FACTS & FUD on the Current State of NFT Lending 🧵

Hints: (🦍,🦍) & 💣⚠️

This thread will overview:

1. How NFT lending works

2. NFT lending analytics

3. Possible outcomes

4. My perspective

Let's first do a quick overview of how this all works and then dive into the fun stuff...

1. NFT LENDING EXPLAINED

The two types of NFT lending platforms:

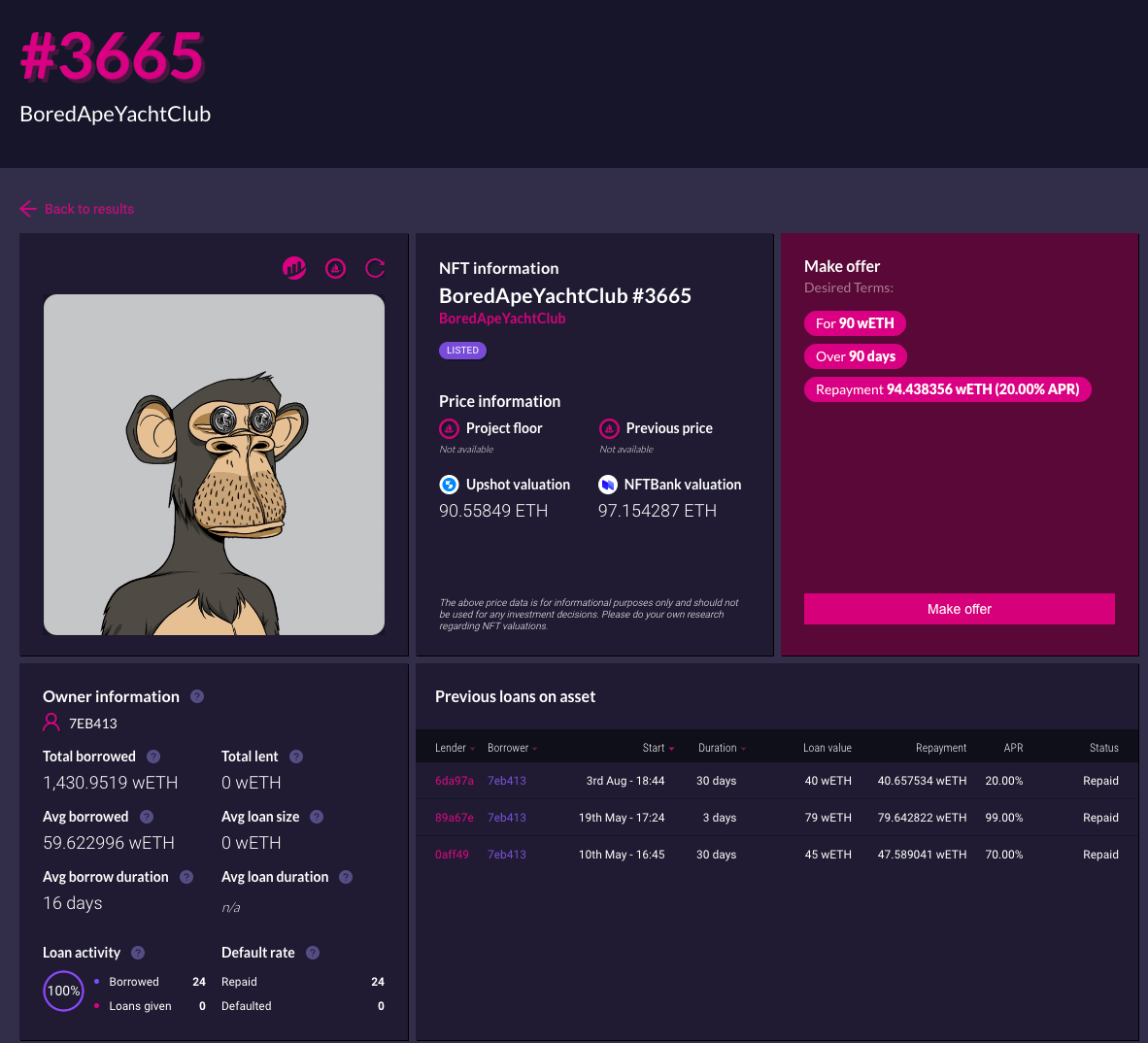

1.1 PEER to PEER (@nftfi): allows anyone to lend ETH to NFT holders on custom terms.

Eg in the pic below, the borrower is requesting 90 WETH and would have to repay 94 ETH in 90 days or the lender keeps the BAYC

1.2 PLATFORM (@BendDAO): pools ETH from lenders (who earn yield) and distributes it to NFT borrowers with set terms (usually granting them 30-40% of the NFT value)

Eg, BendDAO will loan 30 ETH to a BAYC holder (if fp=75 ETH), and give the lender ~6% APY + charge BAYC ~ 17% APY.

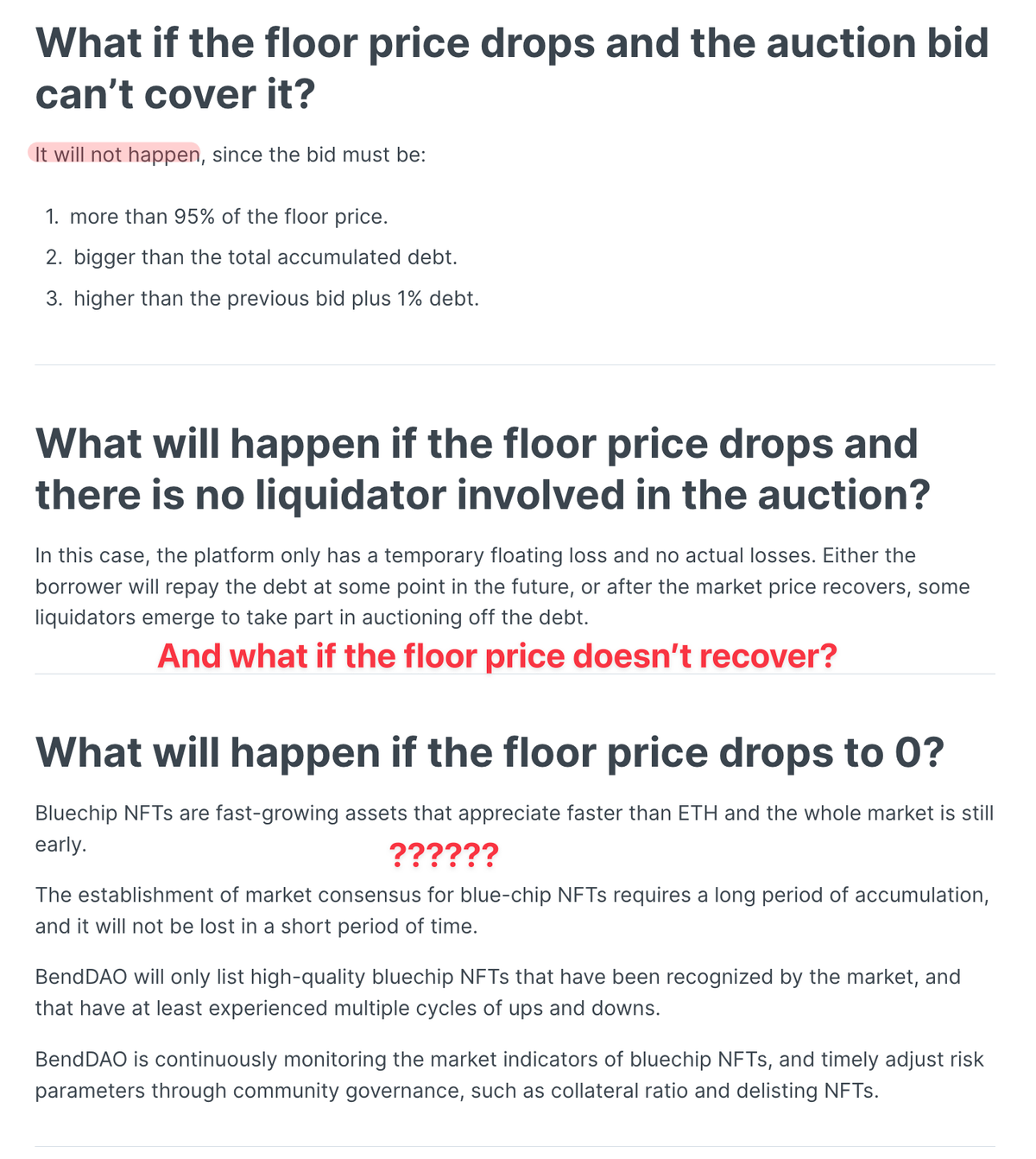

Things get complicated if the NFT drops to within 10% of the loan value.

The NFT will go to auction for 48 hrs and sell to the highest bidder (unless the borrower tops up their loan).

And if no one bids, BendDAO will hold the NFT "until the floor price" rises (as bad debt)

2. STATE OF THE NFT LENDING MARKET

2.1 P2P Loans Breakdown (@NFTfi only)

· Avg APY of 58%!

· $18.3M outstanding loans

· Avg loan duration of 32 days

· ~10% default rate (2% for BAYC)

Overall, the P2P loans skew toward higher loan amounts over shorter durations (& higher fees).

P2P loans have an enhanced risk of some short-term liquidations but...

Less blowup risk as the bad debt would be distributed between lenders, loans have varying terms, and the overall loans outstanding are not super high at $18M.

(ps, Arcade has ~10% the activity as NFTfi)

2.2 Platform (@BendDAO)

· $60M outstanding loans

· Avg lender APY of only 6%

BendDAO poses a greater market risk than P2P lending because they have significant outstanding debt, set borrowing margins (& liquidation levels), and control all the ETH & NFTs (more on that later).

What's most worrisome is the relative % of top collection items which have been borrowed against (especially BAYC, MAYC and Azuki).

There are also accounts which borrowed 100s of ETH and haven't paid back much... whatever NFTs they borrowed against could go to auction soon.

2.3 How did we get here?

Many people took out loans before the Otherdeed mint (presumably with the aim of buying BAYC to claim land).

This was a similar strategy to buying an NFT from an NFTx pool, claiming the $APE airdrop, and selling back to the NFTx pool.

BUT...

the borrowers cannot sell the original NFT because it's being used as collateral for the loan!

The combined price of Otherdeeds + BAYC was LOWER after the Otherside land claim... meaning people who borrowed against their BAYC to buy more BAYC/Otherdeeds were at a fat loss.

Maybe the 18,251 ETH (~$55M) in lending volume on Bend in the week before the Otherdeed mint contributed to the crazy price pump 🤔

I warned about speculative market crashes in the thread below, but I didn't think NFTs were levered enough to be at risk of a liquidation spiral 😬

twitter.com/liamherbst_/status/1523683424619294721?s=20&t=pbnPycOV1NOxYWmcTTY9pQ

2.4 How BAD is it?

BAYC has 1% of the volume/MCAP ratio of ETH and a much greater bid/ask spread (ie, way less liquid)... yet their open interest/MCAP is similar (~3.5%).

Furthermore, many of these NFTs have similar liquidation levels as they were taken at the same time.

The liquidation process is forgiving on BendDAO as there's a 48-hour delay between the liquidation and sale or top-up (vs just being market dumped like in DeFi).

BendDAO will also hold liquidated NFTs as bad debt if no one buys them at auction (creating that MAJOR new risk tho).

3. POSSIBLE OUTCOMES

Let's walk through what the potential good, bad, and ugly outcomes...

3.1 GOOD: Nothing Happens

We're in the middle of a prisoner's dilemma episode where if everyone holds and demand doesn't disappear, things should come out okay...

If people begin undercutting and panic ensues... it'll likely cause a cascade.

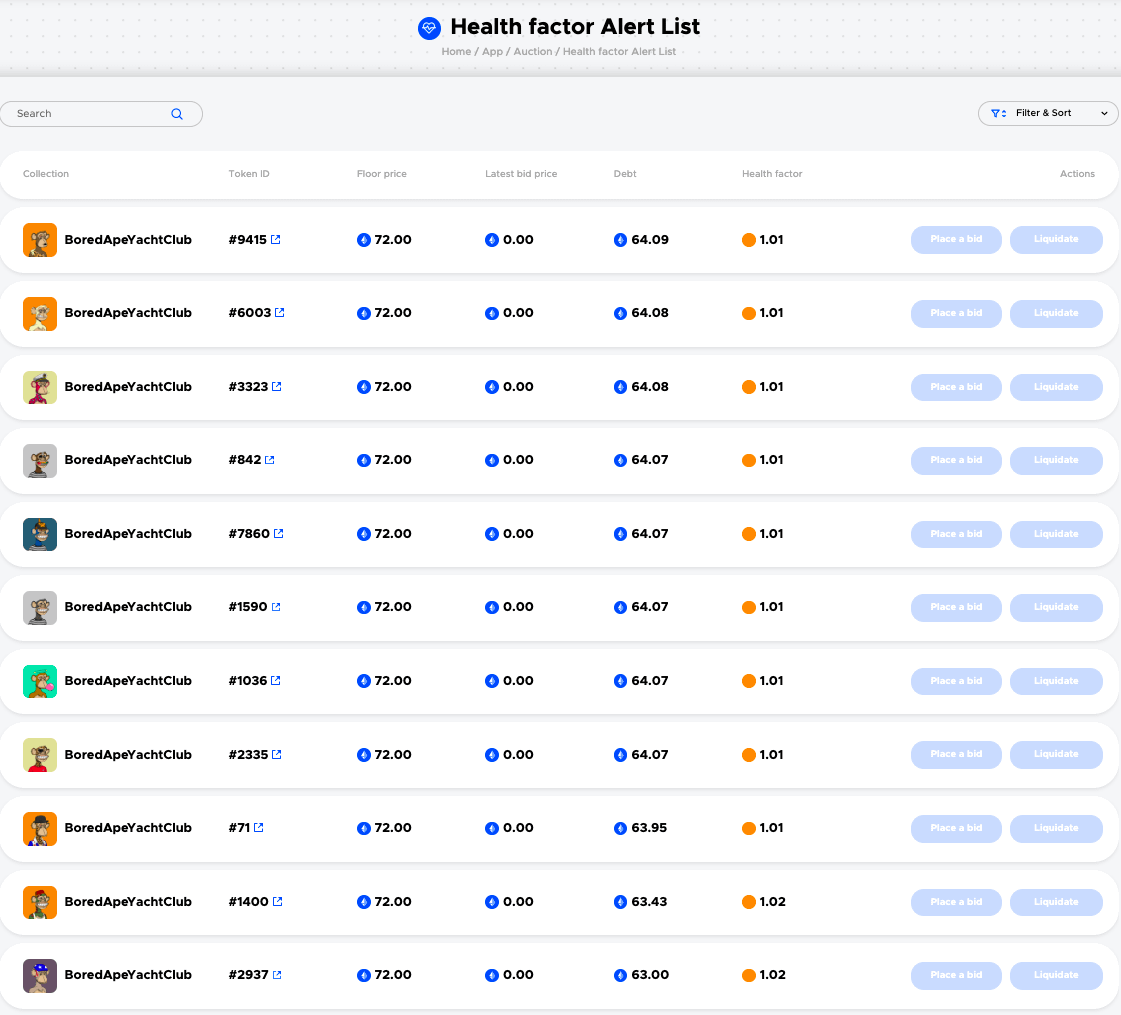

The first BAYC liquidation auction began this morning and there are currently 9 BAYC within a couple of % points of going to auction.

The GOOD news is this didn't immediately cause a series of panic undercutting... we may be inching out of the woods — or at least not deeper in.

twitter.com/CirrusNFT/status/1560291009145102336

3.2 BAD: "Blue Chip" Crash (at least temporary)

Let's imagine if BAYC drops a few more % and the 9 Apes above go to auction.

Anyone will be able to get these Apes for 5% under fp but there are 7 more Apes that'll be liquidated if fp drops 5% more...

If people don't buy them...

A cycle could ensue where the Apes (and other levered projects) keep going lower and lower as more liquidations happen.

Borrowers will sell off other assets to top up their loans and traders may sell assets to get cheap "blue chips."

This spiral would impact the entire market.

Doodles already has 6 NFTs up for liquidation auction and 7 more will be liquidated if their fp falls 10%+.

We could even see a whale or market maker intentionally try to cause this liquidation cascade so they can buy more NFTs at a discount.

There are over 40 Apes within a 20% floor price drop of being liquidated...

Are BAYC holders going to band together and not violently undercut? And will believers step in to pick up the auctions if they begin?

(🦍,🦍) or (—🦍,—🦍)

3.3. UGLY: BendDAO implodes and ALL borrowers and lenders LOSE their assets

NFT loans are initially over collateralized (only 40% of value can be taken) which seems like it would protect BendDAO.

Eg, Bend takes & loans 40 ETH to acquire a 100 ETH NFT (60 "ETH" treasury surplus)

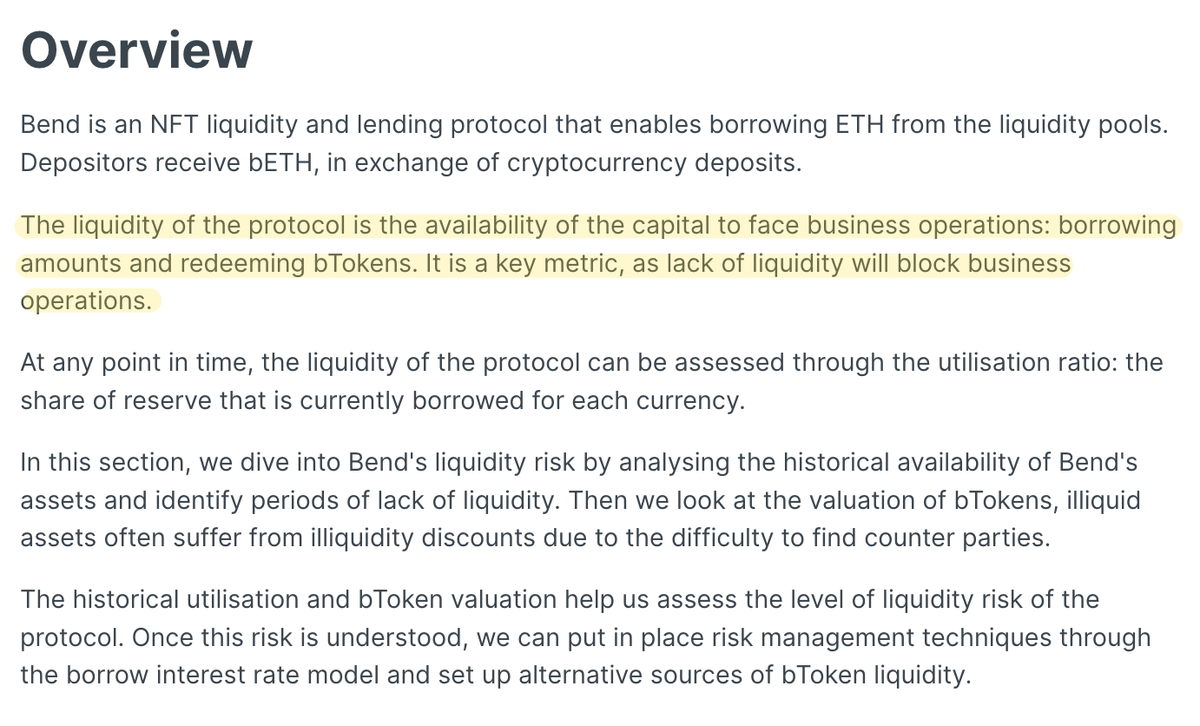

Bend holds ~50% of their lenders' ETH in the treasury and has lent out the remainder to NFT holders.

For every 1 ETH deposited, Bend lenders receive 1 bETH (same model as AAVE).

For comparison, Aave has a liquidation threshold of 80% for ETH and fully liquidates positions 95% LTV... the positions are liquid too.

BendDAO has a little bit "looser" risk practice of 90% liquidation threshold for illiquid assets...

Their reasoning: NFTs are up only

Bend can have a bank run if:

· Liquidated NFT auctions aren't bought

· Bend holds the NFTs as bad debt

· ETH lenders worry and begin reclaiming ETH

· Bend treasury is left with 0 ETH and crashing NFTs

What will happen to the treasury value...

If all the ETH is lent/reclaimed and they're stuck with only overpriced illiquid NFTs?

What will happen to the market if the DAO decides to forcibly sell everything?

Needless to say... holding bETH atm for a 6% yield sounds like an asymmetric downside risk... 🙃

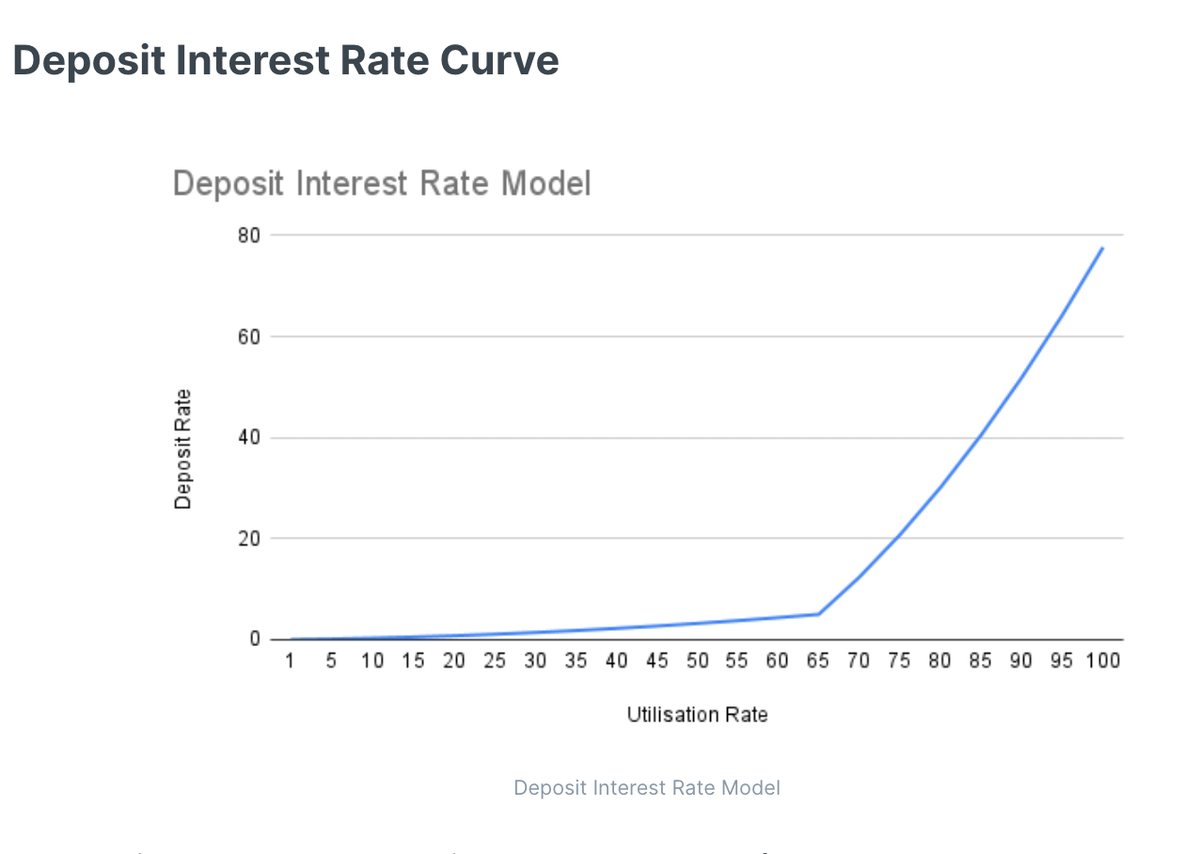

Bend's anti-bank run measure is increasing the lender APY as the ETH lending utilization rises (ie, more illiquidity risk = more return).

As you know by now from Luna, the APY of 0 is still 0. Higher rates shouldn't be enough to incentivize people to hold their position to zero.

Bend should put in protective measures like:

· Lower liquidation thresholds

· Lower the minimum liquidation auction bid

· Accept collection bids if there are no buyers (vs holding bad debt)

Overall, a 10% buffer isn't close to sufficient for a volatile & illiquid asset.

A mass liquidation of blue chip NFTs will leave a stain on the public perspective of NFTs...

The blowup of the top NFT lending protocol will give the anti-NFT media a field day.

And sadly, it'd result in some NFT natives losing ETH and everyone seeing prices fall.

4. MY PERSPECTIVE:

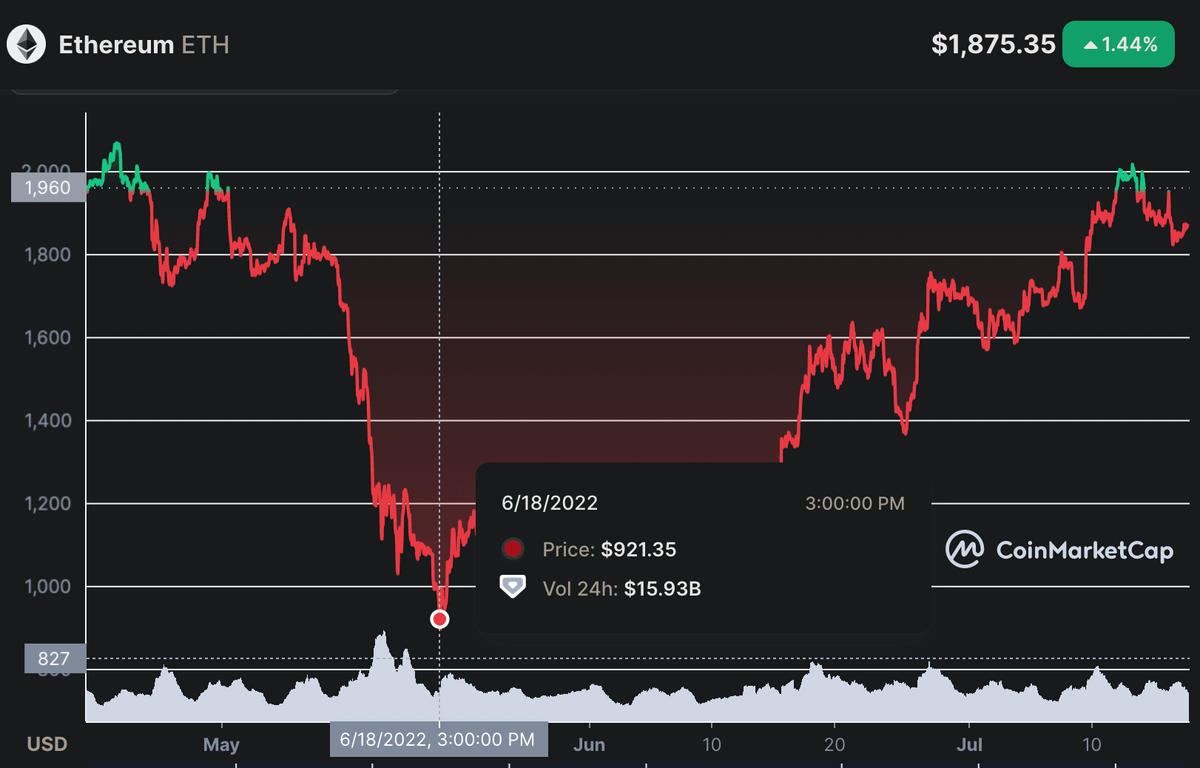

The fear around BAYC liquidations reminds me of when ETH was at $900 and everyone was shouting "it's going to $300" because there were big liquidation walls just below.

Funny enough, it ended up being the pico bottom (at least so far).

twitter.com/Pentosh1/status/1538248787541512192?s=20&t=Lm8x0vLor97rqlW8987KPw

NFTs are on a razor's edge and things could go either way.

The market has had PEAK FUD recently and a potential liquidation spiral was the cherry on top.

On the bright side, this could be the bottom and if it's not, there are many people sitting on ETH/stables waiting to buy.

Nothing has changed about Yuga, what they're building, or the underlying value of the NFTs.

None of this situation is their fault and I hope a potential liquidation spiral won't harm their brand much.

This may just be a great buying opportunity if it happens.

NFT lending is not a terrible idea but we should be less degen as a community.

I listened to the BendDAO founder, @CodeInCoffee, on spaces today and it seems like they have good intentions but Bend's level of risk management is insufficient.

twitter.com/0xquit/status/1560406287468208128?s=21&t=lZYkrSNasYlsN2gQsNr7Pw

Shoutout to the @WumboLabs, @midnightlabshq, and @grassverse crews for jamming on this thread together!

Btw, (🦍,🦍) = Apes strong together & 💣⚠️ = blowup risk