A possible gem worth watching is launching in ~12 hours, it's @ConcentricFi!

$CONE provides concentrated liquidity management strategies similar to @GammaStrategies & @GNDProtocol, except $CONE is built on top of @CamelotDEX v3!

Let's compare projects and launch details! 🧵

One of the reasons I'm excited for $CONE is the massive success of similar protocols.

$GND is a protocol that I've discussed on @MarketCapping and highlighted it here on Twitter.

$GAMMA has also been massively successful and continued to grow.

$CONE can follow a similar path.

So how do these protocols work?

Concentrated liquidity (CL) positions require constant management to keep your LPs in range and earning at their highest ability.

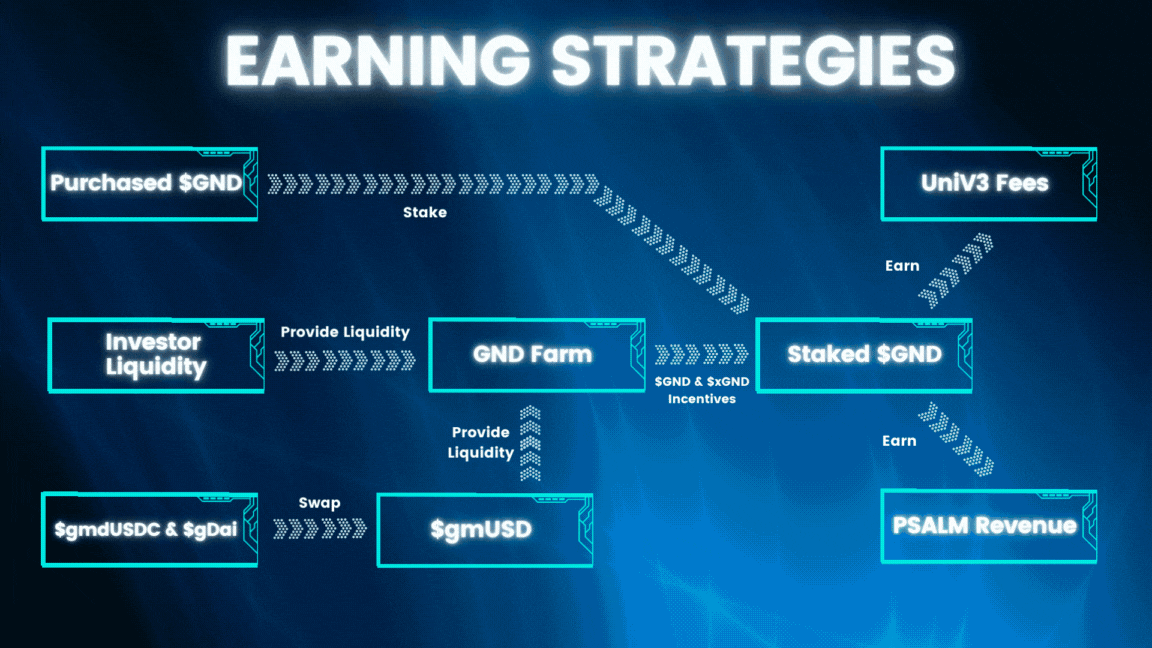

Most users don't have either the knowledge base or time to maximize their LP rewards. This is where $GND comes in...

They manage your concentrated liquidity positions for you by bucketing LPs into ranges and automating management.

With concentrated liquidity, your ETH-USDC LP would grow by earning more ETH/USDC. $GND keeps the ETH/USDC and instead pays you out in $GND / $xGND rewards.

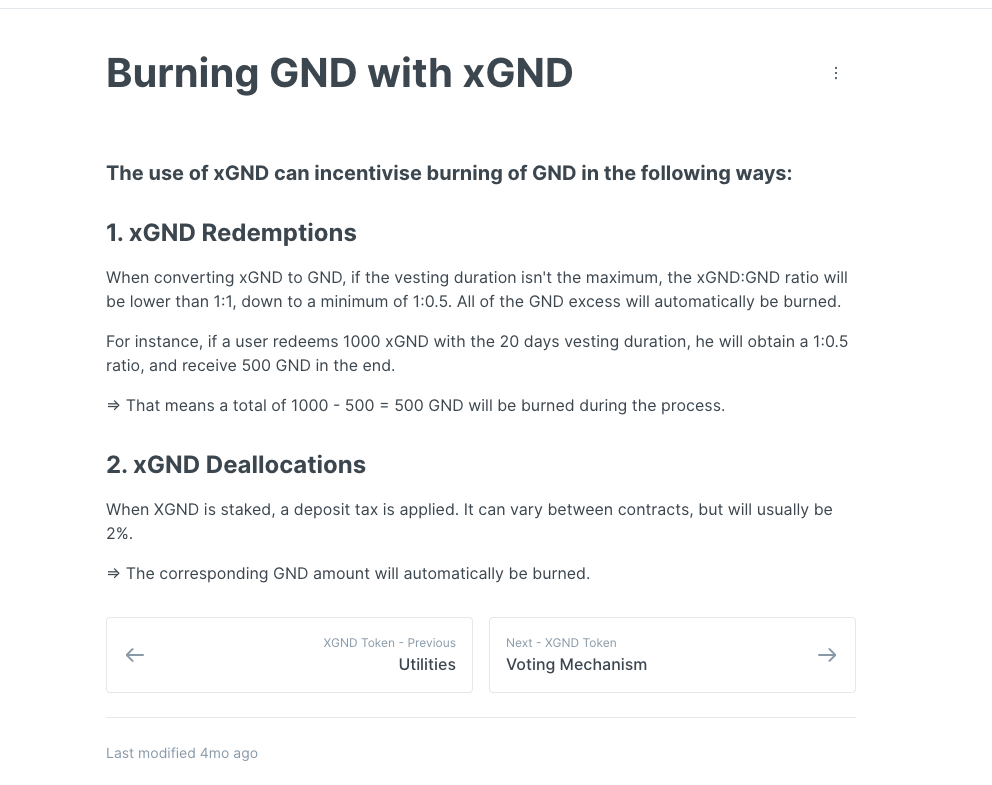

A large portion the emissions are paid out in $xGND which is actually illiquid and needs to vest, similar to $GRAIL / $xGRAIL mechanics.

The majority of revenue from the collective LPs is paid out to xGND stakers or used for buybacks of the $GND token.

This keeps APRs healthy.

There are also several other methods to support $GND such as deflationary mechanisms around vesting or deallocating.

The entire flywheel depends on keeping $GND / $xGND healthy so that APRs will be healthy enough to grow the TVL. $GND unfortunately has had struggled lately.

The protocol itself has paid out over $1M in dividends and bought back nearly $500k worth of $GND.

xGND staking is still paying out over 45% APR in $ETH for staking with the protocol. You also earn RP points that benefit longterm staking and boost your APR.

$GND is built on Uni v3 which is a larger market than @CamelotDEX but lets compare launches.

$GND launched $1.4M Circ MC & $7M FDV.

$CONE

twitter.com/cowperwoodeth/status/1643944355445583872?s=20

$GND ran from $80 to $600+ in the matter of only a few weeks as TVL exploded. At one point, the FDV broke $70 million and circulating MC hit $8M.

Extremely impressive and explosive growth for a brand new protocol joining the scene.

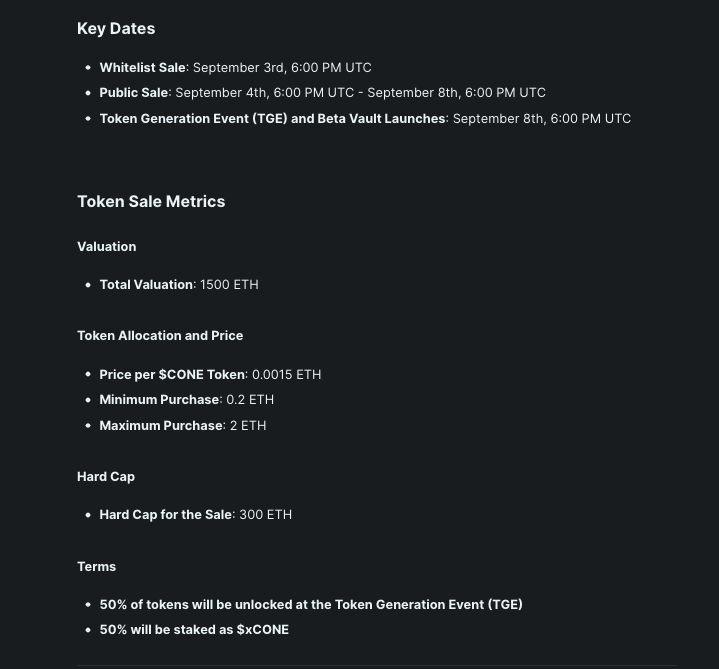

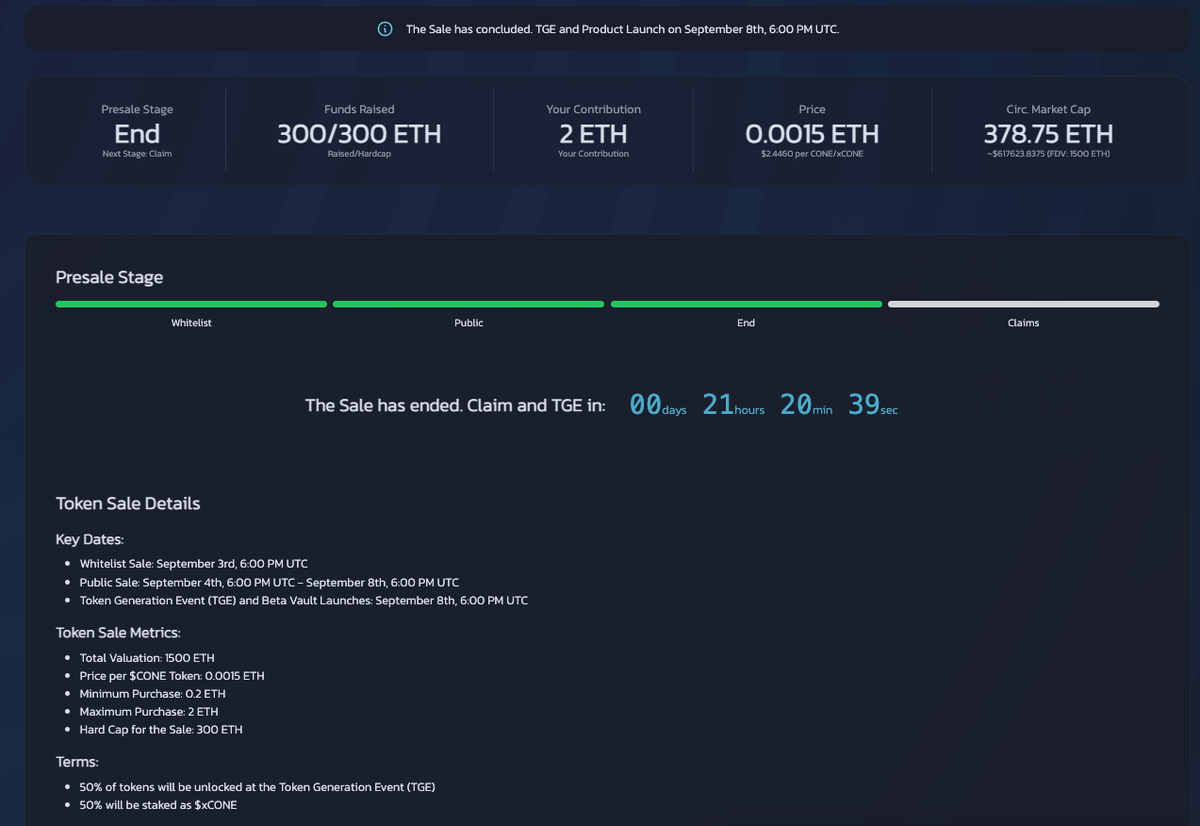

The $CONE public sale launched with an FDV of 1500 ETH which equates to ~$2.47M.

Circulating Supply on launch is tiny with just $613k circ MC based on the current ETH price.

Public Sale was 50% $CONE / 50% $xCONE with capped limits meaning liquid CONE is well distributed.

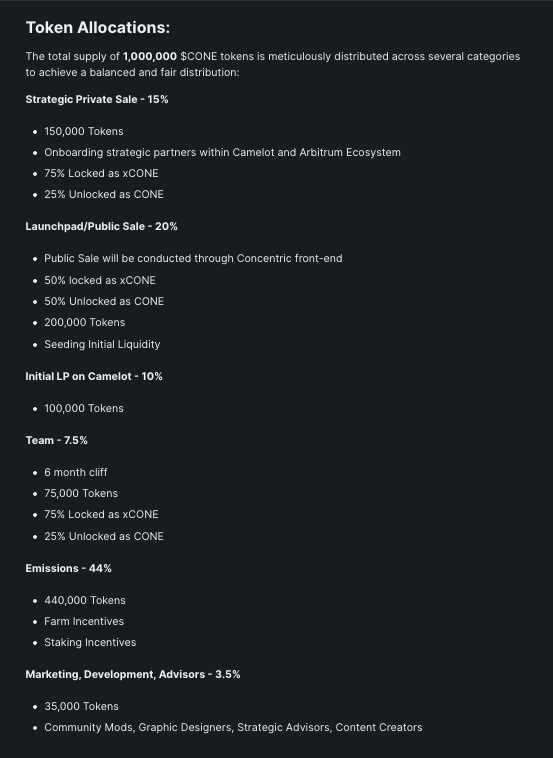

$CONE / $xCONE will have a total supply of 1M tokens.

450k tokens are technically circulating on launch but a portion of that is actually illiquid $xCONE.

Breakdown of liquid $CONE on launch:

37,500 - Strategic Sale

100,000 - Launchpad/Public Sale

100,000 - Camelot LP

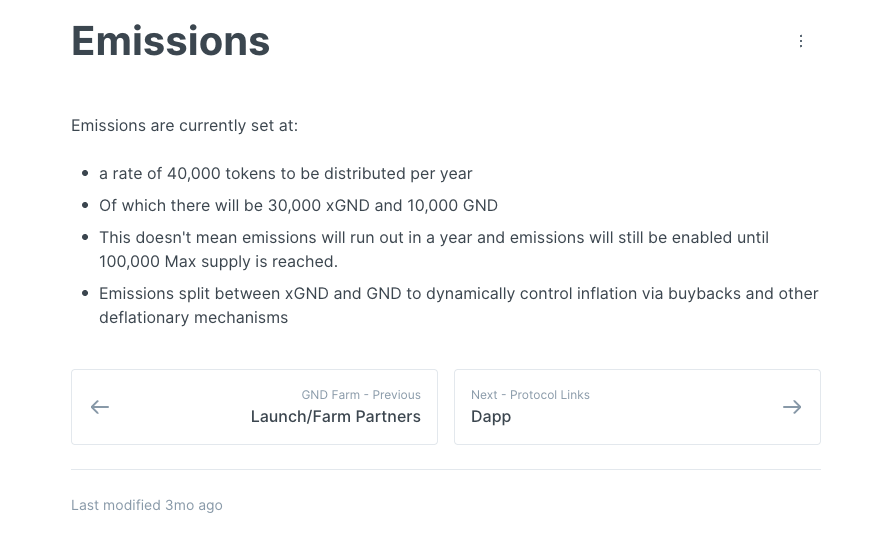

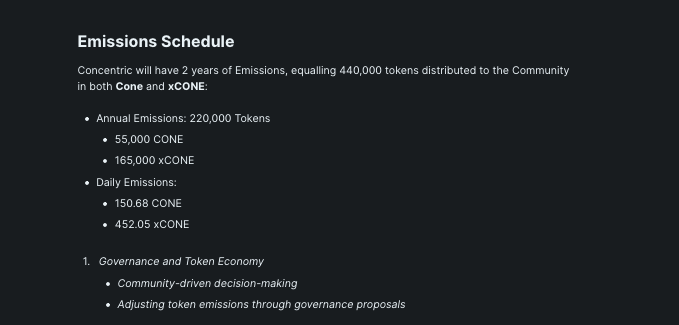

Emissions are split over 2 years and broken down to 220,000 annually.

450k circulating tokens on launch w/ 220k emissions per year means dilution will be ~50%.

Similar to $GND, 75% of the emissions are paid out in illiquid $xCONE which allows the protocol bootstrap TVL.

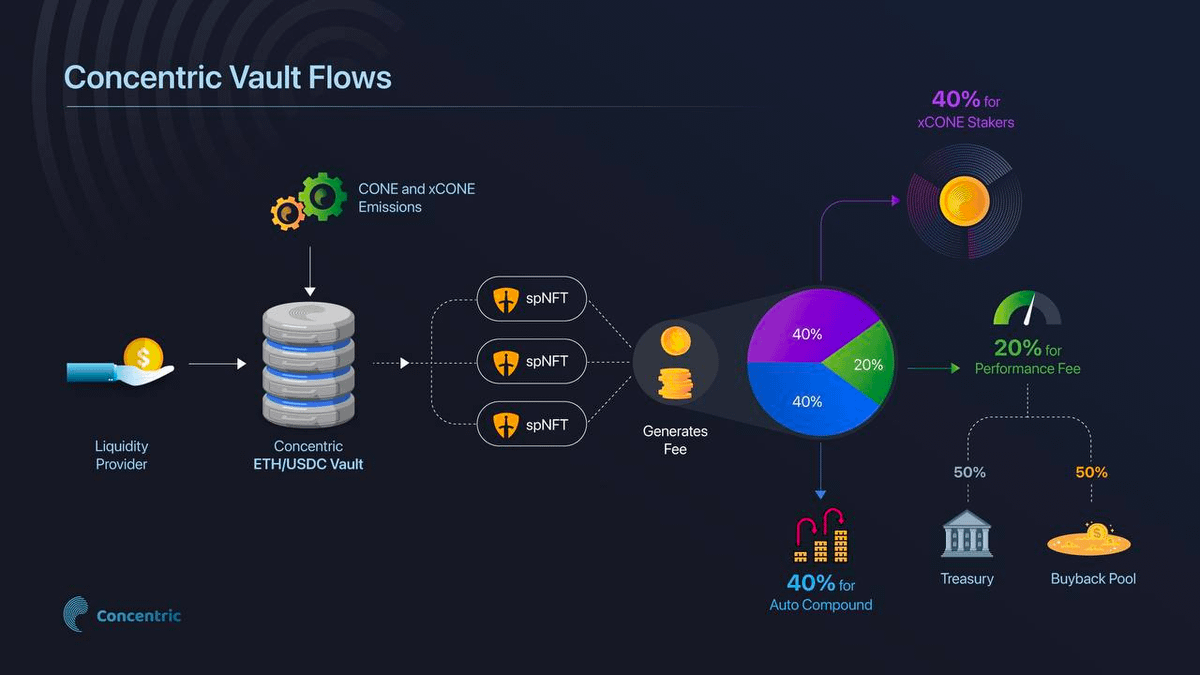

The LP vaults charge a 20% performance fee for managing your LPs.

50% of the performance fee is then used to buyback $CONE / $xCONE to keep the APRs healthy. In theory, as long as the TVL isnt dropping there should be a floor price for $CONE based off of fee intake.

$xCONE holders also get governance rights.

They vote on which pools the $CONE / $xCONE emissions are pointed towards.

Ideally every $xCONE staker would just vote for the LP/vault that is generating the most fees for the protocol. That doesn't always happen.

Two groups of people don't vote towards the highest earning pools:

1. $xCONE holders who are also farming with an LP

2. Partner Projects who want emissions to bootstrap their liquidity 👀

Projects with LPs on Camelot can now take advantage of concentrated managed liquidity.

There is value here for LP farmers, #RealYield degens, and projects looking to maximize their LP with CL ranges.

The cap on launch is low imo and this could possibly go on a run the next few weeks. If that happens, I'll take profit as it could cycle back to launch prices $GND.

My strategy as of now is to watch the TVL and as long as it is ballooning, I'll hold my original position.

Unfortunately, I'll be on a flight during the TGE so it's unlikely I'll be able to buy a larger position than I have now.

My strategy can/will change based on performance.

I've also acquired a $GRAIL position as a lower risk way to benefit on the increased TVL + Volume.

I think this is an opportunity for them to grow their volume + TVL over the next few weeks specifically. I'm hoping $CONE works longterm and it becomes a fee generator for $xGRAIL.

Disclaimer!

I entered the private sale for 3 ETH and the public sale with 2 ETH positions. Relatively small positions and will accumulate more based on TVL.

None of this is financial advice, please do your own research. I'm here to document my strategy and research.

GL!

I highlighted @ConcentricFi last week in my @friendtech group and gave away spots to the presale.

If you would like to see more content from me and sooner, check out my profile on @friendtech.

Multiple other similar protocols and launches will be covered in the next few weeks.