The @OfficialApeXdex is Game-changing.

- Permissionless On-chain Derivatives

- No KYC

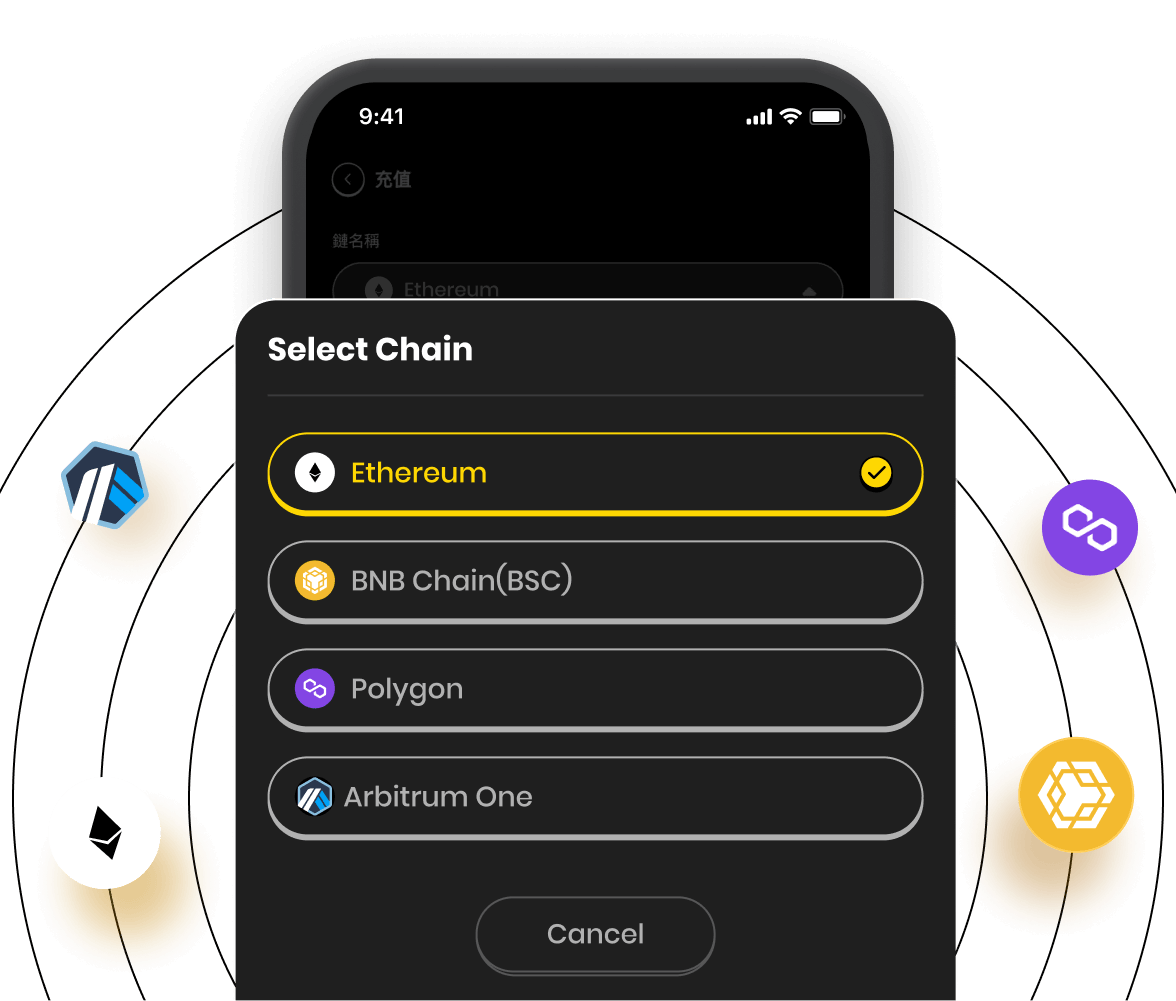

- Launched on MATIC, BNB, ARB, and ETH

- Huge VC/MM Backing

- Partners w/ @Bybit_Official

- Built on @StarkWareLtd

- Lowest On-chain Fees

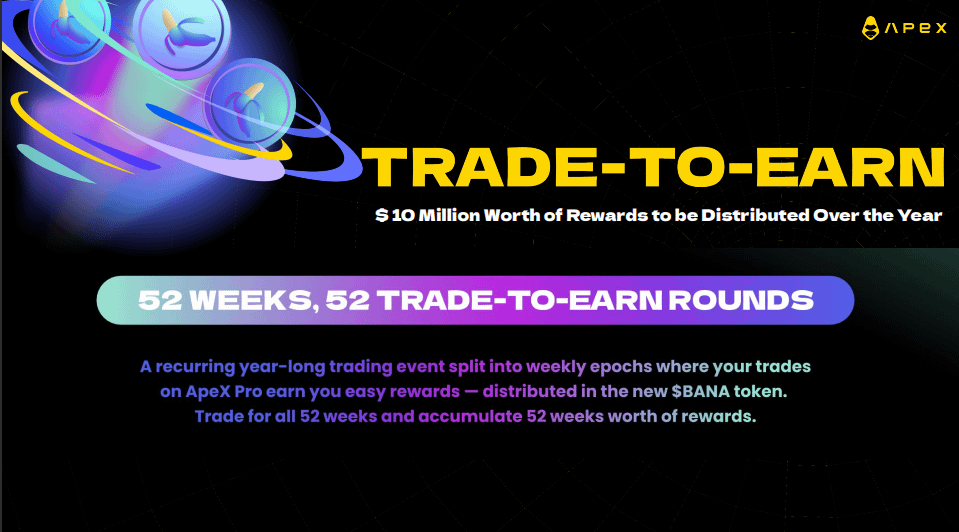

- $10M+ Trade-to-Earn Incentive

- 🔥 UI/UX + mobile

🧵

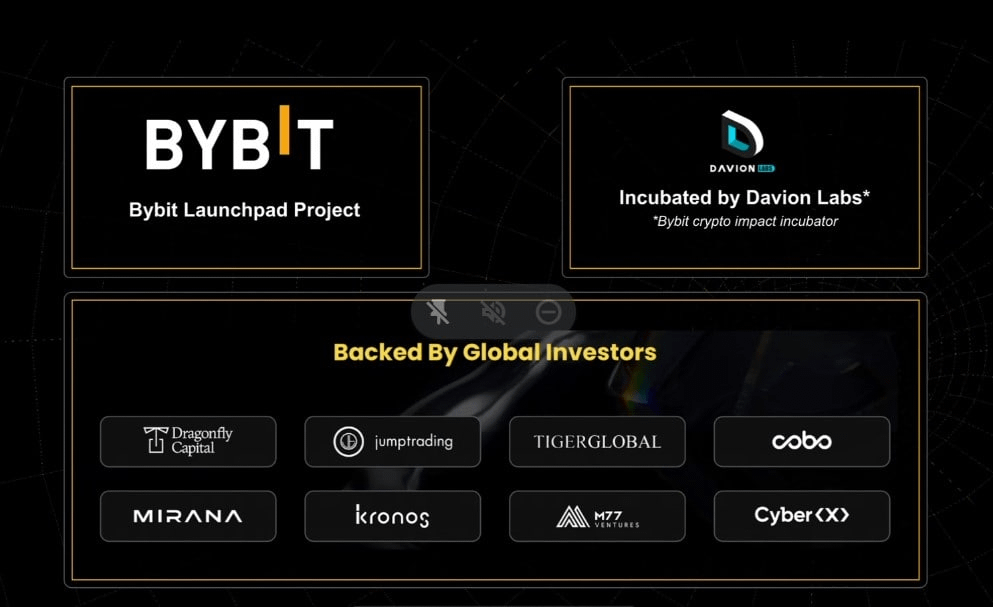

The Apex Pro exchange is incubated by @DavionLabs which is @Bybit_Official's impact incubator.

The goal seems to be bringing the CEX UX and efficiency onchain to a decentralized platform. My experience so far makes me think this has the potential to be the market leader.

On top of ByBit, Apex Pro is backed by some of the biggest names in the space including @jump_, @dragonfly_xyz, Tiger Global, and others.

These backers are extremely important fr deep liquidity within their orderbook model and also will mean heavy on platform volumes.

2022 they already put up some impressive metrics in a very short amount of time.. $1.5B volumes, ~35k users, and 2M+ trades.

With their massive incentive programs in place, I expect them to take the space by storm in 2023 and blow these metrics away.

twitter.com/OfficialApeXdex/status/1608719662803566594?s=20&t=J1LWyDZ0G0ReMhw9cpwUeg

A 2023/2024 narrative for crypto is mobile adoption and dapps prioritizing usability and new user acquisition. Most users aren't or don't want to be tied to a desk.

I'm super impressed by the ApeX mobile UX and think they are landslides ahead of other onchain competition.

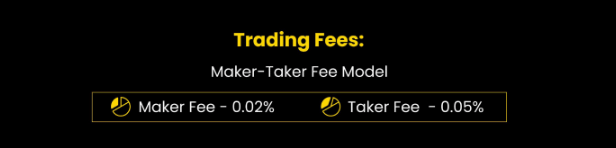

@OfficialApeXdex has extremely low fees compared to even some of their CEX competition and are much lower than onchain options like GMX.

Maker - .02%

Taker - .05%

This is a massive deal for large traders, funds, and market makers that are pushing huge volumes.

Currently, @OfficialApeXdex supports multichain deposits/withdrawals on Ethereum, Arbitrum, BNB, and Polygon.

It's built on @StarkWareLtd layer 2 technology and will expand to further EVM chains in the future. I can see this being a $DYDX competitor with better tokenomics.

Great thread by @drakeondigital on fees compared to the market.

ETH Funding Rates Annualized:

APEX - 11%

DYDX - 20%

GMX - 25%

This also doesn't include opening/closing fees which add up for high-volume users. Loyalty can be bought with low fees...

twitter.com/drakeondigital/status/1604588309686132736?s=20&t=tVHN2pNCXHr-Cnjix9s3cw

Here is another outline from @ImNotTheWolf outlining how trades that should be in profit, can be eaten away by GMX fees.

Large fees mean the largest players can't use these platforms for hedging and/or market making. Betting on DEX longterm, go low fees

twitter.com/ImNotTheWolf/status/1604488274986225664?s=20&t=_A5FJOUgKzvO6577mEm89g

Technically @OfficialApeXdex competes with both CEXs and other on-chain derivatives options.

With the FTX collapse more users are being forced onchain with CEX risks and strict KYC laws. Apex is the lowest fee option for non-KYC users... this is a massive on-chain market.

They have 5 pairs including ETH, BTC, DOGE, ATOM, and XRP.

From their Twitter page, it seems they will be adding pairs soon that are in high demand.

They have done 5 polls this week on which tokens to add. So far $MATIC, $NEAR, $OP, $AVAX, and $UNI/$ALGO are winning.

Volume 📈

twitter.com/OfficialApeXdex/status/1606176152711663617?s=20&t=06ljP95ekvE2wzU0As2YeA

Incentives program -

Everyone asking how to Apex but one of the best ways to earn a position by simply using their platform.

A 52 week trade-to-earn program with over $10M worth of rewards. Last bull run L1/L2s incentivized user adoption, now it's at the project level.

Tokenomics

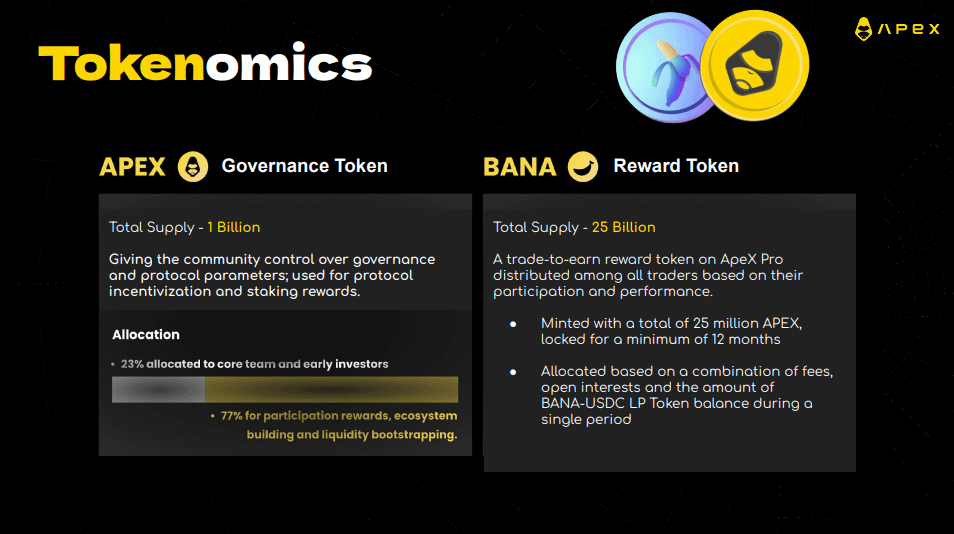

2 Token Model:

$APEX - Governance control and staking rewards (seems like alpha) 👀

$BANA - Trade-to-earn reward token minted with 25M Apex (2.5%). Allocated to traders based on fees paid, usage, and performance..

$BANA

These tokens vest over 12 months when they will be redeemable for a share of 25M APEX at the end of the 52 week Trade-to-earn program. We are on week 6 of 52... you're early.

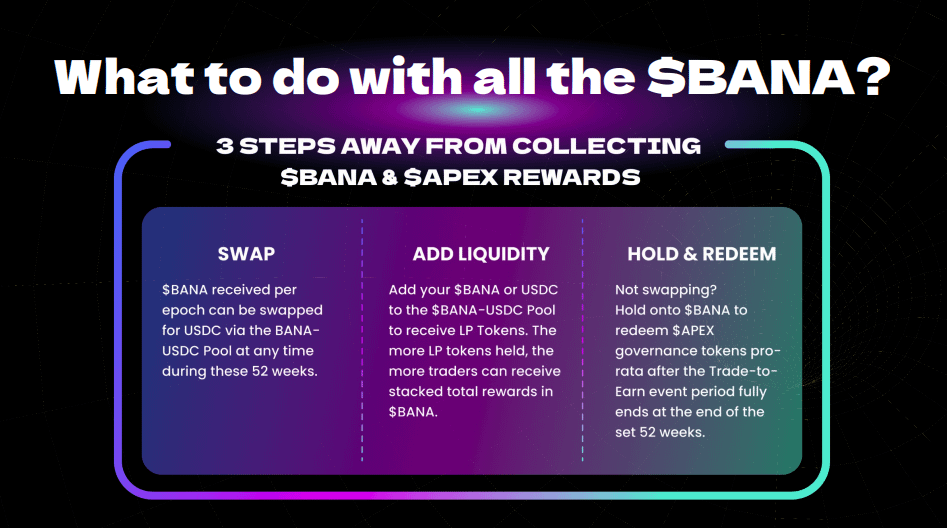

$BANA can be swapped for USDC, LPd (USDC/BANA), or held for a share of $APEX.

$BANA cont.

50% of Apex Pro fees will go toward using USDC to buyback + burn $BANA. This is volume for LPs and makes $BANA more scarce over time until the 52 week inventive program ends.

That means, being early to platform usage helps you earn a larger position.

$APEX

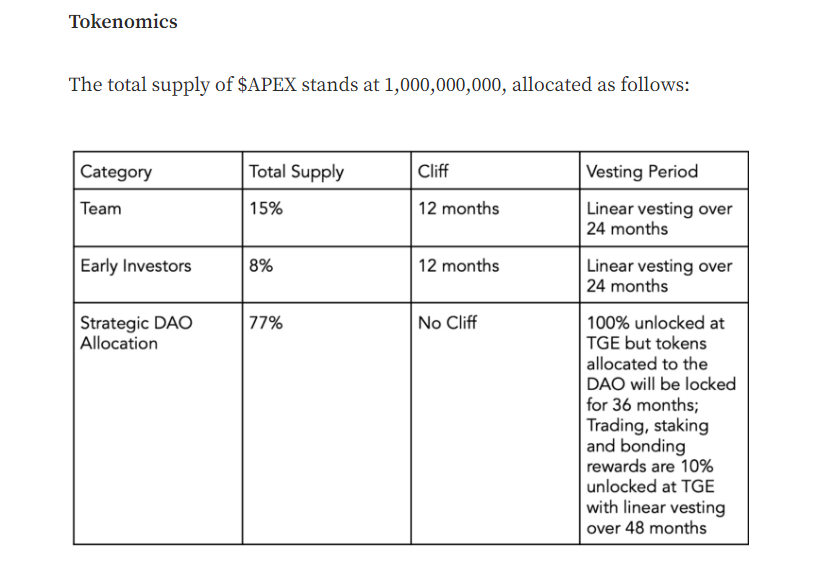

1B Supply

- 23% of $APEX supply is for the team and VC's backing the platform.

- 77% is used for participation rewards, ecosystem building, and LP bootstrapping.

Staking for platform fees is coming, this is alpha. The user incentives built into Apex Pro are unparalleled.

$APEX cont.

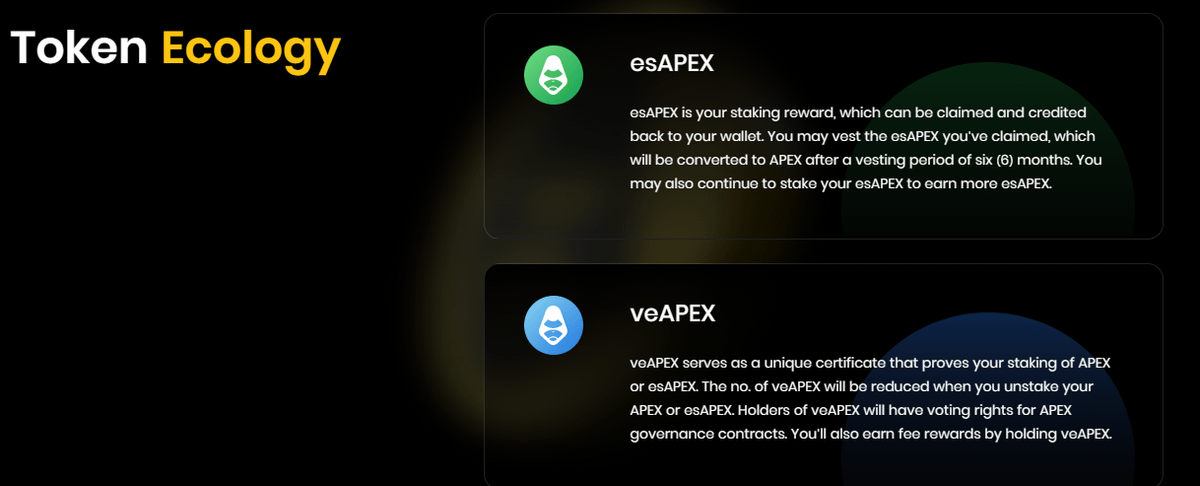

$APEX is broken into two categories.

$esAPEX - Staking reward. Can be staked for more $esAPEX or vested over 6 months to become liquid.

$veAPEX - Governance and fee payouts.

Somewhat similar to $GMX without the need for $GLP and leagues better than $DYDX.

$APEX is currently hard to get with near zero onchain liquidity.

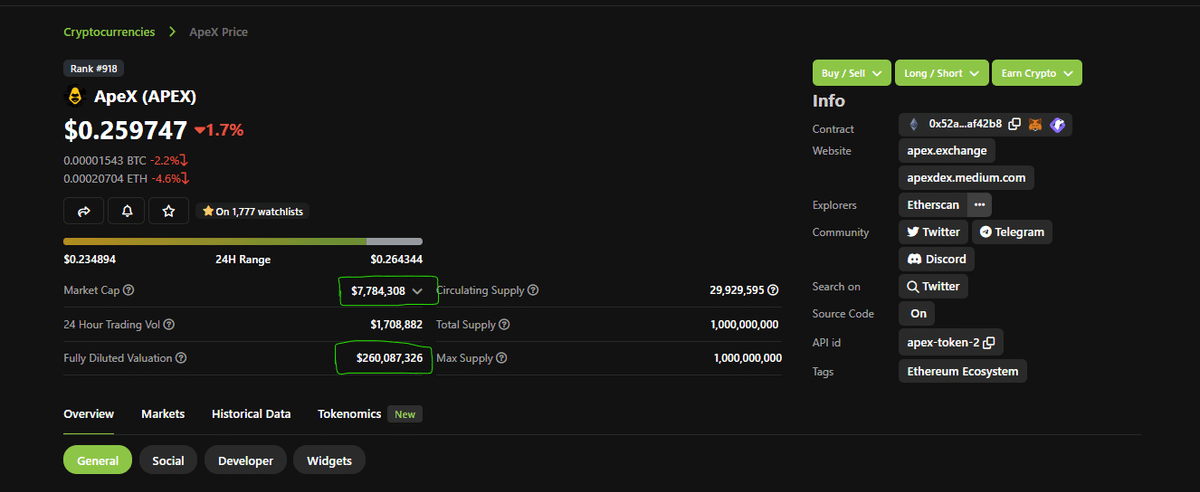

At $.27 per token...

$8M Circ MC

$270M FDV

There is plenty of emissions yet to happen but from an FDV perspective, it's less than 50% of GMX FDV

The majority of these tokens that are unpaid are actually sitting with the DAO and will be used to incentivize things like liquidity and trading volumes

The team and early investors will have linear vesting over 24 months but only account for a combined 23% of the total supply.

I can see L2s, sidechains, or large DeFi projects fighting over APEX governance to get their tokens listed

Wasn't @binance charging $50M per listing according to Andre?

A bonding/order book model doesn't have the same restrictions as a $GLP model for new pairs.

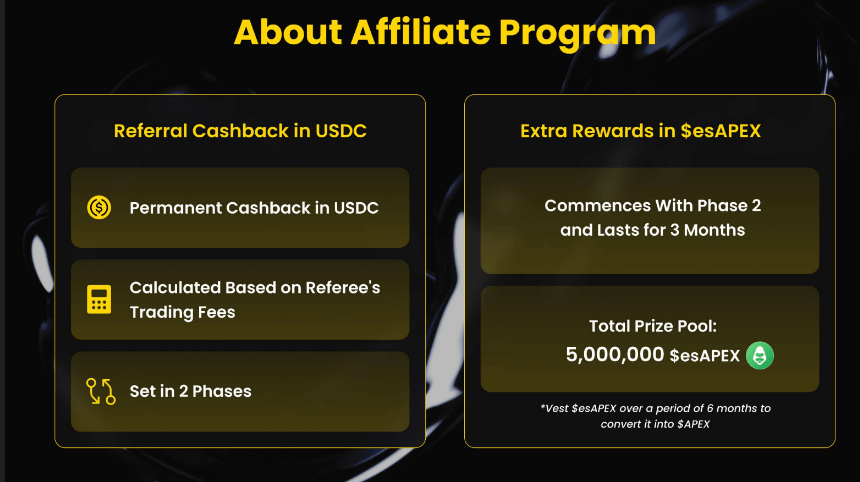

Another reason that @OfficialApeXdex will thrive is they have an unreal incentive program for affiliates.

They are taking a page out of the $GMX / $FTX playbook and hugely incentivizing the marketing of the platform. You'll be seeing $APEX everywhere in a few months...

It has a two-layer affiliate program that is paid out in $USDC.

On top of the $USDC you earn from fees, they also have bonus incentives paid out in $esAPEX for affiliates, influencers, and KOLs to earn their share of the platform.

Early $esGMX holders + promoters have printed.

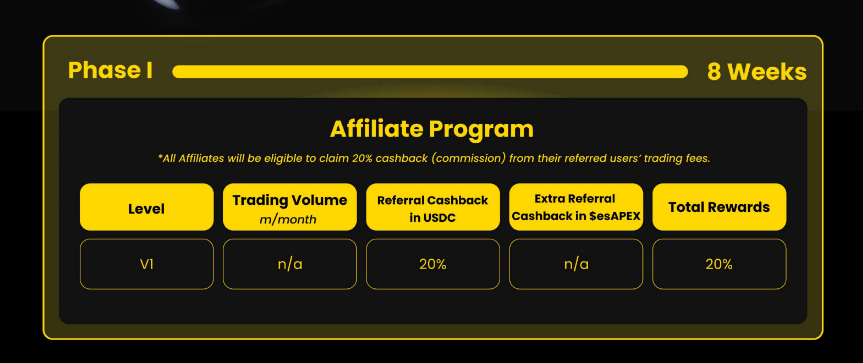

Phase 1 -

We are currently in week 6 of 8 for phase 1 of their referral program

It consists of 20% cashback in $USDC and no extra rewards in $esAPEX. What that means is most people wont catch on or start heavily shilling until Phase 2 in January.

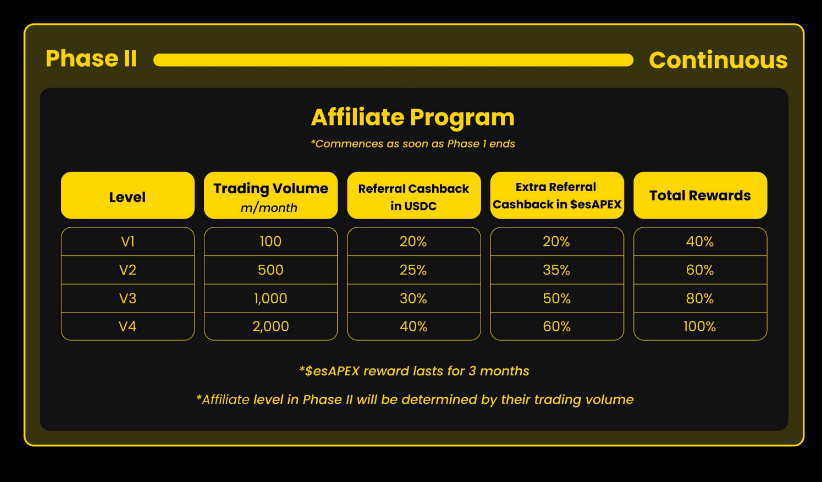

Phase 2-

Mid-January Phase 2 kicks off where affiliates can earn 20-40% cashback in $USDC and up to 60% extra referral fees in $esAPEX. 👀

Early users and influencers will be promoting this all over Twitter, YouTube, and Tik-Tok in the first few months of 2023.

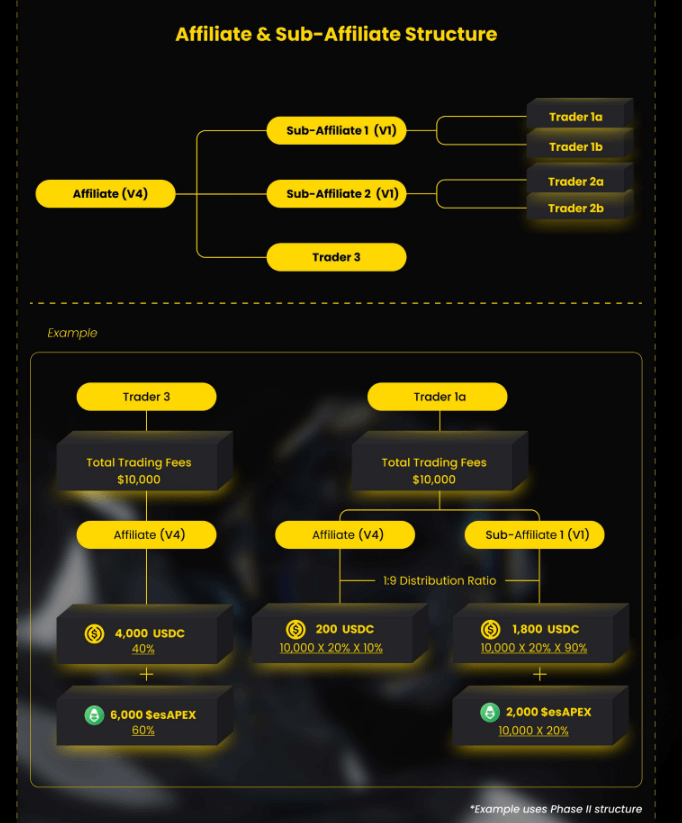

On top of massive $USDC / $esAPEX incentives, they also have a layered sub-affiliate program.

This means if you refer someone, then you can get 10% of what they earn from any of their referrals.

When Phase 2 starts, this will become the highest incentivizes for KOLs.

Users,

My @OfficialApeXdex referral information!

Click the link, connect your wallet, and you're ready to start trading! Mobile users, will need to add the "SCS" code.

You'll save 5% on fees as APEX heads into Phase 2.

Referral Link -affiliates.pro.apex.exchange/b/SmallCapScience

Mobile Code - SCS

Any Influencers or KOLs looking to become affiliates, my DMs are open. I'll do my best to answer any questions or I'll have you introduced to the team.

My sub-affiliate earnings are set to 0% which passes on my rewards.

affiliates.pro.apex.exchange/v2

Master Affiliate Code – 566

The majority of you don't care about affiliate programs but it matters for user acquisition and volumes.

ByBit assistance in building, largest VCs/MMs backing, impressive UI/UX, top-tier marketing program, and incentives for traders/influencers/projects make this hard to beat.

As Phase II starts mid-January, the order book should become deeper as more users pile in.

I'm also expecting the new pairs being added would lead to launching on more chains + larger volumes for alts. If Apex wins on both lower fees + deepest liquidity, it will be hard to beat

Side Notes -

There is a ~4k NFT collection called Apex NFT Predator that has been used in the past for lower fees/ higher incentives for users.

It's not confirmed but these could get future incentives, currently overvalued compared to ~4.5k $APEX each can be burned for!

On top of them receiving APEX tokens, they also are pretty sweet PFPs.

We will see if something cool gets built on top of these NFTs similar to @GBlueberryClub. I only scooped one of them purely for speculation.

opensea.io/collection/apex-nft-predator

This could also be a bullish narrative for $BIT (@Bybit_Official) due to the close integration between the platforms and possibly increasing volumes.

I've been pretty vocal on Buyback Models vs. RealYield. Well, $BIT passed $100M buyback program 🤝

twitter.com/DigitsCapital/status/1609037719262617600?s=20&t=Txw1pLYnSH3ZMM-0hcEMiw

Easy to be bullish on @OfficialApeXdex w/ these narratives...

- Derivatives on 4 Chains

- Built on Starkware

- Massive incentives

- 30x leverage

- Backed by ByBit + biggest Vc's

- Lower fees than most CEXs + DEXs

- Best DEX mobile UX

- Deeper liquidity than DYDX + GMX

Personally, I'm very excited about this platform but will be looking to largely earn my position over time through their Trade-to-Earn program.

Its pretty easy to be profitable on positions with a zero cost basis!

Disclaimer -

So far I've bought on Apex Predator NFT and haven't bought the underlying tokens. I plan on largely using Trade-To-Earn to build a position.

Do your own research and this is not financial advice, all exchanges come with underlying risks.

GL! 📈