The @ThenaFi_ launch could take over the @BNBCHAIN liquidity markets.

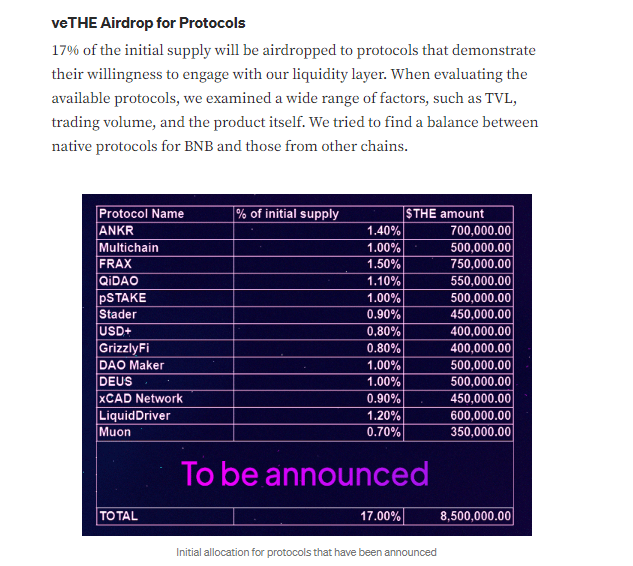

Their prelaunch blue-chip partner list includes @fraxfinance, @TheDaoMaker, @ankr. @MultichainOrg, along with 20+ other protocols.

Bluechip partners + $THE / $veTHE Solidly = Day 1 Demand.

Thread 🧵

With the solidly model, bribes are incredibly important so pulling in the right partners leads to long-term sustainability.

Solidly forks having low bribes has been an issue so this prelaunch ecosystem is impressive.

Massive ecosystem + growing quickly

twitter.com/ThenaFi_/status/1607717042945146880?s=20&t=SNOQufC6uuU3KMsOBmX5SA

They will be partnering with @fraxfinance to bring native $FRAX to @BNBCHAIN and airdropping to 1k+ $veFXS users.

This alone is massive as they are known to be some of the largest bribers in defi and also push very large stablecoin volumes. You'll see why volume is important...

twitter.com/ThenaFi_/status/1606291151043952641?s=20&t=GahjxPhabbA5AHsQHuxyFQ

A partnership with @MultichainOrg most likely means they will use their bridges to bring $FRAX on chain.

Assuming that is the case, @ThenaFi_ will immediately have utility with stablecoin volumes. You'll see why volume is important shortly..

twitter.com/ThenaFi_/status/1589966068411355136?s=20&t=GahjxPhabbA5AHsQHuxyFQ

Their @ankr partnership will be a massive one if they are able to pull all of the $ANKR liquid staking wrapper liquidity onto Thena.

Tokens like $aBNB demand a ton of liquidity and push heavy volume as well. $ANKR has been under a bit of fire recently due to their exploit tho.

twitter.com/Thena_Fi/status/1582416307710222343?s=20&t=GahjxPhabbA5AHsQHuxyFQ

Their kicks off on Jan 5th as the airdrop becomes claimable but the LPs won't go live until January 12th

It gives some time to prepare for the LP launch but there are also ways to possibly capitalize early. Let's cover the launch...

twitter.com/ThenaFi_/status/1607371838035828739?s=20&t=GahjxPhabbA5AHsQHuxyFQ

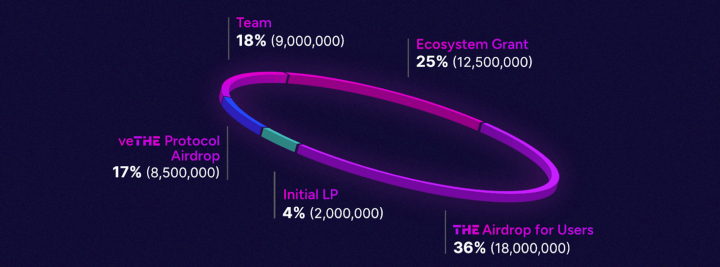

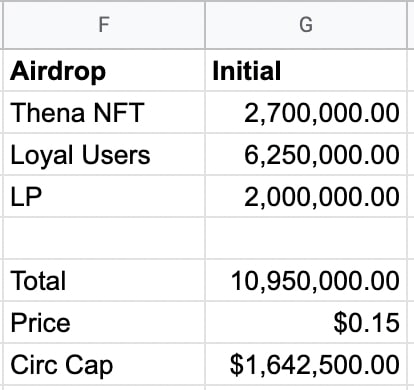

The initial launch is made up of tokens from Initial LP, $THE Airdrop for Users, and veTHE Protocol Airdrop.

The Team portion will be locked, the Ecosystem Grant is for future collaborations, and some of the airdrop is in $veTHE making the circulating MC on launch quite small.

Based on some quick math below, circulating MC on launch will be ~$1.65M.

If you account for all the tokens, the FDV will be sitting at right about $7.5M on launch.

There will be game theory in play on dilution because all returns will depend on how many users lock their tokens

This thread by @Slappjakke is 🔥on @ThenaFi_.

(very underrated threadooor btw)

With partners committing $40k in bribes and Thena matching, there should be ~$80k in bribes in week one.

Annualized that is $4.16M 👀

twitter.com/Slappjakke/status/1607680052883501056?s=20&t=GahjxPhabbA5AHsQHuxyFQ

Partner protocols like these are the best bribers and long-term holders of liquidity platforms.

17% of the initial $veTHE supply is held for partner protocols across some for the biggest names in DeFi.

If these are two-way deals, TVL + volumes should start high.

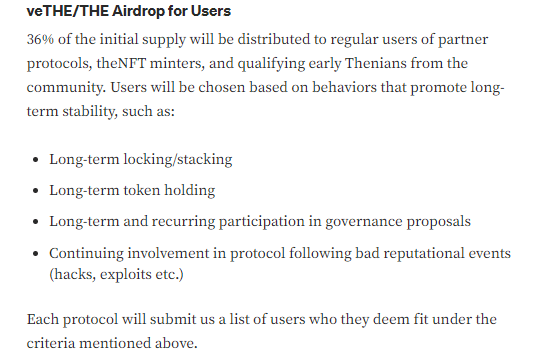

36% of the initial supply will be set aside for users of these partner protocols to hopefully pull in a large user base. If you use any of the above protocols, check in to see if you'll be eligible for the airdrop of $THE / $veTHE.

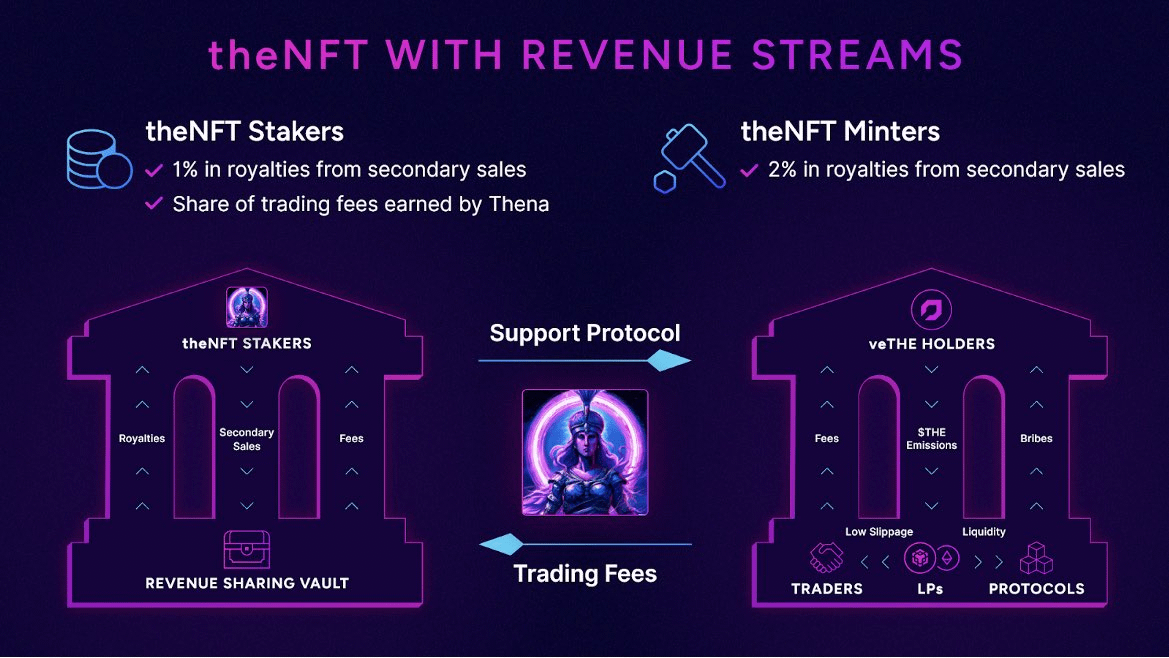

Prelaunch exposure is possible w/ @ThenaFi_ NFTs. Minters get airdrop as well as earn "Founders Share" of swap fees.

Told you volumes were important!

Swap fees going to these Thenian NFTs could end up being a big deal if they do take a large share $BNB liquidity.

twitter.com/ThenaFi_/status/1600435339864444929?s=20&t=SNOQufC6uuU3KMsOBmX5SA

It's important to understand the differences between minting the NFTs and purchasing on secondary...

Mints have already happened but there could be an opportunity on secondary.

Secondary - opensea.io/collection/thenian

twitter.com/KurtoKrypto/status/1605554177161175040?s=20&t=GahjxPhabbA5AHsQHuxyFQ

If you're considering buying some ThenaNFTs prior to launch as a way to build a position, I'd highly recommend taking a look through this post from the team to simulate NFT returns - medium.com/@ThenaFi/thenft-simulations-babb4968d336

NFT Simulations + Partner volumes can help paint a picture on returns.

I've highlighted in the past the massive opportunity on $BNB to take over the liquidity market.

$QUO / $WOM have had first mover advantage but $WOM is extremely inflationary.

$THE door is open for market share to be taken with this massive partner list.

twitter.com/SmallCapScience/status/1588292024704253952?s=20&t=Q8fpof70oMfs6kJLWu_PQw

Disclaimer -

I did purchase some Thenian NFTs and have exposure to the token. I plan to play long-term but will see how the launch plays out.

Do your own research and this thread isn't financial advice, it's for my own record only.

GL 📈

twitter.com/ThenaFi_/status/1608455995377737728?s=20&t=v1BwftBzDB9usPIY2bmobQ