The final piece in @JohnHCochrane's "Interest Rates and Inflation" trilogy has finally dropped. Here is a short thread with my summary of the many insights that pop up in it. Do read the whole thing!🧵

twitter.com/JohnHCochrane/status/1696364112723562511?s=20

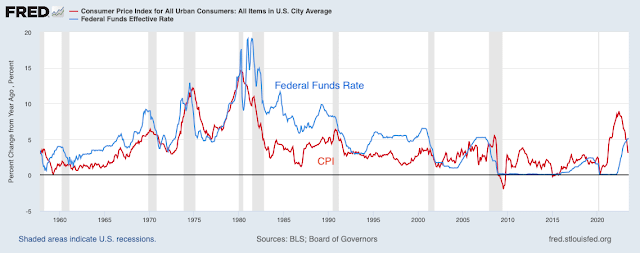

The conventional wisdom states that raising interest rates reduces inflation over time (Friedman's "long and variable lags.") However, Cochrane's blog posts (chapters?) question whether data, empirics, or theory substantiate this standard narrative.

Part 1: DATA

Historical data reveals an inconsistent correlation between interest rates and future inflation, with multiple periods directly contradicting the standard account. According to Cochrane, empirical backing is doubtful.

johnhcochrane.blogspot.com/2023/08/interest-rates-and-inflation-part-1.html

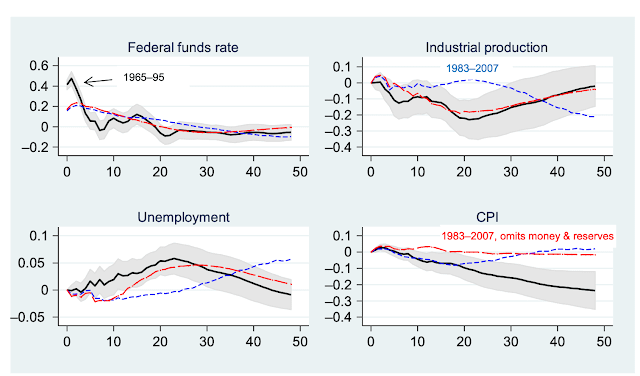

Part 2: VAR

Formal estimation using structural VAR models also provides precarious evidence. Effects evaporate post-1982, account for small fractions of inflation variation, are sensitive to specification choices. Statistical support is fragile.

johnhcochrane.blogspot.com/2023/08/interest-rates-and-inflation-part-2.html

Part 3: MODELS

Modern macro theory struggles to naturally reproduce the standard narrative without incorporating intricate assumptions. No simple macro model produces the standard narrative about interest rates and inflation out of the box.

johnhcochrane.blogspot.com/2023/08/interest-rates-and-inflation-part-3.html

In summary, according to Cochrane, the mechanistic connection between raising interest rates and subsequent declines in inflation may lack the robustness suggested by the consensus view.