Decided to do the math for the @ChronosFi_ and the $chrNFT based on the latest Epoch.

Using a conservative approach I evaluate the 3 revenue streams of the $chrNFTs which I break down below.

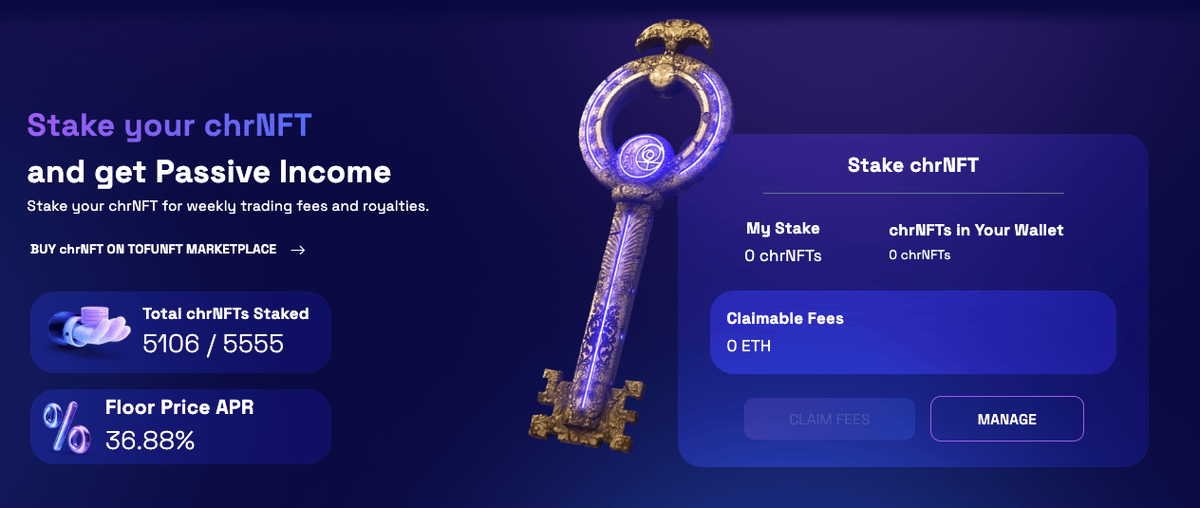

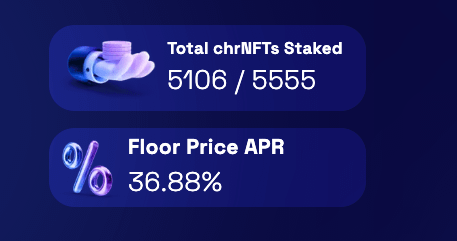

A nondilutive asset paying 36.88% APR in $ETH and imo it's undervalued by multiples!

If you aren't up to speed with how these work, please catch up before continuing.

Here is a thread and/or video I put together on the NFT model.

Thread - twitter.com/SmallCapScience/status/1657027110664323080?s=20

Video - youtube.com/watch?v=Iuc7QD4wgTM&t=264s

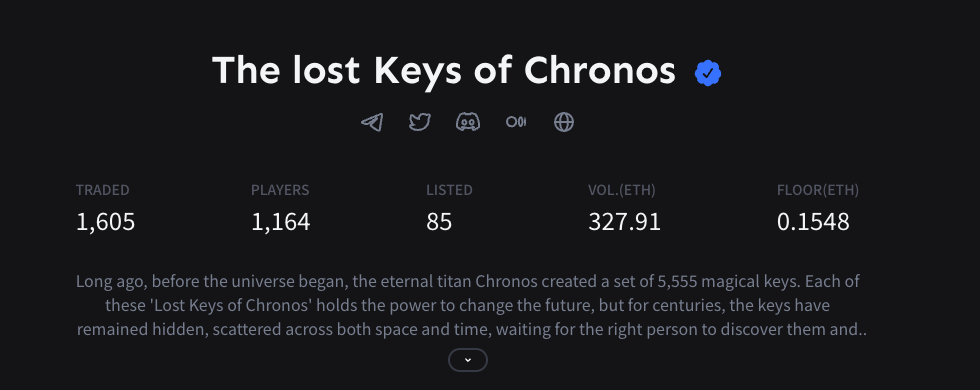

Current "Lost Keys of Chronos" MarketCap -

5,555 NFTs x .15 Floor x $1.8k per $ETH = ~$1.5M MC for the $chrNFT collection.

$1.5M FDV for a nondilutive asset automatically gets my attention, especially while paying 35%+ in #RealYield.

Let's dive into the 3 Revenue Streams...

Revenue #1 - Swap Fees

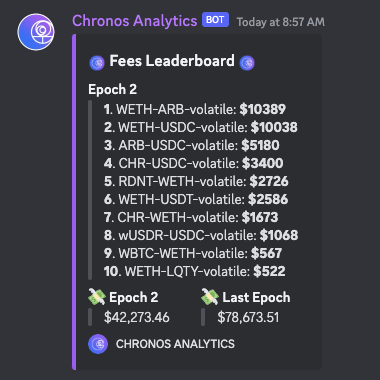

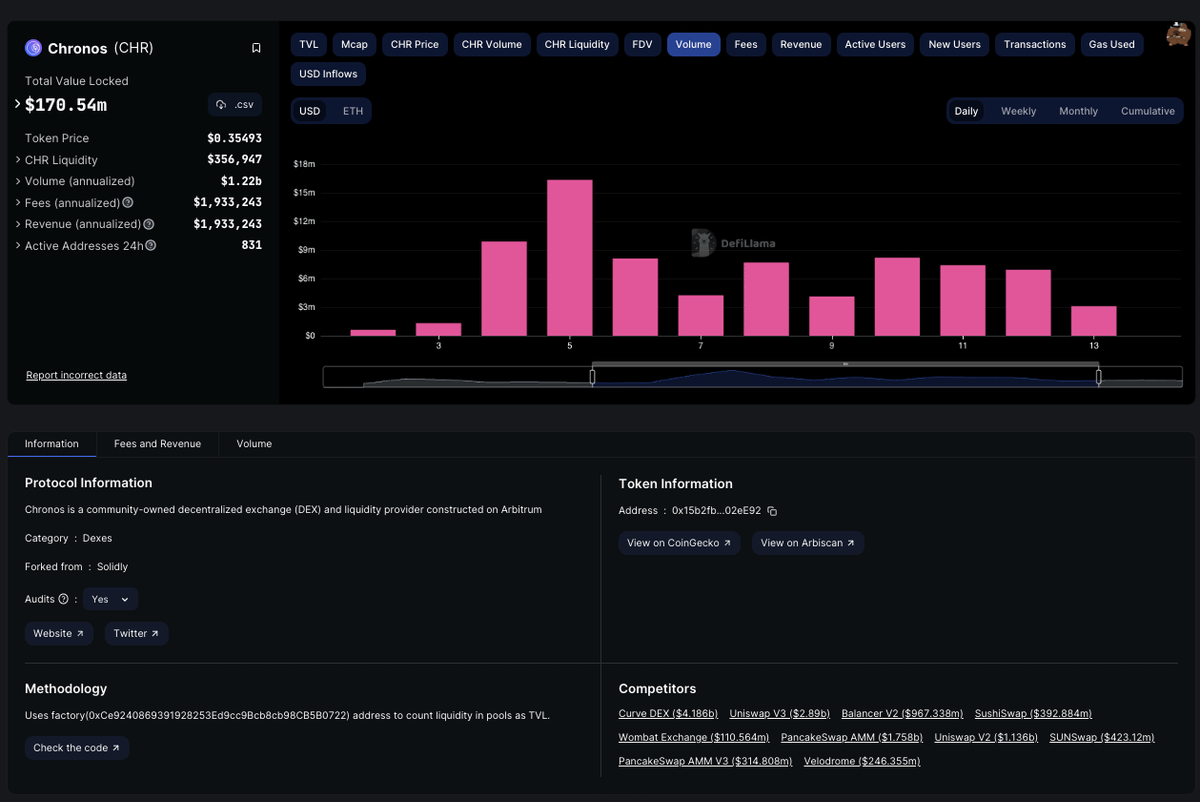

Based on Epoch 2, @ChronosFi_ swap fees were $42k.

Epoch 1 the protocol earned $78k in swap fees but we will use $42k and annualize it to be conservative.

$42k x 52 weeks = $2.18M Swap Fees Yr.

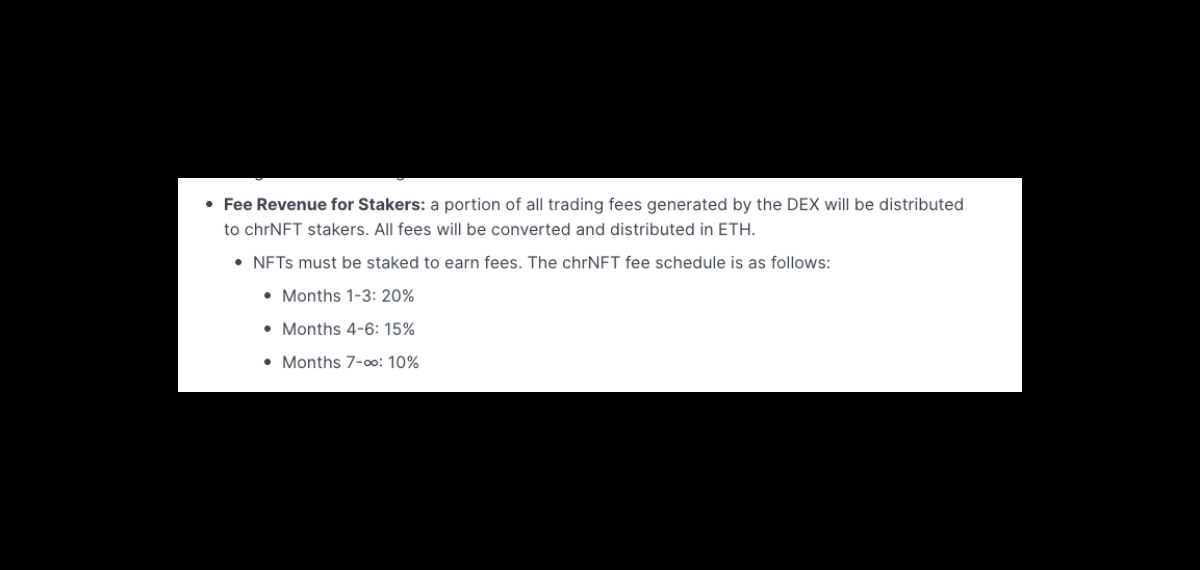

The $chrNFTs earn 15-20% of swap fees for 6 months and then 10% in perpetuity. Being ultra-conservative we will annualize using 10%.

$2.18M x 10% = $218k in $ETH rewards for $chrNFT stakers.

With a PE of 15, this single revenue stream puts $chrNFTs value at $3.27M (2x the MC)

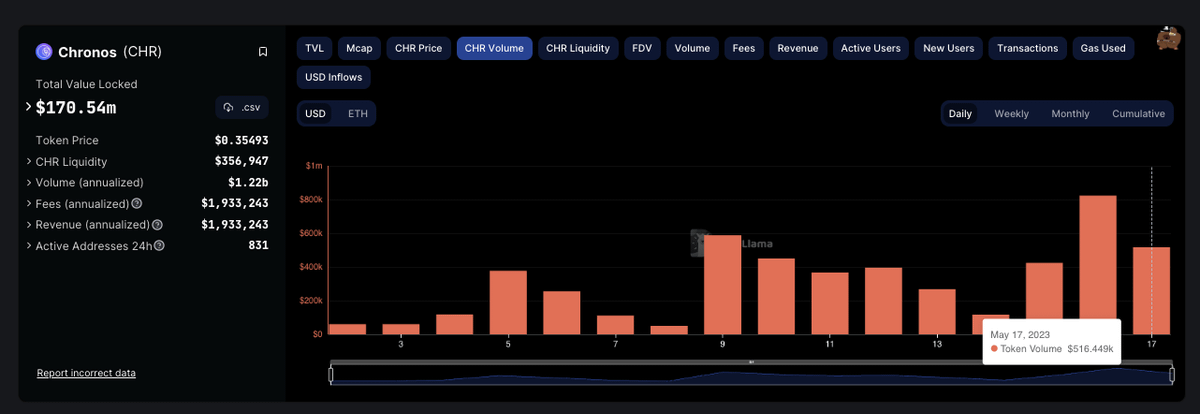

Keep in mind, swap fees for Epoch 2 came during a relatively light week for a protocol with $170M in TVL.

I expect growth here in the future, not further contraction. Especially with new dex aggregators, concentrated liquidity, and perps. Tons of upside for this to explode

Revenue Stream #2 - $veCHR NFTs

One of the only reasons to buy $CHR currently is to lock the tokens and earn bribes. $veCHR NFTs are users with locked $CHR positions.

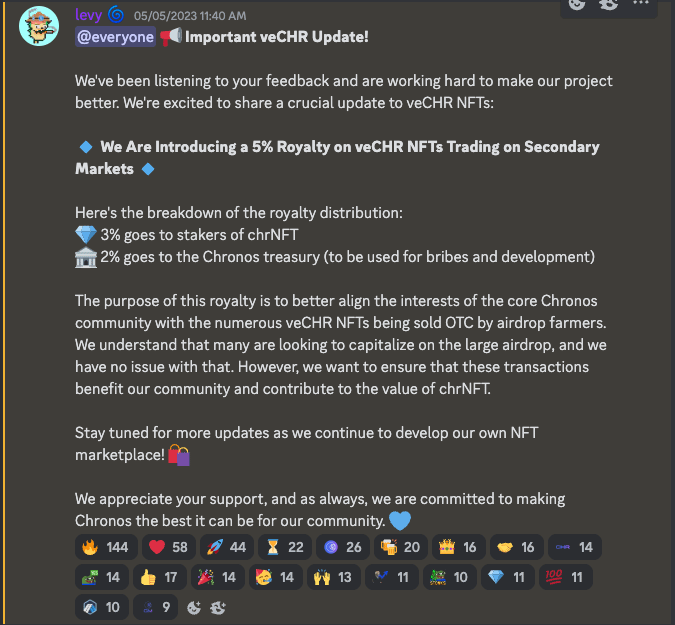

3% of the secondary sales on $veCHR NFTs from @opensea are passed onto $chrNFT stakers.

$veCHR NFTs are trading at ~30% discount compared to liquid $CHR and did 3 $ETH or $5.4k in volume yesterday.

3 ETH x 365 days x 3% x $1800 per $ETH = $59k yr $chrNFT earnings.

PE of 15 would put the value of the $chrNFT collection at ~$887k from this single revenue stream.

Liquid $CHR did roughly $516k in volume yesterday and thats been roughly the average.

Compared to $5.6k traded of locked $CHR on Opensea soon the market will realize the 30% discount and move more $CHR volume to opensea.

This should be a huge fee driver for $chrNFTs longterm.

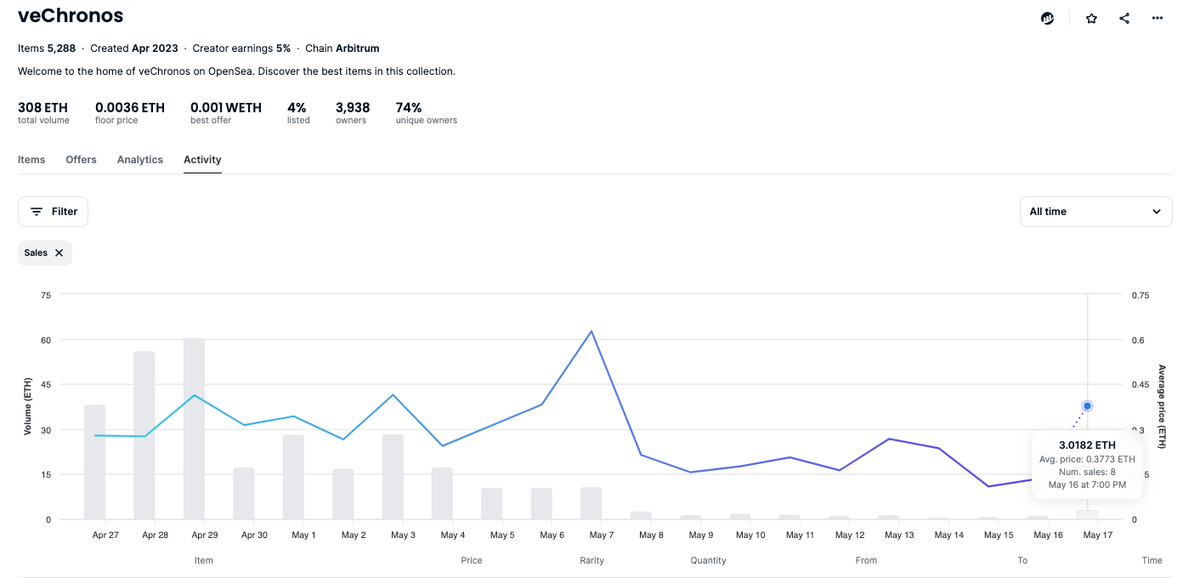

Revenue #3 - $chrNFTs Secondary

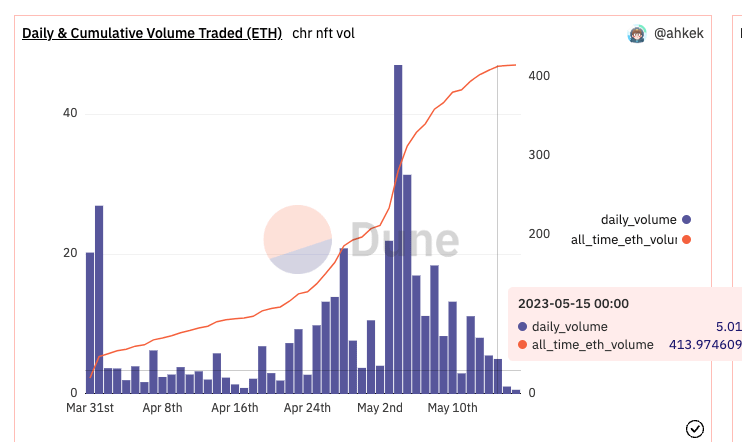

Taking the average of the past 7 days (post-launch) this collection averaged 6.78 ETH per day.

6.78 ETH x 1% chrNFT earnings x $1.8k per ETH x 365 days = $44,544 per yr. PE of 15 for this revenue stream alone would value the collection at $668k.

That puts our combined earnings of all 3 revenue streams at roughly $320k and with a PE of 15, the collection value would be $4.8M.

Fair Value:

$4.8M / 5,555 NFTs / $1.8k ETH = .48 $ETH or $868 per NFT

$chrNFTs are nondilutive so it being undervalued just means a higher APR.

If the price does catch up to fair value based on these #'s, that means the earnings from secondary sales will increase.

These are over 3x undervalued using a very conservative approach to Fair Value and could easily be closer to 5-6x undervalued if more aggressive.

Disclaimer -

Please DYOR, this is for entertainment purposes and to show my math process. I'm also not perfect so please double-check my work, I make mistakes all the time.

Hope you enjoyed and please share if you did! GL!