Huge amount of $ETH, from ~3M to even ~6M ETH, will be withdrawn after the Shanghai upgrade.

How much will be SOLD?

I broke down stakers into segments to understand their ability / willingness to sell and analysed different scenarios.

Read this thread to see what's coming:

Withdrawals after Shanghai are probably the biggest headwinds for $ETH price in the nearest future.

In this thread I will estimate their potential selling pressure.

If you are not familiar with withdrawal mechanics, I highly recommend to read my earlier thread:

twitter.com/korpi87/status/1620407242410594307

Quick reminder:

Withdrawals can be either partial or full.

Partial (PW)

- Only earned rewards are withdrawn

- Processed for ACTIVE validators with balance >32 ETH

Full (FW)

- The entire validator balance is withdrawn

- Processed for validators that EXITED the validator set

➡️ How much ETH will be withdrawn?

If Shanghai happened today:

- 1,021,602 ETH: PW (staking rewards for 512k active validators)

- 37,758 ETH: FW (total balance of 1,105 exited validators)

Total: 1,059,360 ETH

It would take ~4.5 days to process.

But Shanghai will most likely happen by the end of March.

If current trend of daily activations is continued, there will be:

- 540k validators

- 97k extra ETH issued as staking rewards

This gives us 1,119k ETH in total in PW only.

What about FW?

Most likely there will be many FW at the beginning.

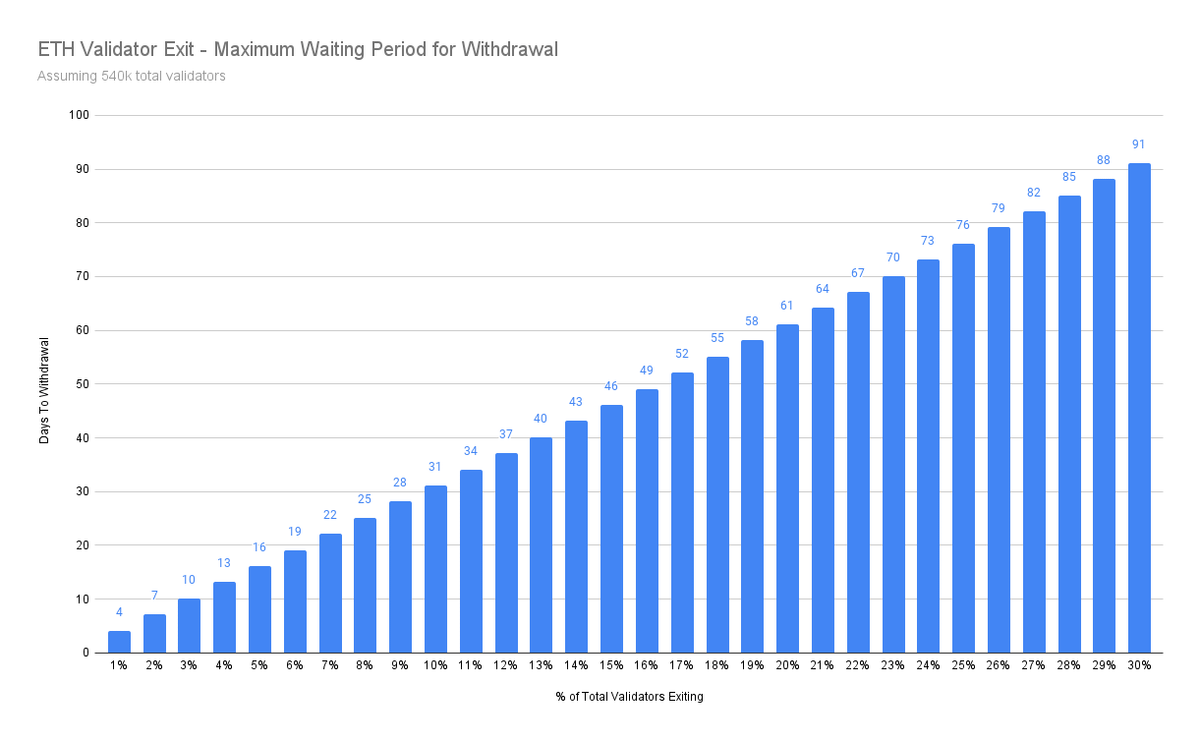

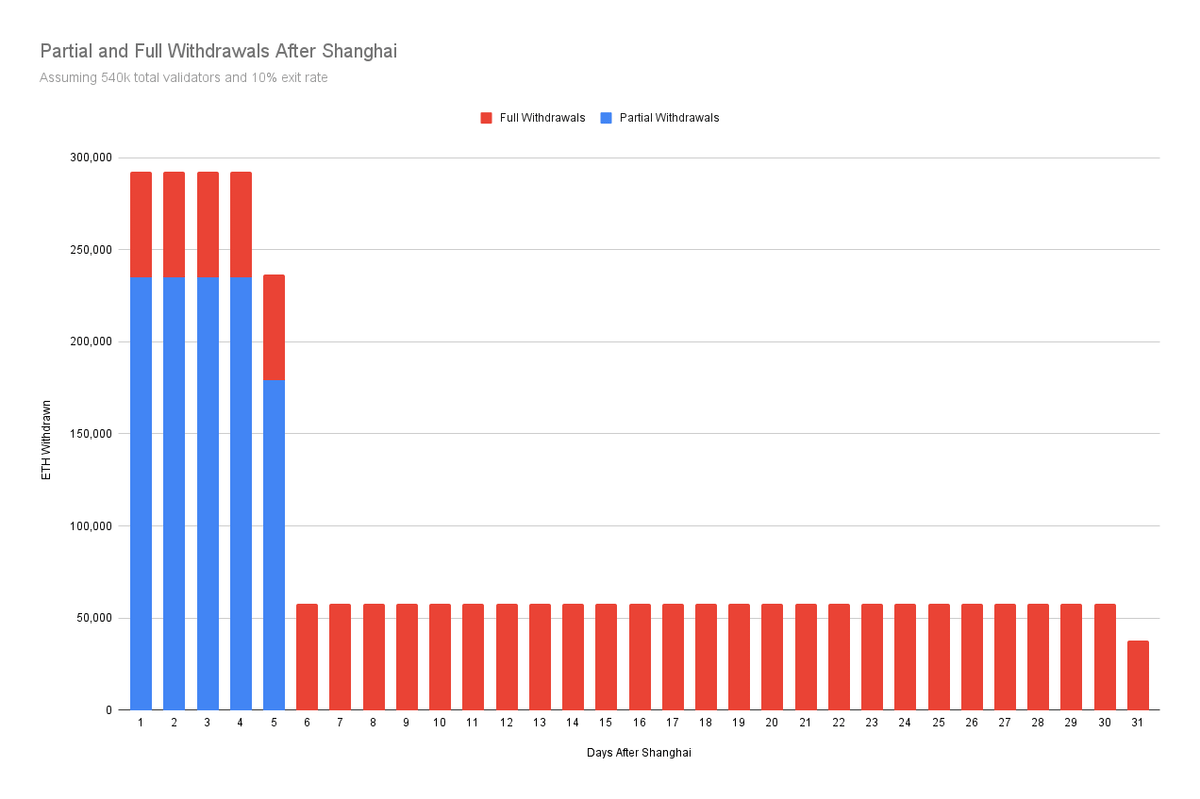

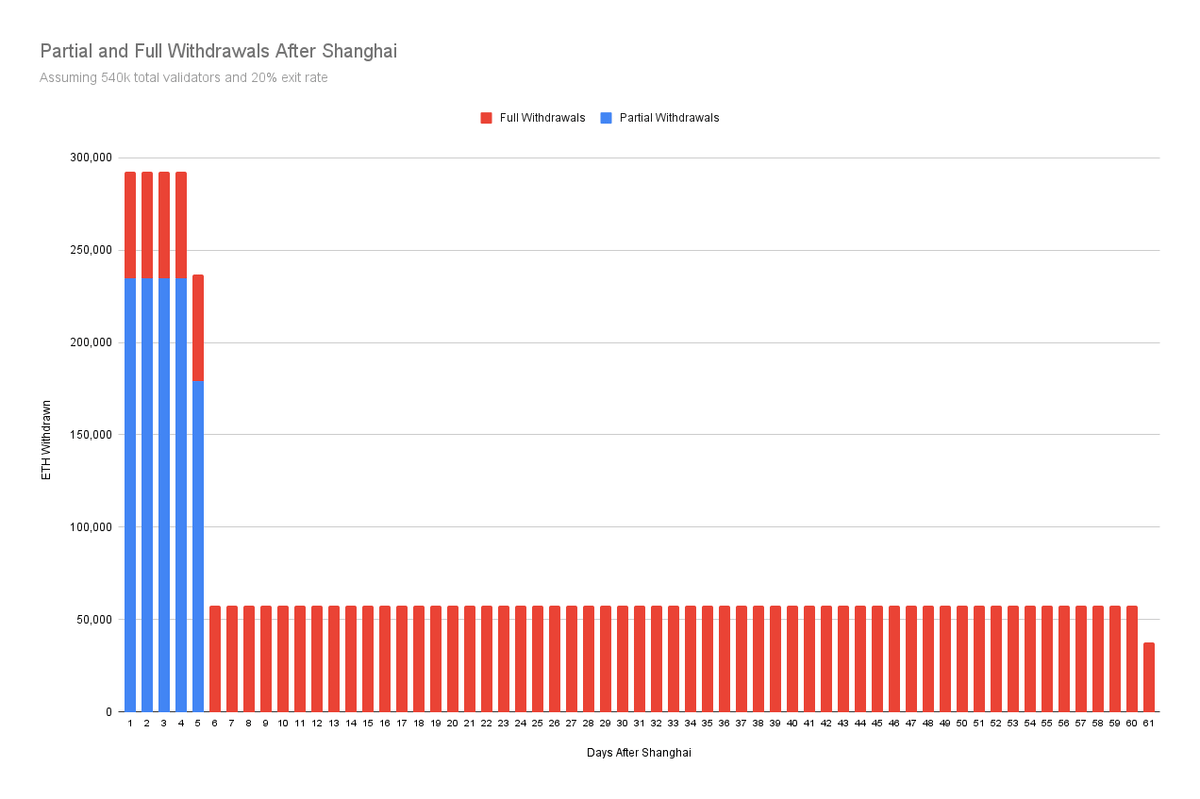

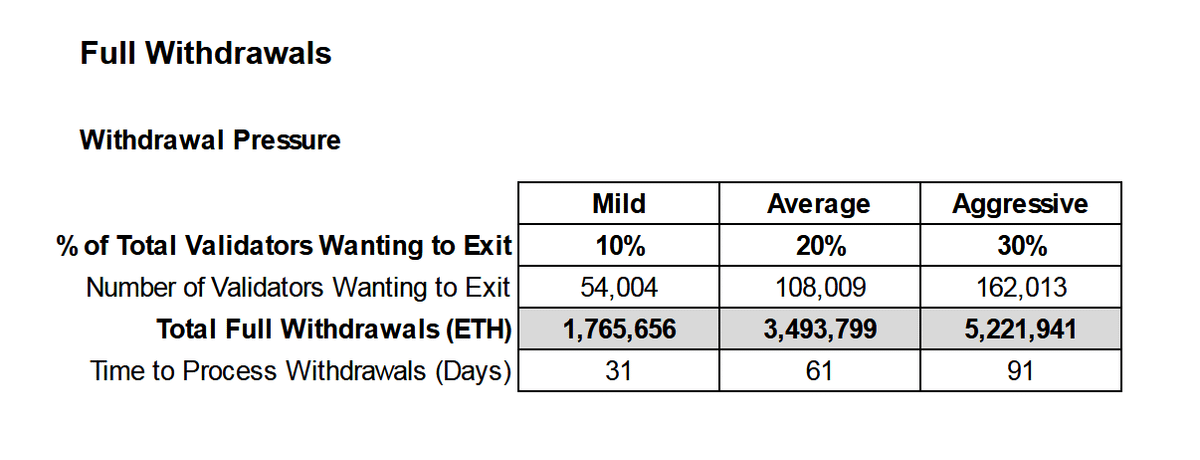

Even if only 10% of all the validators decide to exit, it will take 31 days to clear the exit queue (8 exits / epoch).

Assuming 1,800 FW per day, 57.6k ETH will be unlocked daily for a month.

twitter.com/WestieCapital/status/1613645275234729984

Let's wrap it up:

- 1,119k ETH: PW (staking rewards for 540k active validators)

- 38k ETH: FW for already exited validators

- 1,728k ETH: FW if 10% of total validators will exit

Total: 2,885k ETH

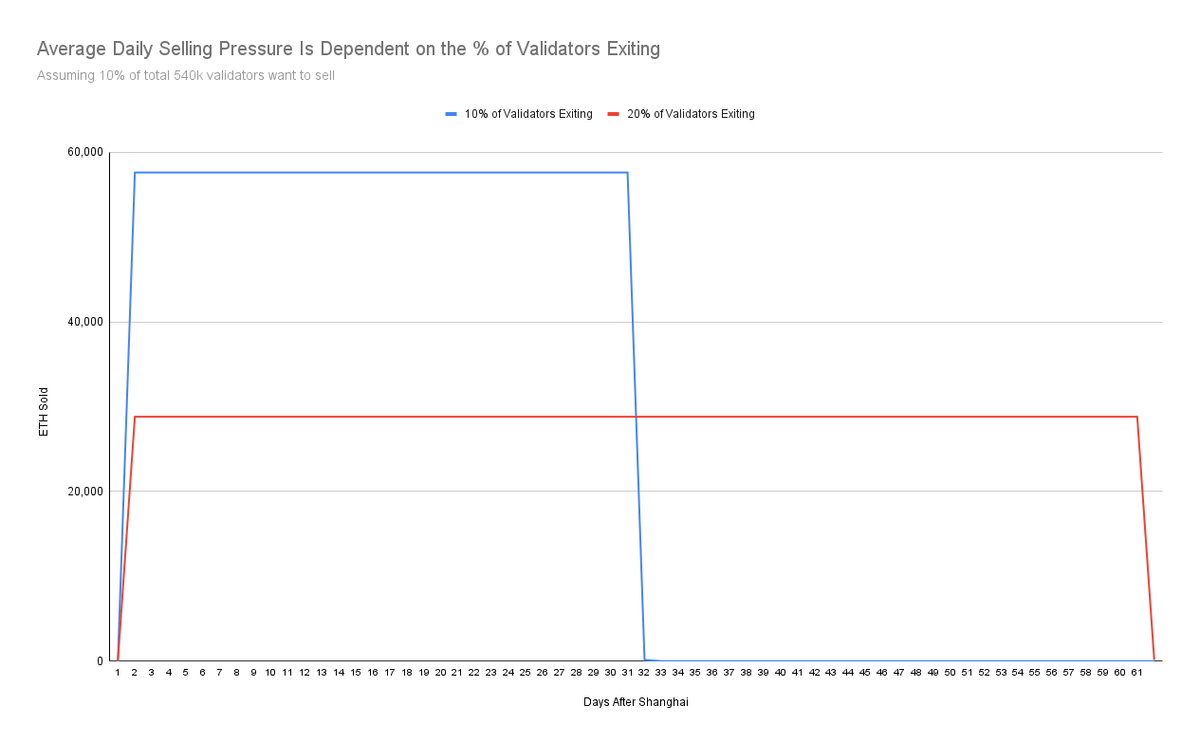

This is how withdrawals would look day by day:

If more validators decide to exit, the schedule of withdrawals in the first month won't change.

The only difference is that it will take more time to process all the FW.

➡️ How Much ETH Will Be Sold?

My estimates range from 436k ETH to 2,917k ETH.

It's a pretty wide range representing the borderline scenarios: mild selling and aggressive selling.

Read on if you are interested how I got to these numbers.

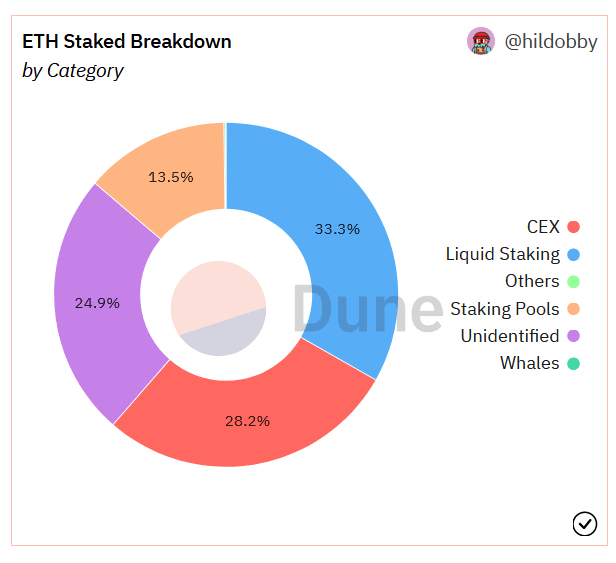

Staker Category

It's useful to break down staked ETH by Staker Category:

33.3% Liquid Staking

28.2% CEX

25.0% Unidentified + Whales + Others

13.5% Staking Pools

Each category will approach PW and FW differently.

---

Dune dashboard by @hildobby_:

dune.com/hildobby/eth2-staking

➡️ Partial Withdrawals - Assumptions

- All validators update withdrawal credentials asap - PW are processed automatically but only when credentials are updated to the new format (see Appendix)

- Staker Category defines the ability / willingness to sell (more below)

twitter.com/korpi87/status/1620407269715488769

Liquid Staking

Staking rewards are already accounted for by the design of liquid staked ETH (lsETH).

It means PW won't be distributed to lsETH holders.

They will go to liquid staking providers who will most likely use them to set up new validators.

No selling pressure here.

Staking Pools

SPs don't have any incentive to let stakers get their PW immediately.

It's more profitable to set up new validators.

Some SPs may also require "unbonding" periods to let stakers get their rewards.

I suppose a suppressed selling pressure here.

CEX

Some CEXes use lsETH and the playbook will be the same as for Liquid Staking category, i.e. no selling pressure.

Others are more like Staking Pools - no incentive to let stakers get their PW immediately, meaning a suppressed selling pressure.

Unidentified + Whales + Others

I guess, these are mostly individuals staking on their own.

Solo stakers are most likely the biggest Ethereum believers and long term ETH hodlers.

Some of them may want to take profits but I don't expect a lot of selling pressure in this group.

➡️ Partial Withdrawals - Selling Pressure

I assumed what % of PW may be sold in each staker category in 3 scenarios: mild, average and aggressive.

Total Selling Pressure from PW:

- Mild: 8% => 92k ETH

- Average: 16% => 183k ETH

- Aggressive 30% => 333k ETH

Sold over ~5 days.

➡️ Full Withdrawals - Assumptions

- Validators exit asap - every day max number of exits is processed (1800)

- Every day all FW are processed (1800)

- The number of active validators stays flat - new ones are set up

- Staker category and profitability defines willingness to sell

twitter.com/korpi87/status/1620407267056308229

Predicting sell pressure from FW is challenging.

There are two unknown variables:

- % of validators wanting to exit

- % of validators wanting to sell

To assess the average daily sell pressure both factors must be taken into account.

% of Validators Wanting to Exit

There are 3 reason to exit:

- Sell

- Hodl / Farm

- Re-enter (change staking set-up / provider, etc.)

It's hard to predict what fraction of validators will exit.

I will consider 3 scenarios:

- Mild: 10%

- Average: 20%

- Aggressive: 30%

The more validators exit for reasons other than selling, the lower the average daily selling pressure becomes although total selling pressure stays the same.

E.g.:

- 10% of validators want to sell

- If 10% exit, 100% of daily FW are sold

- If 20% exit, 50% of daily FW are sold

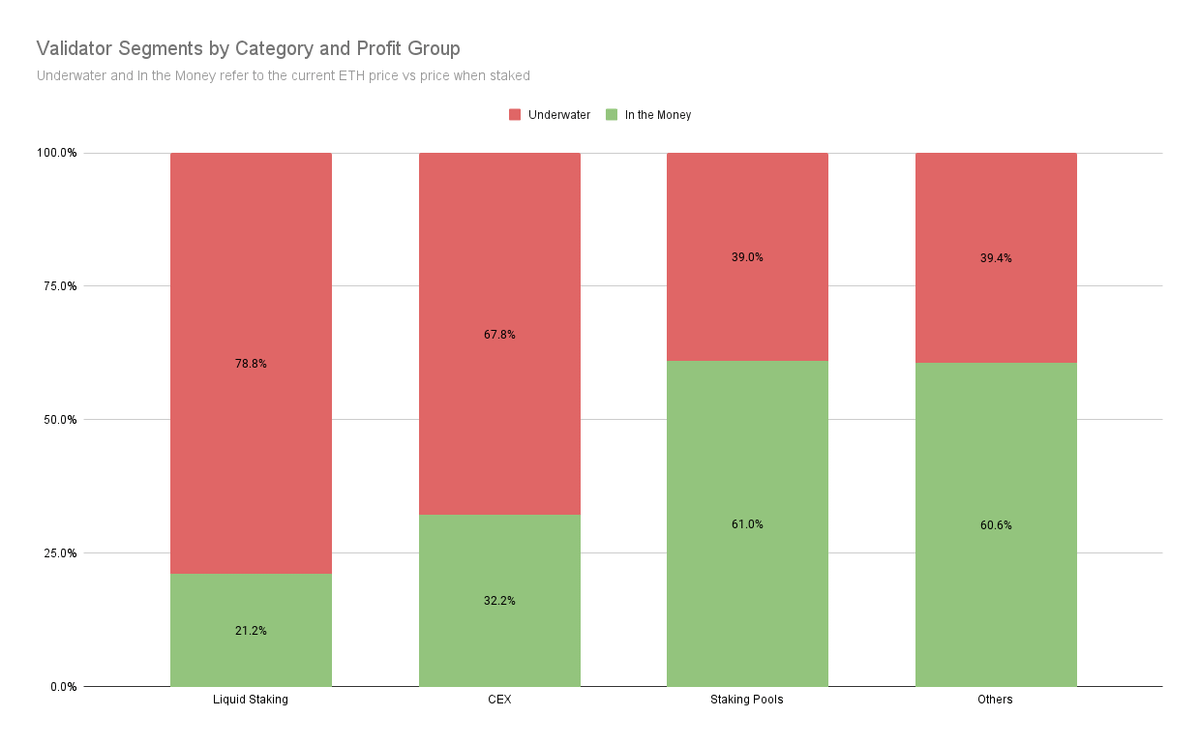

Validator Segments

I split the entire validator set into segments by two dimensions:

- Staker Category

- Profit Group

Reasons:

- Categories differ, e.g. solo stakers are less likely to sell than CEX stakers.

- Stakers in the money are more likely to sell than underwater ones.

➡️ Full Withdrawals - Selling Pressure

By making selling pressure assumptions for each segment I calculated % of total validators wanting to sell in 3 scenarios.

Total Selling Pressure from FW:

- Mild: 2% => 345k ETH

- Average: 7% => 1,206k ETH

- Aggressive: 15% => 2,585k ETH

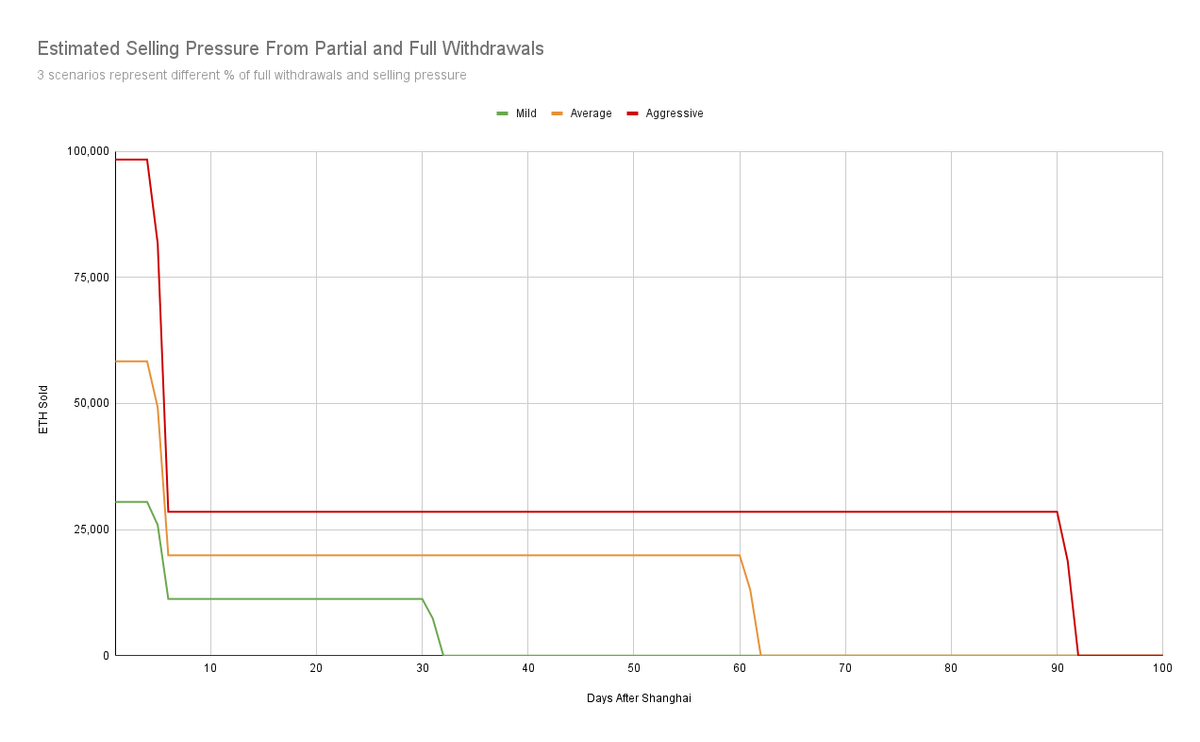

➡️ Total Selling Pressure

By aggregating selling pressure from PW and FW, we get total selling pressure in 3 scenarios:

- Mild: 436k ETH => 14k ETH / day over 1 month

- Average: 1,390k ETH => 23k ETH / day over 2 months

- Aggressive: 2,917k ETH => 32k ETH / day over 3 months

14k ETH / day in Mild scenario is comparable to daily issuance to miners before transition to PoS (~13k ETH).

Probably a non-event.

Average and Aggressive scenarios represent stronger selling pressure that may impact the price, unless new buyers show up.

➡️ Final Thoughts

I'm ultra(sound) bullish ETH over the long term.

Nevertheless, it's hard to ignore the headwinds from withdrawals.

A mere expectation of a dump may lead to a dump.

But if the market is still bullish, it may be easily absorbed by the new buyers.

How much ETH, do you think, will be sold?

How will it impact ETH price?

Let's discuss in comments!

Appendix

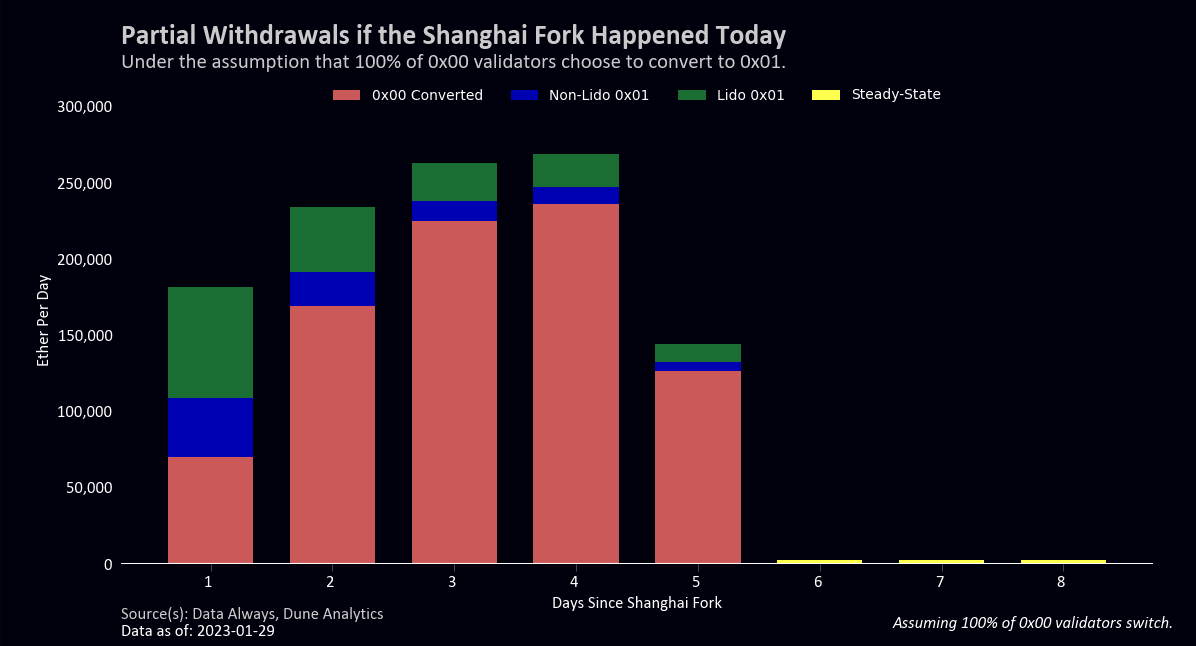

For simplicity, my calculations assume flat daily inflow of PW.

Actually, it will be a curve reaching its peak after a few days.

Total PW won't change though so it doesn't make a big difference.

Detailed analysis of PW distribution:

dataalways.substack.com/p/partial-withdrawals-after-the-shanghai

Disclaimers:

It's not fud!

I'm ETH bull / maxi!

Most of my net worth is in ETH.

Don't hate me for stating the facts you may not be comfortable with.

Peace!

Tagging my favourite content curators / creators:

@rektdiomedes

@DAdvisoor

@crypto_linn

@alpha_pls

@CryptoShiro_

@llamaintern

I believe your audiences may find this thread valuable.