Binance has been trading against it's own customers, allege the CFTC

Here's why this is bad for you as trading users

like and retweet for more otter threads

🦦🧵👇🏻

A cryptocurrency exchange, like any financial institution, is expected to act as an intermediary between buyers and sellers, providing a fair and transparent marketplace for trading.

When an exchange engages in proprietary trading - trading on its own account - it creates a conflict of interest, as it has access to information that its users don't.

Proprietary trading can also create an unfair advantage for the exchange, as it can use its platform to execute trades more quickly and efficiently than its users.

This can lead to users being disadvantaged in the market, as the exchange is essentially competing against them.

When an exchange trades against its own users, it also undermines the integrity of the marketplace, as it is no longer acting as a neutral third party.

The exchange's profits become tied to the performance of its users, rather than the performance of the market as a whole.

This creates a perverse incentive for the exchange to manipulate the market in order to increase its own profits.

When an exchange engages in proprietary trading, it also creates a risk that the exchange could use its insider knowledge to trade against its users.

This is particularly concerning in the case of a cryptocurrency exchange, where market manipulation and insider trading are already major concerns.

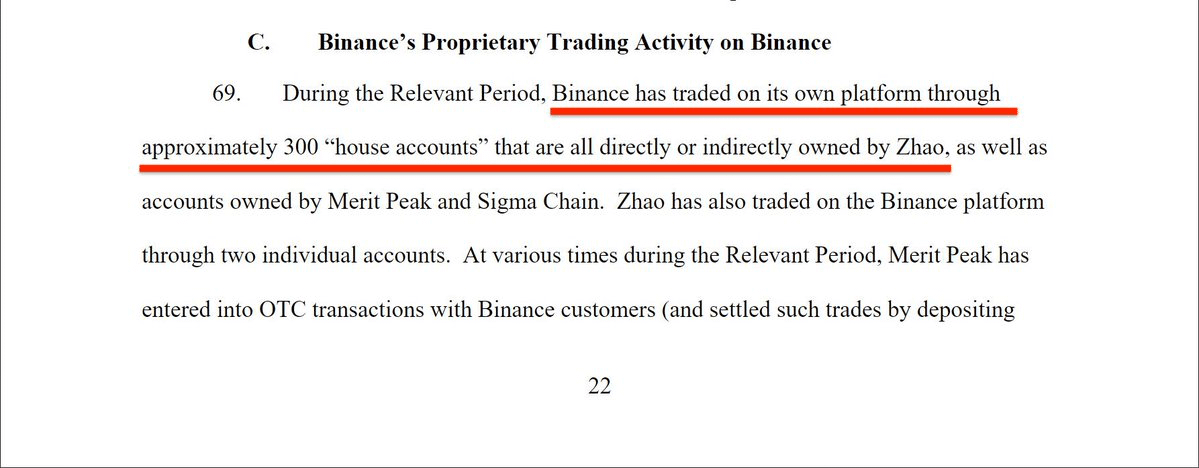

In the case of Binance, the fact that the CEO directly or indirectly owned 300 accounts used for trading on the platform raises further questions about the exchange's practices.

Trading against its own users in this way undermines trust in the exchange, and can ultimately harm the entire cryptocurrency ecosystem.

Users may choose to take their business to other exchanges that are seen as more trustworthy, leading to a loss of market share for Binance.

It also risks attracting regulatory scrutiny, as regulators may see this behavior as unethical and potentially illegal.

For these reasons, it is generally considered unethical for an exchange to engage in proprietary trading against its own users.

Instead, exchanges should focus on providing a fair and transparent marketplace, free from conflicts of interest, in order to foster trust and promote the growth of the cryptocurrency ecosystem.

Want to learn more about the CFTF allegations? Check out otter's previous thread

twitter.com/otteroooo/status/1640529216830857216?s=46&t=TJqY7T601qP_XhXVAViauA