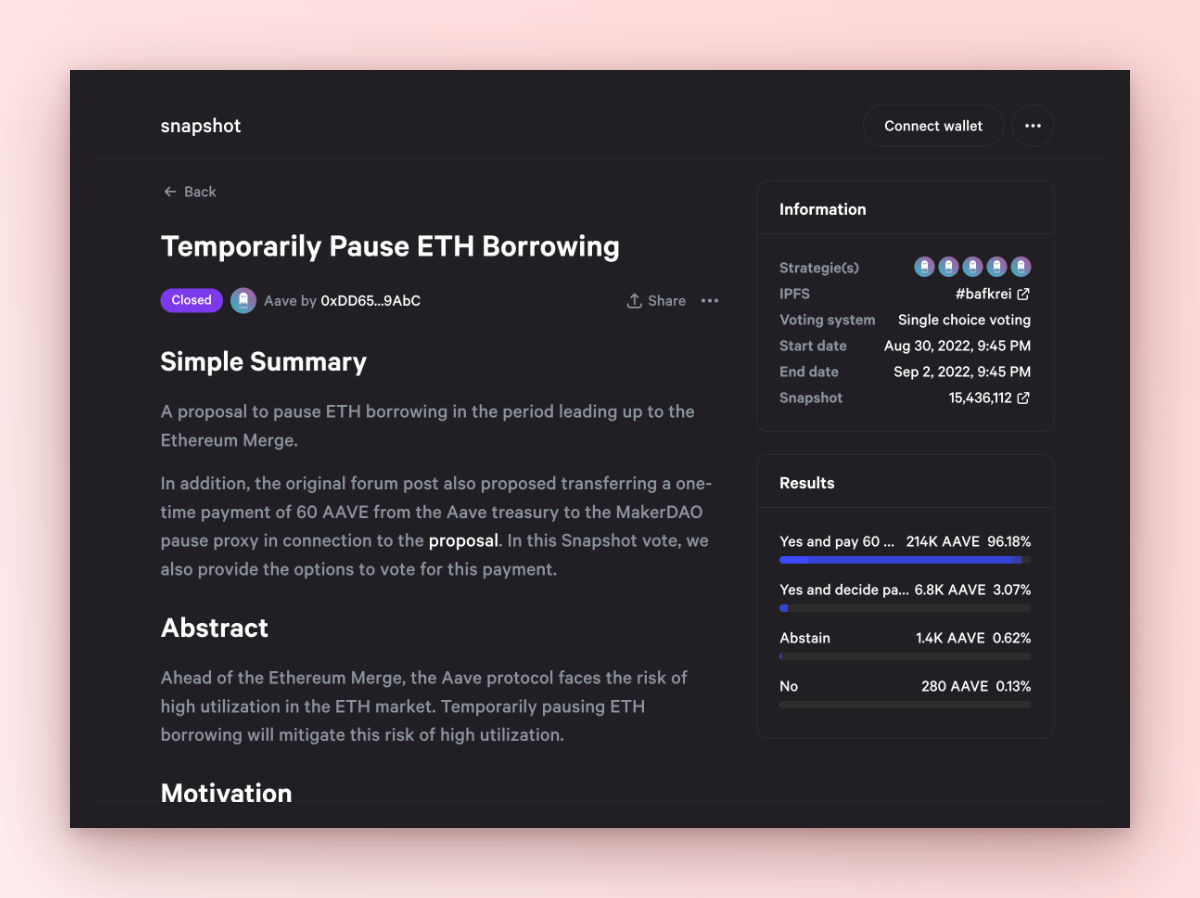

3. The utilization and interest rates for borrowing $ETH on @AaveAave shot up as people started stacking ETH to farm the ETH PoW snapshot.

twitter.com/hufhaus9/status/1567126156134027272

4. So much so that @AaveAave has temporarily paused borrows on the $ETH market, fearing the high utilization might interfere with liquidations and increase chances of insolvency for the protocol.

They are also worried about $stETH price deviating further causing causing destructive domino effects.

More than 96% voted yes to temporarily pausing $ETH borrows on @AaveAave.

How to prepare / profit

---

This thread by @lemiscate is an excellent guide on what to do (and what not to do)

twitter.com/lemiscate/status/1567081095639826440

The gist of it:

• Doing nothing is ok (seriously!)

• Get your money out of CeFi as they won't support ETH PoW.

• CEXes are also likely to stop withdrawals close to the Merge.

• Mainnet DeFi plays like lending $ETH can be profitable

• You could buy $stETH (or other liquid staking ETH tokens) at a discount

• Monitor L2s for arb opportunities

If you're planning to borrow ETH to farm ETHPoW, @BarryFried1 points out that @eulerfinance has some very cheap rates.

Barry is a DeFi giga-🧠 – definitely worth following.

twitter.com/BarryFried1/status/1565074228684144642

But don't be blindly bullish.

• It might be underwhelming - won't change all that much immediately.

• It could be a "sell the news" event.

• You could lose $ trying to play the merge.

• There could be destructive domino effects (like stETH depeg)

And of course, there's always a chance that it could all go catastrophically wrong and doom crypto forever.

(unlikely, but anything is possible 😅)

twitter.com/shivsakhuja/status/1539124331002871809?s=20&t=yp1QqMIuzQpL3LZAF-uRWA

Follow me @shivsakhuja and subscribe to my newsletter to receive important updates and interesting web3 ideas directly in your inbox.

getrevue.co/profile/shivsak

Finally, here are some 🧵s explaining the Merge in more detail if you want to dive deeper.

twitter.com/shivsakhuja/status/1528553462220197889?s=20