1/🧵The Death of King Oil

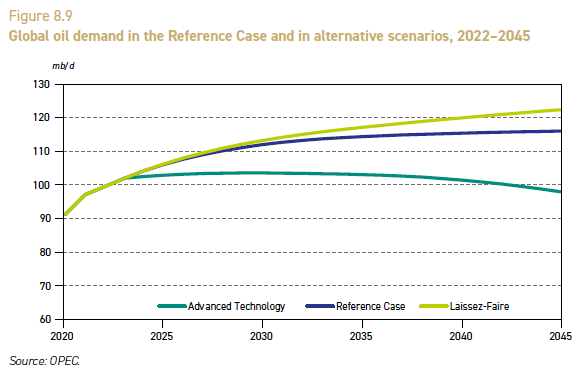

Will global oil demand peak in 2030 then decline quickly @IEA or peak in 2045 and decline slowly @OPEC?

The answer has significant implications for #Canada and oil-producing provinces, especially #Alberta.

#OOTT #ABleg #cdnpoli

share.transistor.fm/s/72e05025

2/Framing the peak oil demand discussion: Fast vs slow energy transition

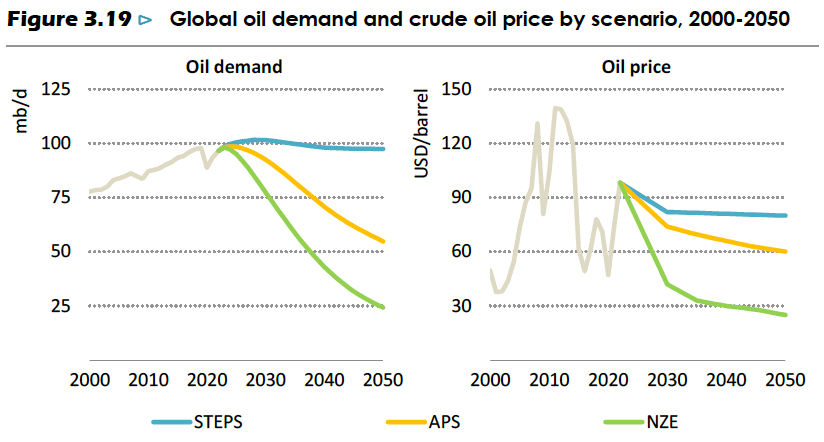

International Energy Agency (IEA) = fast

*Peak oil demand by 2030, short plateau, rapid decline in 2 of 3 scenarios

OPEC = slow

*Peak oil demand in 2045, long plateau, slow decline

energi.media/energi-notes/world-petroleum-congress-fighting-to-redefine-energy-transition-on-its-terms/

3/My hypothesis: IEA's modelling and analysis is more credible than OPEC's.

Several of OPEC's key assumptions (discussed later in this thread) are falling apart only a few months after the release of World Oil Outlook 2045.

opec.org/opec_web/en/press_room/7225.htm

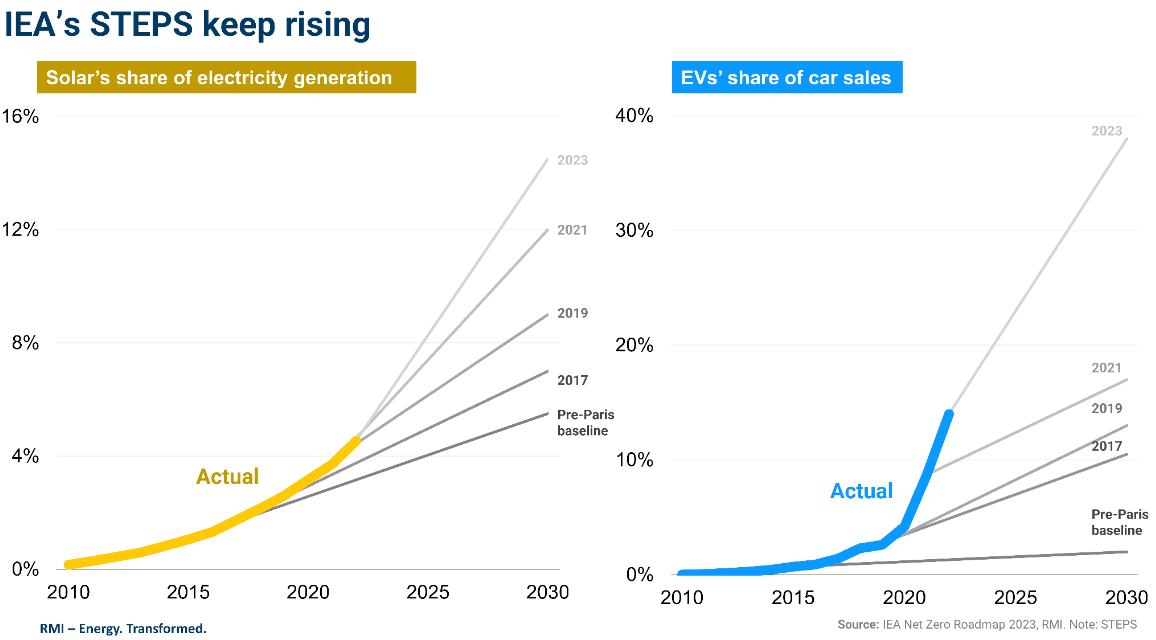

4/If anything, IEA studies have historically UNDER-ESTIMATED the pace of the energy transition.

Other analysts have said the energy transition is accelerating so rapidly they revise forecasts multiples during a year.

Conclusion: Fast transition transition is more likely.

5/IEA's World Energy Outlook 2023 is my main source, but I also rely heavily on excellent analysis from @colinmckerrache's BloomberNEF team + my many expert interviews about the topic.

The IEA has also released many thorough energy transition studies about more specific topics.

6/In 2017 I interviewed a @WoodMackenzie economist who said oil companies are most concerned about the shape of the oil demand decline curve rather than timing of peak demand.

IEA modellers think decline curves will be steep in APS, NZE scenarios.

7/IEA scenarios:

STEPS: No new policies

*Business as usual

APS: govts follow through on announced policies

*Significant change to global energy system, but not enough to achieve 1.5C global temp rise target

NZE: net-zero emissions

*Achieves 1.5C

share.transistor.fm/s/3fe52c5f

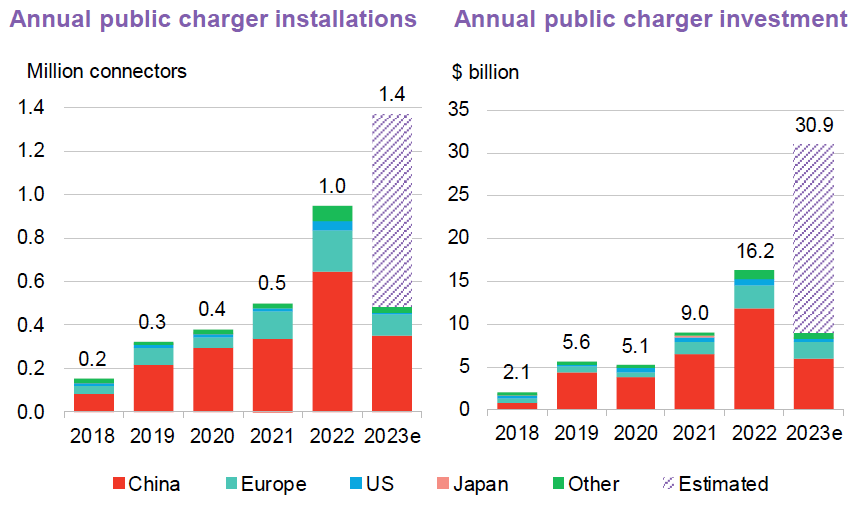

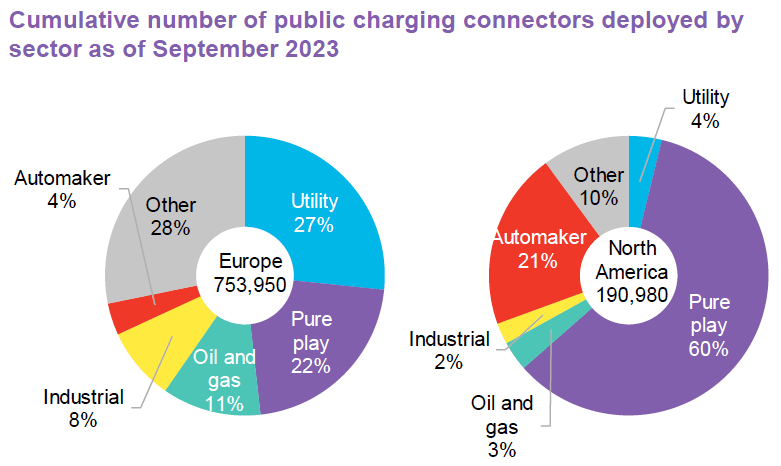

8/Predicting the future is impossible, but here's my handicapping of the IEA scenarios:

STEPS: unlikely. EVs already destroying oil demand.

APS: most likely.

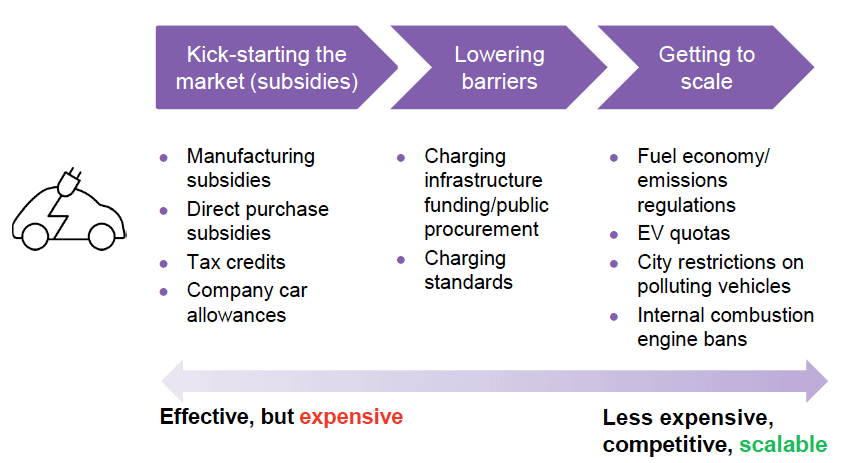

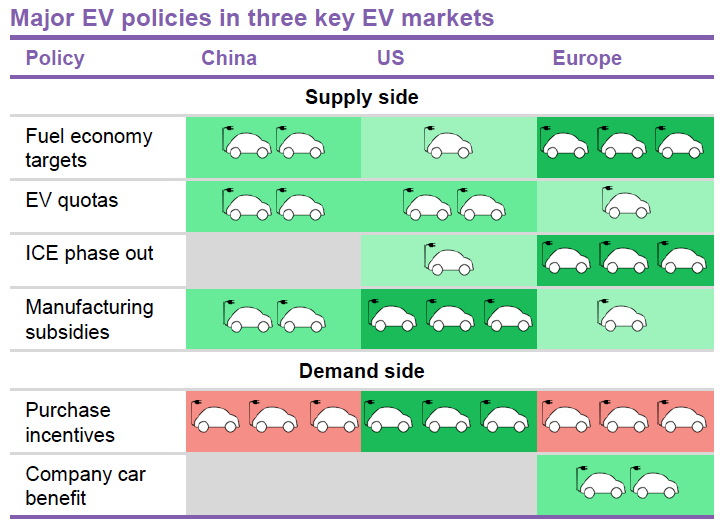

NZE: unlikely, but possible, according to current experts.

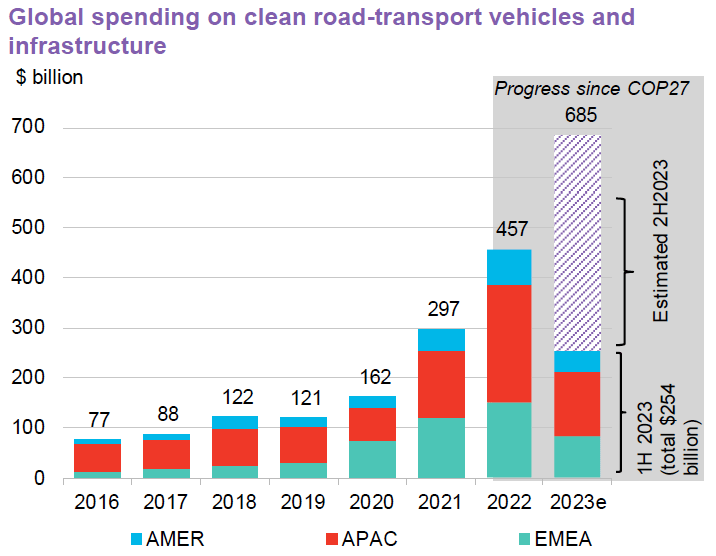

share.transistor.fm/s/e11b2525

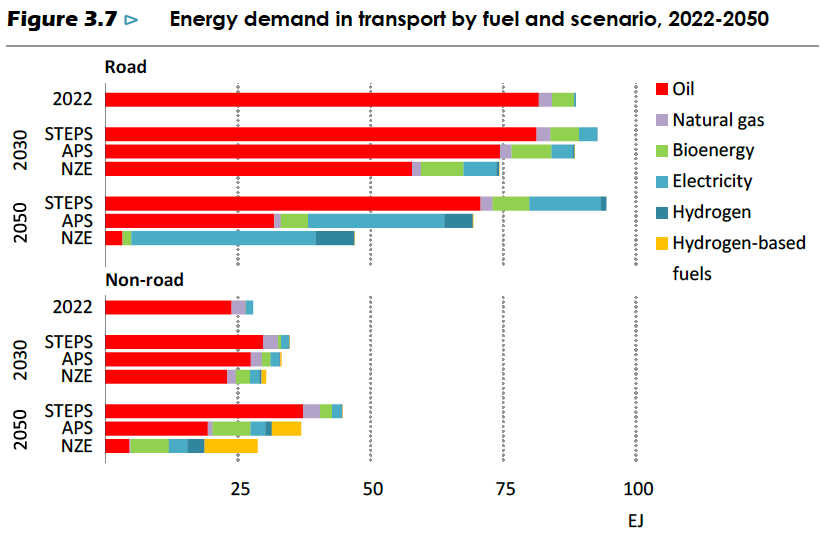

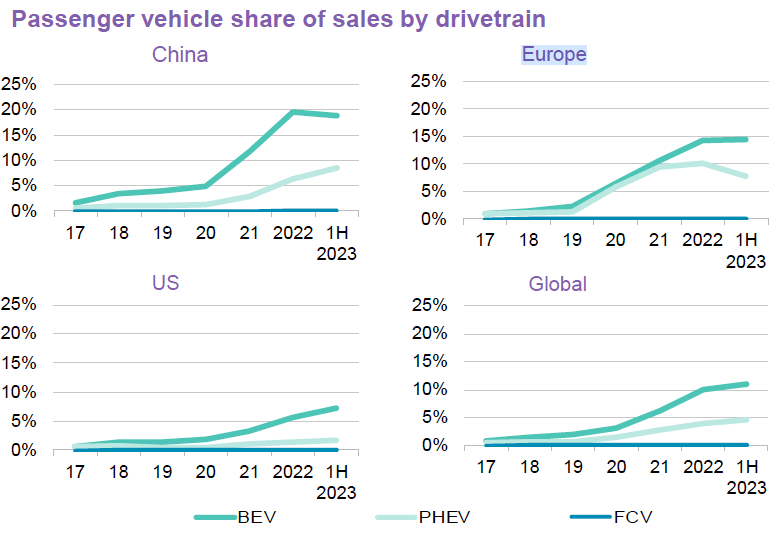

9/Rapid rise in EV sales (up 38% 2023) will have the most impact on oil demand between now and 2050.

IEA is now calling for peak oil demand in road transport by 2030 in all scenarios.

In APS scenario, demand falls a small amount by 2030, much more by 2050.

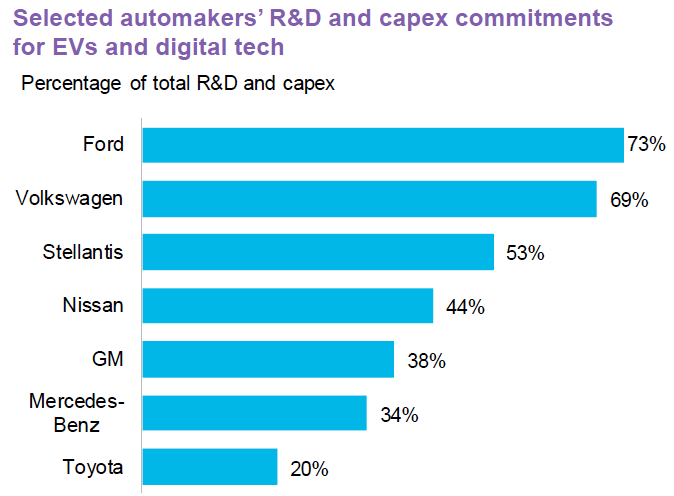

Source: WEO 2023

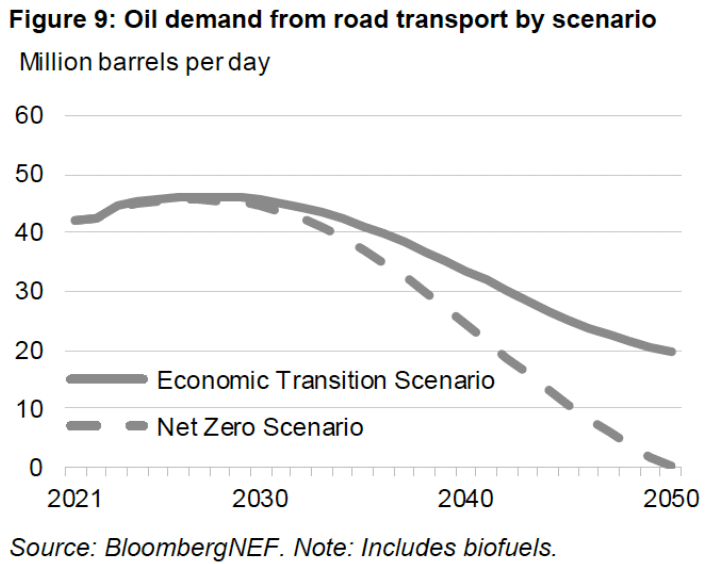

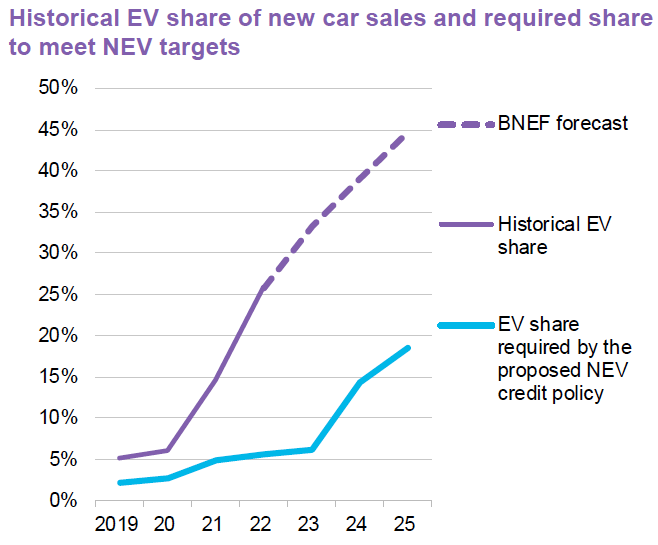

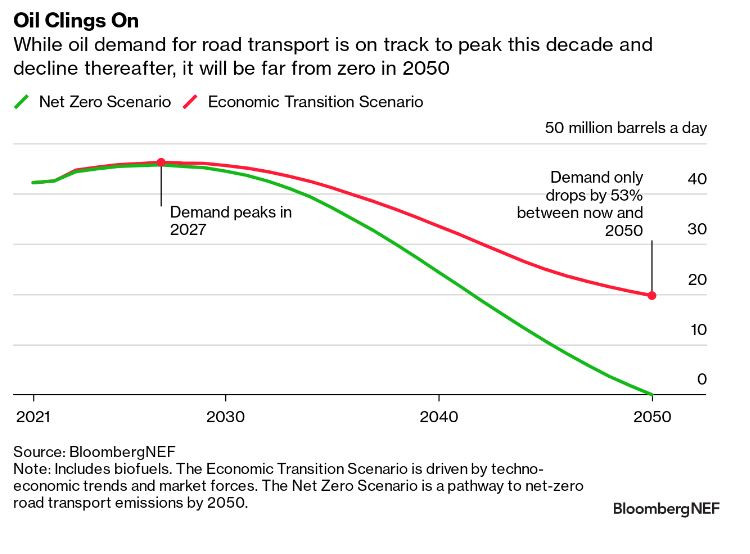

10/BNEF's Economic Transition Scenario roughly mirrors that of IEA's APS scenario.

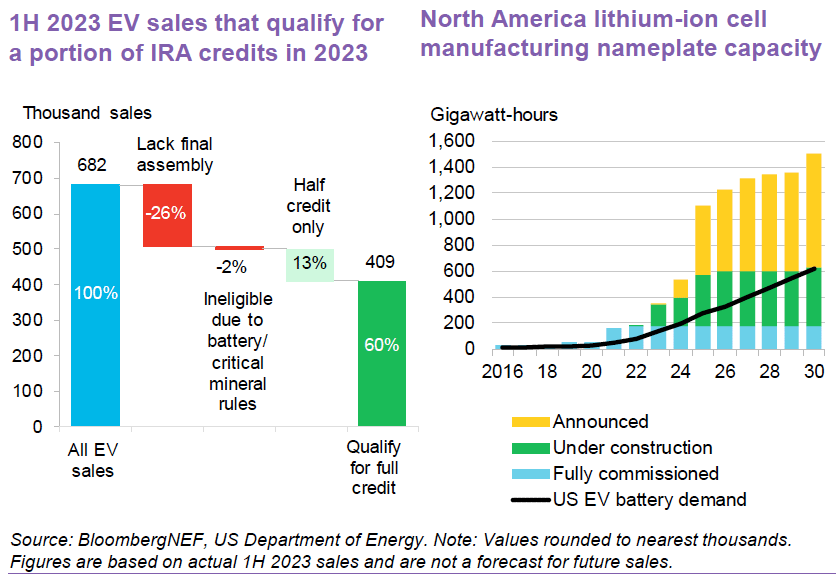

BNEF is forecasting peak oil demand from road transport in 2027, just 3-4 years away.

Demand decline begins in the early 2030s.

bloomberg.com/news/articles/2023-06-08/ev-sales-are-soaring-and-oil-use-is-about-to-peak-hyperdrive?sref=2P50Jwox

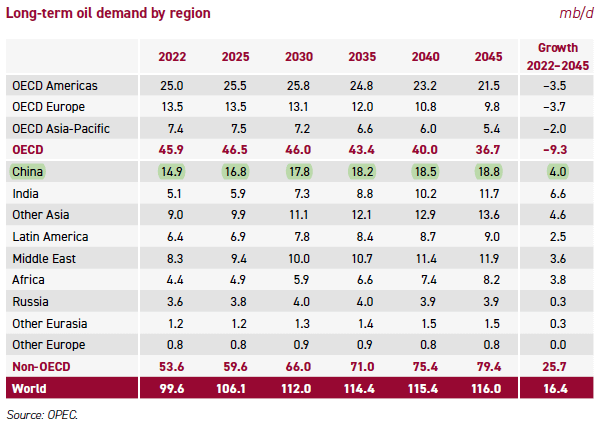

11/OPEC's World Oil Output 2045 models oil demand to rise in two scenarios and to decline only marginally in the other.

These are radically different scenarios than the IEA.

12/Why is difference between IEA, OPEC so important?

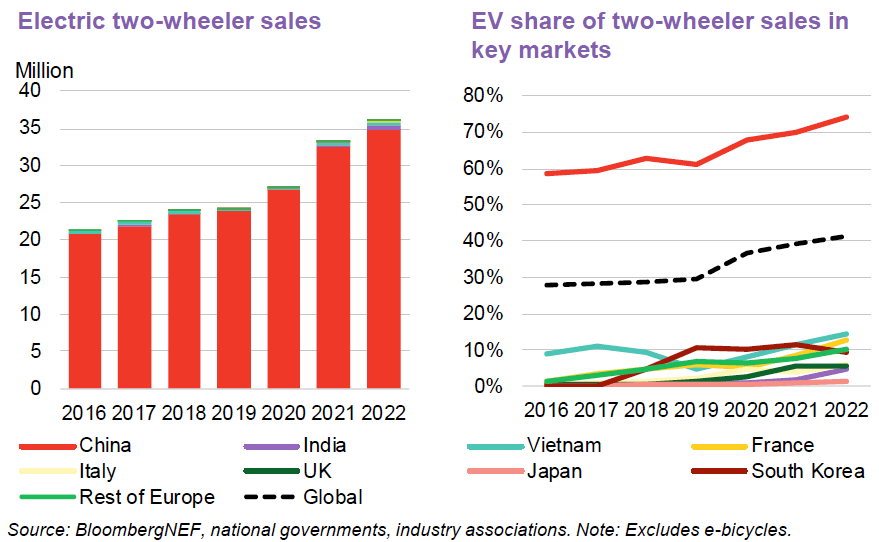

*Alberta govt endorses OPEC's assumptions, reflected in @ABdanielleSmith's Emissions Reduction + Energy Development Plan

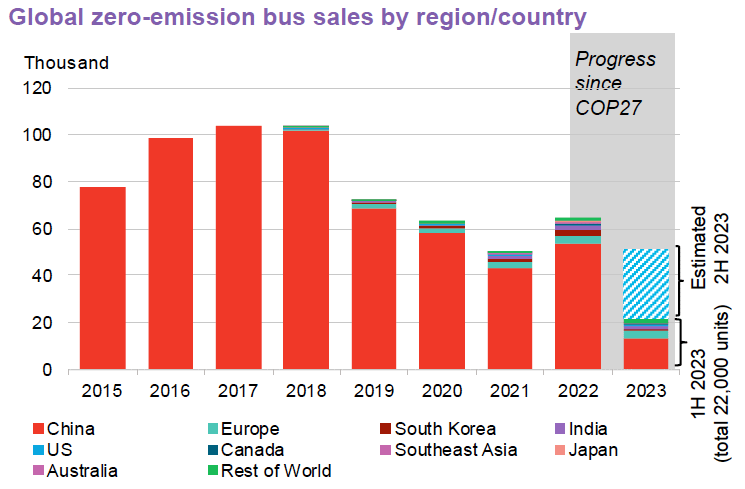

*Canadian oil co.s use scenarios similar to OPEC's to make investment decisions.

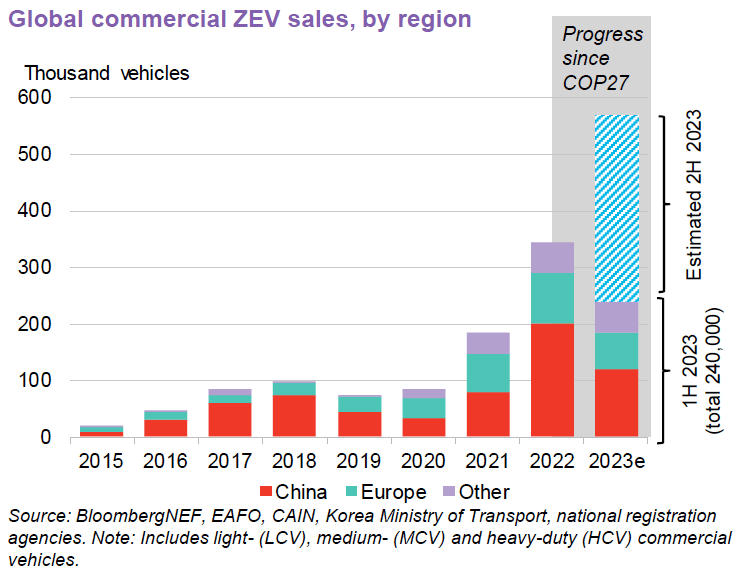

energi.media/markham-on-energy/danielle-smith-has-an-oil-and-gas-marketing-plan-not-a-climate-plan/

13/Three unlikely WOO 2045 oil demand assumptions:

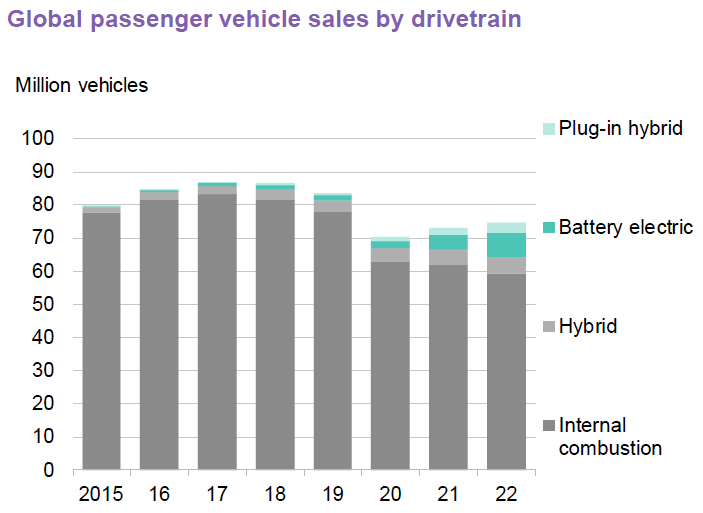

1. Clean energy tech like EVs not yet economic

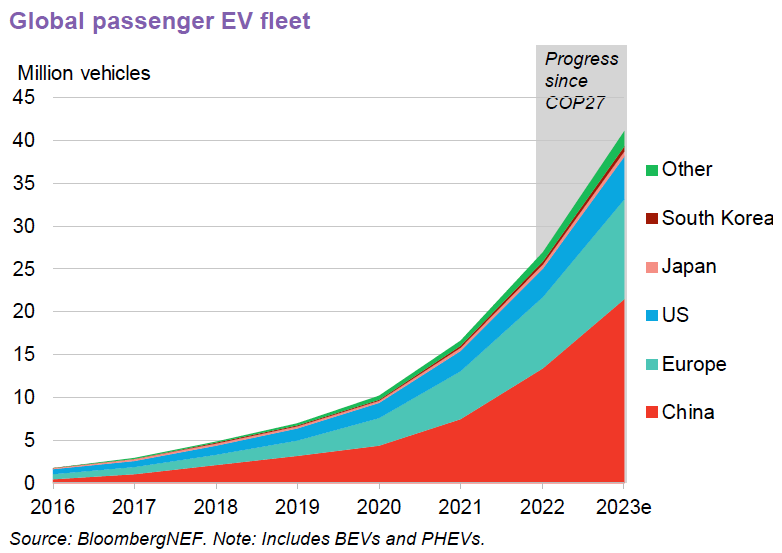

2. Govts/citizens tired of climate policy costs, support softening

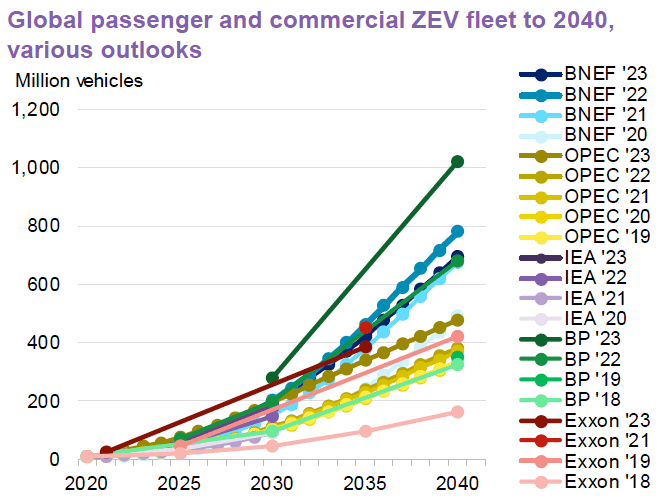

3. Emerging economies more than make up for decline in rich economies

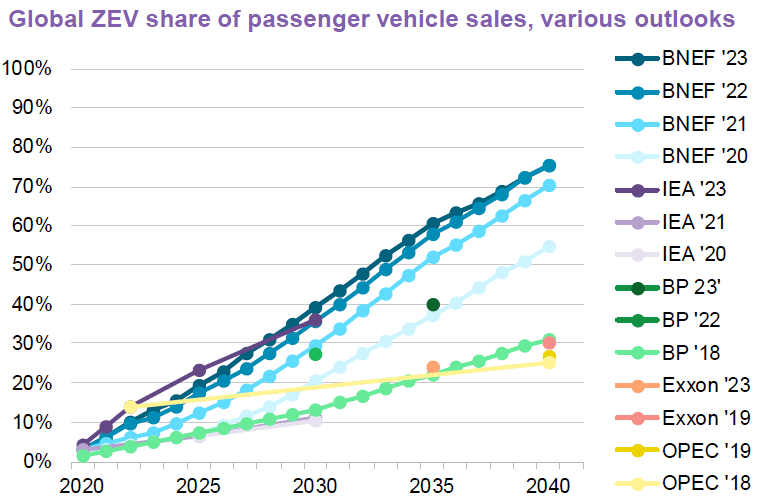

*WOO 2045

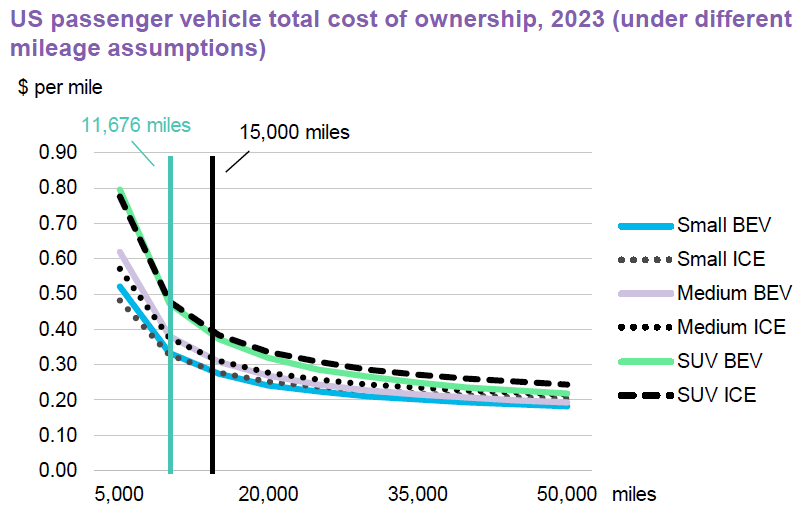

14/Assumption #1:

Lower fuel, operating, maintenance costs = EVs compete well with ICE on total cost of ownership

ICE purchase price still higher, but automakers turning focus to lower-priced models.

China (now exporting) has huge lead in low to mid-range of EV market.

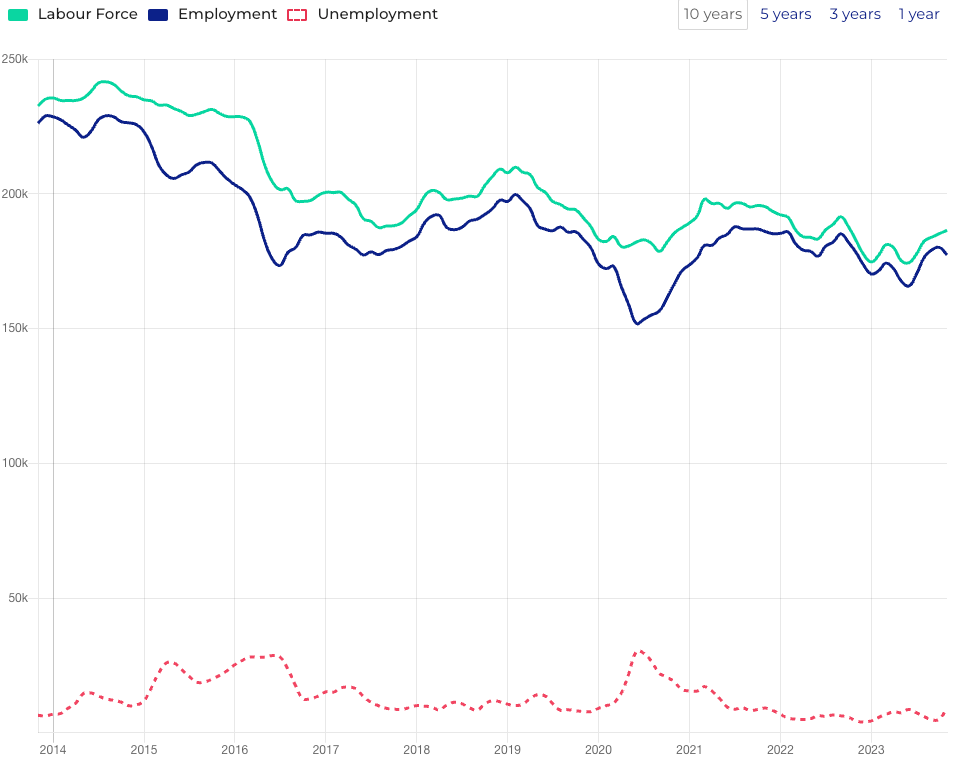

*BNEF

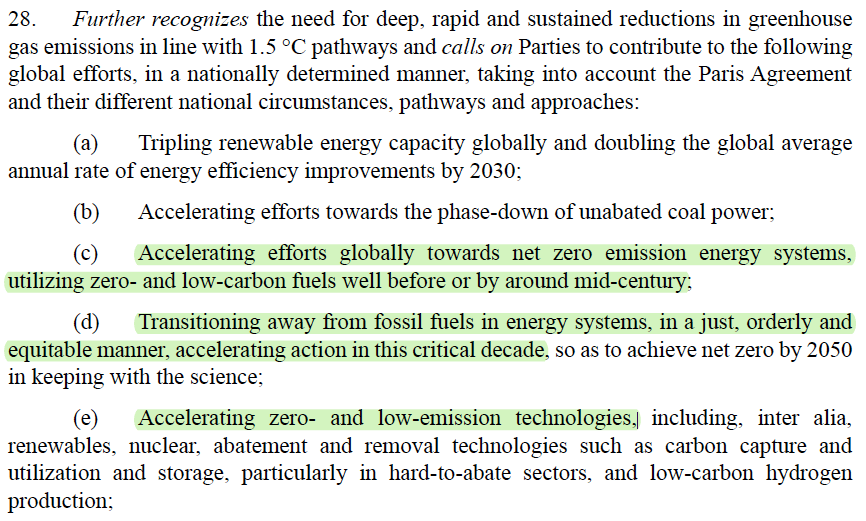

15/Assumption #2

COP28 undermines this assumption. Final agreement was iterative, not a "breakthrough," but signalled continued forward momentum on climate policy ambition.

Including "transitioning away from fossil fuels" language for first time was historic.

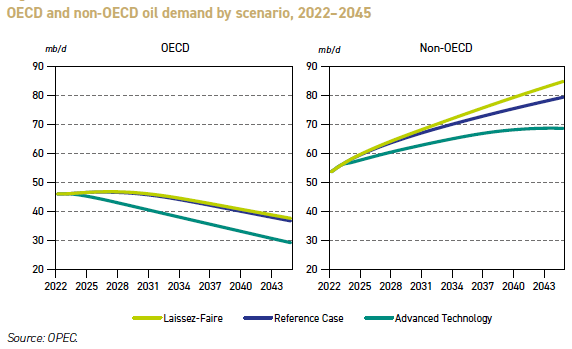

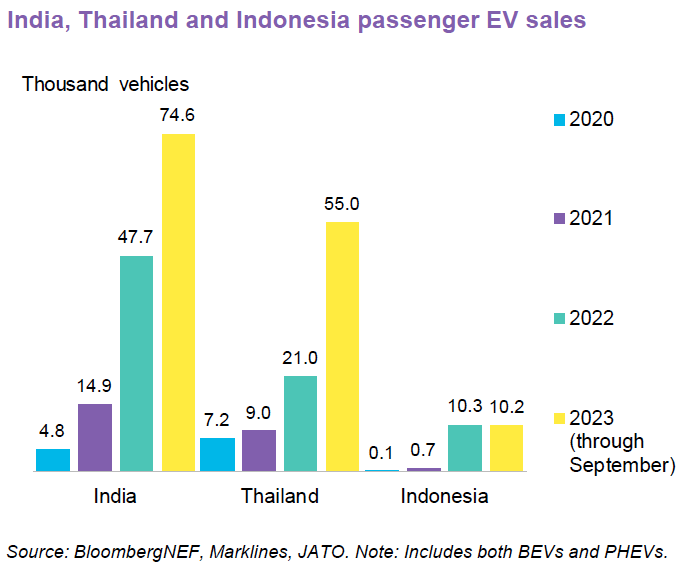

16/Assumption #3

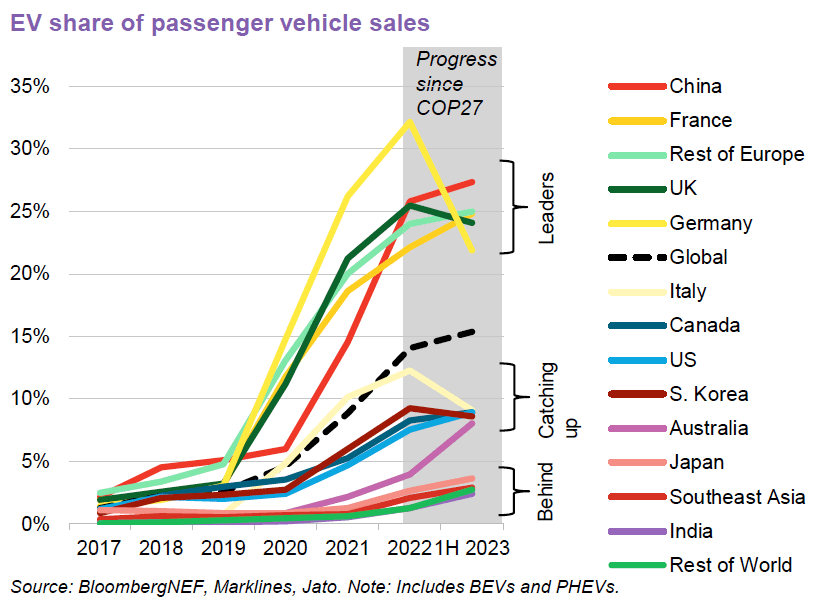

This assumption has some legitimacy. Africa, in particular, is home to oil producers determined to develop their economies by exploiting significant oil/gas fields.

But Asia, inc India, seems to be slowly pivoting to EVs.

*BNEF

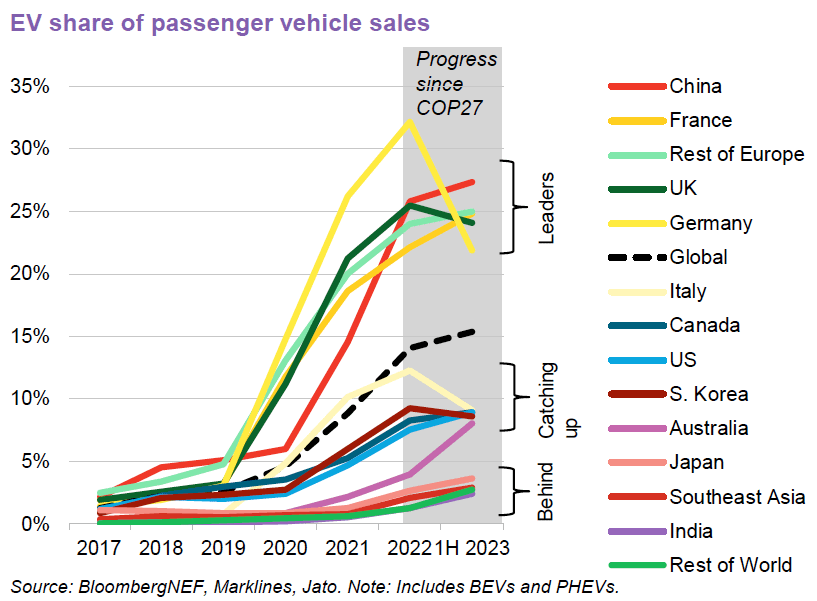

17/Assumption #3 cont.

But there is still a long way to go. Most of the countries/regions where EVs comprise less than 10% of new vehicle sales are in Asia.

Note: 5%-10% of new sales is generally considered the "inflection point," where sales begin to grow exponentially.

*BNEF

18/Assumption #3 cont.

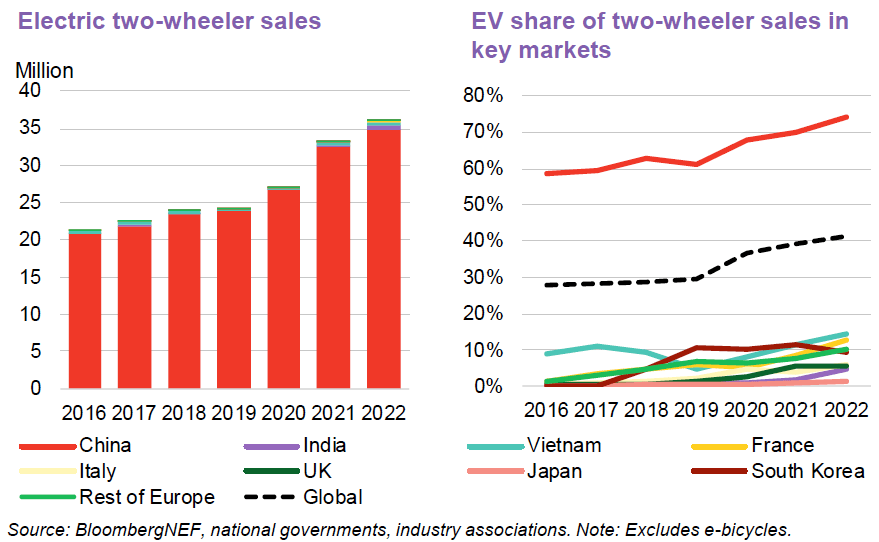

One sector where Asia has made considerable progress is electric 2/3-wheelers, which are most popular mode of transportation in most countries.

Again, China has a big lead but other countries are near or past the inflection point.

19/Assumption #3 cont.

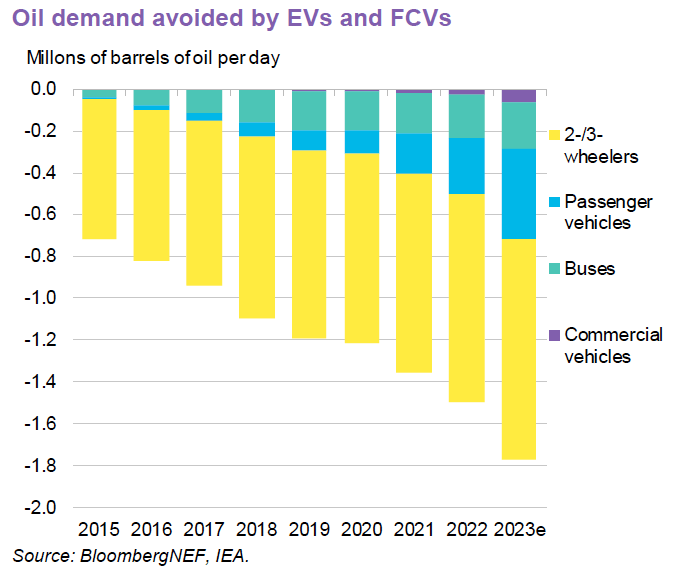

2/3 wheelers have already avoided ~1 million b/d of oil demand.

Oil use avoided by total EVs has more than doubled since 2015

20/Biggest blow to OPEC's slow energy transition narrative came just a few months after WOO 2045 was released.

Sinopec, China's largest refiner, forecast that China would reach peak oil demand as early as 2026, no later than 2030.

OPEC forecast growth of 4 million b/d by 2045.

21/That's a quarter of the demand increase OPEC expected globally.

How did OPEC get it so wrong?

What other assumptions and forecasts will prove to be wrong?

China’s peak oil demand bombshell eviscerates Danielle Smith’s energy strategy

energi.media/markham-on-energy/chinas-peak-oil-demand-bombshell-eviscerates-danielle-smiths-energy-strategy/

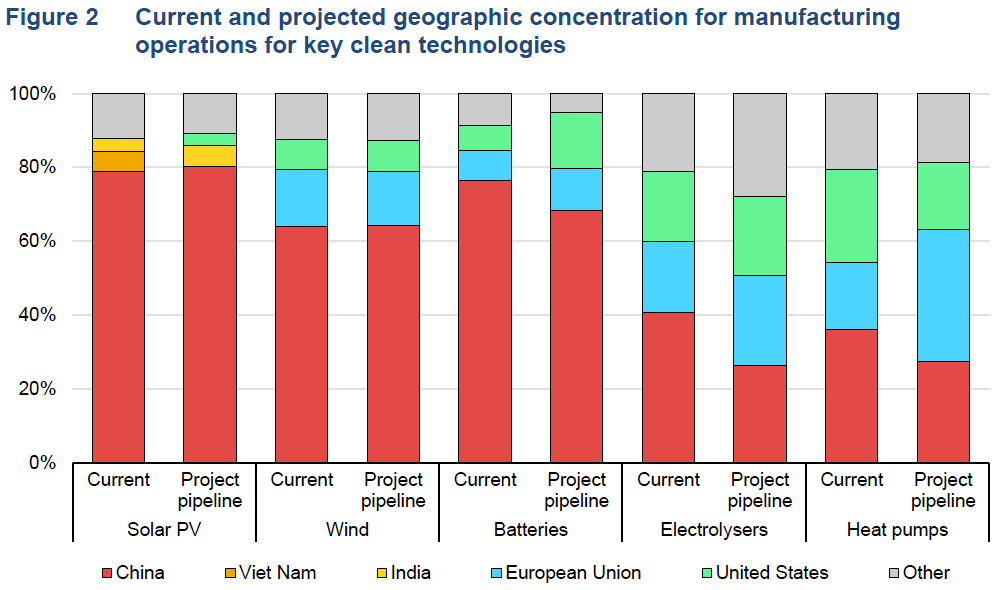

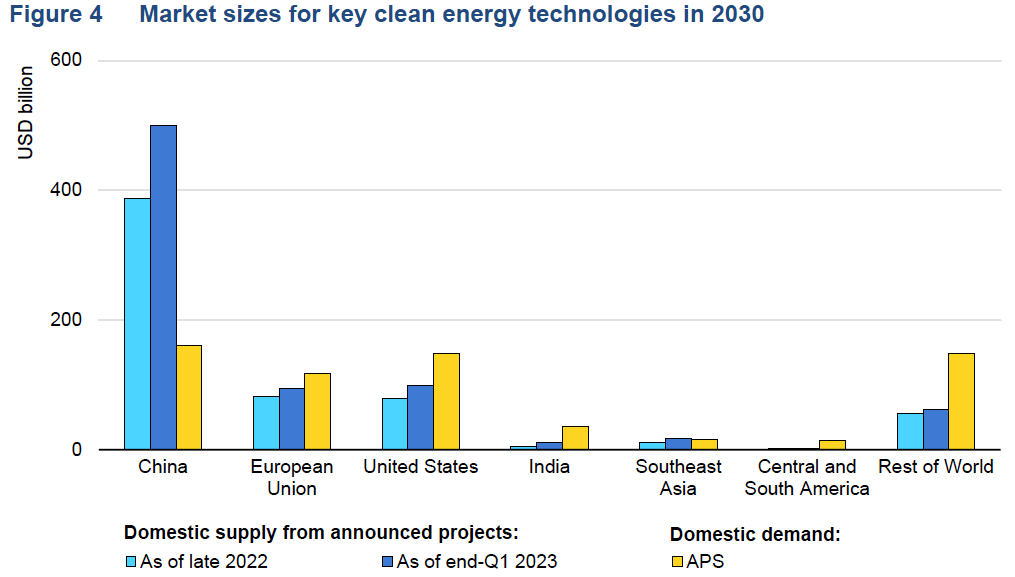

22/China's now leads world by a wide margin in both manufacturing the clean energy technology and adopting it.

*IEA State of Clean Energy Manufacturing report 2023

23/China's clean energy manufacturing sector is so big that by 2030 it will have 3x more production capacity than is required to meet domestic demand.

That scale enables China to drive down prices, export in large volumes.

*IEA State of Clean Energy Manufacturing report 2023

24/China is poised to dominate global manufacturing of electric vehicles.

*Highest EV sales volume (8.3 million in 2023)

*Biggest EV manufacturing sector

*Controls 50%-80% of EV supply chains

*~600,000 e-buses in China

*40% of 2/3-wheelers now electric

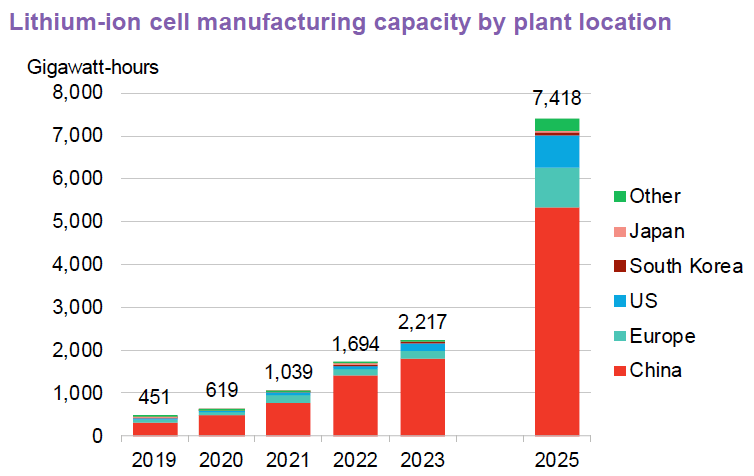

25/China's lead in batteries is important b/c batteries make up 1/4 to 1/3 of EV cost.

Battery manufacturing capacity has increased 31% since 2022

BYD, now the world's biggest EV maker, began business as a battery manufacturer, giving it complete control of the supply chain.

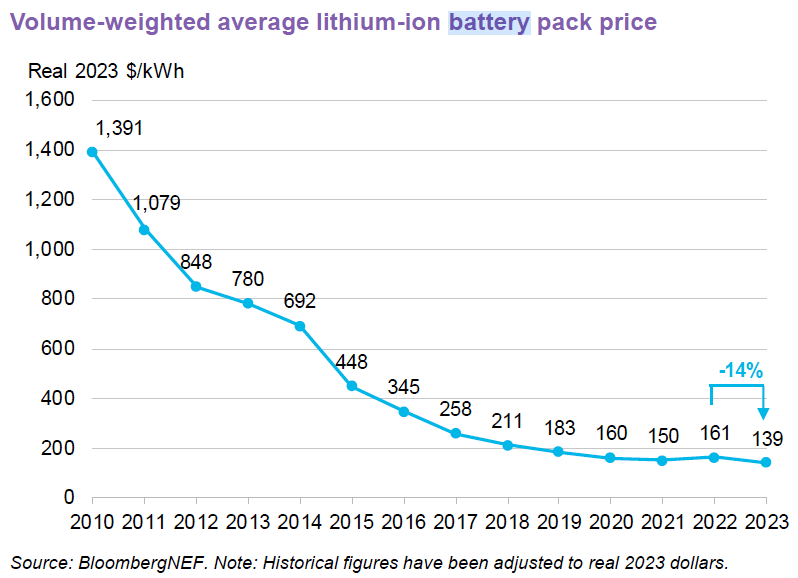

26/Battery prices ticked up for first 2 years of the COVID-19 pandemic b/c of raw material shortages, but are falling again.

China has lowest prices: $126/kWh for passenger EVs, $100/kWh for buses.

EV makers are switching to even lower cost LFP and sodium-ion batteries.

*BNEF

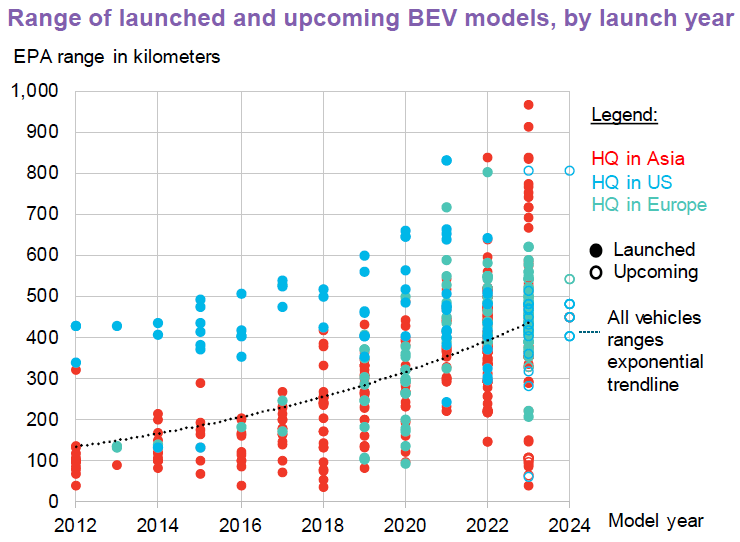

27/Not only are batteries getting ever cheaper, but energy density (the amount of power that can be stored in the battery) is rising 7% per year.

That means more range, as this graphic demonstrates.

EVs drive for longer distances: average range for 2023 is 470 kilometres.

*BNEF

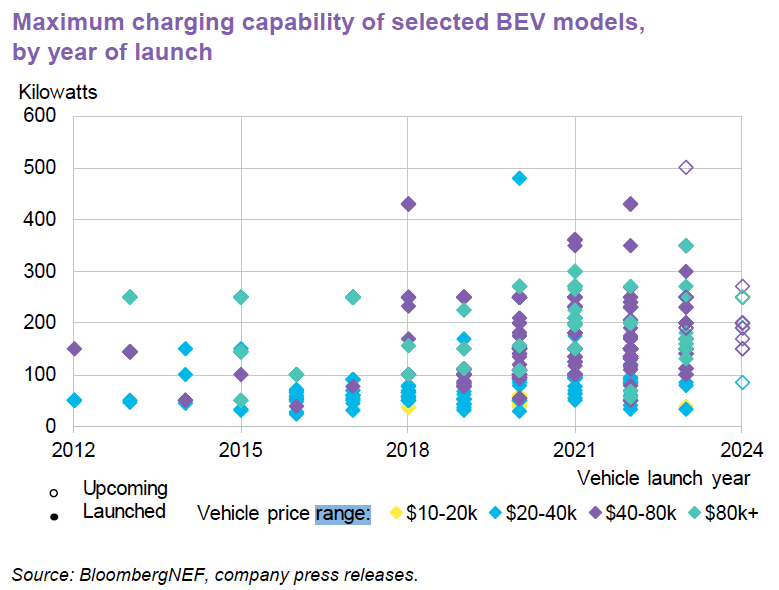

28/New BEVs can charge faster

Average max-charging power of a 2023 BEV was 186 kilowatts (kW), 25% higher than 2022.

Some EV makers switching to 800-volt architectures that enable charging powers of 350kW and higher in future models.

Goal: 80% charge in 10-20 minutes

*BNEF

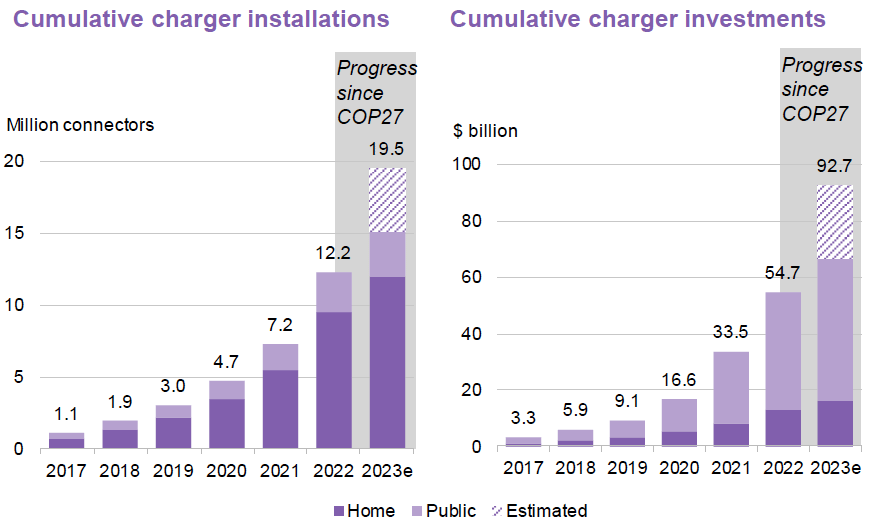

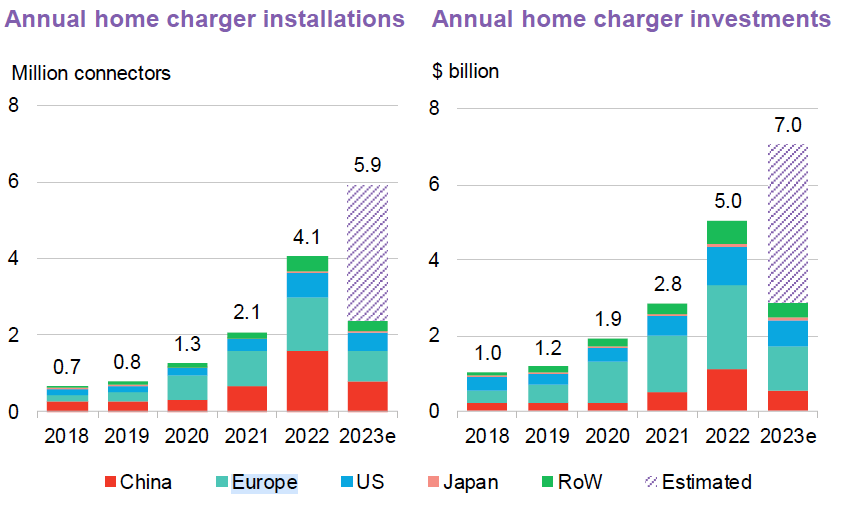

29/Cumulative global investment in EV charging approaches $100 billion

BNEF estimates for global chargers end of 2023:

*15.4 million home EV chargers

*4.1 million public chargers

% of total:

China: 69%

Europe: 17%

USA: 6%

30/Access to public charging is a major consideration for EV buyers.

2023 expected public charging investments:

China: $19 billion

Europe: $5.3 billion

US: $2.7 billion

31/In the latter part of 2023, news stories reported softening US interest in EVs (sales still rose 47% YoY).

Not enough (and poorly working) charging infrastructure/range anxiety is a big reason.

Other reasons included high interest rates, $13,000 price premium.

32/Policy has played an key role in the development and adoption of clean energy technologies like EVs.

Supply side: grow EV makers/supply chains until they can compete w/o subsidies

Demand side: subsidize EV purchases/support infrastructure until no longer required.

33/Global spending on clean road-transport vehicles/infrastructure:

From 2015 to 2022: $1.3 trillion

2023: as high as $685 billion

Asia Pacific, dominated by China = 50% of last year's spending.

*BNEF

34/Strong industrial strategies/policies have figured in the efforts of all regions/countries trying to build electric transportation industries.

35/Policy provides strong foundation for EV adoption in major car markets.

From 2010, China had generous subsidies, but has reduced them each year, fully eliminating some at the end of 2022.

36/Canada is a laggard in clean energy industrial policy.

Canada's policy has 3 parts:

1. Carbon tax

2. Regulations

3. Subsidies

Ontario, home of Canada's auto sector, has no real strategy or plan. Quebec has attracted battery plant investments.

share.transistor.fm/s/dce2ba14

37/Major automakers' investment plans highlight EV commitments.

But several have delayed capital spending over "soft demand."

Most are OEMs over-estimated their ability to switch to EV manufacturing.

Example: GM's problems with its new Ultium platform, software, etc.

*BNEF

38/China's EV demand running ahead of what govt regulations require.

39/COVID-19 pandemic made US realize how vulnerable it is to Chinese supply chains, especially clean energy technologies.

$369 billion Inflation Reduction Act expected to leverage $1.7 trillion of private capital in clean energy manufacturing by 2032

share.transistor.fm/s/0eda97b8

40/US EV/battery sector has been energized by Inflation Reduction Act, other federal and state legislation.

IRA funding restricted to US manufacturers and countries with which US has free trade agreement, like Canada and Mexico.

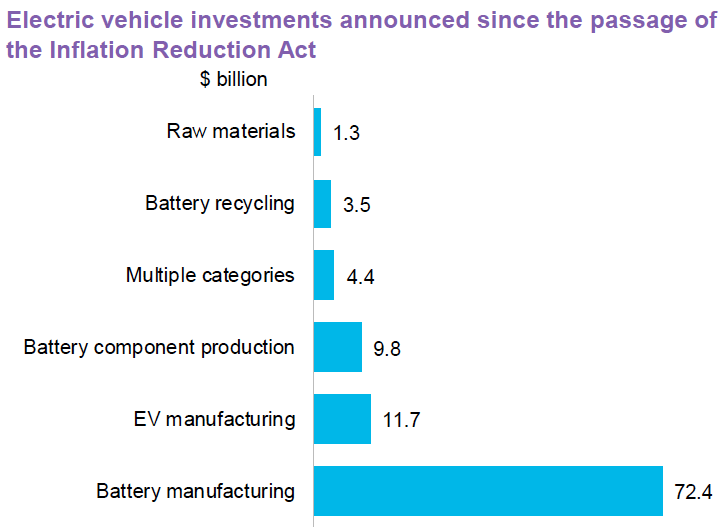

41/Inflation Reduction Act already attracted over $100 billion of EV investment in North America

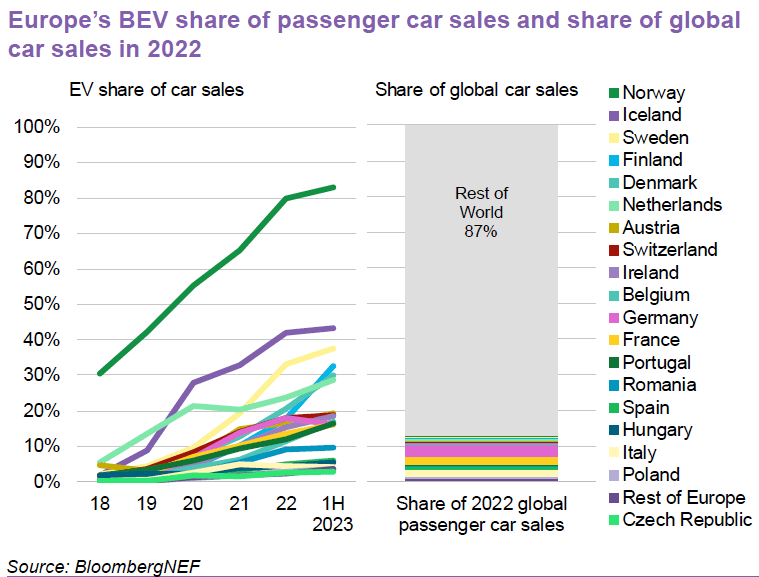

42/Despite China's rapid growth in clean energy adoption and manufacturing, Europe is running a close second in many sectors.

43/European home charging companies are benefiting from high sales

44/EU’s plan to phase out ICE sales covers 13% of global auto market

45/ZEVs fuelled 2-wheeler market with 9% sales growth in 2022

46/ZEV bus sales slowing in China but rising elsewhere

47/Commercial ZEV adoption beginning to take off

48/Global EV sales growth is unevenly distributed

49/Combustion vehicle sales have already peaked.

*BNEF

50/Almost 41 million 4-wheeled passenger EVs on the road.

51/Forecasters consistently under-estimate growth of zero-emissions vehicles.

*BNEF

52/ZEVs are now expected to take more market share, sooner.

*BNEF

53/

54/Alberta Premier @ABDanielleSmith, Saskatchewan @PremierScottMoe, Canadian oil CEOs are committed to OPEC's slow transition modelling.

Govts are committing tens of billions to continued growth of oil/gas industry.

energi.media/markham-on-energy/albertas-political-business-elites-have-misread-the-global-energy-transition/

55/If OPEC is wrong and the IEA is correct, then AB, SK, and Canada have made poor decisions with significant implications for citizens, taxpayers, workers, and businesses.

Alberta = $300 billion of unfunded O&G liabilities.

Who will pay for clean up?

energi.media/markham-on-energy/unethical-oil-and-the-regulator-albertas-shameful-secret/

56/Canadian Energy Regulator's Energy Futures 2023 report models net-zero scenario for first time.

Policy costs may make some producers uncompetitive, leading to oil company failures.

Could all or most of govt subsidies be lost?

share.transistor.fm/s/3fe52c5f

57/Canadian oil/gas sector has already lost 51,600 jobs in past 10 years.

2014 = 229,000

2023 = 177,400

Alberta jobs losses during that period: 42,000

*careersinenergy.ca

58/2020 EY study suggests another 40,000 to 50,000 will be lost by 2040, if not sooner, due to automation and new digital technologies like AI.

youtu.be/v8soHTp81m0

59/The evidence in this thread suggests that the future of the global energy system is much more likely to resemble IEA's fast energy transition case than OPEC's slow energy transition case.

OPEC's case is at the heart of Alberta energy/climate policy.

energi.media/markham-on-energy/chinas-peak-oil-demand-bombshell-eviscerates-danielle-smiths-energy-strategy/

60/Oil companies, almost all of them headquartered in Alberta, mostly favour the OPEC view of the energy future.

Canada leans more toward the IEA fast energy transition case, but too often is stymied or swayed by Alberta.

energi.media/markham-on-energy/slow-walking-the-energy-transition-a-mistake-for-alberta-oil-patch/

61/Premier Danielle Smith told me at a press conference that there is no Plan B.

Then, if the IEA is right, as appears likely, Alberta and Canada are very poorly prepared for the death of King Oil.

The economic, financial, and environmental consequences could be catastrophic.