I've been farming to accumulate a small $SPA bag.

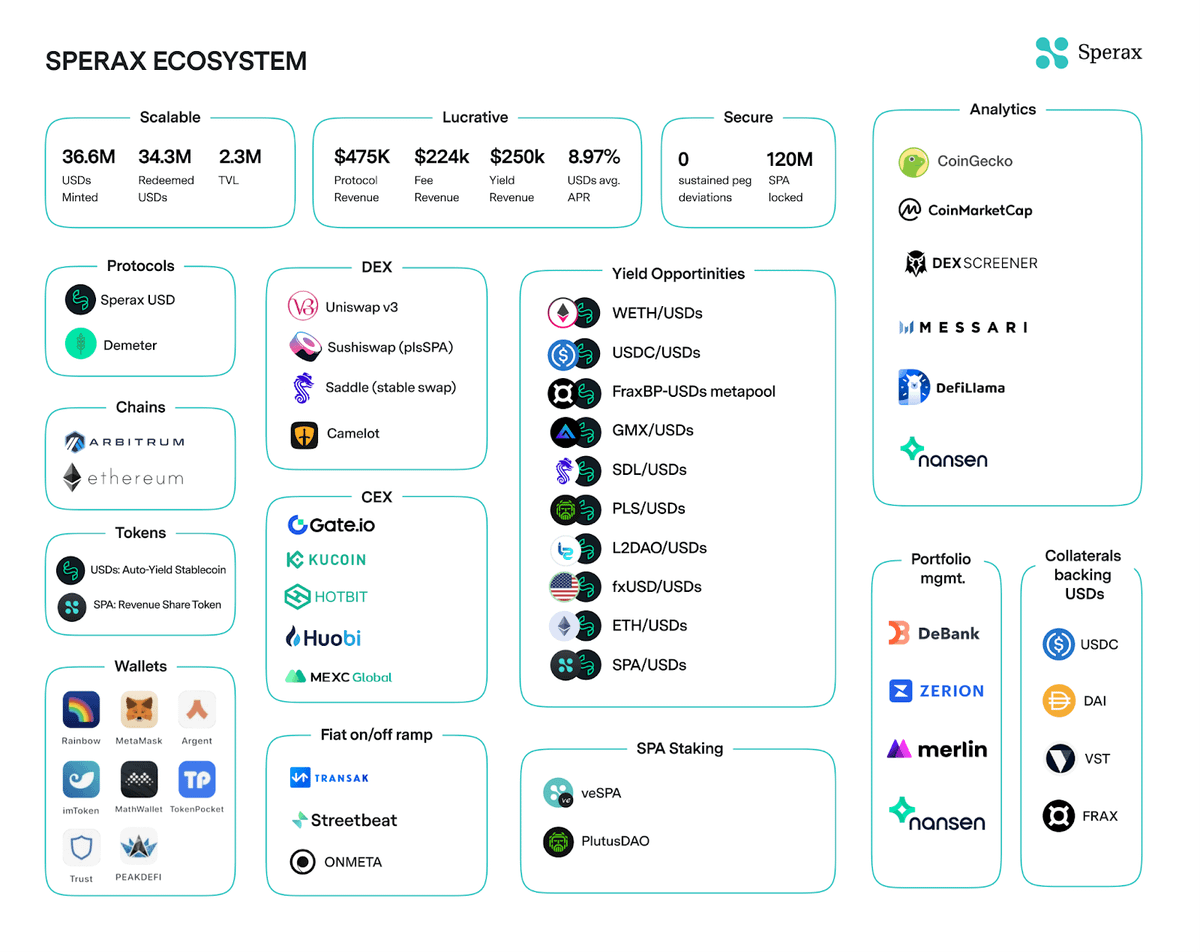

The @SperaxUSD partner list is next level with @GMX_IO, @GainsNetwork_io, @CamelotDEX, @rage_trade, @JonesDAO_io, and the soon-to-launch @vela_exchange.

It's lagged behind the market and has multiple ongoing narratives.

Mini 🧵

What originally caught my eye was the @SperaxUSD 2022 Recap and 2023 Roadmap document they put out a few ago.

This slid under the radar and is packed with alpha, highly recommend a read. I'll cover a few quick details...

medium.com/sperax/speraxusd-2022-recap-2023-roadmap-4b6f474267f0

The piece that stuck out to me was they announced $GMX + $VELA are in talks for integration.

@vela_exchange launches in the next week and if you aren't familiar it's a perp exchange similar to $GMX. Their $VLP (think GLP) liquidity for perp trading will be entirely stables

Now, if you are familiar with $USDs from @SperaxUSD, its an autoyielding stablecoin that earns ~10% yield just for holding. $USDs being minted causes $SPA that ends up burned.

There are about $2.1M $USDs in circulation (tiny). The issue has been low utility and high emissions..

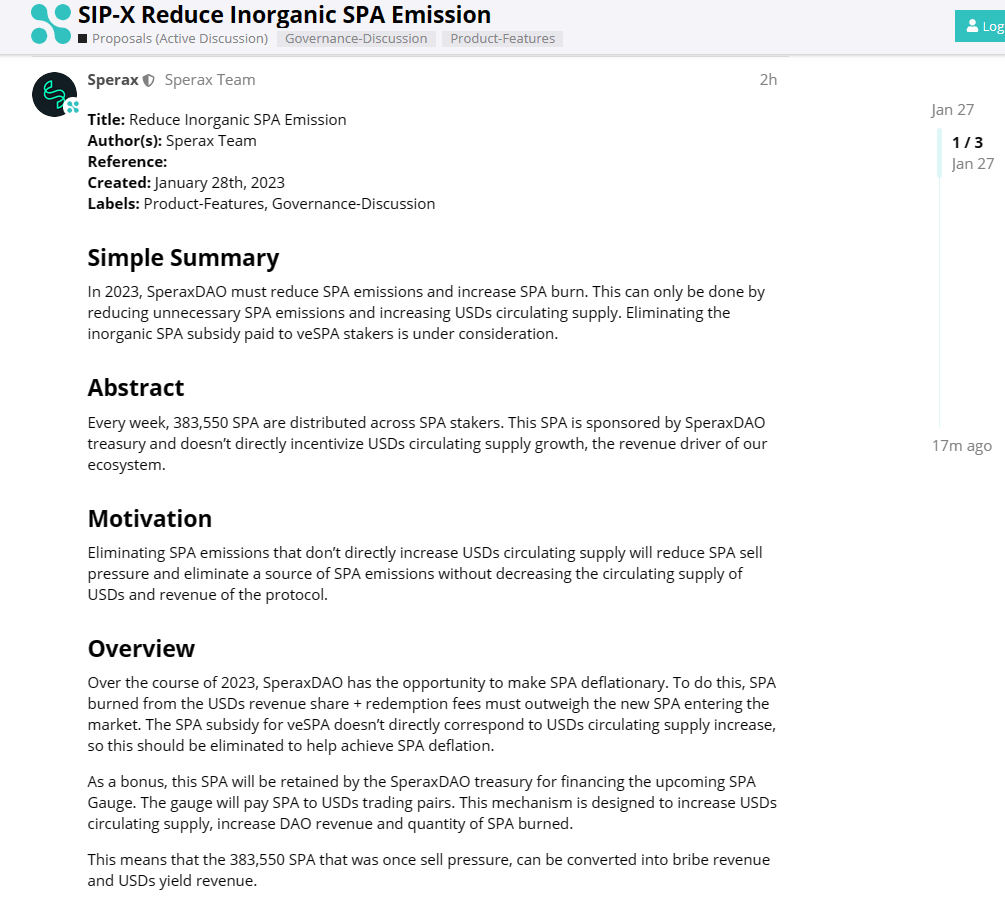

It looks like that will be changing based on a governance proposal from today...

The current ~400k $SPA per week going to $veSPA stakers would be reduced.

SIP-X Reduce Inorganic SPA Emission - Proposals (Active Discussion) - Sperax DAO forum.sperax.io/t/sip-x-reduce-inorganic-spa-emission/935

The emissions cut also states that the $SPA will be redirected towards bribe revenue, so the $veSPA stakers still win.

It's very similar to $AURA bribing $AURA - $ETH LP with $AURA during every epoch.

It makes the current $SPA emissions more productive for the protocol.

Outside of emissions, the other issue with SPA was utility.

Without gauges and bribes, the token has very little utility outside of the USDs burn function.

This governance shit should mean both Gauges / Bribes are on the horizon for $veSPA holders. Flywheel is starting.

My bet is that one of their partners catches on and accumulates more $veSPA to direct emissions post-gauge launch.

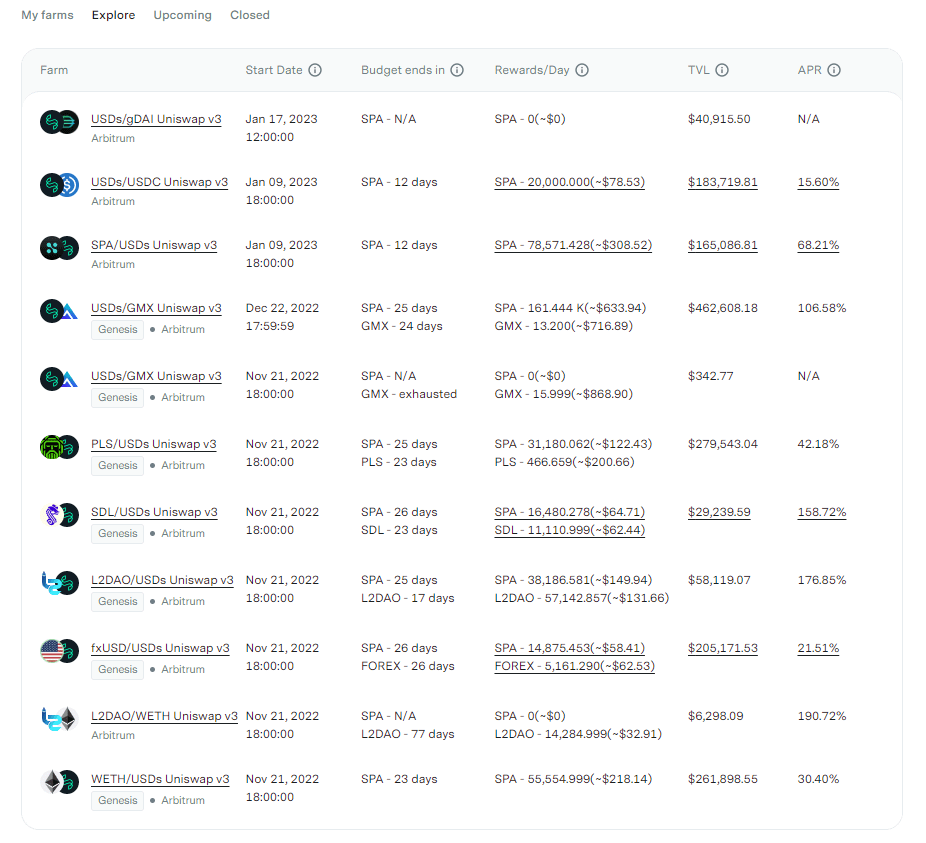

Looking at their Demeter farms, most reward budgets coming to an end in the next 2-3 weeks. I'd assume that's probably when gauges would launch...

The reason I'm bullish...

Partners include @GMX_IO, @GainsNetwork_io, @PlutusDAO_io, @TheLayer2DAO, and @handle_fi. They also have partnered with @JonesDAO_io and @CamelotDEX which arent included below...

All massive names and I bet one accumulates $veSPA before gauges.

I'd also keep an eye on @PlutusDAO_io as they have become a sinkhole for $SPA accumulating about 80M $SPA due to their $plsSPA wrapper.

Once gauges go live it will make $PLS much more of a productive asset as they own a large % of $veSPA.

twitter.com/PlutusDAO_io/status/1618354908390117376?s=20&t=-HGDyZvy77AohOon0GogZw

$SPA has lagged this bull run due to emissions and could break its longterm downtrend soon. I'm hoping emissions cuts + gauge utility will help.

SPA is a market hedge IMO because if the markets change direction, people will crave stable yield.

Disclaimer -

None of this is financial advice and is used for my own record.

I've purchased a small bag of $SPA but will be farming my position due to low liquidity. It is a medium conviction play for me. My personal goal is to hold 25% long-term and 75% ~1-1.5 months.

GG 🚀