One of my highest conviction plays over the next 12-24 months is @ConicFinance!

The new v2 rollout has the potential to turn $CNC & $vlCNC into kingmakers of DeFi Liquidity.

Multiple of the largest protocols in the space are silently accumulating, it's time to pay attention ⬇️

Omni Pools are the future of efficient liquidity for stablecoins, LSTs, LRTs, and other stable liquidity pairings.

LST/LRT/Algostables are the largest bribers across most ecosystems.

Omni Pools are more predictable and efficient compared to the current gauge options.

Instead of renting liquidity w/ gauges to push emissions toward the LP of your choice, you direct a % of TVL staked as single-sided liquidity.

It guarantees liquidity unlike pushing emissions toward your choice of LP and liquidity is redirected toward your asset faster.

Example: If I'm @PrismaFi looking for $mkUSD liquidity for $150M of $mkUSD, currently I need to bribe protocols like BAL/AURA/CRV/CVX to push emissions toward a $mkUSD-$USDC LP.

Renting liquidity through emissions doesn't guarantee that TVL will flow into the LP.

With Omni Pools Similar to Conic Finance -

Users single-sided stake approved assets like USDC, USDT, ETH, and others then $vlCNC holders direct that liquidity toward their LPs.

To oversimplify, if Prisma owned 10% of $vlCNC they could direct 10% of USDC toward the mkUSD LP.

Now onto @ConicFinance.

It showed explosive growth in 2023. From $0 > $60M TVL in 24 hours during a bear market!

$CNC has one of the cleanest UIs in web-3, their multisig signers are all Curve OGs, and there was speculation Curve was behind it.

x.com/markjeffrey/status/1632548150417436672?s=20

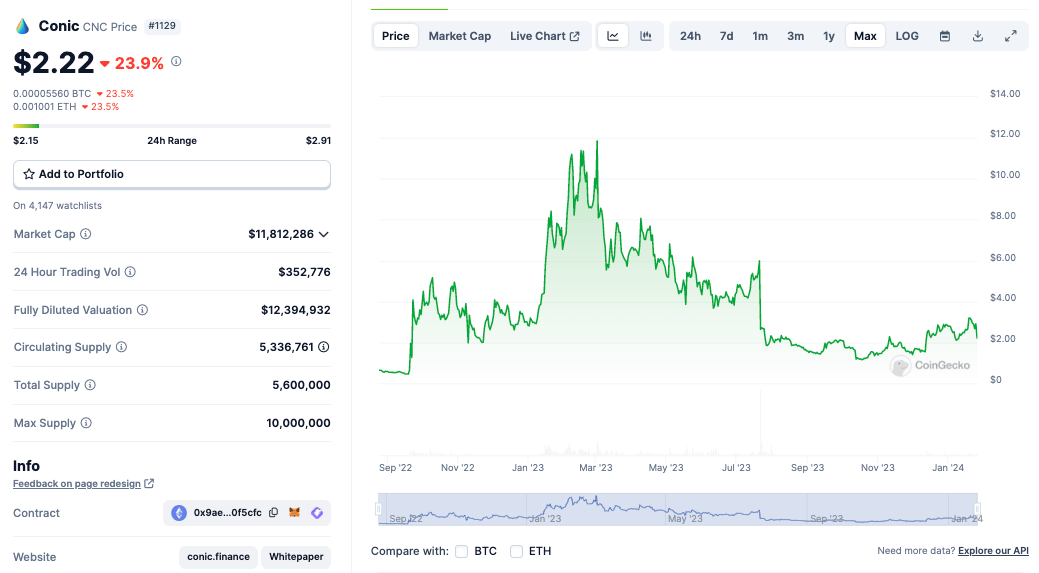

$CNC price exploded from $2 > $12 in the coming months which was impressive during such a terrible 2023 market.

$CNC emissions are tiny and it has a healthy token distribution. Nearly 50% of tokens are in circulation.

All these were reasons the price soared.

$CNC price soaring caused APRs to skyrocket... TVL continued piling in.

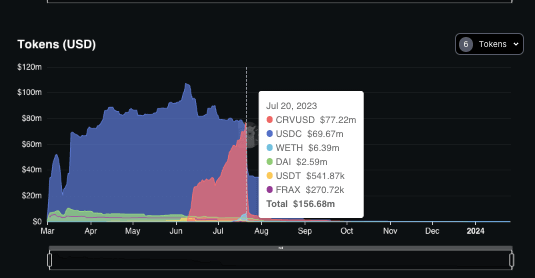

$CNC reached $12+ and TVL reached $150M+ before an exploit occurred in July 2023 leaving Conic with $4.3M of bad debt. Not ideal.

Post Mortem - medium.com/@ConicFinance/post-mortem-eth-and-crvusd-omnipool-exploits-c9c7fa213a3d

At the time, $crvUSD supply was ~$100M and $77M was in Conic providing deep liquidity & utility (yield) for crvUSD.

The exploit dried up $crvUSD utility and liquidity overnight. To make matters worse for CRV, they were also exploited at the end of July.

x.com/megastuffs/status/1681966941639000065?s=20

The success of both $CNC and $crvUSD became closely aligned.

Post exploit the CRV Founder ( @newmichwill ) proved that by investing $1M into Conic Finance.

Conic was ~$17M FDV at the time, so we can assume he purchased roughly 6% of the total supply.

medium.com/@ConicFinance/conic-raises-1m-f88ad30460fd

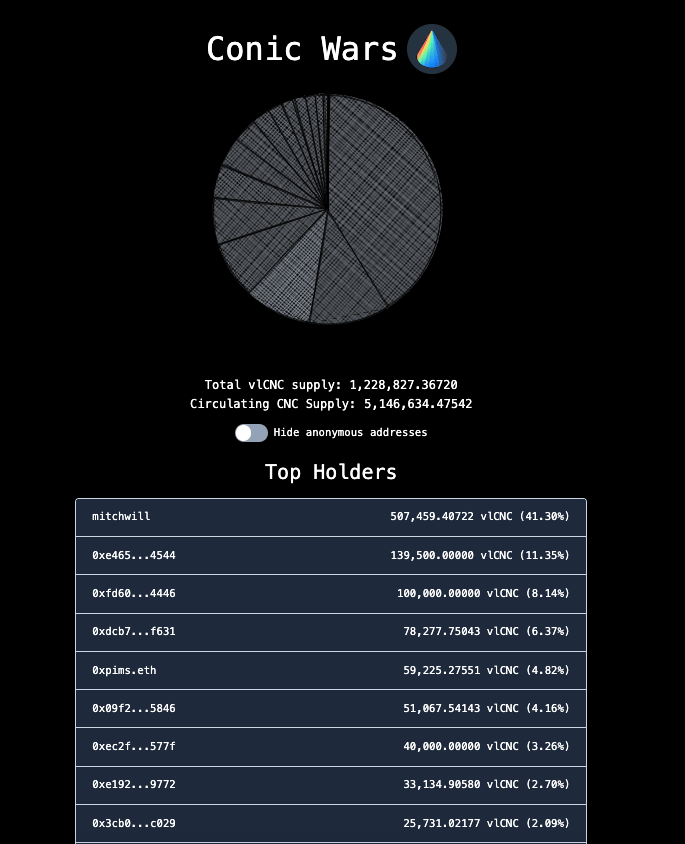

Due to vlCNC not earning fees in v1, the major protocols were the only lockers. They had no competition for directing liquidity.

As an example...

April 11th $CNC was ~$7 meaning a single $vlCNC was directing 15x its value in liquidity.

x.com/ConicFinance/status/1645823217099997191?s=20

Conic is essential to the Curve Ecosystem and Michael is leaning into it to support crvUSD liquidity.

He is by far the biggest $vlCNC holder with 500k vlCNC that makes up about 5% of FDV and 41% of all locked vlCNC.

I consider that supply locked forever, he won't sell

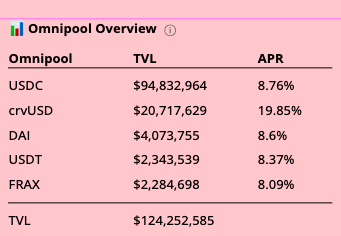

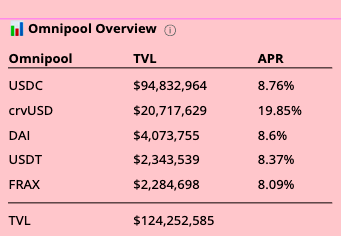

The way Conic works is governance ($vlCNC) votes on whitelisting Omni Pool assets, users single stake to earn yield (CNC/CRV/CVX), and then vlCNC votes on redirecting the staked $125M TVL.

In this screenshot, only stablecoins are shown but $ETH & $ETH LSTs have pools as well.

$CNC reached $45M Circ MC and $120M FDV without most $vlCNC holders locking, earning fees, and barely any LST competition

Conic v2, $vlCNC holders will receive fees from bonding $crvUSD for locked $CNC.

$CNC holders are finally pushed to lock, they will earn $cncCRVUSD fees.

On top of $vlCNC bonding fees, they will also be boosting everyone $vlCNC who locks before the v2 migration (next few days?).

1. There will be a big circ supply shrink from locking

2. After v2 launch any net new buyers will be bonding

Circulating supply 📉

Rewards for vlCNC 📈

Unfortunately, the protocol does have debt.

(We will cover this in-depth later)

As part of the Reimbursement Plan, users who lost funds during the hack will receive a debt token. The token earns fees from Conic v2 for the first year (anyone can purchase these tokens).

The plan is that initially all fees will be routed to the debt pool and then over time transitioned to $vlCNC holders.

So as the debt is paid off, $vlCNC will catch momentum 👀

The platform fee is 10% of all CRV/CVX that is farmed from the omni pools... wow.

TVL before the exploit included...

$77M $crvUSD

$69M $USDC

$2.6M $DAI

Can't forget the $6.5M $WETH - The $WETH launch was brand new. With v2 coming LST/LRTs will compete for liquidity, this ETH position should easily go to $100M+. Which LST will dive in first... 👀

Looking at Curve, $crvUSD positions are averaging about 10-20% APR annualized.

$77M $crvUSD x 10% APR = $7.7M fee intake

$7.7M fee intake x 10% platform fee = $770k

That is only from the $crvUSD LP... $4.3M in debt goes away quickly if you are farming with $150M+ TVL.

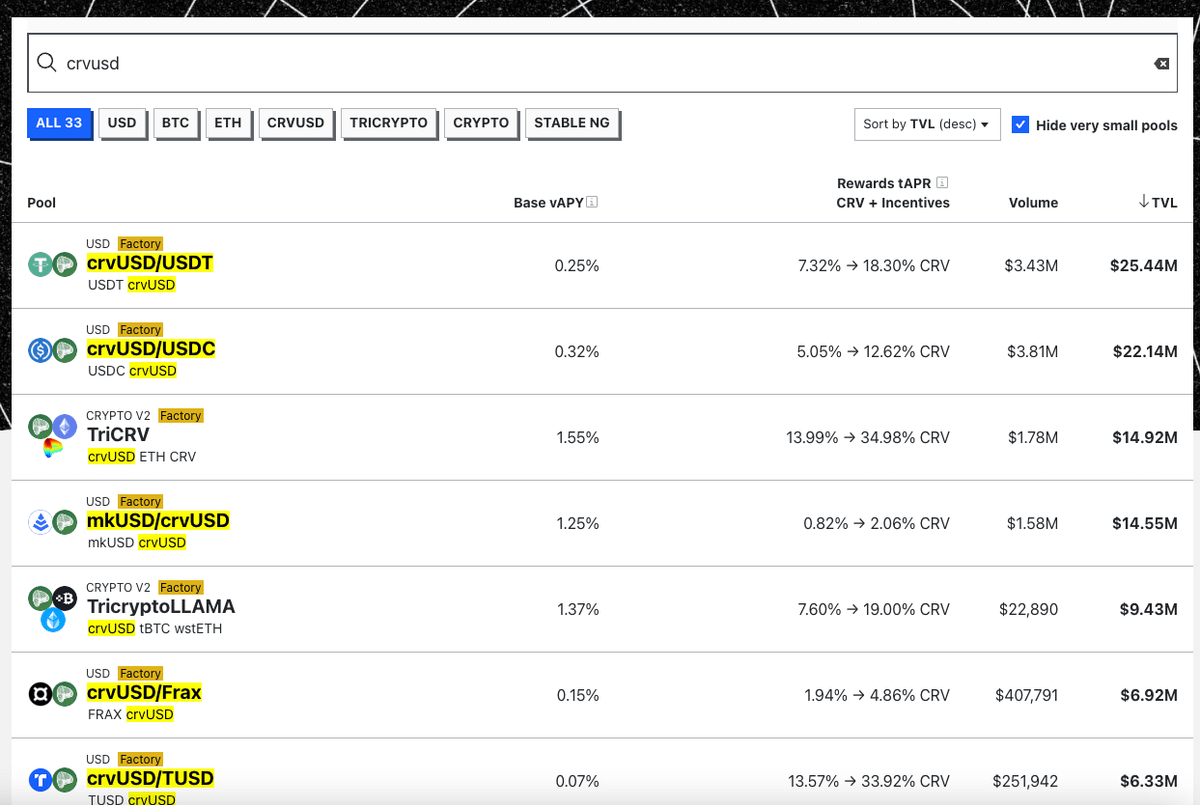

v2 Launch is close so voting for LAVs and whitelisted pools is complete.

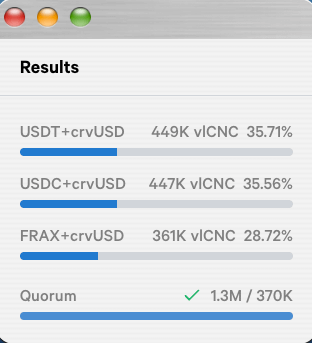

Looking at v2 Genesis crvUSD Weights...

USDT+crvUSD - 18.5% APR

USDC+crvUSD - 12.6% APR

FRAX+crvUSD - 4.86%

All of the APRs assume max boost (convex) and are annualized...

$150M x 10% Avg. APR x 10% Platform Fee = $1.5M Yr.

As the debt gets erased the $CNC setup is elite... $CNC has very light dilution, it's farming 9 figures w/ platform fees, earning bonding fees, and possible protocol bribes in the pipeline.

$vlCNC wars incoming.

The market is in a much different position than July 2023.

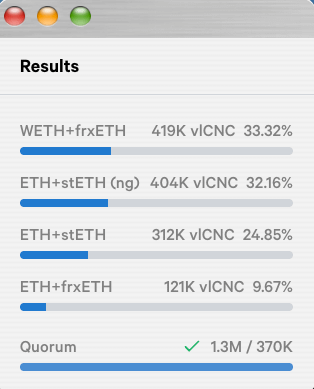

Conic as a stablecoin Omni Pool protocol is already proven, I'm more bullish on the LST/LRT opportunity. $ETH Omni Pools will be ready on launch.

If you look at the v2 ETH Weights, Frax and Lido have a head start 👀

$crvUSD has been a proven use case but the total $crvUSD circulating is ~$160M currently.

LST/LRT projects lean on liquidity for LST utility and for users to scale in/out in size.

The combined TVL of stETH / frxETH is $21.5B currently.. and LST market as a whole is $32.2B.

The LRT market on Eigenlayer has taken off as well with nearly $2B of TVL and liquidity is arguably even more important at that layer.

Every day a new project is popping up in the LST/LRT space, they all need deep liquidity to survive and Conic becomes the hub for ETH LSTs.

The USDC Weights also show FRAX/DAI/MIM receiving votes.

New stablecoin projects will come after launch.

Prisma Finance $mkUSD has over $130m TVL and already hosts liquidity on Convex/Curve, integrating makes too much sense.

Side note - $cvxCNC wouldn't surprise me 👀

Based on the v1 performance, use cases above, and the investors onboard I believe the below cases are fair assumptions.

Expected - $500M TVL x 10% APR x 10% Platform = $5.0M Fees

Bull - $1B x 10% APR x 10% Platform = $10M Fees

High Bull - $2.5B x 10% APR x 10% Platform = $25M

Fully diluted there are only 10,000,00 $CNC tokens and the project sits at $12M Marketcap and $22M FDV.

Using FDV and a P/F Ratio of 15...

Expected - $7.50 per $CNC

Bull - $15 per $CNC

High Bull - $37.50 per $CNC

Keep in mind, that these are conservative estimates...

1. They are calculated on FDV instead of circulating supply

2. They assume all CNC would be fee-earning when only vlCNC earns

3. It only accounts for the revenue stream from farming, not bonding or bribe income.

$CNC cruised to $12 last time omni pools were live.

Keep in mind...

1. There was zero incentive for your average user to lock

2. No Bonding Income for vlCNC

3. No Protocol Fees

Perfect setup for a giant wave of locks, circulating supply to shrink, and the price to send.

The other thing that is being discounted is the LST/LRT narratives.

v2 will launch with ETH and these protocols all are in a giant turf war for deep liquidity. I'm expecting a few of these protocols to catch wind and start to heavily accumulate vlCNC.

More locking...

crvUSD, Conic, Prisma, and Llamalend will revive the Curve Ecosystem.

I won't be surprised to see Conic become a $1B+ protocol and a kingmaker liquidity protocol.

Keep in mind people laughed when I called $CVX at $1.86 ($60MC) before it ran to $2B+...

x.com/SmallCapScience/status/1423693199596474370?s=20

Llamalend is a one-way lending market based on crvUSD.

The launch is only a few days away and timed perfectly with the Conic v2 relaunch. I don't think it's a coincidence that all of these projects are launching at the same time as the CRV unlock.

x.com/CurveFinance/status/1750572090942533790?s=20

We are also at a point on the HTF charts where both CRV/CVX are due for a bounce, I'm not the only Chad accumulating positions.

Conic success will be directly aligned to both these protocols and is a higher beta play on the Curve & Convex ecosystems.

x.com/CredibleCrypto/status/1751184134553170061?s=20

I think everyone should take a minute to appreciate their v2 announcement video, plenty of gold in here.

twitter.com/ConicFinance/status/1748334443792588835

Once v2 goes live and vlCNC rewards start, I'm expecting there to be tons of users to start to lock their CNC for vlCNC to earn rewards.

Due to low emissions, I can see CNC circulating supply going deflationary for a period...

$vlCNC has kingmaker potential, hope you enjoyed!

Disclaimer -

There is risk associated with Omni Pool protocols.

They are a newer branch of DeFi and have seen an increased exploit rate in the past 12 months due to the amount of TVL they host.

I'd encourage everyone to read their latest audit:

x.com/chain_security/status/1749407216686248161?s=20