$CNC v2 Update!

It's been two weeks since the @ConicFinance v2 launch..

- 700k CNC (12% of circ supply) has been locked

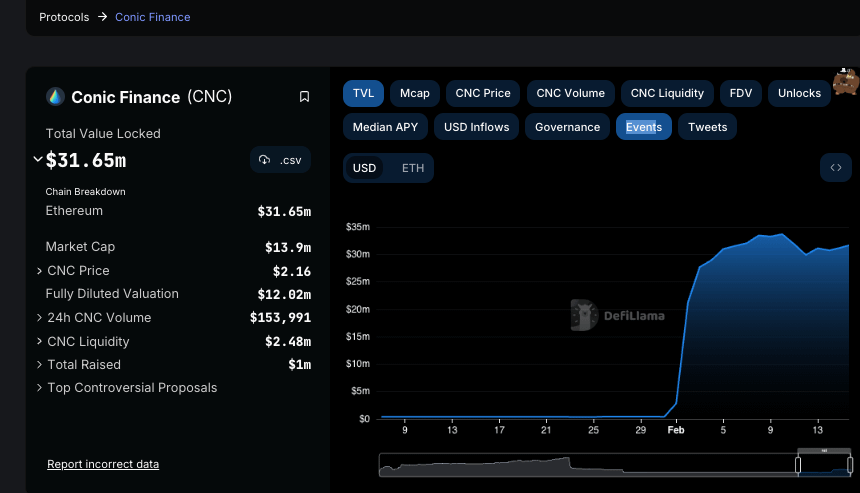

- $31M TVL

- $16+ of liquidity per locked $CNC which is 8x the current value while earning 20%+ APR paid in stables.

Diving in..

x.com/SmallCapScience/status/1752739554841526498?s=20

On v2 launch, 1.2M CNC were locked.

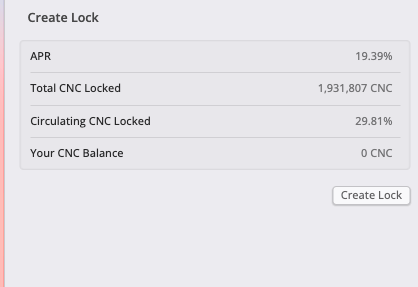

Today there is 1.93M CNC locked meaning 730k CNC have been locked worth around $1.45M.

$CNC emissions are 4,200 per day meaning the 730,000 CNC that have been locked are equivalent to 174 days of emissions. vlCNC is still earning 19% APR

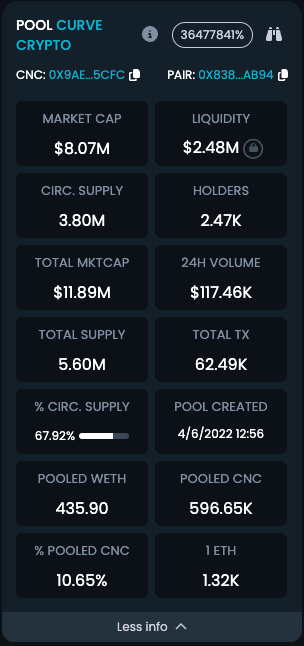

Circulating supply is deflating and emissions are tiny compared to the TVL making it hard for projects to scale in.

Currently, the best way would be to market buy $CNC and the LP only has about 600k CNC for purchase.

Eventually, I think this squeezes as someone scales in.

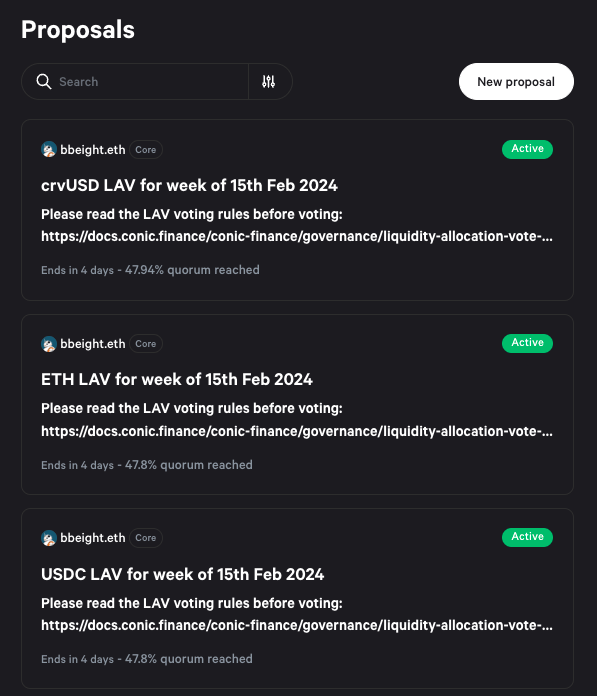

The first round of LAVs launched yesterday for vlCNC voting.

1.9M locked CNC is voting on directing $31M of liquidity.

-$5.2M of crvUSD

-$7.2M of USDC

-$18.8M of ETH

That is $16+ of liquidity directed per CNC locked (8x value).

vlCNC also has 20% APR paid in stables

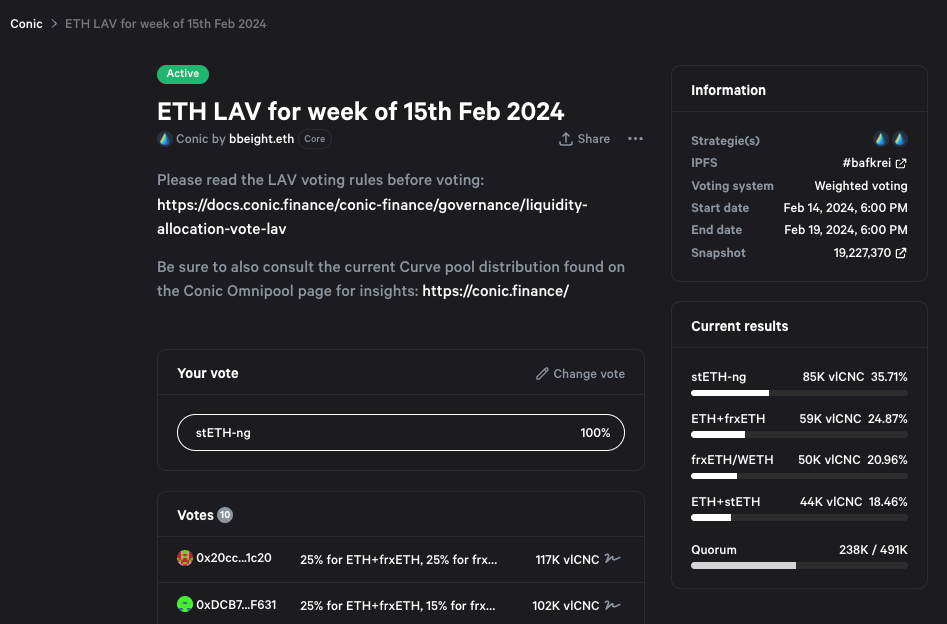

Looking at $ETH alone...

The 1.9M locked CNC is directing nearly $19M of liquidity... $10 of ETH liquidity for each $2 locked CNC.

These are also assuming that every vlCNC ends up voting, which they won't. At quorum, $19M ETH liquidity would be directed by 500k CNC worth $1M.

The TVL has also proven to be extremely sticky hovering between $30-35M since v2 launch.

As TVL rises, it becomes more attractive for projects to accumulate and lock into $vlCNC. $100M TVL would mean each locked $CNC is directing more than 25x it's value in liquidity.

LAM - Liquidity Allocation Modules

These were called out by the team in the v2 launch governance proposal and are one of the most overlooked pieces of v2.

It allows Omnipools to be allocated across multiple platforms. It specifically mentions Prisma & crvUSD peg keeping.

Yesterday @PrismaFi announced their new lending product backed by LRTs including EtherFI ($1.2B TVL).

Between $mkUSD / $ULTRA it makes sense for $PRISMA to start accumulating $vlCNC in order to have deep exit liquidity for their lending products.

x.com/PrismaFi/status/1757743997592945030?s=20

Prisma has been incentivizing liquidity for mkUSD on Bal/Aura to the tune of $10K+ biweekly.

It makes sense between $mkUSD and $ULTRA for them to start accumulating a Conic position although I've seen nothing concrete announced.

Speculation for now.

x.com/PrismaFi/status/1756993430989779377?s=20

Countless other LST/LRTs could also already be targeting @ConicFinance.

Prisma is just a specific example due to them already calling it out in governance snapshots.

The main value driver for $CNC / $vlCNC is directing liquidity so I'm watching the TVL closely.