1/🧵"First, in what is the most significant economic transformation since the Industrial Revolution, our friends and partners around the world—chief among them, USA—are investing heavily to build clean economies and the net-zero industries of tomorrow." FinMin @ChrystiaFreeland

2/"...Canada must either meet this historic moment—this remarkable opportunity before us—or we will be left behind as the world’s democracies build the clean economy of the 21st century." - Freeland

#cdnpoli #bcpoli #ableg #onpoli #cleanenergy #canada

3/The "most consequential budget in recent history for accelerating clean growth in Canada. Climate action, economic policy are one and the same—world’s major economies know that investing in clean energy is the catalyst for future competitiveness" - Rick Smith @ClimateInstit

4/ "...smart, market-oriented measures to increase Canada’s low-carbon competitiveness...big boost for clean energy...[w]e are in a clean energy arms race and there is no time to waste.” - @bernstein_micha @CleanProsperity

4/Freeland budget's clean energy priorities:

*Electrification

*Clean energy

*Clean manufacturing

*Emissions reduction

*Critical minerals

*Infrastructure

*Electric vehicles and batteries

*Major projects

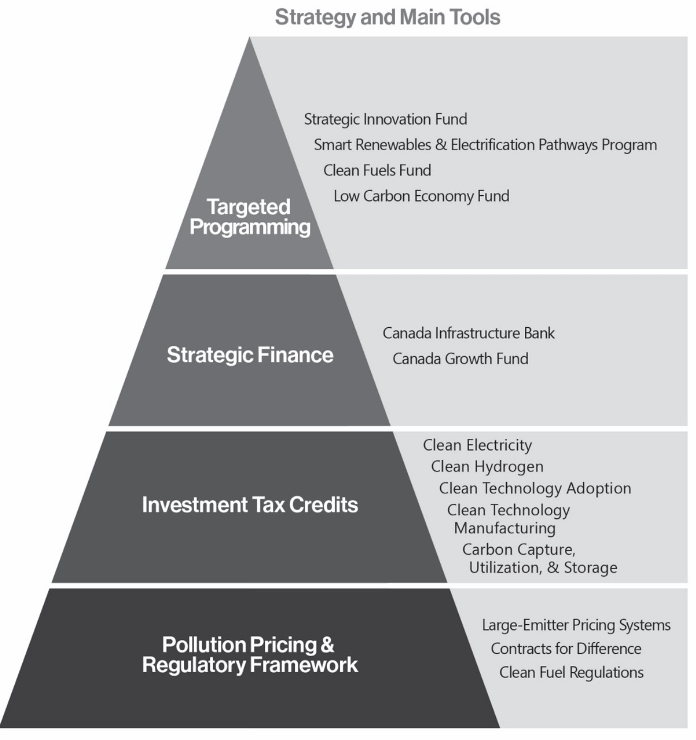

5/How CANGov will finance support for the clean energy economy AND growth of clean energy technology industry.

6/Clean energy budget highlights:

*15% refundable tax credit for investments in clean electricity: wind, solar, hydro, wave, tidal, nuclear, energy storage, electricity transmission

*Available for abated natgas, subject to GHG-intensity compatible with net-zero by 2035

7/$3 billion over 13 years to:

*Advance offshore wind projects

*Support critical regional priorities

*Transmission

*Indigenous-led projects

*Renew Smart Grid program (support electricity grid innovation)

8/Cleantech manufacturing tax credit equal to 30% of investments in new equipment used to manufacture/process key clean technologies and critical minerals

*Estimated cost: $4.5 billion over 5 years,

*Additional $6.6 billion between 2028 and 2035.

9/Clean hydrogen investment tax credit

*Support between 15% and 40% of eligible project costs

*Extends 15% tax credit to equipment needed to convert hydrogen into ammonia for transportation

10/To be eligible for highest clean technology and clean hydrogen tax credit rates, businesses must pay a total compensation package that equates to the “prevailing wage."

Prevailing waged based on union compensation, including benefits and pension contributions

11/CANGov will consult w/provinces/territories, industry, workers/unions on concrete "reciprocal procurement."

*Conditions on foreign suppliers' participation in federally-funded infrastructure projects

*Creating a preference program for Canadian small businesses

12/"Govt has shown they are listening to workers. From 2022 Budget that included the Labour Mobility Tax Deduction for Tradespeople, to this year doubling Tradespeople Tool Deduction from $500 to $1000 – both measures directly impact a worker's wallet."

buildingtrades.ca/budget-2023-delivers-strong-wins-for-building-trades-workers-and-canadas-net-zero-economy/

13/A commitment to plan to “improve the efficiency of the impact assessment and permitting processes for major projects.”

Slow approval for Canadian energy projects a sore point with many energy sectors, inc oil/gas, transmission, renewables, energy storage. etc

14/Canada Growth Fund (CGF) is $15 billion of public investment to attract private in clean economy.

Public Sector Pension Investment Board to manage assets of CGF.

15/Committment to "carbon contracts for difference (CCD)" to a select set of large decarbonization projects, via CGF.

*CCD are like insurance policies on future value of carbon credits that will help de-risk expensive capital projects, get investment flowing.

16/"While a positive step, a broader program that is accessible by a wide range of industrial emitters is still needed urgently...program should be designed in consultation w/provinces, include measures to increase efficiency, transparency of carbon-credit markets." - Bernstein

17/Canada Infrastructure Bank's role clarified: "govt's primary financing tool for supporting clean electricity generation, transmission, storage projects, including for major projects such as the Atlantic Loop."

18/Canada Infrastructure Bank will provide loans to Indigenous communities to support them in purchasing equity stakes of projects in which the Infrastructure Bank in investing.

19/Drawing on existing resources, it commits at least $10 billion of support for clean power and an additional $10 billion for clean growth infrastructure.

Investments will be sourced from existing resources.

20/Investment Tax Credit for carbon capture utilization and storage (CCUS) to be expanded to cover additional equipment, and now be available for dedicated geological storage projects in British Columbia.

21/Freeland promised muscular and robust clean energy industrial policy in the 2023 budget. Where is it?

The USA, Europe, Asia Pacific countries - they're all in on modern industrial policy, which is based on a more active, interventionist state.

energi.media/markham-on-energy/is-muscular-industrial-policy-coming-soon-to-alberta-freeland-doctrine-suggests-it-might/

22/Read this speech by USA Sec of Commerce Gina Riamondo @SecRaimondo. The USA has embraced industrial strategy and policy with gusto.

commerce.gov/news/speeches/2022/11/remarks-us-secretary-commerce-gina-raimondo-us-competitiveness-and-china

23/USA "has chosen to rely heavily on new industrial subsidies to reduce its emissions," says CANGov. "Canada has taken a market-driven approach to emissions reduction."

Translation: let carbon pricing, requiring few CANGov subsidies, do the heavy lifting

budget.canada.ca/2023/report-rapport/chap3-en.html#m23

23/There's $$ in Budget 2023 for clean energy and clean energy industry.

But Freeland promised more: industrial strategy and policy that would make CANGov an active player in Canada's clean energy industrial revolution.

This is not Canada's clean energy Industrial Revolution.