One of the @arbitrum projects I'm long-term bullish on is @vela_exchange!

Users that missed $GMX have heavy coping going on. $VELA / $VLP are a 2nd chance.

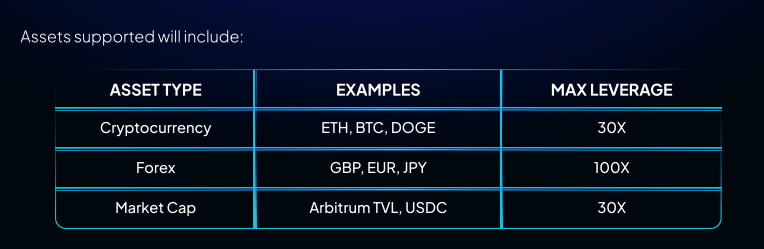

The perp exchange differentiates w/ synthetics, forex trading, and other differentiators.

Alpha + Airdrop 🧵

Free money is the best money! 💰

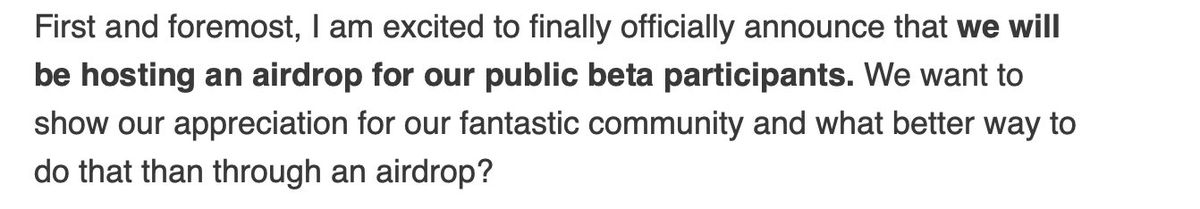

Airdrop confirmed for Public Beta testers:

1. Visit the Link Below

2. Deposit USDC

3. Start Trading

SCS Labs Referral Link - app.vela.exchange/?refer=2BU0KT6E

Ref ID - 2BU0KT6E

All referrals help the @SCSLabsResearch team in bringing you more content!

Let's dive directly into the alpha for once...

One of the biggest differentiators between $GMX and $VELA is the fact synthetics are already live on @vela_exchange.

This means volume is guaranteed on pairs GMX doesn't support like forex ($EURO, $GBP, $JPY) which are live.

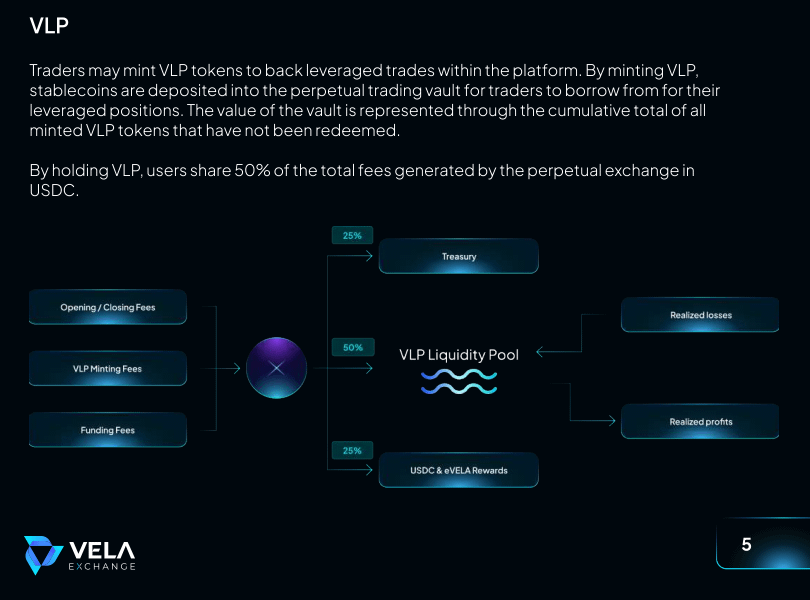

The second biggest differentiator is $VLP.

Instead of being a basket of assets like $GLP, their $VLP is backed entirely by $USDC. They are able to do this because of synthetics and it takes away the IL risk out of providing liquidity.

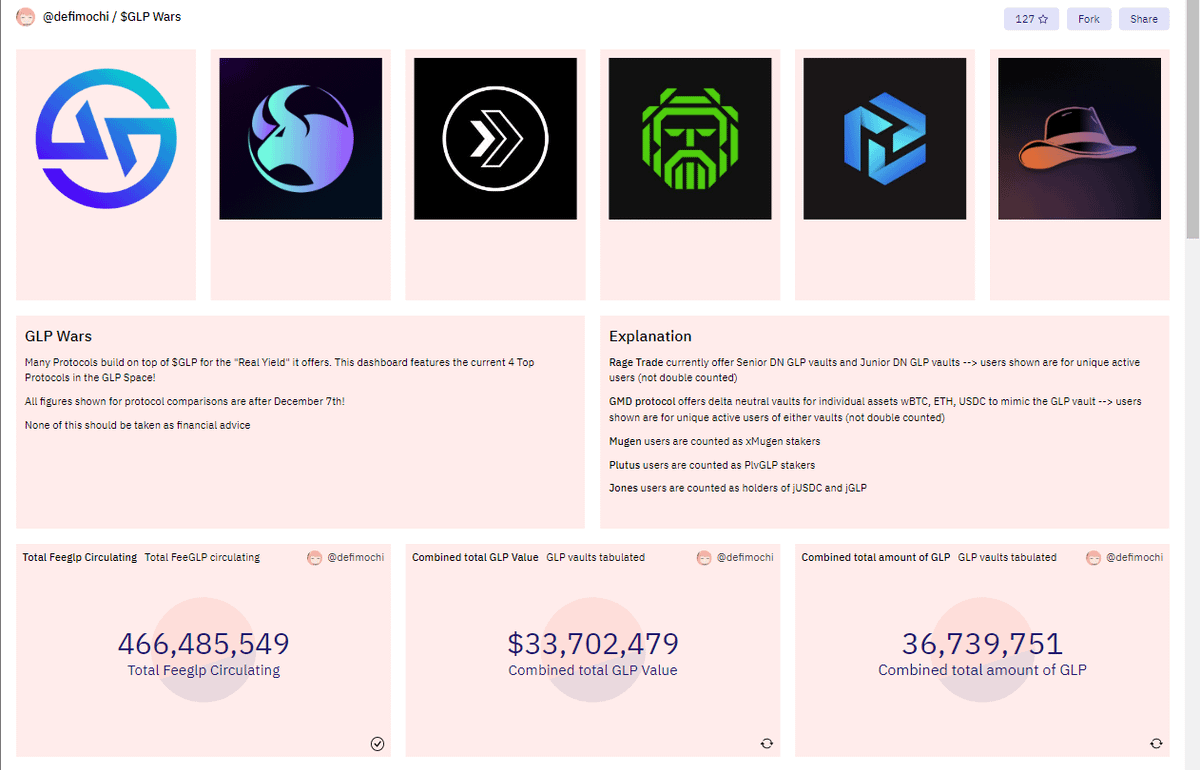

The demand for delta-neutral and/or gamma-neutral yield is extremely high with $33M+ sitting in the top 5 projects.

The reason for this is $GLP consists of a basket of assets including $BTC/$ETH that suffer from IL. 2022 the market fell by ~75% which effects $BTC / $ETH in $GLP

These Delta/Gamma Neutral vaults help take positions to derisk the underlying $GLP from the IL to make their $GLP yield very low risk.

Even with the market crash + IL from 2022, $GLP was one of the best-performing assets of the year due to profiting off of GMX perp fees.

Here is a great thread by @pt1mfv_ on the $GLP wars and the new $jGLP product from @JonesDAO_io which is taking over the market.

twitter.com/pt1mfv_/status/1624576332884774913?s=20&t=_dNMX0_yGJopVO1kQ-iGGw

When taking a deeper dive and looking into a few of these vaults the returns sit are right around 25-50% APR.

These obviously vary over time based on things like GMX usage, the profitability of traders, etc.

So what does this have to do with $VELA?

The @vela_exchange is a step ahead and has an opportunity to get extremely deep liquidity, extremely fast.

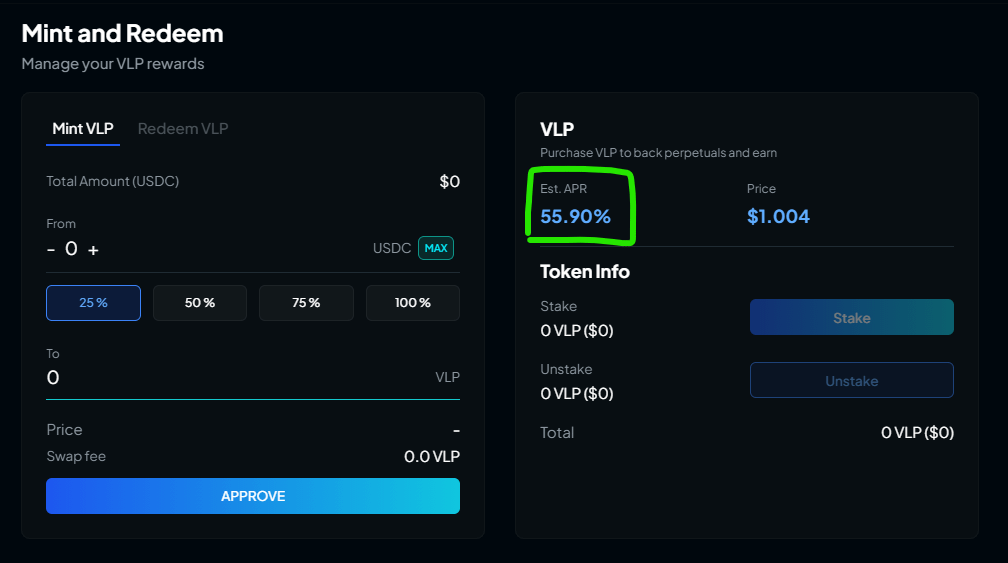

Their $VLP product being backed by $USDC means that delta-neutral vaults arent needed and it's paying 56% APR. Deposit $USDC, mint + stake $VLP, and start earning

If all of the perps traders on the exchange do extremely well, the $VLP pool can take losses.

That means there is more risk with $VLP compared to traditional stables but based on the success of $GLP, I think it's relatively safe. DYOR.

Imagine using $USDC to mint $VLP, earning 50% APR (assuming this APR holds), and then borrowing against your $VLP position.

With $GLP being one of the most productive assets of 2022, $VLP can also print $USDC during both bull + bear.

$VLP & $VELA staking has 72-hour cooldown*

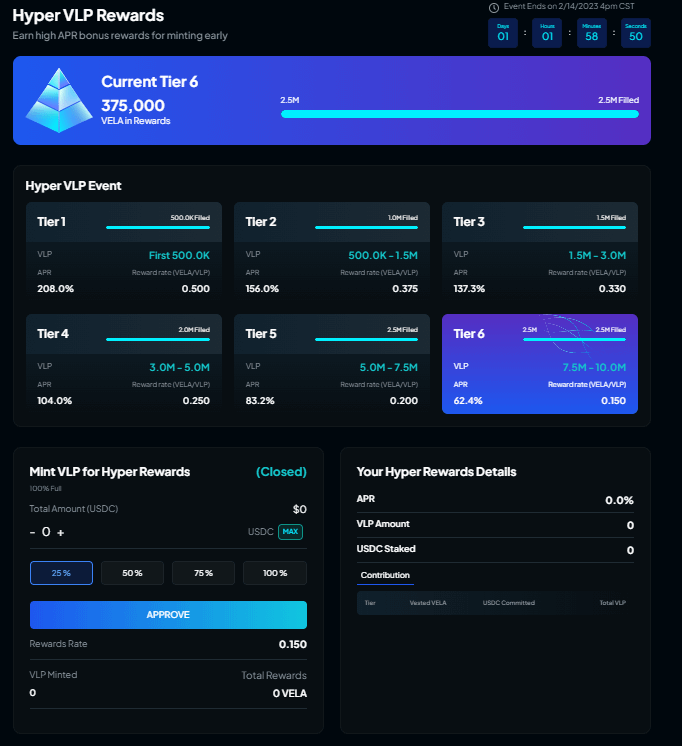

They did an event for early beta users called "Hyper $VLP" which incentivized early liquidity.

The exchange already amass about $13.5M in liquidity for their perps exchange. Extremely Impressive start.

Everyone has been watching the massive influx of stablecoins coming to @arbitrum and a large reason for that was the @vela_exchange Hyper VLP event and Public Launch.

I'd expect Vela to be a massive reason for the growth of Arbitrums TVL going forward.

twitter.com/Dynamo_Patrick/status/1623714407145504776?s=20&t=3WTYfU0YTOxNNE2EG4bzEg

Now that the implications of $VLP are understood, let's talk about sustainability.

High yields are pointless if they don't last. Let's dive into model + tokenomics...

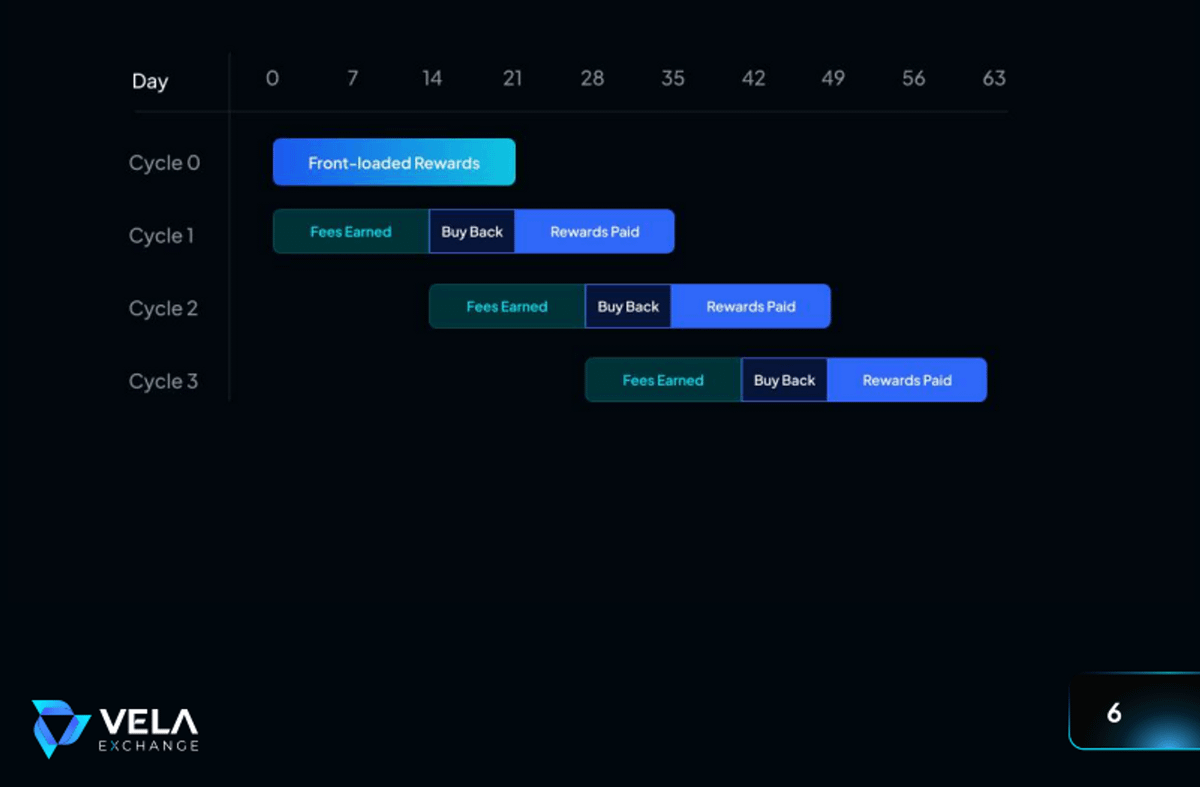

Rewards for the first few weeks are front-loaded to bring in ultra-deep liquidity.

Their tokenomics came under fire early on as everyone complained of dilution and compared them to $DYDX, they are very wrong imo.

"High FDV" complaints got squashed when $VELA decided to cut their token supply from 100M > 50M, this went under the radar.

medium.com/@vela_exchange/vela-tokenomics-the-new-wave-d340708ba8f5

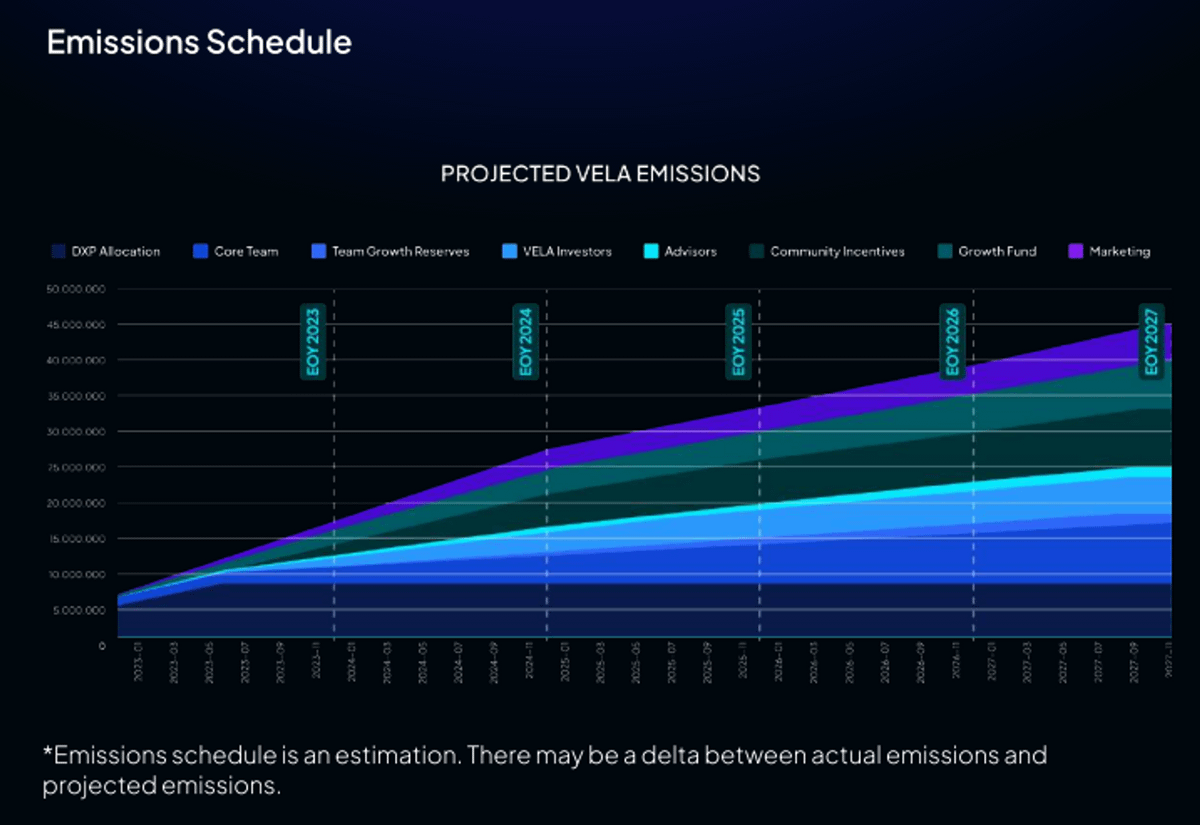

The updated emissions schedule, supply grows from ~7M to 17M in 2023, most of that supply will be paid out in $eVELA emissions.

$eVELA has a 12 month vest period.

A "kick the can down the road approach" that helps build long term holders and gives them time to build up fees.

The first few week's emissions will be decently heavy because emissions are higher than they will be post-front-loaded rewards.

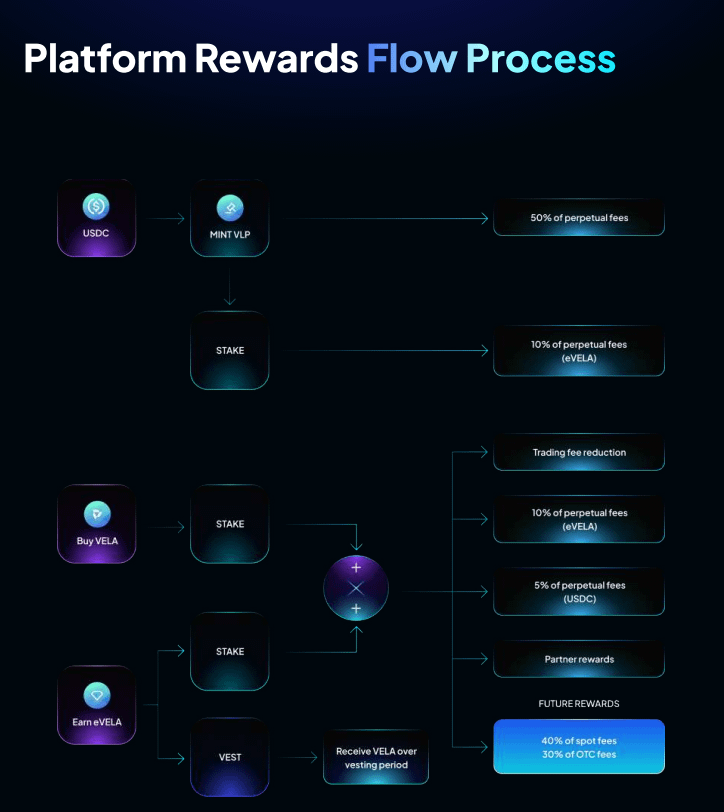

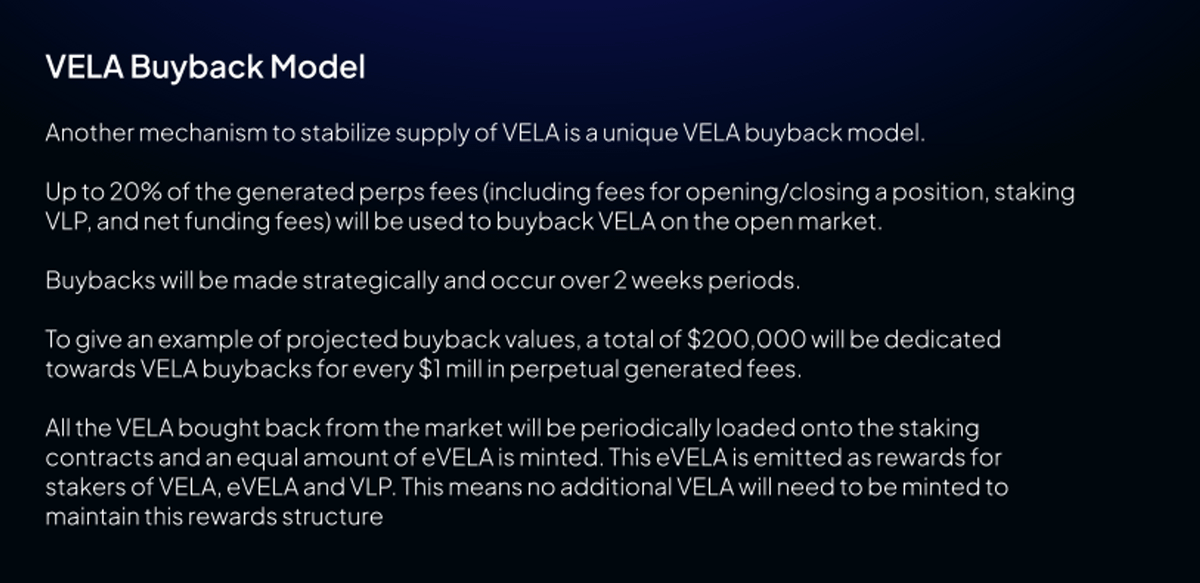

Once fee payouts kick in their buyback model is elite. They will be using 20% of fees to purchase $VELA, convert it to $eVELA, and reward it to stakers

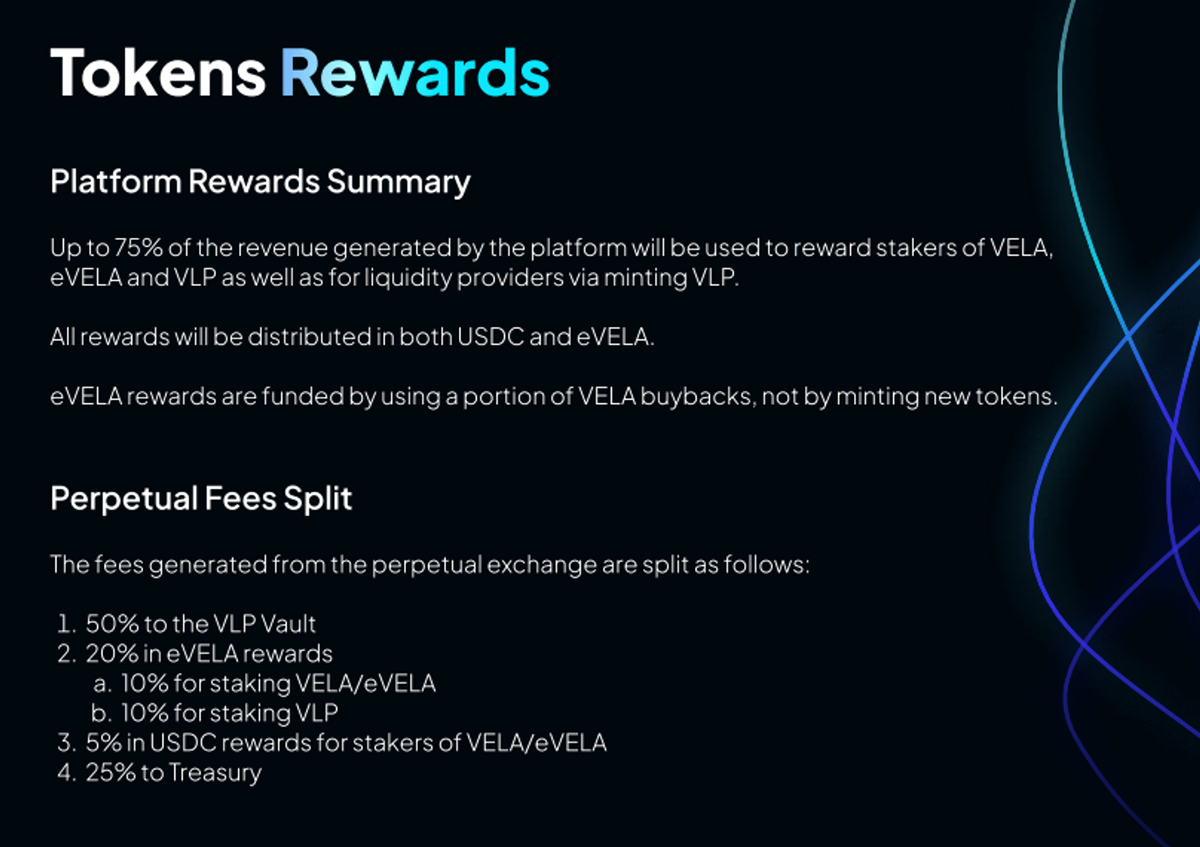

#RealYield is still a very big narrative and there are very few protocols that it well, and even fewer pay in $USDC.

50% of all perps fees go to $VLP stakers 👀

5% go to $VELA / $eVELA stakers 👀

20% goes to Buyback Mechanism

75% of perps fees go towards supporting $VELA / $VLP

The key here is that any buybacks they do are turning liquid $VELA into $eVELA which has a 12-month vest period.

The circulating supply should be crunched over time as fees grow and with 25% of rewards going towards supporting $VELA price, there will be demand.

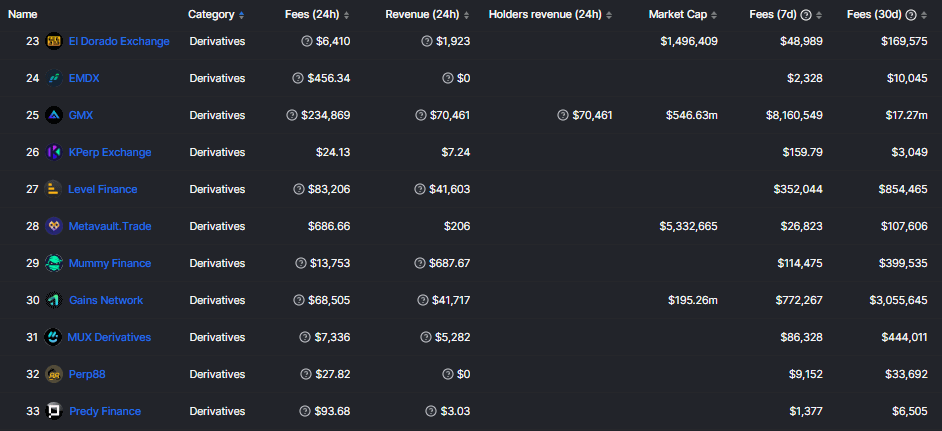

Taking a deeper dive into their BuyBack model, it's worth loosely comparing them to some other derivatives exchanges to estimate returns.

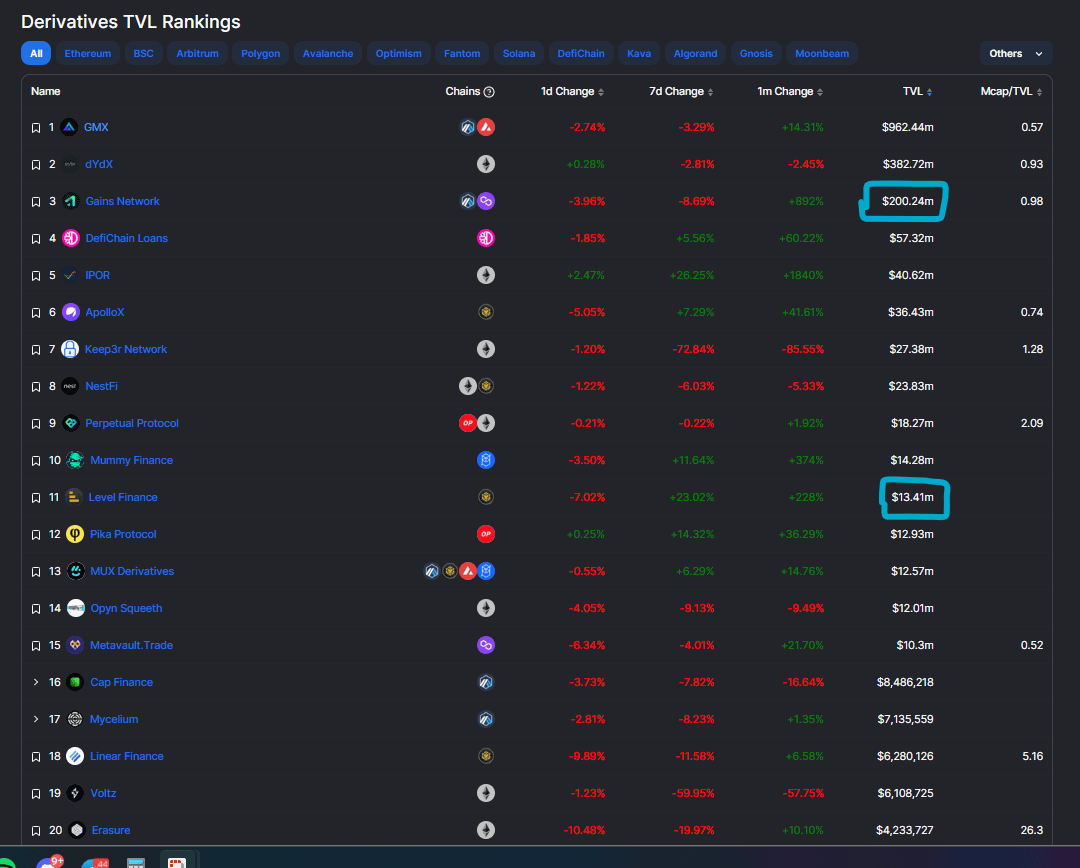

Level Finance - $352k weekly fees ($18.3M annualized)

Gains Networks - $772k weekly fees ($40M annualized)

Impressive fee intake....

Comparable Derivatives to $VELA

$VELA @ $LVL fees - $3.66M of $VELA buyback + burn, ~$900k paid to $VELA stakers year one, and $9M paid to $VLP in $USDC

$VELA @ $GNS fees - $8.02M of $VELA buyback + burn, ~$2M paid to $VELA stakers year one, and $20M paid to $VLP in $USDC

👀

$VELA currently sits @ $22.5M MC.

$3-8M of estimated buyback + converting to $eVELA is extremely significant compared to the current MC. On top of that, another $900-$2M would be paid out in $USDC to $VELA stakers.

Comparing TVL's, $VELA launched in the past week and already has a larger TVL than $LVL finance according to DeFiLlama.

There is a long way to go until they reach $GNS levels of TVL but high stable yields are always in demand so $VLP should grow quickly.

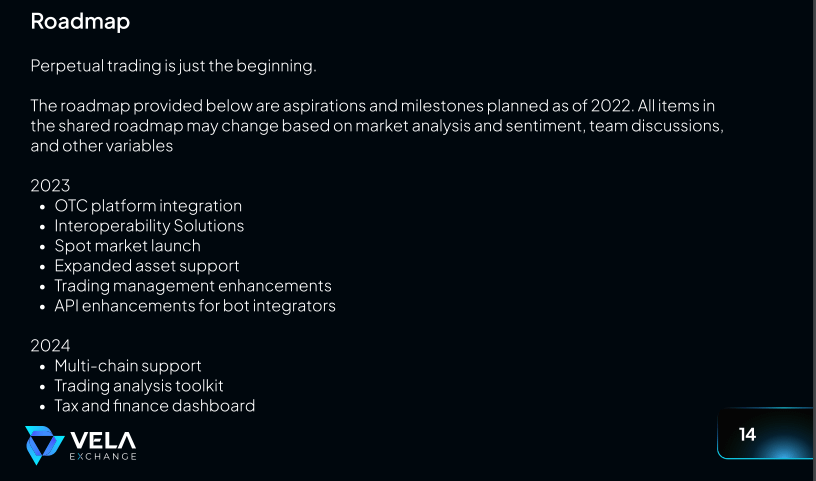

The 2023 Roadmap includes the spot market launch, an OTC Market, and further asset expansion.

In the future, they will also push to make tax and finance integrations streamlines as well as moving to a multichain model (huge for fees).

Nearly all of the Team & Advisors are doxxed for @vela_exchange which is also a differentiator.

It's a very impressive group across the board and led by some chads who come from next-level backgrounds like @BCG, @BalancerLabs, and @romeblockchain.

Big $$$'s want transparency.

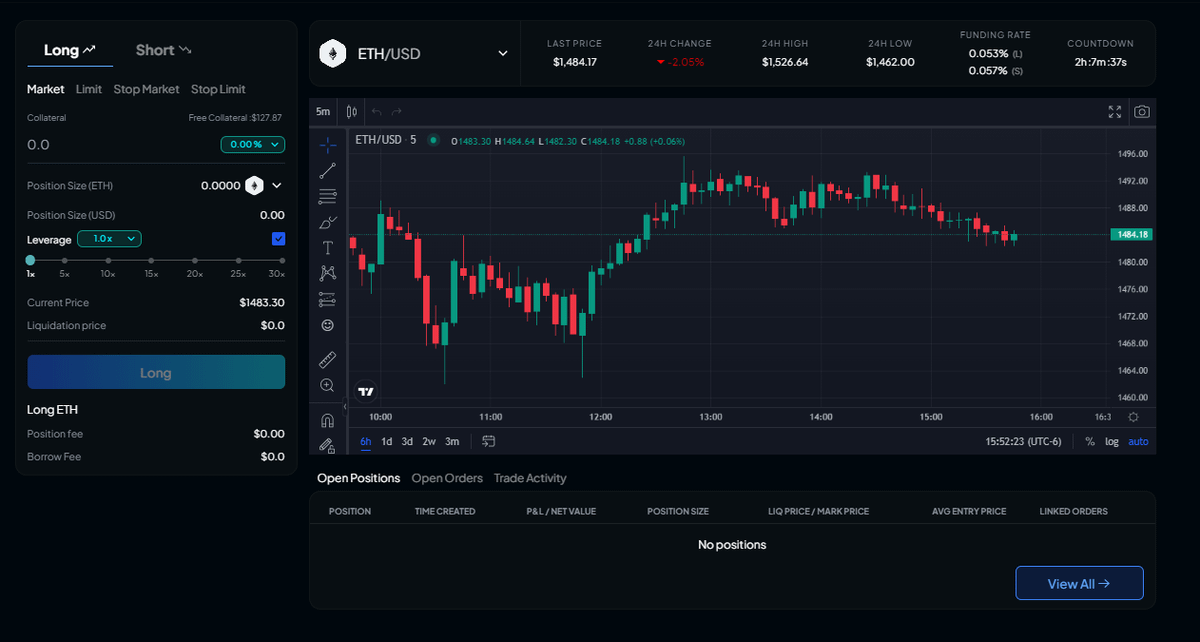

Any $VELA thread isn't complete without complimenting how clean their UI came out, embedded TradingView charts are actual dream come true.

With the DEX Perp market becoming more crowded their UI, position management (stop loss), and texting alert features go a long way.

If you have been enjoying the content and decided to use @vela_exchange, we'd appreciate it if you used our @SCSLabsResearch reference link which funds our team.

SCS Labs Referral Link - app.vela.exchange/?refer=2BU0KT6E

Ref ID - 2BU0KT6E

Don't miss the airdrop....

Disclaimer -

This is not financial advice and please do your own research on all of the above information. This post is strictly for my own record.

I have started accumulating a longer-term position in both $VLP and $VELA.

Follow @SCSLabsResearch for more content! 📈