Two derivatives of the Solidly model @ChronosFi_ and @ThenaFi_ changed the game by bootstrapping their protocol with NFTs.

$chrNFT & $theNFT are a new way to profit off the growth of your favorite exchanges

1. Zero Dilution

2. Fees on Volumes

3. Rewards in $ETH / $BNB

4. No Lock

The @SCSLabsResearch team put together a YouTube deep dive on Solidly NFTs if you'd like to hear me discuss this in full detail.

Watch here: youtube.com/watch?v=Iuc7QD4wgTM

Continue with the thread on @ChronosFi_ & @ThenaFi_ ⬇️

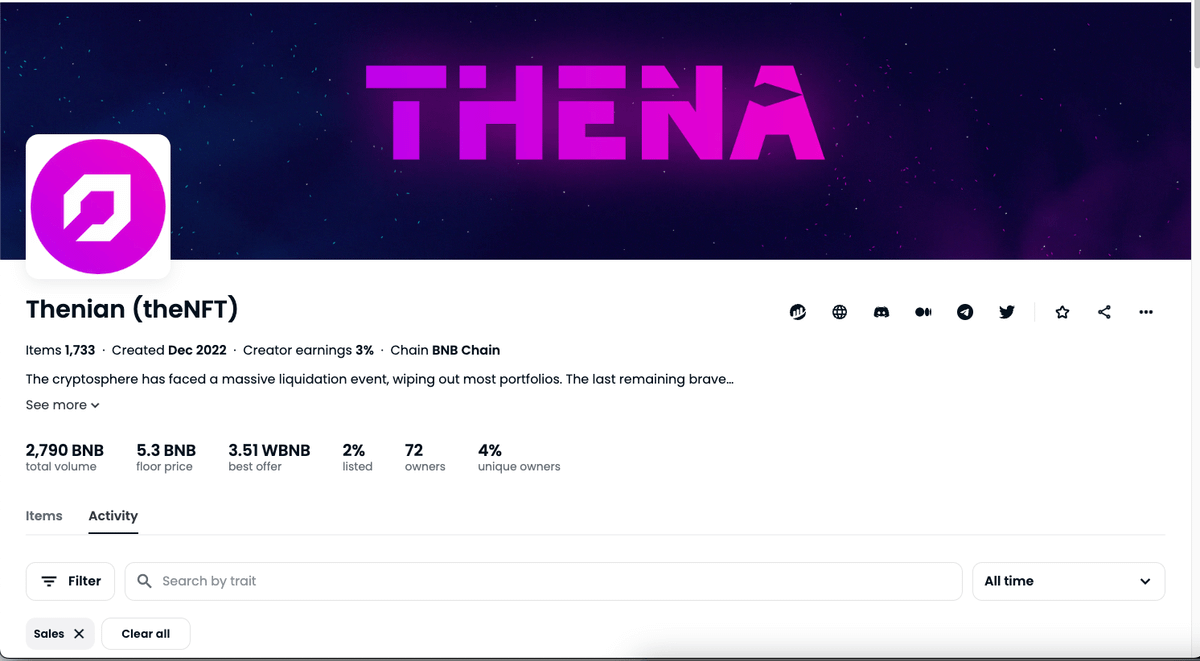

We will start with @ThenaFi_ as they pioneered the model that we will be discussing today.

I actually discussed $THE / $veTHE prior to launch and gave my takes on why it could be successful.

twitter.com/SmallCapScience/status/1608505549070675968?s=20

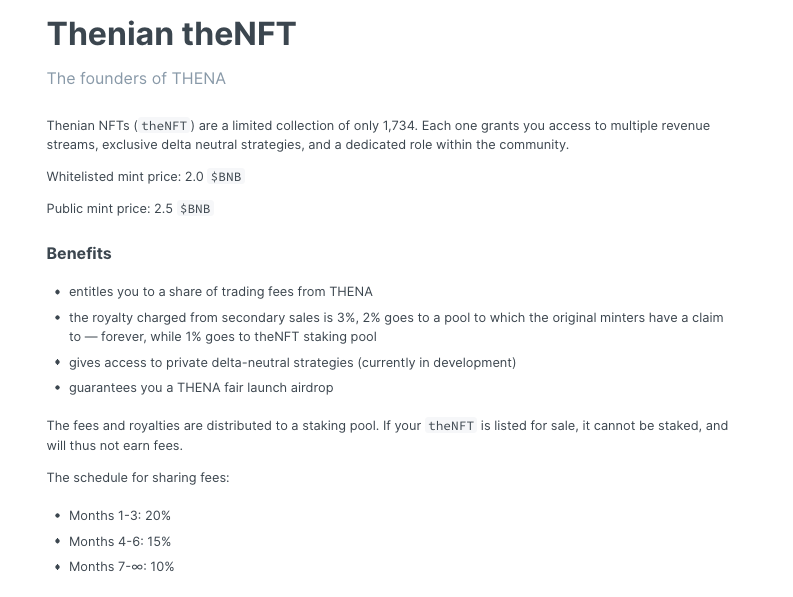

The simple concept is that the NFTs are a way to raise funds for the protocol while giving utility back to the minter.

Minters enjoyed an airdrop of $THE / $veTHE on launch, a % of trading fees forever, a portion of NFT secondary sales, and future gated utility w/ perps.

These NFTs actually did not mint out on launch due to being during an exceptionally rough period of the market (imo at least).

The max possible mint was 3,000 $theNFT but in the end, only 1,734 were minted.

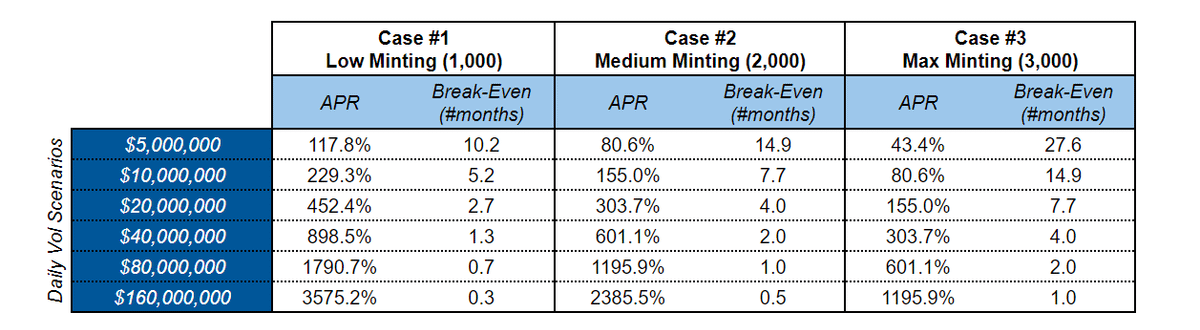

Prelaunch NFT simulation info:

medium.com/@ThenaFi/thenft-simulations-babb4968d336

Due to not fully minting out these NFTs had a breakeven period of ~12 months if you are taking the most conservative approach and assuming $5M daily volume.

This turned a ton of people of investors away.

If you listened to me discuss volumes on @MarketCapping, we discussed profiting off of volume heading into a new cycle.

This one is the perfect method as it allows you to earn fees without being diluted like most tokens on the market.

(youtube.com/@marketcapping8873)

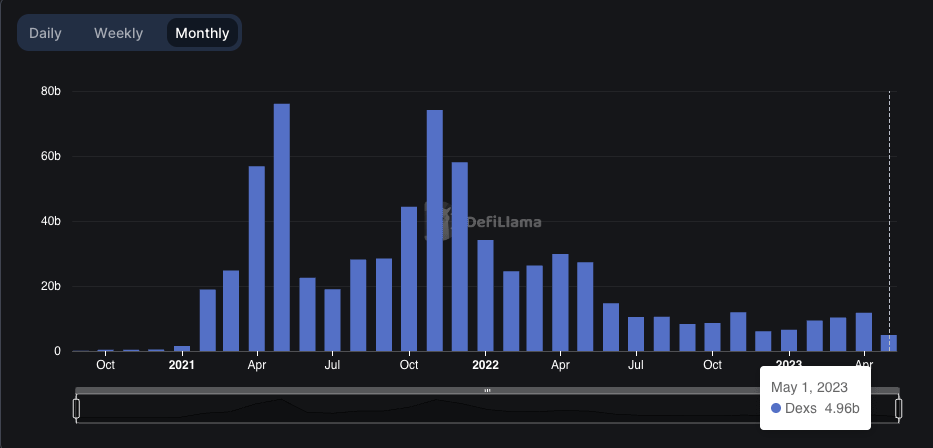

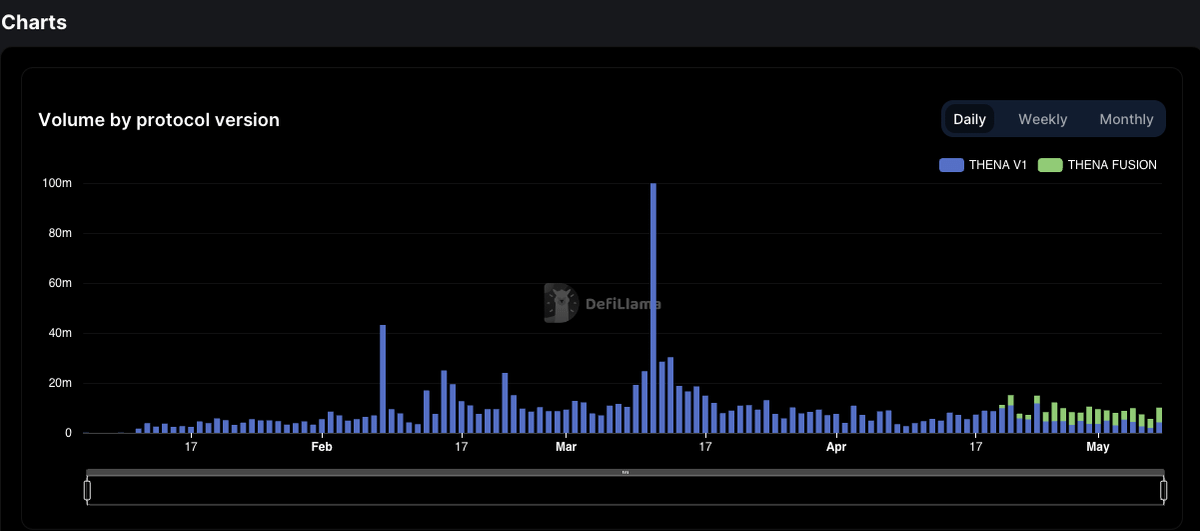

My hunt for volumes comes from the fact most users don't fully grasp the difference in volumes from the top to the bottom of the market.

Taking a look at $BSC, the chain had about $80B monthly of volume at its peak in 2021 while averaging $6-10M in today's market.

For perspective, DEXs like @Platypusdefi & @traderjoe_xyz on avalanche had days where their combined volume would be larger than the current monthly volume on $BSC.

Even smaller DEXs like @SpookySwap were doing $2B+ in volume per week.

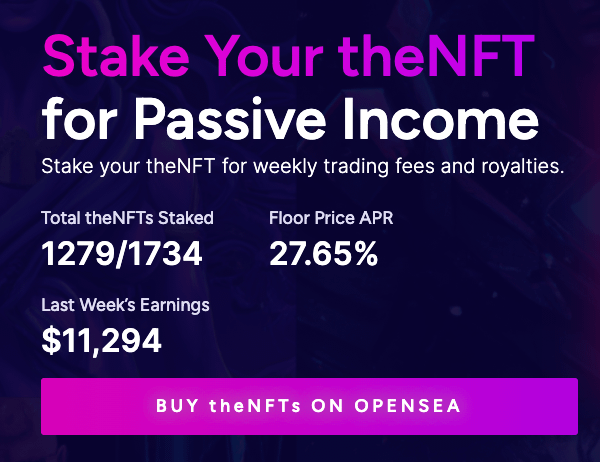

These NFTs will always earn at least 10% of all swap fees.

The difference between these and your average token is these come with zero dilution. There aren't new NFTs being minted and their utility means there shouldn't be a ton price volatility over time.

Thena NFTs on launch were only 2 $BNB per nft and since the floor has risen to 5.3 $BNB.

They are appreciating while still holding a very consistent APR paid out in L1 tokens.

Even with their appreciation in price, $theNFTs are paying roughly 25-30% APR consistently.

Considering the upside of 10-15x in volume during a bull cycle (conservative) there is tons of upside here. The hardest part is scaling in overtime

The @ThenaFi_ has also been grinding and pumping out features including their new Fusion Concentrated Liquidity by @CryptoAlgebra & @GammaStrategies.

Every tweak improves the efficiency which means aggregators push higher volumes through the platform.

twitter.com/ThenaFi_/status/1655517965553487872?s=20

The next feature that has been teased is their perps platform which will surely come with new features and functionality for $theNFTs.

The docs mention theNFT having private access to delta-neutral strategies. They are incorporating these longterm.

twitter.com/odiummm/status/1652212795721515009?s=20

1. $veTHE holders are forced to lock their tokens longer term to earn bribes while also having dilution from net new tokens.

2. $theNFT has no lockup, pays consistent fees, has other platform utility, & profits on volumes which are more consistent than bribes.

This brings me to the next opportunity which is @ChronosFi_.

They recently launched an extremely similar model to @ThenaFi_ but with a few small tweaks. Extremely impressive launch with $200-250m in TVL.

twitter.com/SmallCapScience/status/1654518118226485248?s=20

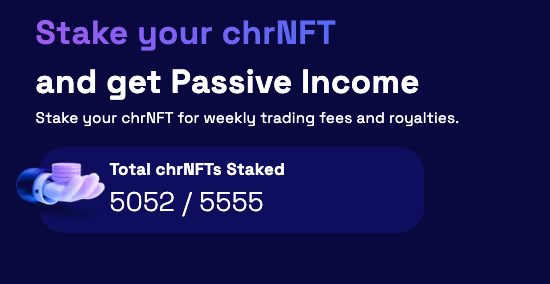

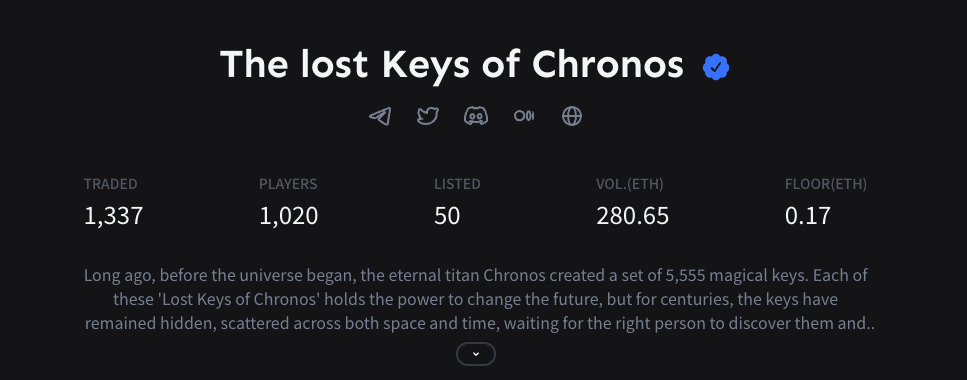

Similar to @ThenaFi_, they bootstrapped their launch with an NFT collection called $chrNFTs.

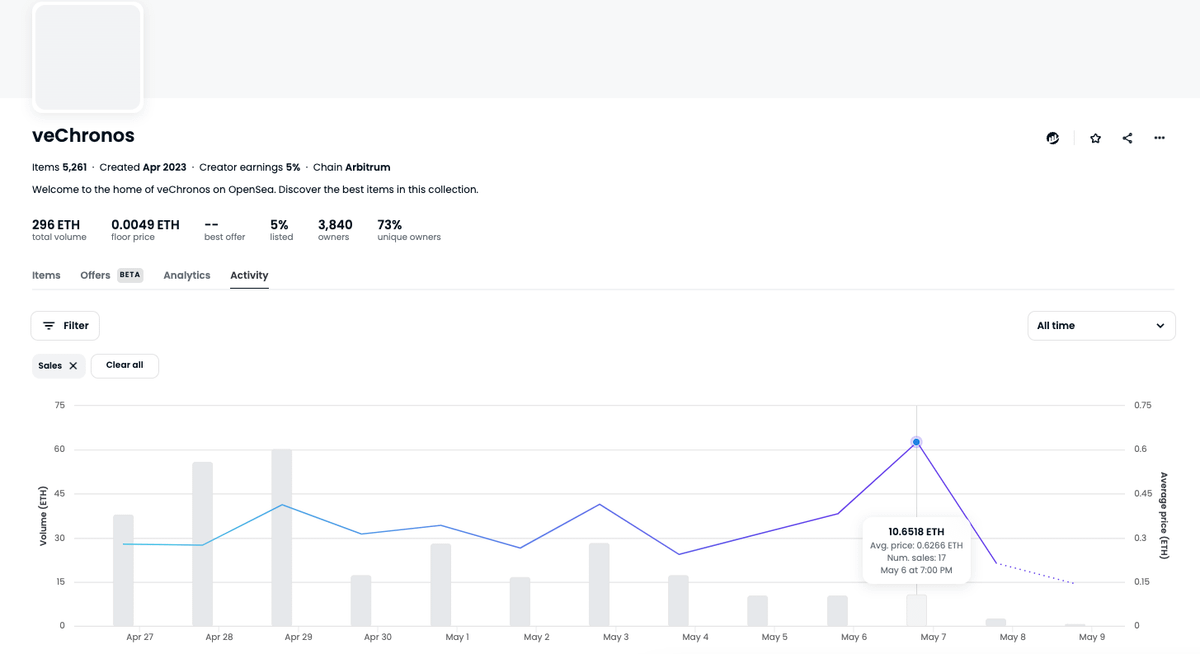

This collection has 5,555 pieces and mint was .3-.35 ETH dependant on the whitelist. Now that the NFT holders have received their $CHR airdrops, most are discarding their NFTs.

Tons of Smart Money minted these NFTs early for their airdrop and are dumping them to recoup a % of their upfront cost.

twitter.com/nansen_ai/status/1641279786453712896?s=20

The floor has collapsed down to .15-.17 ETH range for the past week.

They are available on @tofuNFT, @WenMoonMarket, and @ZonicApp to check individual floors.

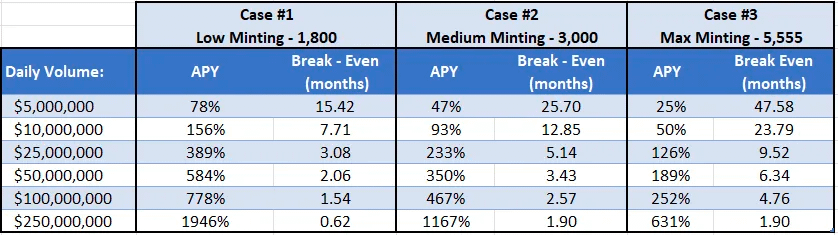

The @ChronosFi_ published a similar article on the possible returns for these NFTs over time.

medium.com/@chronosarbitrum/chrnft-simulation-case-study-exploring-return-profiles-5b29608a6825

This article states that on ONLY VOLUME the NFTs should return 50% APY based on a purchase/floor price of .35 and a volume of $10M daily which they've averaged.

With floor prices at .17 $ETH, APR would be roughly 100% if they manage to keep the volume consistent at $10M daily.

The "Lost Keys of Chronos" NFTs also have utility where they earn 1% of all secondary sales paid out to stakers.

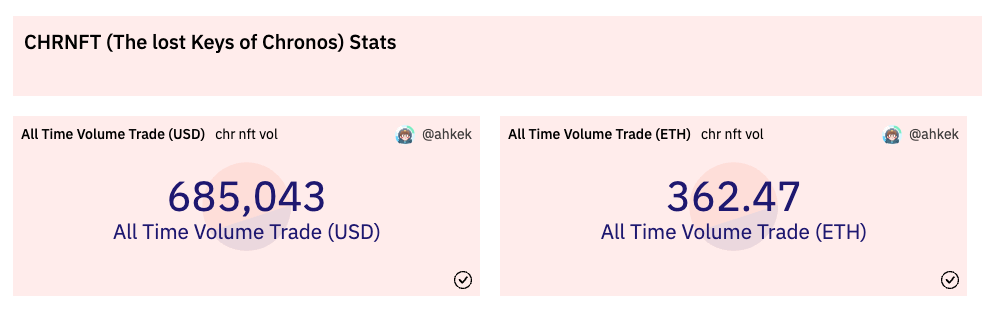

These have already done 362 $ETH in volume across marketplaces, this should slow now that airdrop has been distributed but is still another revenue stream.

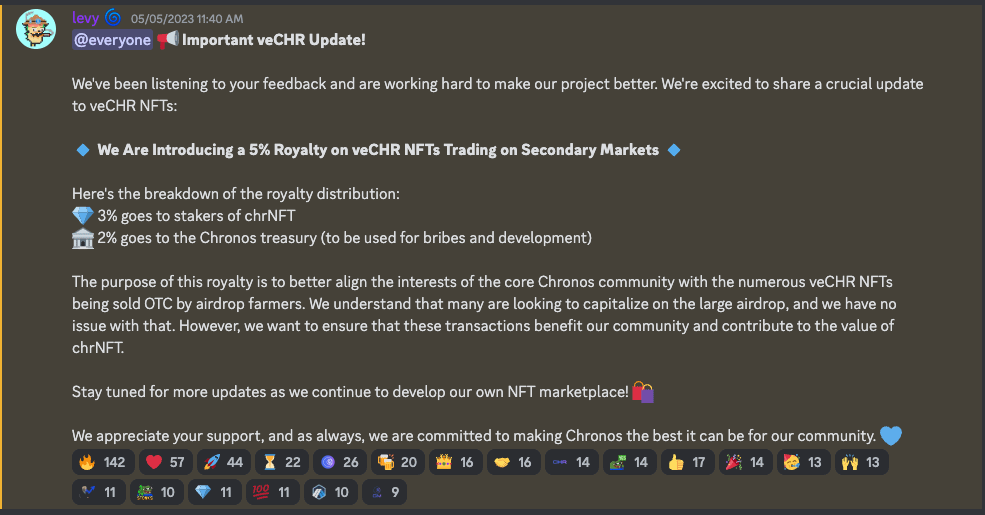

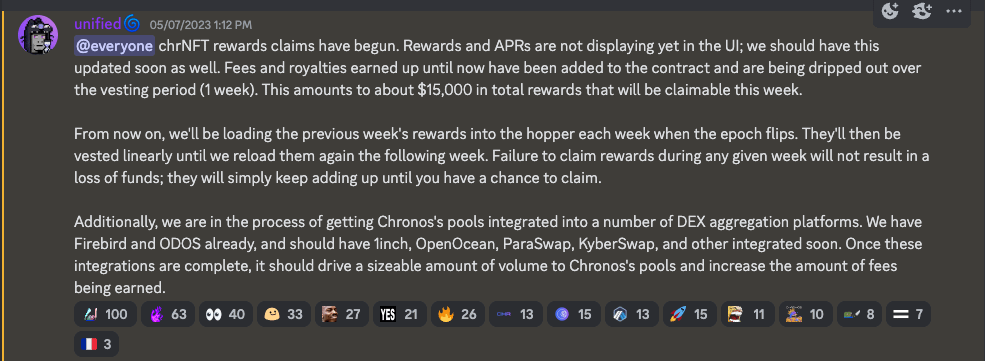

The team also announced a 3rd revenue stream for $chrNFTS, which is 3% of secondary sales from $veCHR.

This is a massive announcement as I see $veCHR (locked $CHR) having more volume than Lost Keys of Chronos NFTs as people trade in/out of locked positions.

$veCHR has seen 300 $ETH in volume traded already with some days being as high as 60 $ETH.

Once again, I'm expecting some of these numbers to slow post-launch but 3% of secondary here is a massive income stream for $chrNFTs.

Profit on DEX + OTC volumes... clutch.

There is a very easy path to these NFT's either rising in value or paying 100%+ APR in $ETH based on the above income streams as is.

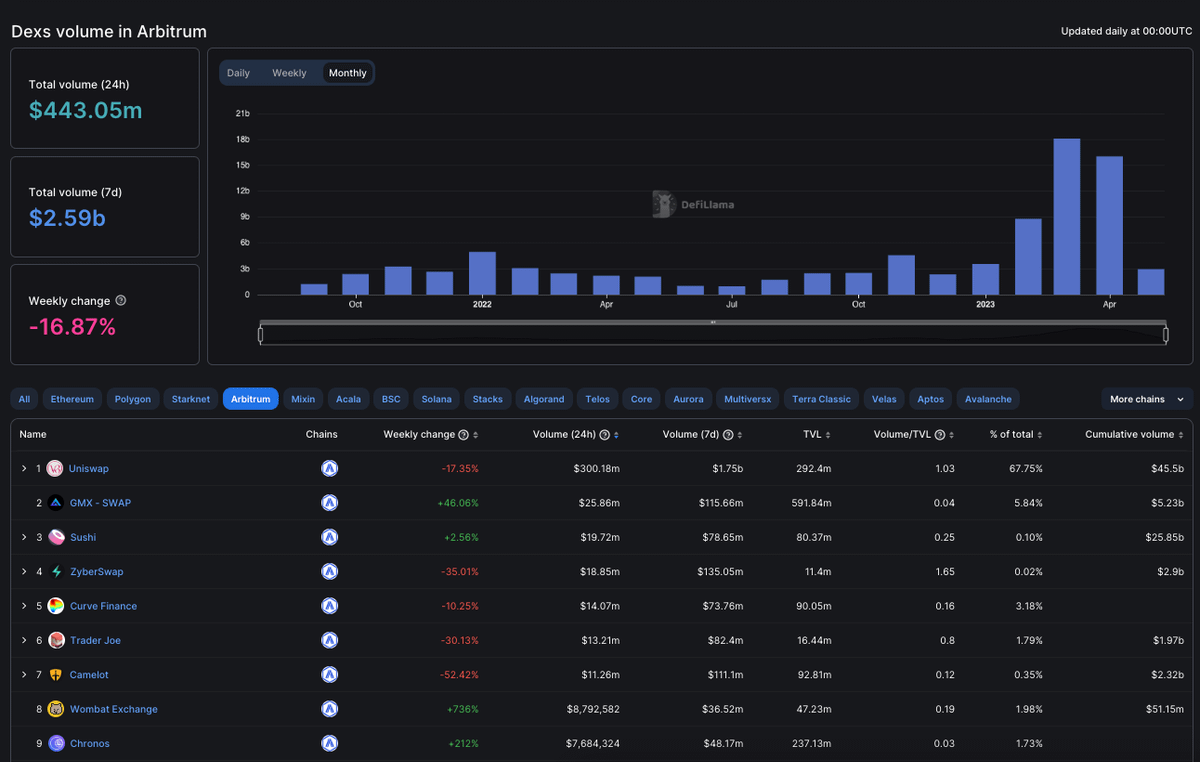

@ChronosFi_ is currently #9 in volume but #3 on TVL on @arbitrum, some TVL has trickled out since launch but it's been relatively sticky thus far.

They have averaged $7-10M in volume but they are yet to be plugged into some of the most popular aggregators in the space like @1inch, @OpenOceanGlobal, @paraswap, @KyberSwap, etc.

If they are able to hold their TVL until the integration of these aggregators volume should send.

The @ChronosFi_ team themselves talking about all the products that are soon to be built on $CHR also makes me extremely bullish.

Perps, Options, Lending/Borrowing, Stablecoins, etc.

All of these could bring further utility + income for $chrNFTs..

twitter.com/levysaur/status/1653806060799692800?s=20

The $CHR Ecosystem is already robust but I like the upside as some of these projects grow over time.

I'm using my chrNFT position to hedge my bets on @CamelotDEX long-term and diversify. Low-risk bet imo due to the passive income and zero dilution.

twitter.com/ChronosFi_/status/1653061006879277061?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1653061006879277061%7Ctwgr%5E3429d6f93dffd3ad37b1b35791185dc123cf8719%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.notion.so%2FChronosNFTs-4d2fdd3d11d847428c14b81a4880e177

If you enjoyed the thread and decide to use @ThenaFi_, consider using our reference link to help support the @SCSLabsResearch team in bringing you more content.

thena.fi/referral/?ref=SCSLabs

Chronos will be using a similar system and we will have "SCS Labs" Ref Link once operational.

Disclaimer -

I own theNFT, veTHE, chrNFTs, and veCHR as medium-longer term positions based on performance

Please do your own research and this post should not be considered financial advice! I missed $PEPE, go find financial advice somewhere else.

✌️