I've been doing some research on $wBTC for the past 24 hours. I'd recommend steering clear of any wrapped assets for the time being.

Highlighting some of my concerns to eyes on this and hopefully clear up some of the concerns around wrapped asset custody + liquidity.

🧵 ↓

I'm not an expert on $wBTC or wrapped assets so take this with a grain of salt. I'd appreciate misconceptions being corrected, I'm simply sharing my findings lately...

My rsearch started after seeing unusual activity on the wBTC / BTC pair which fell 2% from 1:1 liquid peg.

Normally this is a free arb for big players so why is this happening now?

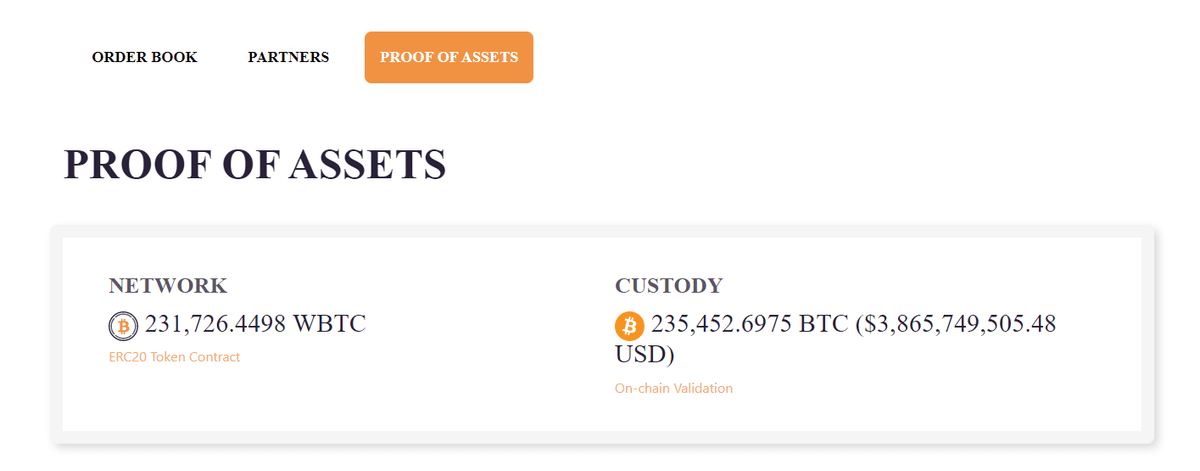

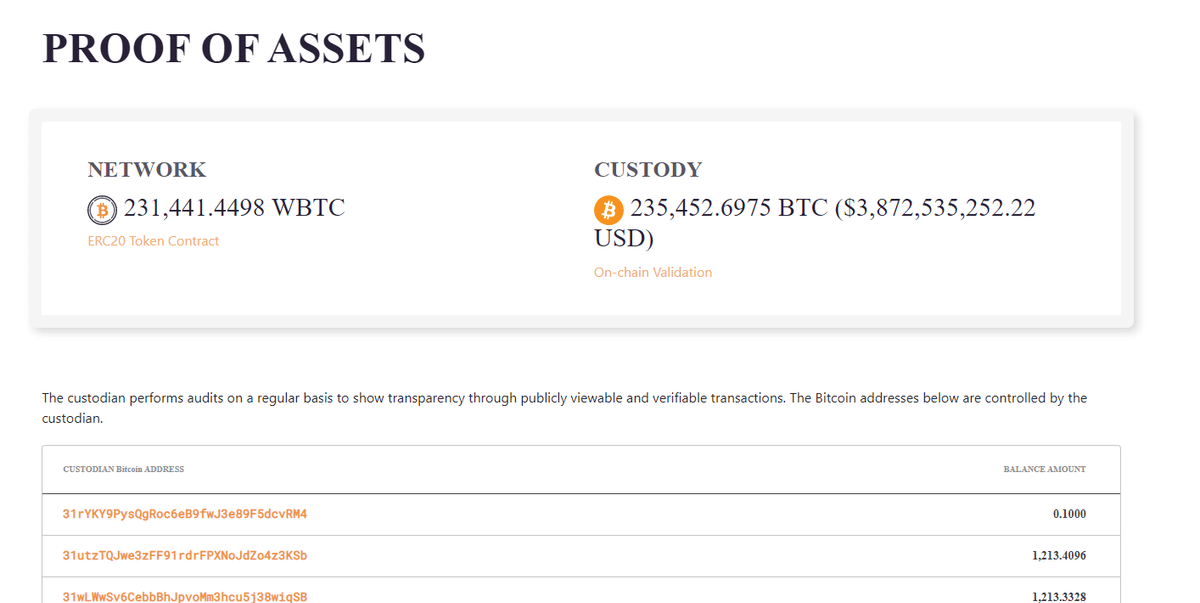

Checking the wBTC website and their proof of assets shows more than full backing so where is the issue? Taking a deeper look at asset custody was the next step.

wbtc.network/dashboard/audit

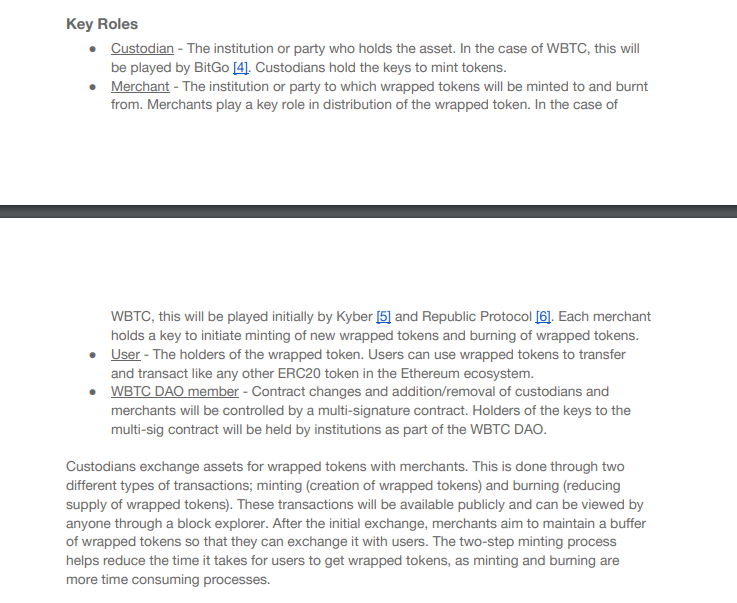

When looking at $wBTC there are two roles...

1. Custodian - Holds the BTC backing for wBTC + keys to mint tokens

2. Merchants - Key parties which send/receive the BTC in order to mint/burn wBTC.

In this case, @BitGo is the custodian and the merchant is one of 60+ partners.

Looking into @BitGo, the first thing that comes up is that @mikebelshe states BitGo had "no Alameda or FTX exposure" but they are now raising funds.

Would have loved to DM either party but both of them have their DMs off for the public.

twitter.com/mikebelshe/status/1593352572684976131?s=20&t=ss-R0Cl--Lst7vsHA5i5Qw

Looking into @BitGo as they have the $BTC custody, it turns out they launched a $150M lending business for institutional clients back in 2020.

They claimed zero FTX / Alameda but they could have loans with other parties that are currently underwater.

twitter.com/fintechfrank/status/1235506090495938565?s=20&t=JoYviGSMePqhfx_HkC89ww

Announcing a raise at a $1.2B valuation only 4 days after the collapse of FTX seems like a red flag. They claim to not need the capital but if that's the case, this seems like the worst possible time to raise funds.

Speculation, form your own opinion..

forbes.com/sites/stevenehrlich/2022/11/15/amid-ftx-fallout-crypto-custodian-bitgo-looks-to-raise-funds-at-a-12-billion-valuation/?sh=730abe9d1ceb

The concern for me is if @BitGo were to be insolvent, I'd assume that wBTC holders would not be considered BitGo creditors.

If they custody Billions of $'s in $BTC, what happens when either BitGo or their merchants file for bankruptcy? Crypto lawyers could use your help here..?

The 2nd part of wBTC, is the merchants responsible for burning/minting wBTC for customers.

There are more than 60+ partners who currently have the ability to mint/burn wBTC.

wbtc.network/dashboard/partners

Partners include 3AC, Nexo, Ren Protocol, Crypto .com, Coinlist, and plenty of other parties.

As you know, some of these have already filed for bankruptcy and some others have speculation surrounding them. Alameda was the only one removed from the list.

twitter.com/kingblockchain/status/1595333235348832257?s=20&t=DT4piDO9f7wNYSGrkLaiyg

Keep in mind these are only merchants for minting/burning and not $BTC custodians like @BitGo. This means they had access to burn/mint but likely held minimal amounts of the underlying BTC, if any.

The issue I see here would be on bankruptcy filings and possible asset clawbacks.

Multiple issuers have been struggling with burning/minting since the FTX fallout occurred.

In a healthy market, market makers are minting/burning quick enough to hold the 1:1 wbtc/btc peg. That currently isn't happening and users are stuck.

twitter.com/gregosuri/status/1595250748714938370?s=20&t=v-80149cDmrHdFLe_FR42g

Another thing highlighted by @kingblockchain, FTX had the ability to mint directly on FTX. With Alameda being removed from the wBTC site, this is also a bit concerning.

twitter.com/FTX_Official/status/1295144129869971456?s=20&t=YyfAmSlahgT_8_-hntSpJQ

FTX US stated in their docs that the majority of customer assets were stored at BitGo Trust. Oh, and it's backed by a $100M insurance policy? 👀

This post is from prior to the FTX blow up. ↓

twitter.com/unitimpulse/status/1589887311323738113?s=20&t=hgLOAtVp5B1LWw2RYJ98fg

Ideally, I'd like to be able to verify that all 235k $BTC in "Custody" are all held in wallets controlled by @BitGo. Proof of assets onchain helps, it's impossible to tell if these would be tied into legal proceedings.

Onchain analysts should further explore the custody wallets.

My thought would be if @AlamedaResearch issued these $wBTC and @BitGo held custody, wouldn't the $BTC end up with creditors of FTX US instead of backing $wBTC?

It could be that $wBTC holders end up responsible for the debt if the underlying BTC is rolled into Alameda bankruptcy.

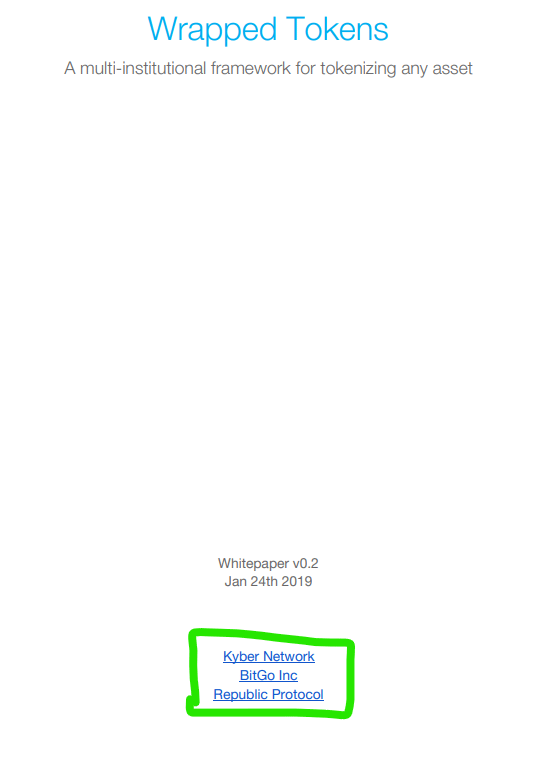

Another bit player mentioned the $wBTC white paper, is @renprotocol. AKA Republic Protocol or more well known as $REN + $renBTC.

$REN is a native BTC bridge that has been through all the headlines recently, mainly for unfortunate reasons.

$REN was actually owned by @AlamedaResearch.

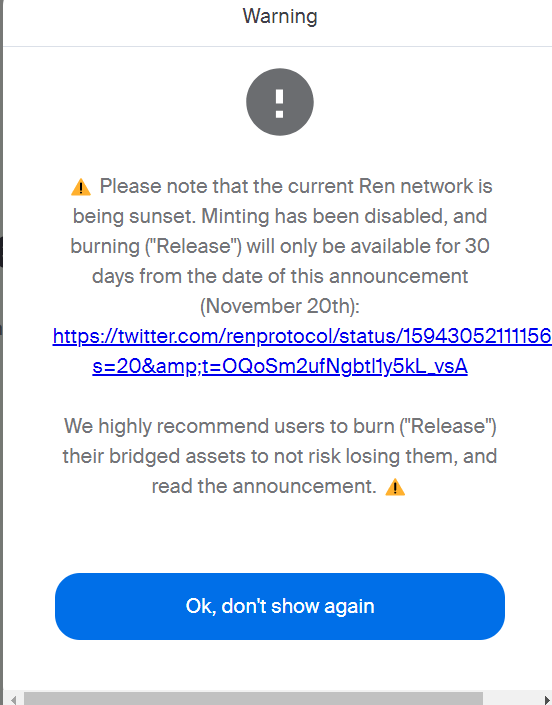

Due to being owned by Alameda, the dev team only has funds to to operate until the end of Q4. They are currently raising funds while speeding up plans for their new Ren 2.0 bridge.

v1 will sunset in 30 days.

medium.com/renproject/moving-on-from-alameda-da62a823ce93?_branch_match_id=948994197398170011&_branch_referrer=H4sIAAAAAAAAA8soKSkottLXz8nMy9bLTU3JLM3VS87P1S8pDPJP9C4JMy1NAgC%2FVvTGIwAAAA%3D%3D

Keep in mind the @AlamedaResearch backed assets on $SOL lost their entire backings and fell way below peg.

The command center on Ren Protocol shows that their assets are currently properly collateralized as of now. Hopefully no risk there

twitter.com/alex_valaitis/status/1592633121195032576?s=20&t=hgLOAtVp5B1LWw2RYJ98fg

This puts a large number of assets on chain at risk if not burnt within the next 30 days. The goal would be to move towards Ren 2.0 and transition away from Alameda, but that's only if they are able to raise funds to continue operations.

On top of $renBTC being sunset liquidity is a massive issue as the FTX exploiter address has been swapping ETH > wBTC > renBTC > native BTC.

This is drying up the bridge funds for renBTC which the team has said won't be replenished.

twitter.com/kamikaz_ETH/status/1594326233189617666?s=20&t=EBHheeHXCt7n3e2uHTZ47g

The hacker still has over 8 figures worth of funds that they are trying to move across the bridge w/o liquidity for it.

If the hacker is an FTX insider, could they be forcing the liquidity crunch knowing that wrapped assets will suffer?

twitter.com/Dogetoshi/status/1594733859668729856?s=20&t=EBHheeHXCt7n3e2uHTZ47g

This is another area where it sketches me out that @AlamedaResearch filed for chapter 11 while owning $REN.

I don't feel as if there is a clear precedent set on what could happen to the underlying BTC from Ren 1.0. Be safe, don't trust 3rd parties.

twitter.com/umbrella_uni/status/1594693059765481474?s=20&t=DT4piDO9f7wNYSGrkLaiyg

Bridge liquidity and the trapped FTX exploiter are the two main risk factors that I'm keeping an eye on from a $REN perspective.

I haven't used @renprotocol before researching the past few days, so maybe others more familiar can provide more color.

Plenty of people are shorting $ETH expecting moves from the FTX exploiter but they are largely trapped in $ETH due to liquidity constraints.

With the exploiter looking for avenues back to native BTC, it could cause other issues with wrapped versions.

twitter.com/umbrella_uni/status/1594779775838883840?s=20&t=vj7gtDLET3EYfHjH8C-9dQ

My belief is that it is better to natively hold your asset and we've repeatedly been shown to not trust 3rd parties, this is no different.

For the time being, I'd exit wrappers like $renBTC / $wBTC / $wETH and others until confirmed to be safe.

If you are stuck in wBTC, I'd recommend using @THORChain or @krakenfx to swap for native $BTC to be safe.

It's tricky because both CEXs and Oracles might get tested if $wBTC is having issues. Holding $wBTC when your customers own $BTC could turn into a pile of bad debt.

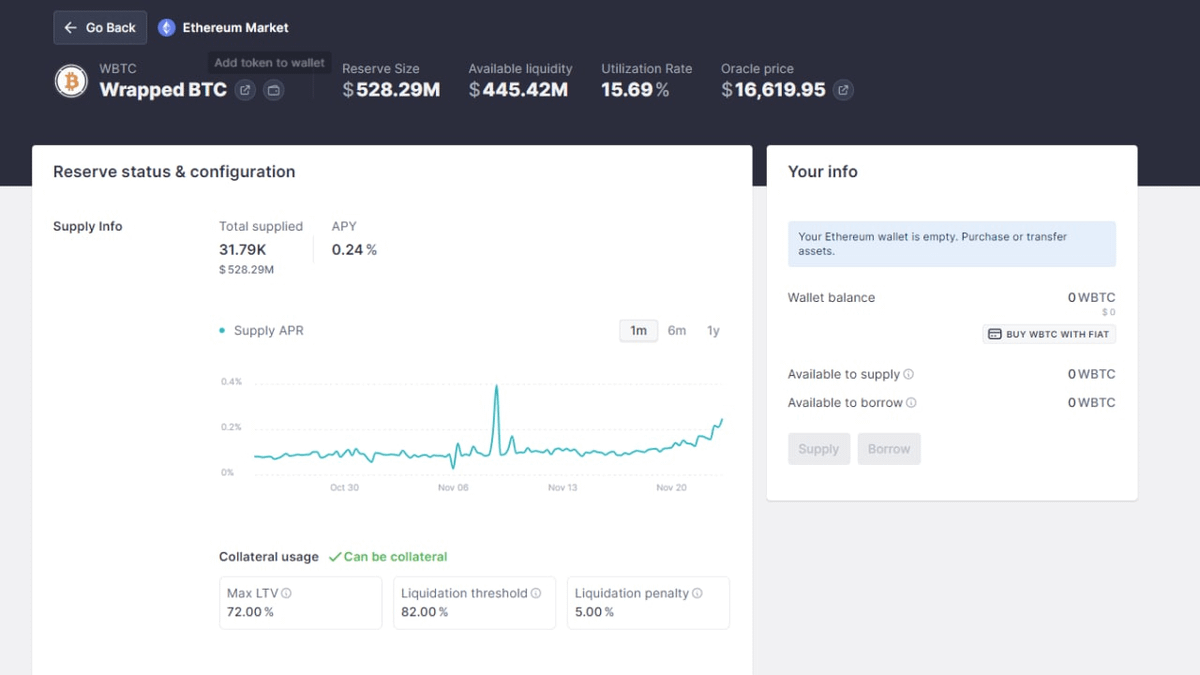

DeFi protocols with a ton of wrapped assets could run into a tough time if these assets heavily depeg from 1:1. Once again, I'd err on the side of caution in this market when it comes to taking on risk.

There is an immense amount of DeFi liquidity in wrapped tokens so stay safe.

It looks like @AaveAave for example has seen a large uptick in wBTC usage as of late. This could be due to the Avi / CRV anticks or possibly users shorting wBTC.

This feels largely like a market maker failure so far the market is pricing in wBTC risk by being 1%+ away from 1:1.

Personally feel that where there is smoke, there is fire. Especially when it comes to crypto. I do doubt that the large majority of wBTC / renBTC backing is in danger though.

Ideally, some chads with legal backgrounds can help clarify how this might play out.

Remember... "Not your keys, not your coins."

Stay safe and hopefully, this leads to some good discoveries and discussion. Demand transparency from third parties!