The genesis pools & $GRAIL public sale are ongoing @CamelotDEX on @arbitrum.

Stacked partnerships, game-changing $GRAIL tokenomics, and creative plans for NFT-based liquidity are a few reasons this could win the @arbitrum DEX wars.

This one is worth the deep dive... 🧵 ↓

The way DeFi is heading, @Uniswap and @SushiSwap will own most of the cross-chain liquidity for top pairs like USDC/ETH or ETH/wBTC.

It makes sense to target your incentives toward the native pairs on @arbitrum and possibly leverage deeper liquidity elsewhere for main pairs.

The team is taking a unique approach by concentrating on @arbitrum native projects focusing on project partnerships.

User-provided liquidity often isn't sticky as it chases the highest APR, projects on the other hand are long-term LPs and normally concentrate liquidity on 1 DEX.

With this in mind, @CamelotDEX decided to heavily incentivize their partners to keep liquidity on their platform.

Partners to date already include @GMX_IO , @UmamiFinance , @DAOJonesOptions , @Buffer_Finance, @SperaxUSD , @MIM_Spell , @GMDprotocol , and @nitrocartel!

The possibility of protocols like @GMX_IO marketing @CamelotDEX and possibly moving liquidity over is what sets this apart from other DEX launches.

The team even shares some of the same advisors as GMX.

twitter.com/GMX_IO/status/1597812148310224896?s=20&t=_H0nhEhv6Ru3Wmhmm6lWlQ

The @DAOJonesOptions team has also partnered and marketed @CamelotDEX on socials.

This is a huge win for these protocols as they earn a share of the DEX by partnering, can incentivize LPs with $GRAIL, and pool in deeper liquidity than with a major DEX.

twitter.com/DAOJonesOptions/status/1596214256525258752?s=20&t=_H0nhEhv6Ru3Wmhmm6lWlQ

With these projects all partnering and incentivizing liquidity, it becomes a competition between projects for incentivizing liquidity.

Extremely intriguing model and users are the ones that should benefit the most long term w/ deep liquidity.

twitter.com/SperaxUSD/status/1595455643229585411?s=20&t=_H0nhEhv6Ru3Wmhmm6lWlQ

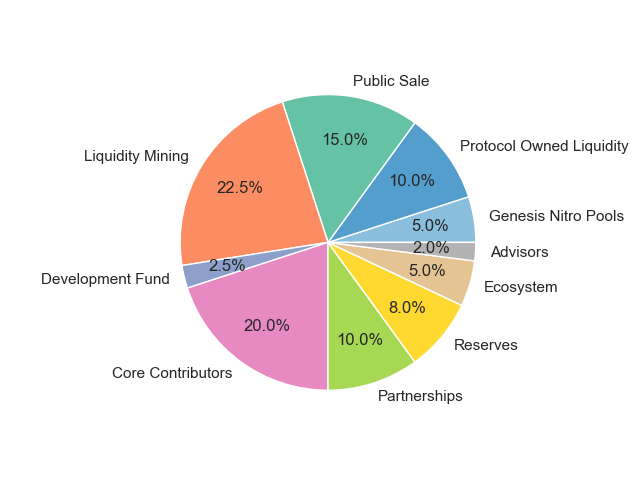

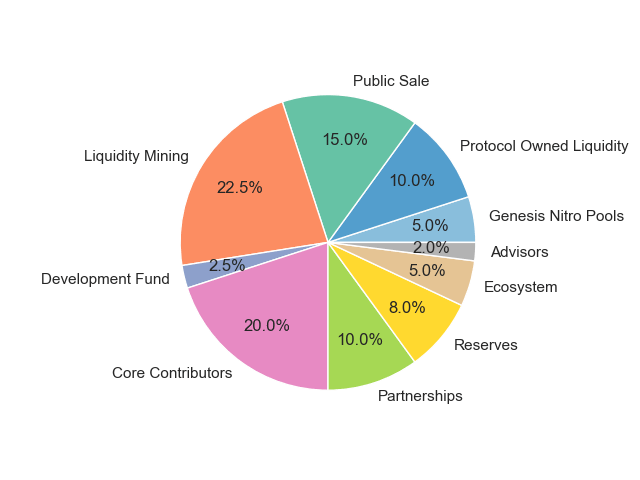

~25% of Total Supply is reserved for Partnerships (10%), Reserves (8%), Ecosystem (5%), and the Development Fund (2.5%).

This means they are heavily incentivizing their current partners to use Camelot as their main DEX while setting aside reserves for future partnerships.

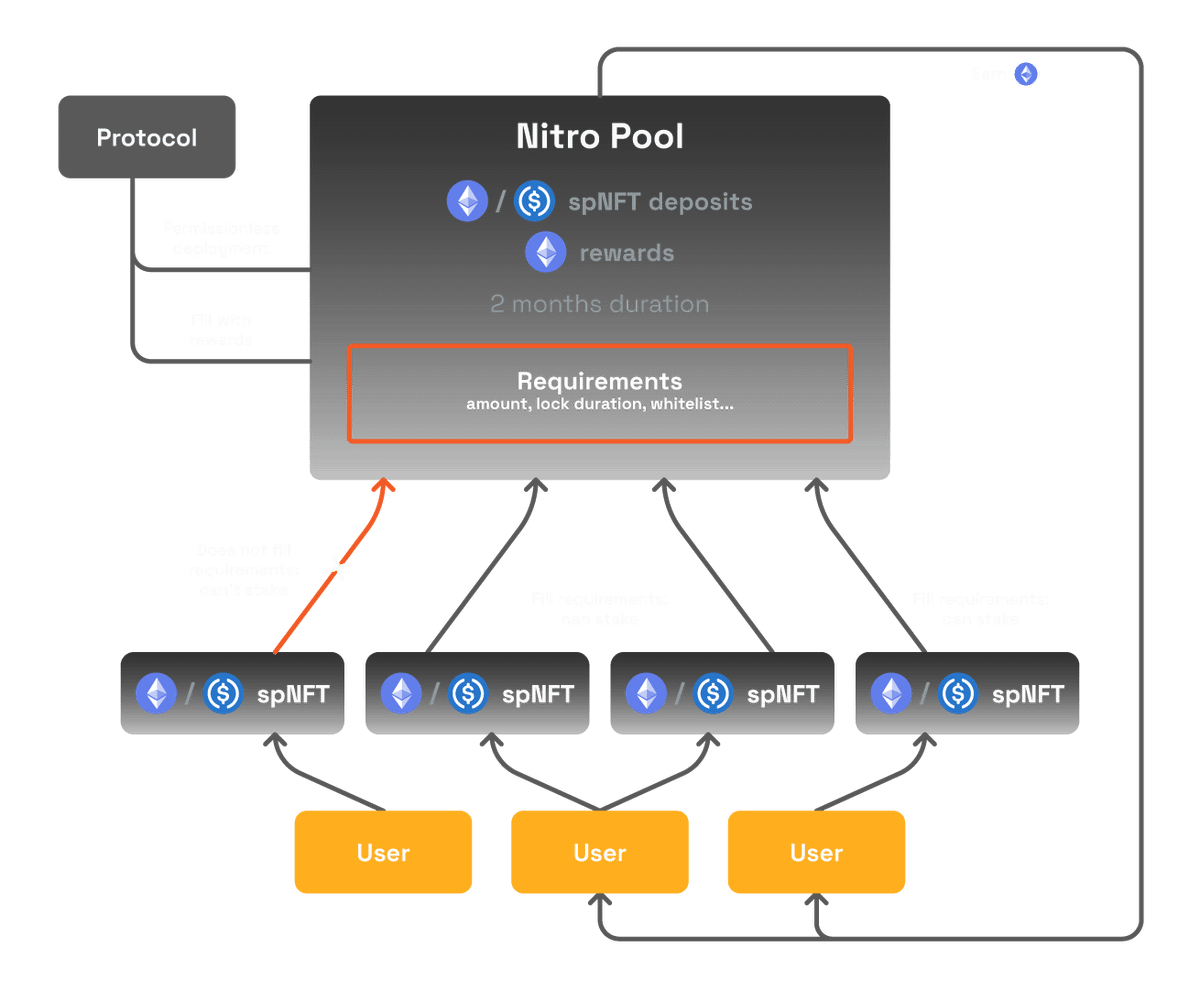

One feature that is incredibly compelling for partners is the Camelot Nitro Pools.

Their spNFTs allow projects to set parameters for things like min. amount LPd, timelocks, or whitelists to selectively incentivize LP rewards. These allow unlimited options for selective LPs

Hypothetical Ex. -

$JONES could use Nitro pools to say "any users who lock JONES/ETH for 6 months, have at least $500 LPd, and are whitelisted by the team can deposit." Then allocate 50k JONES toward the pool.

Rewards = loyalty + longterm holders

Penalizes = vampire capital

Ideally in the future, you'll be able to take your long-term spNFT positions and stake them as collateral for lending/borrowing.

In the roadmap and it would unlock a whole layer to incentivize long-term liquidity for projects. Projects you LP might even do 0% interest loans 👀

A less discussed Camelot feature, they will leverage dynamic and directional swap fees on a per-pair basis.

This allows fees on pairs like cmUMAMI/UMAMI directionally. (Ex. 0.01% to get into cmUMAMI, 2% to get out). This would help stabilize volatility events like launches.

Dynamic fees allow the implementation of a system based on the volatility of individual pairs whereas it's normally done on the exchange level.

As you can tell, the system heavily concentrates on new features/functionality for its partner projects.

The thing that I'm most excited about is their tokenomic system.

I've been waiting for a DEX to use a similar two token system. Their $GRAIL / $xGRAIL system isn't exactly what I described below but it has a ton of the same benefits.

twitter.com/SmallCapScience/status/1573366742700752897?s=20&t=_H0nhEhv6Ru3Wmhmm6lWlQ

$GRAIL is liquid, while $xGRAIL is the vesting & profit sharing token for the DEX.

Example - You LP in $JONES-$ETH LP and earn 100% APR, 60% APR would be earned in liquid $GRAIL and 40% is in the form of $xGRAIL.

It aligns LPs toward the long-term success of the protocol.

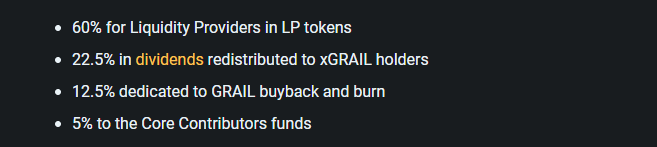

$xGRAIL is a nontransferable token you stake in order to earn a share of protocol fees (paid in ETH/USDC LP), participate in governance, or to YieldBoost your LPs.

22.5% of swap fees go towards $xGRAIL staking so users and partner projects will profit w/ increased DEX volume.

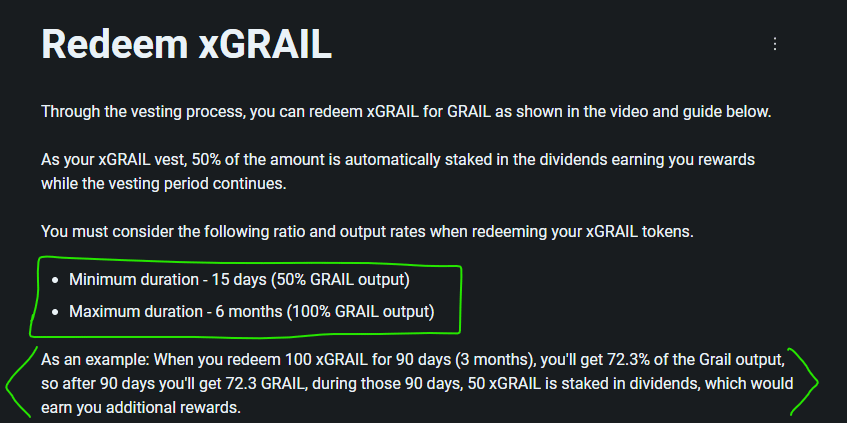

It is possible to redeem $xGRAIL for $GRAIL but it will require vesting if you want a 1:1 return.

Min $xGRAIL vesting will be 15 days at a ratio of .5:1.

Max $xGRAIL vesting for 1:1 ratio will take 6 months

This keeps the $GRAIL circ supply low while giving users flexibility.

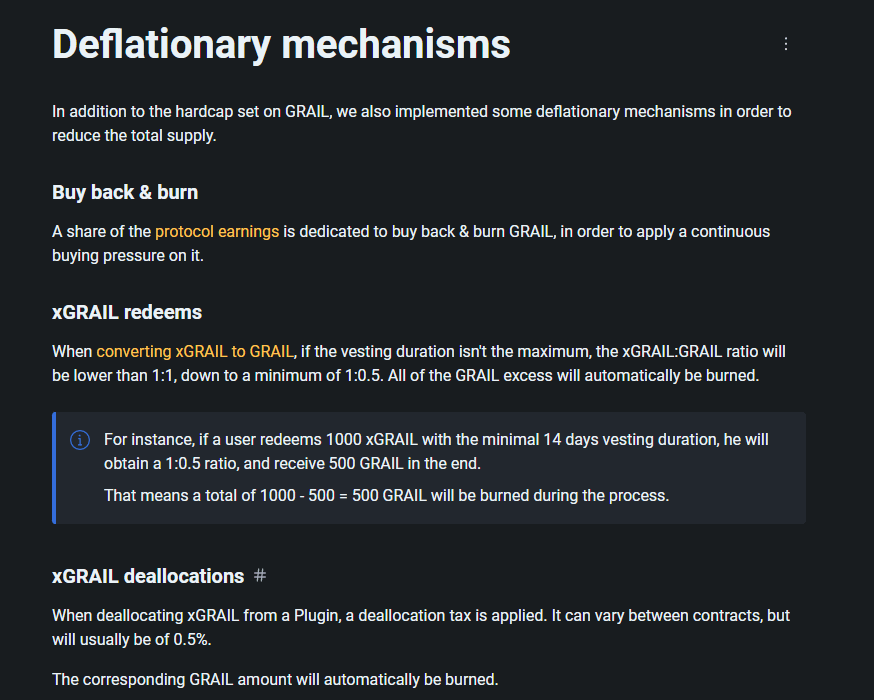

Camelot is also deflationary by using 12.5% of swap fees to buyback $GRAIL for burn and fees on $xGRAIL redemptions.

This helps with inflation and makes their model more similar to $ETH where increased volumes over time could make the protocol deflationary. Ultrasound Grail? 👀

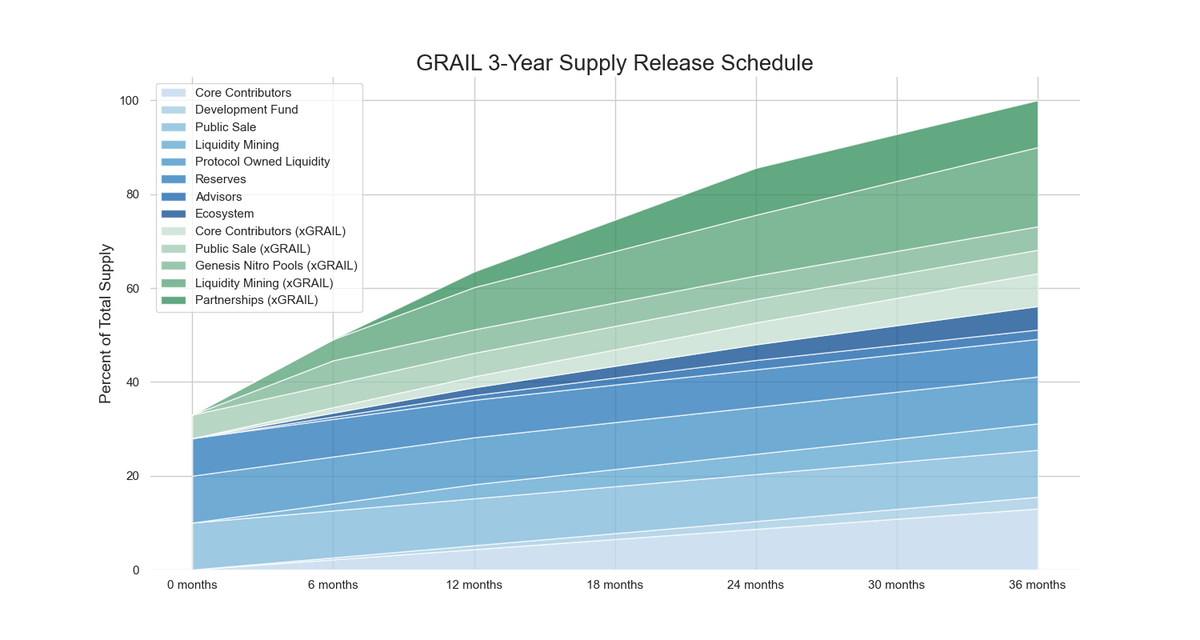

Token Distribution helps highlight that the majority of dilution comes from $xGRAIL in the first year, while $GRAIL (Blue) only grows by ~50%.

Keep in mind that it's impossible to account for xGRAIL redemptions (inflationary for GRAIL) or burns (Deflationary).

At launch, there will be roughly 35,000 of the 100,000 total supply of $GRAIL + $xGRAIL.

Notable Supply for Users:

10k PoL (GRAIL)

15k Public sale (10k GRAIL + 5k xGRAIL)

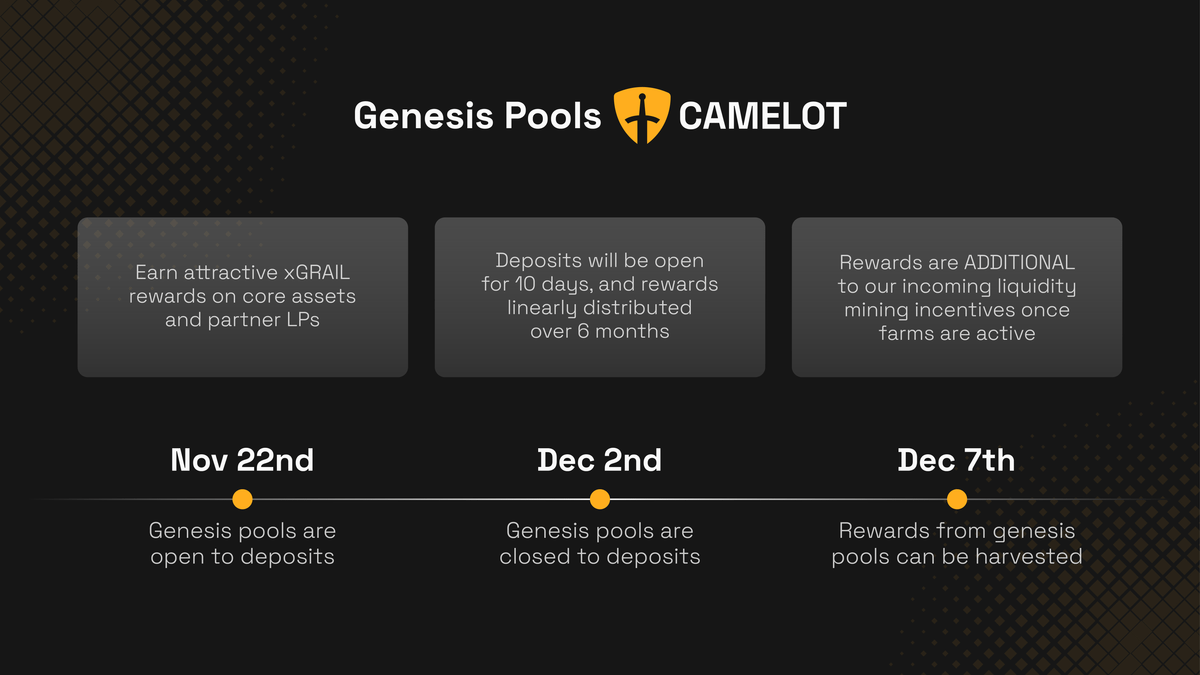

5k Genesis Nitro Pools (xGRAIL distributed over 6 months)

The Genesis farms are a free way to provide liquidity and earn an $xGRAIL stake that vests over 6 months.

Deposits for these end in a few days and there is zero locking of liquidity required to start earning.

Dec 7th $xGRAIL claims start

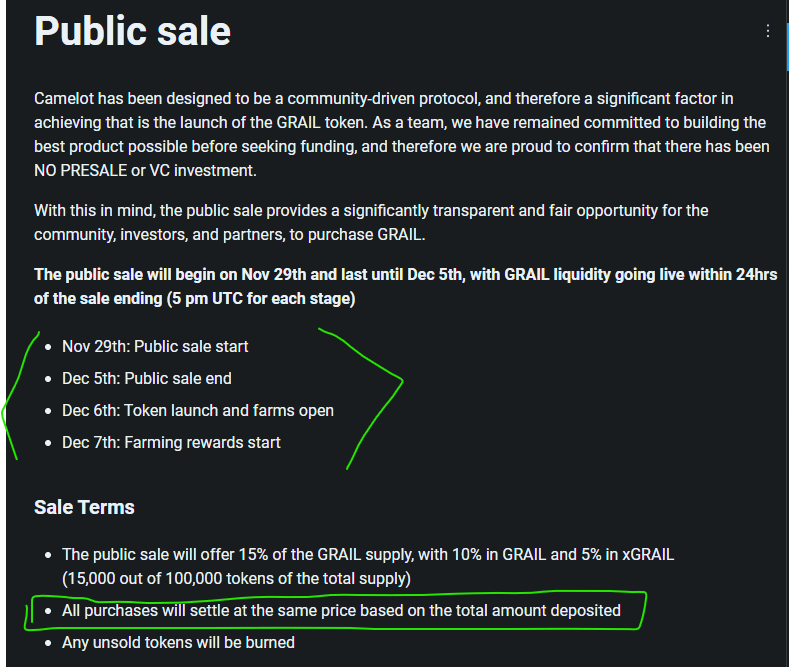

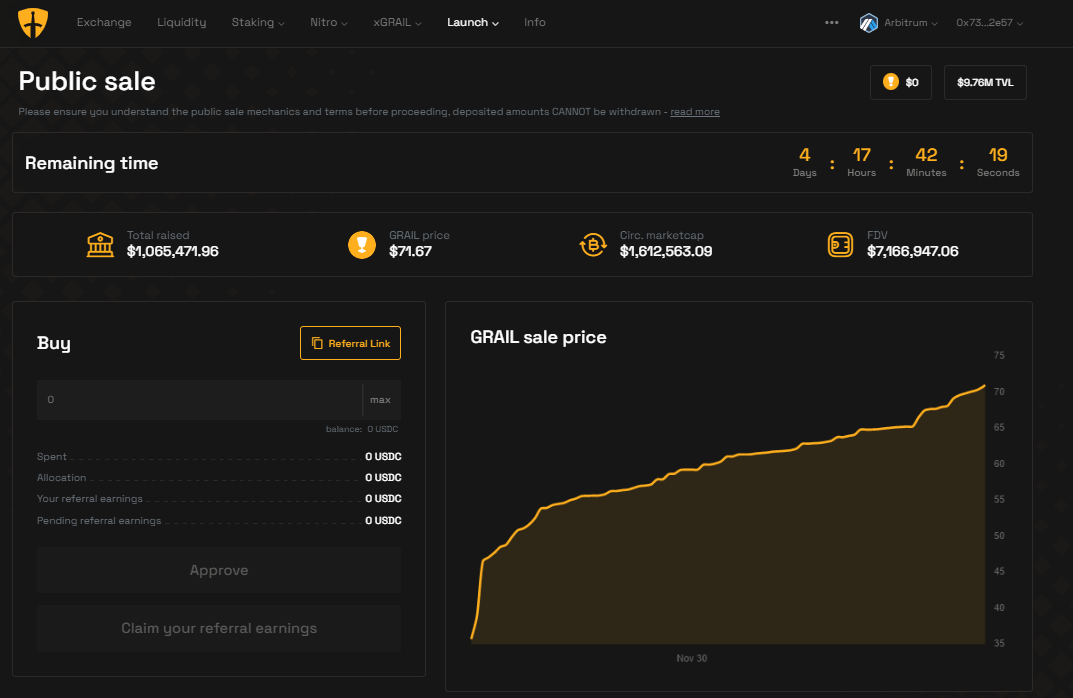

Public Sale is also currently ongoing until December 5th and is for 15% of the total supply of GRAIL.

All purchases are settled at the same FDV so there is plenty of time to get purchases in.

app.camelot.exchange/sale?r=MHg3MzMyNDZiY2VlMWQzOWYzY2FlNjk5YTFmMWNmZmM5N2Q2N2QyZTU3

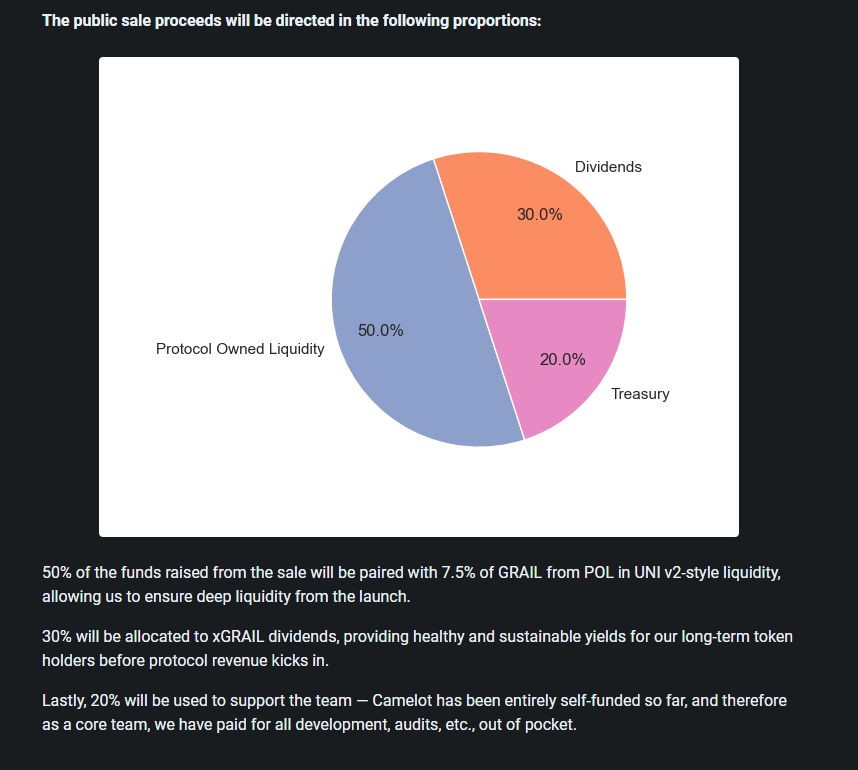

30% of the proceeds will go towards bootstrapping the $xGRAIL dividends. It's like a rebate for public sale buyers and for genesis farmers the higher the sale FDV, the better.

50% of the proceeds for the Public sale will go towards funding the GRAIL PoL on launch

Personally, I feel as if the genesis pools are an absolute no-brainer to earn a position.

It feels like a no brainer to earn a long-term position and they are still open for a few days. Apologies for not getting this out sooner.

I'll also be participating in the public sale.

Already $1M raised which means FDV to ~$7M with nearly 5 days left. I'd expect this to be much higher at close.

Not needed but if you enjoyed the thread, here's my referral link - app.camelot.exchange/sale?r=MHg3MzMyNDZiY2VlMWQzOWYzY2FlNjk5YTFmMWNmZmM5N2Q2N2QyZTU3

Comparing their FDV to other top DEX platforms, this has a ton of upside IMO.

FDV Comps:

$OSMO - $1B

$JOE - $85M

$JEWEL - $131M

$BOO - $19M

Worth considering that @arbitrum has immense upside compared to most side chains or other L2's as well.

coingecko.com/en/categories/decentralized-exchange

I personally did some early buys in order to earn the 3% bonus on the public sale.

There is risks with early buys as FDV will continue climbing. I planned to buy some no matter the FDV so allocated a portion early.

Hopefully this helped!

twitter.com/CamelotDEX/status/1597636999158337537?s=20&t=KKlwsA7AmY0kT-zzIFt9UQ

Disclaimer -

None of this is financial advice and is strictly for my own record. Do your own research.

If the past 12 months have shown anything, it's that I have no idea what I'm doing so don't listen to me. If not, you will end up thinking wETH is insolvent.

Hope you enjoyed the thread and please share if you did.

Good Luck!