While doing research for a @SCSLabsResearch video, it came to my attention most protocols are mispricing the risk surrounding @circle and the $USDC peg.

Projects and investors both should do some basic risk management exercises regarding $USDC exposure.

Let's discuss 🧵

To start, I have zero positions to profit off of a $USDC depeg and still have $USDC exposure. Similar to @CryptoHayes and @balajis native $BTC is my favorite hedge for USD/USDC risk.

$LUSD, $ETH, $OHM, etc. also help diversify but come with their own set of pros and cons! DYOR

In 2022 projects with treasuries and dev funds that were 100% in either $ETH or on FTX got absolutely rekt.

Please learn from the mistakes of others and diversify your treasuries and dev funds!

Let's dive into the discussion...

To get the full picture you must understand the difference between the 2 types of USDC liquidity.

1. Offchain Liquidity - 1:1 backing of Cash, Cash Equivalents, and Short-term Treasuries (<3 Months)

2. Onchain Liquidity - DeFi liquidity (Uniswap, Curve, etc.)

Both have risks.

Let's start with #1, off-chain liquidity.

Circle announced it held $3.3B of liquid reserves for USDC at the now-bankrupt SVB. This caused an immediate bank run as people considered that $USDC may not be backed fully 1:1 offchain anymore. $USDC fell 13%.

cnbc.com/2023/03/11/stablecoin-usdc-breaks-dollar-peg-after-firm-reveals-it-has-3point3-billion-in-svb-exposure.html

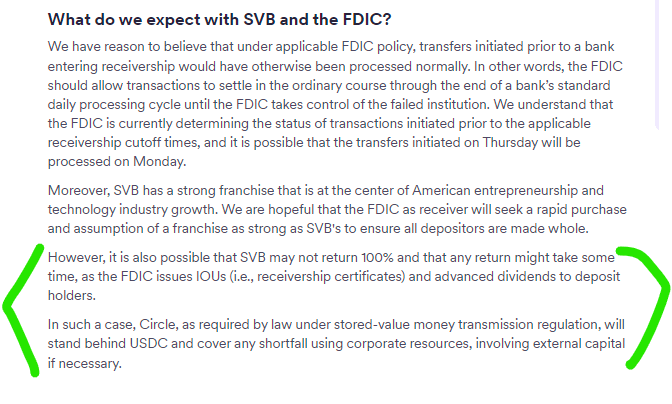

This became a massive issue for @circle as they are required by law to fully back the asset.

The plan was to leverage their corporate resources or outside capital to fill the gap. Neither are ideal options and lack a bit of transparency IMO.

One reason $USDC is considered a safe haven is powerful players like @BlackRock and @GoldmanSachs back $USDC.

Their "external capital" likely is some extremely deep pockets with a vested interest in the asset continuing to thrive. Some peace of mind...

bloomberg.com/news/articles/2022-04-12/blackrock-fidelity-back-circle-in-400-million-funding-round

By the end of the weekend, the contagion was spreading and the US Government decided to step in and fully back all customer deposits so external capital wasn't needed.

Huge win for Circle and it helped $USDC regain peg.

markets.businessinsider.com/news/currencies/silicon-valley-bank-svb-collapse-circle-stablecoin-usdc-crypto-markets-2023-3

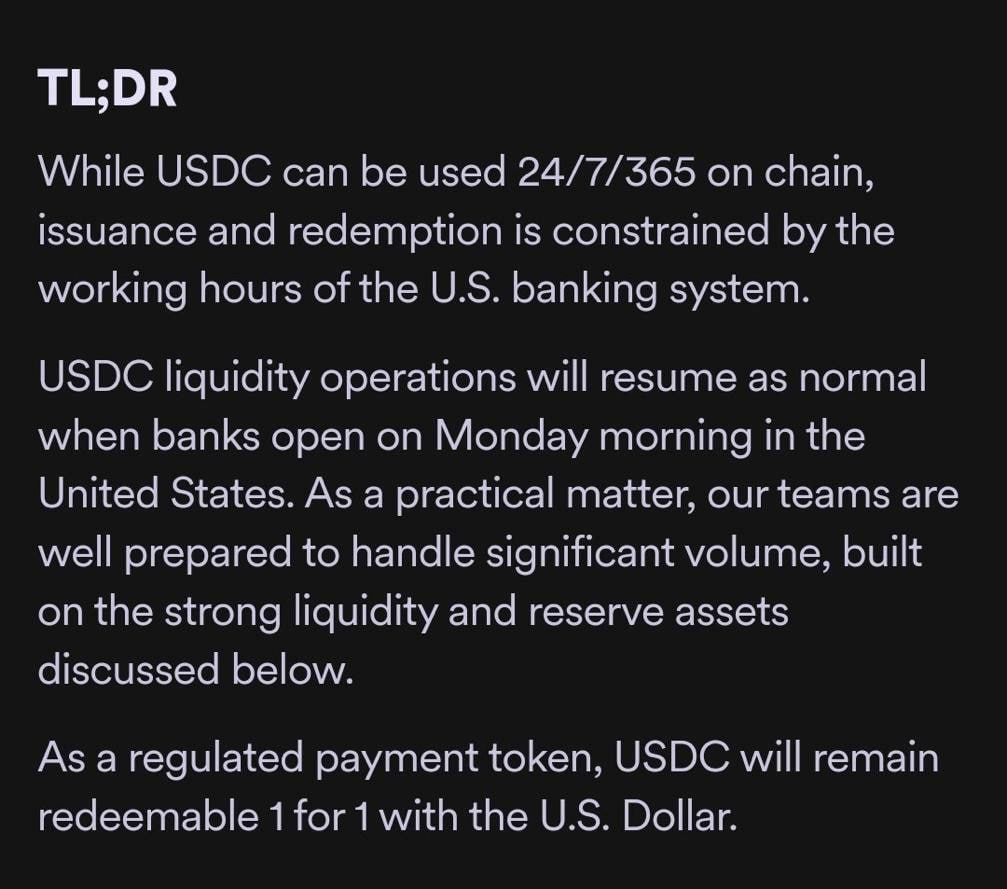

Part of the issue with offchain liquidity is the speed of redemptions.

Circle loses access to some of its capital on the weekends due to the restraints from US Banking Hours. There is more risk of liquidity challenges on the weekend, the last depeg started on a Friday night.

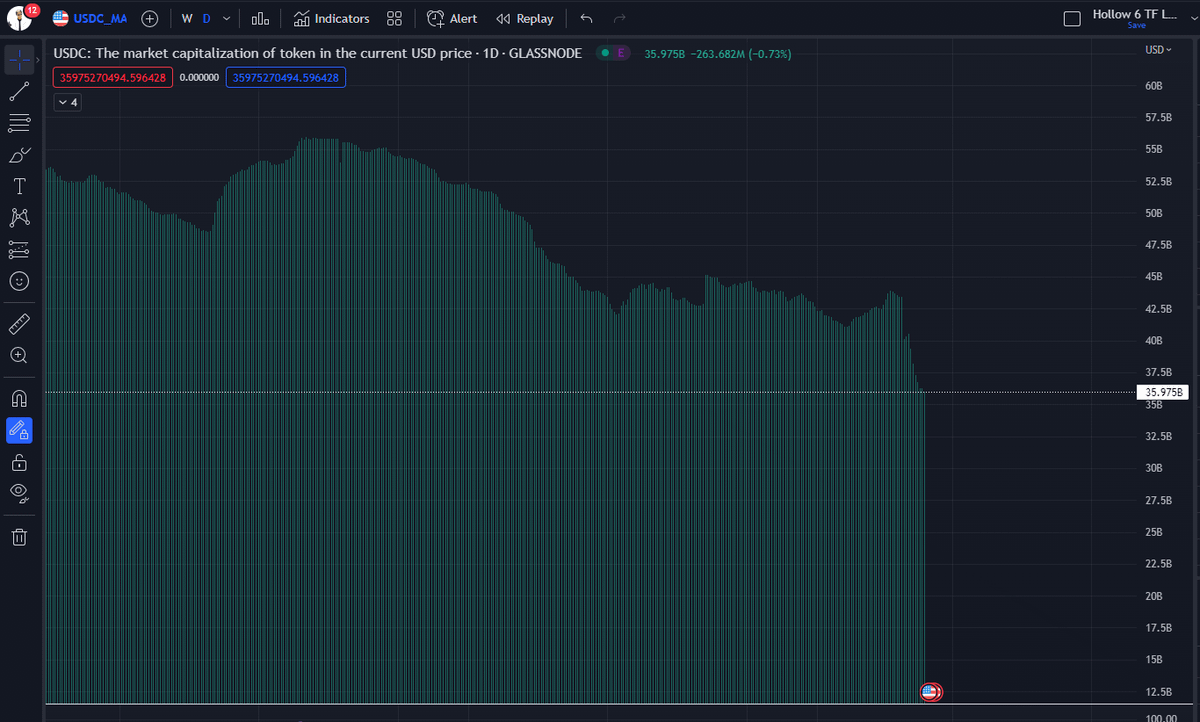

Due to the off-chain backing/liquidity scare, there has been a massive amount of $USDC redemptions.

Over $7B $USDC has been removed from circulation and burned since March 11th.

twitter.com/btctn/status/1636797591638638600?s=46&t=KKPEQuvPulSOiW5yf4THLA

One would think that after regaining peg the outflows of USDC would subside, but in fact, redemptions picked up and have averaged $1B a day for the past 3 days.

cryptonews.com/news/usdc-stablecoin-sees-massive-3-billion-outflows-three-days-whats-going-on.htm

The redemption backlog wasn't cleared until the Wednesday after, ~5 days later. That should help give you an idea of the off-chain liquidity challenges that come from redeeming $7B worth of an asset.

twitter.com/circle/status/1636177961312301058?s=20

I'm not saying $USDC was to blame for the SVB bankrun but it's worth considering that many of $USDC banking partners might not be expecting such large outflows of cash.

This is amplified with non-crypto-centric banks which they are now forced to use.

twitter.com/Investingcom/status/1638630456081133577?s=20

The US Government has recently had a massive target on any banks with ties to crypto.

Operation Chokepoint 2.0's entire goal is to cut off crypto's access to the banking system. CEX's and Stables are in the crosshairs, neither can operate without banks.

blockworks.co/news/operation-choke-point-2-0

Collapses of both SVB and Signature banks make mass redemptions an even bigger challenge for Circle as they are in the process of shifting banking relationships toward BNY Mellon.

marketwatch.com/story/stablecoin-issuer-circle-to-transfer-3-3-billion-in-cash-held-at-silicon-valley-bank-to-bny-mellon-414a6820?siteid=yhoof2&yptr=yahoo

If the US continues the crackdown and cuts off crypto ties then Circle loses the ability to be agile with the offchain backing of USDC.

They also are at risk of another bank going bankrupt where they aren't lucky enough to get bailed out.

finance.yahoo.com/news/collapse-crypto-banks-signature-silvergate-193551850.html?fr=sycsrp_catchall

In fact not only did Coinbase pause redemptions of USDC to USD but other exchanges like @cryptocom paused redemptions due to offering 1:1.

1:1 redemptions haven't returned on Crypto.com so price is dependent on liquidity onchain, not ideal.

twitter.com/FinancialDAO/status/1635983759894884352?s=20

When looking at redemptions during the run, nearly all of them were pushed through @coinbase.

One party is responsible for majority of redemptions is a risk. Who steps up if they lose access to banks, even if only partially or for a short period of time?

twitter.com/nansen_alpha/status/1636713752954535936?s=20

It also seems that @coinbase was the "close partner" that offered up a $3B lifeline when the run caused by SVB occurred.

$USDC / @circle are very dependant on Coinbase, their banking relationships, and liquidity.

protos.com/coinbase-allegedly-offered-circle-3b-lifeline-during-usdc-depeg/

Unfortunately @coinbase also just came under fire for both their staked $ETH offering and their asset listings.

This also puts increased scrutiny on @coinbase themselves where they might not have the flexibility to lend a hand in the future.

twitter.com/brian_armstrong/status/1638654192138199041?s=20

If you look at $BUSD as an example, the SEC labeled it an unregistered security and put a target on Paxos as the issuer.

They likely consider $USDC a security and could target Coinbase/Circle both for involvement and force the pause of minting/burning.

twitter.com/Delphi_Digital/status/1625917550637744139?s=20

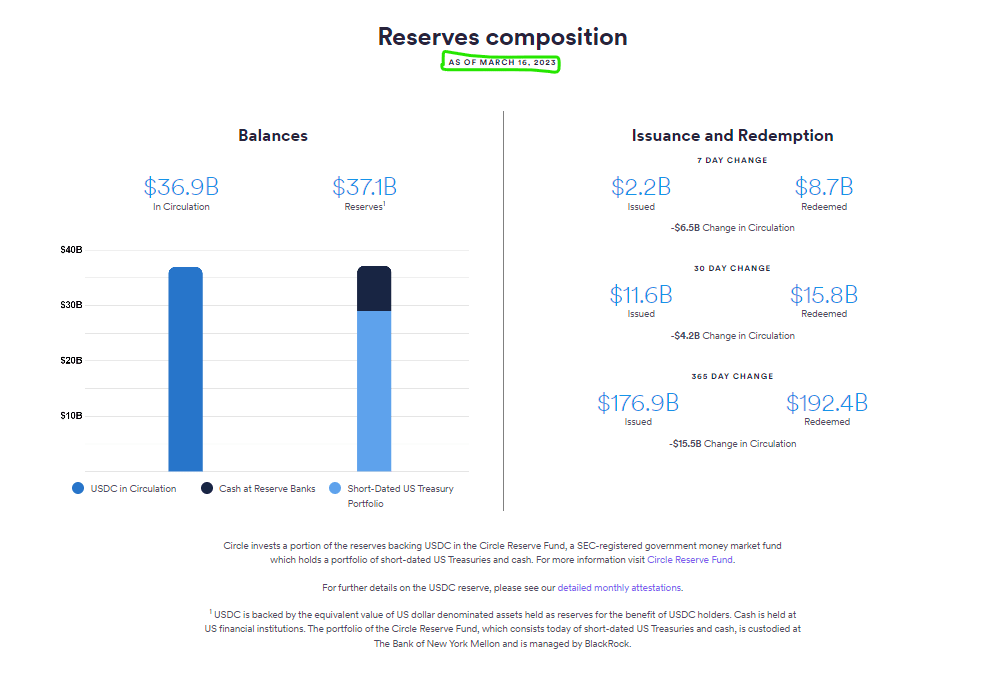

As of March 16th, $36.9B $USDC was in circulation and @circle had $8.1B in cash on hand.

Currently, the $USDC redemptions have continued and the $USDC cap sits just shy of $36B. This means they after the past few days of redemptions they have ~$7.2B in cash on hand.

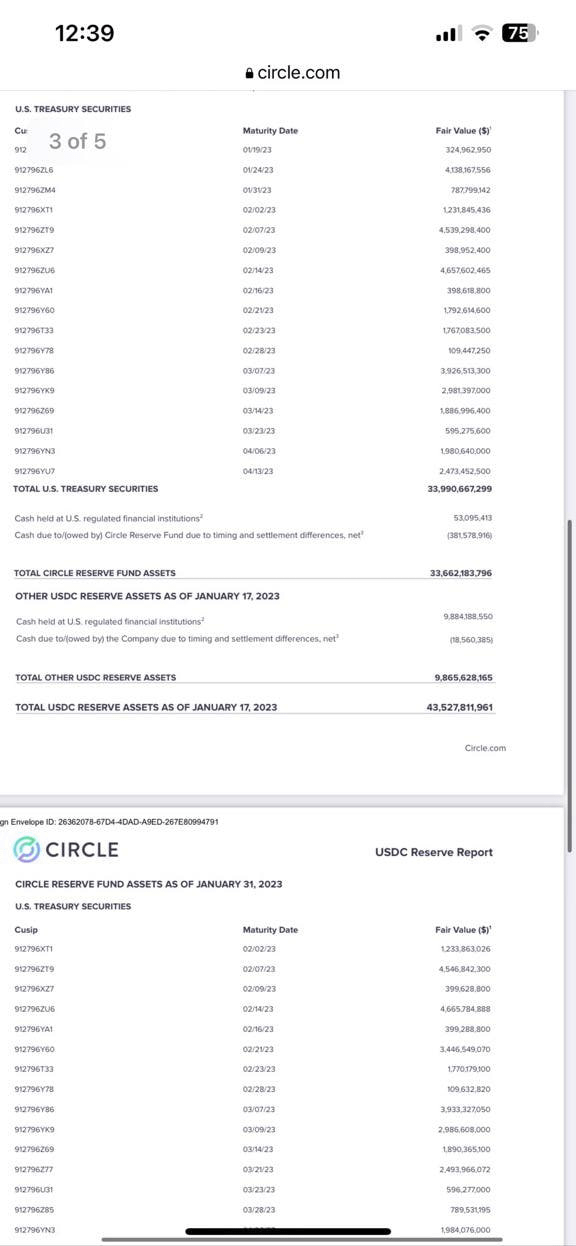

Their last attestation report conducted by Deloitte on January 19th showed that @circle had $9.9B in cash on hand.

Thus far they have been able to keep up with redemptions and keep sufficient liquidity on hand.

Looking at their upcoming Treasury Bills coming to maturity they have ~$4B coming due before the end of March.

We can estimate that between their upcoming USTs + Cash on hand they have roughly $11-11.5B of liquidity for the remainder of March.

With 12 days left, they can cover $1B in redemptions per day before needing to offload some of their short-term USTs.

I'd assume these UST's are currently still worth $1 or more due to recent yield % but that could quickly change with an upcoming FED rate hike.

In a situation where they burn through their cash liquidity if their treasury portfolio is worth less than par value they are required by law to backstop it.

They were willing to backstop a $3.3B SVB loss so I don't think this likely poses as a huge risk, worth watching though!

Today @jerallaire announced Xapo Bank which should (🤞) fix most of the offchain $USDC issues.

1:1 USDC/USD redemptions

Further Utility

Guaranteed USD Deposits

A massive step forward and I'm hopeful this solves most current issues.

bloomberg.com/press-releases/2023-03-22/xapo-bank-becomes-the-first-fully-licensed-bank-to-enable-usdc-deposits-and-withdrawals

Now let's discuss #2, onchain liquidity.

I find onchain liquidity to be the largest immediate risk to $USDCs future yet it is discussed much less than the offchain backing.

Due to last weeks event, $USDC liquidity onchain was stress tested, it hasn't recovered.

As we've seen with many failures in the past year, @CurveFinance is usually the last line of defense when an asset implodes.

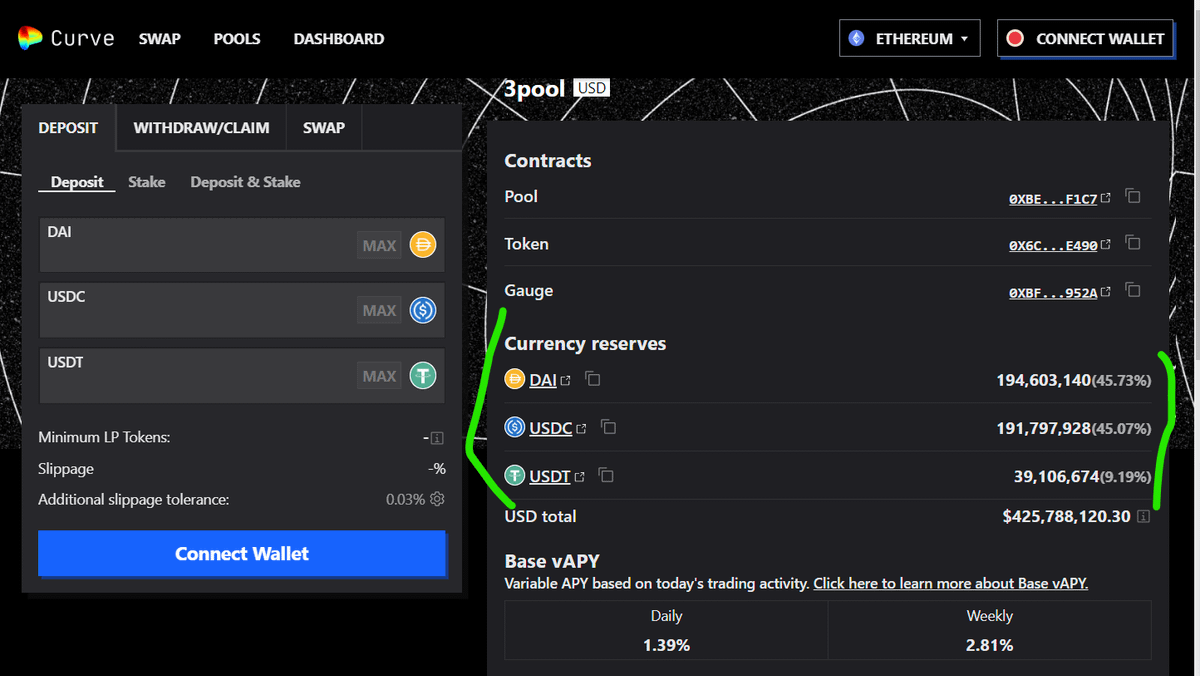

The $CRV 3 Pool with $USDC, $DAI, and $USDT is the largest source of $USDC liquidity onchain and

>90% is $USDC + $DAI (USDC Backed). Very unhealthy.

The above clearly shows that very few people want to hold $USDC as they and depositing $DAI and $USDC and pulling out $USDT.

The way Curve balances pools leverage A Factor, as this pool gets more unbalanced price begins to rise/fall much quicker.

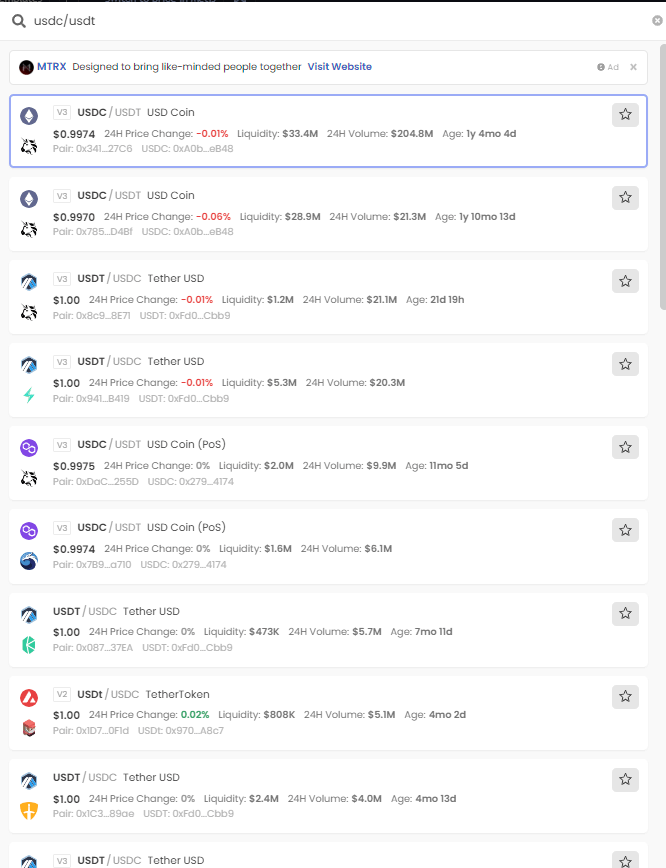

Other onchain pools are also struggling to hold their 1:1 peg including Uniswap. If you are familiar with Uniswap v3, similar to Curve's A Factor the further you get outside of the 1:1 range the more liquidity dries up and price begins to slide.

Snowball Effect ☃️

Unlike many other stables, @circle, doesn't help incentivize onchain DeFi liquidity.

Other stablecoins find creative ways to grow their liquidity incentives through renting liquidity or partnerships, circle doesn't.

Circle built liquidity by being the most used and trusted asset in DeFi. If public sentiment and banking fears continue to keep investors on the sidelines, there easily could be a scenario where $USDC falls below 1:1 peg and stays there due to redemption speed + challenges.

Even if investors are guaranteed to eventually get 1:1 backing by holding $USDC, there is an opportunity cost associated with holding stables as opposed to risk on assets in this environment.

Many are bullish on native $BTC as a USD/USDC hedge and won't stay trapped in USD.

If $USDC falls to $.95 onchain and $BTC continues to swing 5%+ daily while going parabolic, investors will gladly sell $USDC at a loss in order to catch the upside of being Risk-On in the $BTC market.

Looking into the top $USDC holders, there are several that could potentially move away from $USDC.

A few of the larger holders are having challenges of their own..

Binance - BUSD struggles

Voyager - Bankrupcy

MakerDAO - Proposals to diversify backing

twitter.com/fklivestolearn/status/1636042751044390913?s=20

A huge narrative for DeFi has been all the money in stablecoins that is now pouring back into the market.

Stablecoin Dominance is falling off a cliff as investors become risk on, this leads to mass redemptions offchain and crunches for onchain liquidity.

twitter.com/onchain_edge/status/1636909976466898945?s=20

The collapsing supply of USDC also presents challenges for onchain liquidity which is already quite light.

Personally, I'd love to see @circle lean into DeFi and find ways to help incentivize liquidity on-chain. Top DeFi projects would gladly work with them.

Do I believe $USDC is fully backed and redeemable? Yes.

Are there multiple struggles they are dealing with right now? Yes.

Will they be fine long term? Highly Likely!

The goal of this post is to inform and push for better risk management and diversification throughout DeFi.

Having 100% of your Treasury and Dev Fund entirely in $USDC is a larger risk than most dev teams realize. It's no different than the companies / tech founders who were all in with Silicone Valley Bank, except crypto is much less likey to get a bail out.

twitter.com/SmallCapScience/status/1637202383565475841?s=20

I'd highly recommend spreading treasuries across a basket of assets including USDT, DAI, USDC, ETH, BTC/wBTC, OHM, LUSD, GLP, etc.

My favorite hedge is $BTC by a landslide followed by $OHM & GLP. With regulation crackdowns $BTC narrative seems the safest

Find ways to hedge your stablecoin risk by using things like LUSD (Decentralized), y2k finance, crvUSD (soon), and a basket of other stables.

I'd also recommend not being 100% in stables due to the US government's current target on crypto banking relationships.

The $USDC commentary has also been disturbing, did we not learn anything from FTX?

"If USDC goes to zero we are all screwed anyway"

This line of thought is a very dangerous risk management strategy both for individuals and project treasuries.

Recap of Offchain Liquidity Risks:

1. Unsecured Deposits @ Banks that Default

2. Loss of Banking Relationship

3. Circle Bankruptcy Risk

4. Regulation Causing Mint/Redeem Pause

Recap of Onchain Liquidity Risks:

1. Largest LPs @ Unhealthy Ratios

2. Lack of Incentives for Users to LP

3. CEXs Using Onchain Pricing

4. Currently Weekends

Recommended Reads on Banking Risks:

@CryptoHayes deep diving covid, fed printing, risks to the banking system, and why crypto (specifically BTC) is a perfect hedge.

Very eye-opening when considering the risks to stablecoins in the current environment.

twitter.com/CryptoHayes/status/1636503341701255170?s=20

Recommended Read on $BTC as Banking Hedge:

@balajis betting on $1M $BTC in the next 90 days due to the possibility of hyper inflation.

Highlights the risk of holding only USD and also touches on native $BTC as a banking hedge.

twitter.com/balajis/status/1636822077775941633?s=20

If you enjoyed the thread or learned anything new regarding $USDC/$USD then please follow @SCSLabsResearch.

We will be publishing more content in the future, hopefully, it's more bullish than today's thread.

Depending on feedback, we might put together a deep dive vid on $USDC.

ZYou aren't a decentralized finance protocol if the bankruptcy of a single centralized entity kills the future of your project, no matter how unlikely that bankruptcy is.

The SEC and US Government started their war on crypto, prepare accordingly.

Protect yourself, diversify.🤝