A new player entered the arena..

@OpalDeFi is a new Omni Pool protocol built on top of @balancerlabs and @AuraFinance ecosystems with an ongoing LBP!

$AURA is the king of LST liquidity which perfectly sets up deep omni pool liquidity. $GEM / $vlGEM can become kingmakers.

⬇️⬇️

Gem closed an early seed round last year, unfortunately I missed it.

Key players from @AuraFinance, @Balancer, @RamsesExchange, and @Paladin_vote were part of the seed.

They also have some top tier angels onboard such as @Bluntz_Capital and @DeFi_Dad.

x.com/OpalDeFi/status/1730965075832238236?s=20

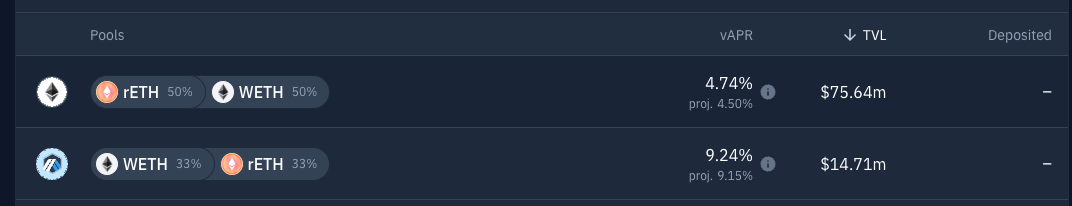

The team has onboarded some of the top LSTs @Rocket_Pool and @LidoFinance.... TVL 📈!

On $AURA alone, the top two $rETH pools have over $90M of TVL, even capturing 25% of those single LPs could send $GEM.

How does it work?

x.com/OpalDeFi/status/1736835209918660846?s=20

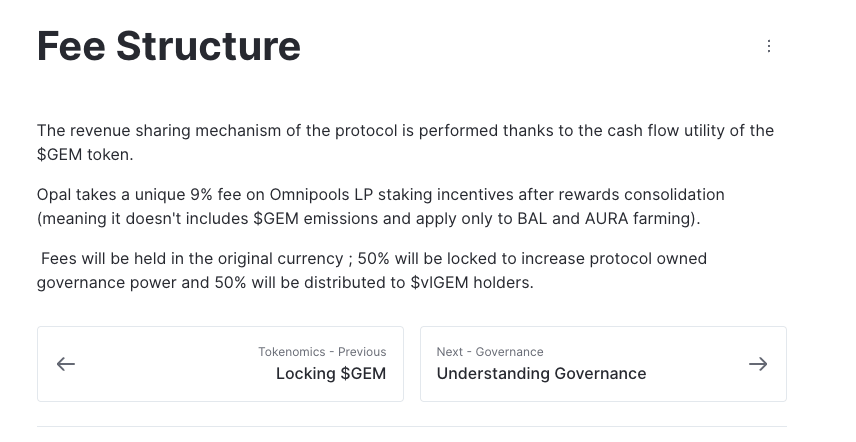

The @OpalDeFi fee structure takes a 9% fee on emissions of these massive LPs.

$90M x 7% yield = $6.3M Yield on $rETH annualized

$6.3M x 9% = $567k Protocol Earnings Yearly

Keep in mind, this is only the Rocketpool LPs... Add in Lido, Stablecoins, and other massive LSTs 😱

Tokenomics -

The ongoing public sale makes up 10% of supply and is currently at ~$2M Marketcap and $20M FDV. The FDV looks scarier than it is but emissions are spread out over 10 years.

Fees being used to build a governance moat should build a price floor from $AURA / $BAL

Flywheel -

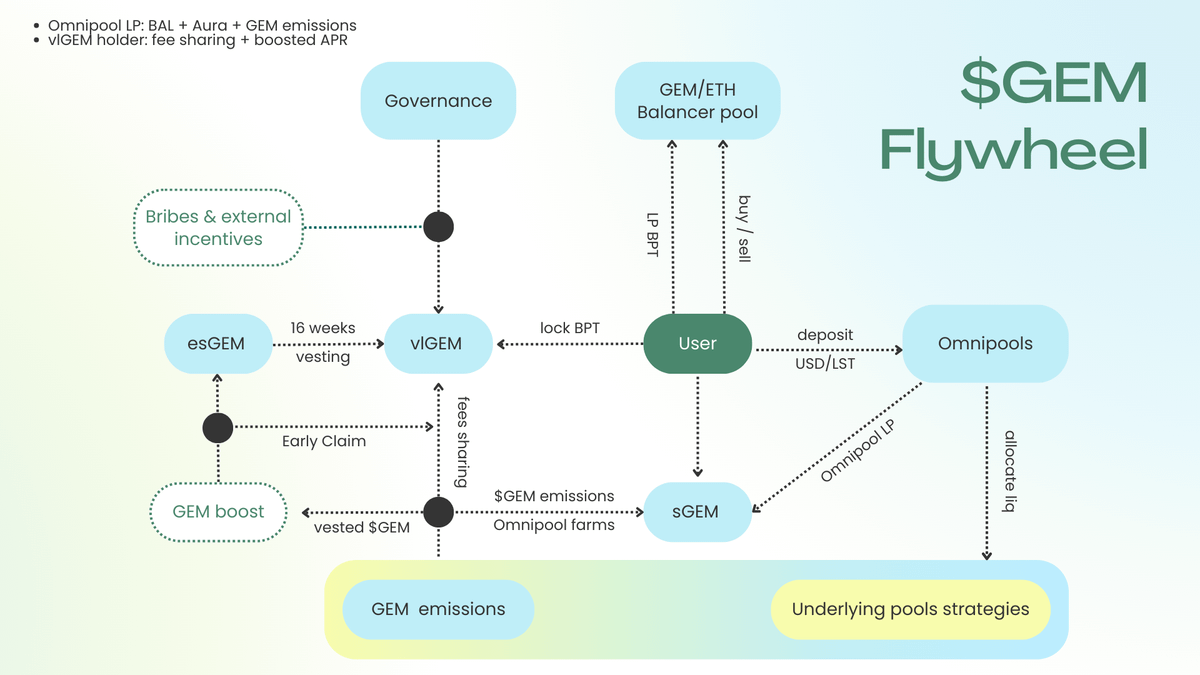

Similar to veBAL and veAURA, to receive vlGEM you will lock $GEM into an 80/20 $GEM - $ETH LP.

This will ensure super-deep liquidity for $GEM and help offset some of the early emissions. Circ MC is ~$2M and on launch a large portion will be locked into liquidity..

Conic Finance which is an omni pool protocol built on Curve / Convex was able to amass $150M in TVL without turning on fees.

The Opal Flywheel is much more powerful than Conic before the exploit and their v2 model.

Here is more details on the flywheel:

x.com/OpalDeFi/status/1731690012364677363?s=20

The $GEM LBP is ongoing but it closes in a few hours.

If Opal goes as planned, I think LST protocols will start going to war over $GEM influence. 🤞🏻

I think the timeline will be buzzing about $GEM / $vlGEM in a few weeks once the full launch occurs.

app.v2.fjordfoundry.com/pools/0x1F272Ab2BDc512cb59e7b49485eFE16d2d7F9ffa

Disclaimer -

I invested roughly $30k into the LBP but like any prelaunch protocol, there are risks involved.

Please do your own research. This is not financial advice and is used solely for my record-keeping.

Find your own $GEMS... Don't ask me!