The @asymmetryfin team has me excited with $afETH.

It's an LST that is comprised of 70% ETH and 30% CVX.

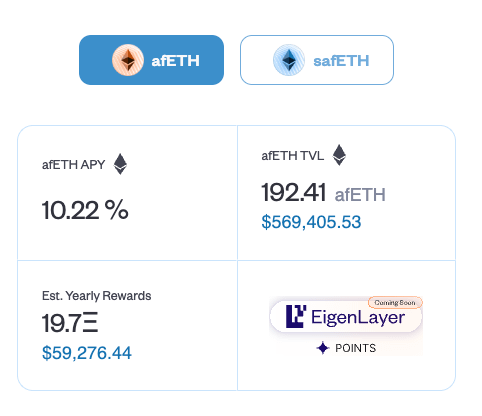

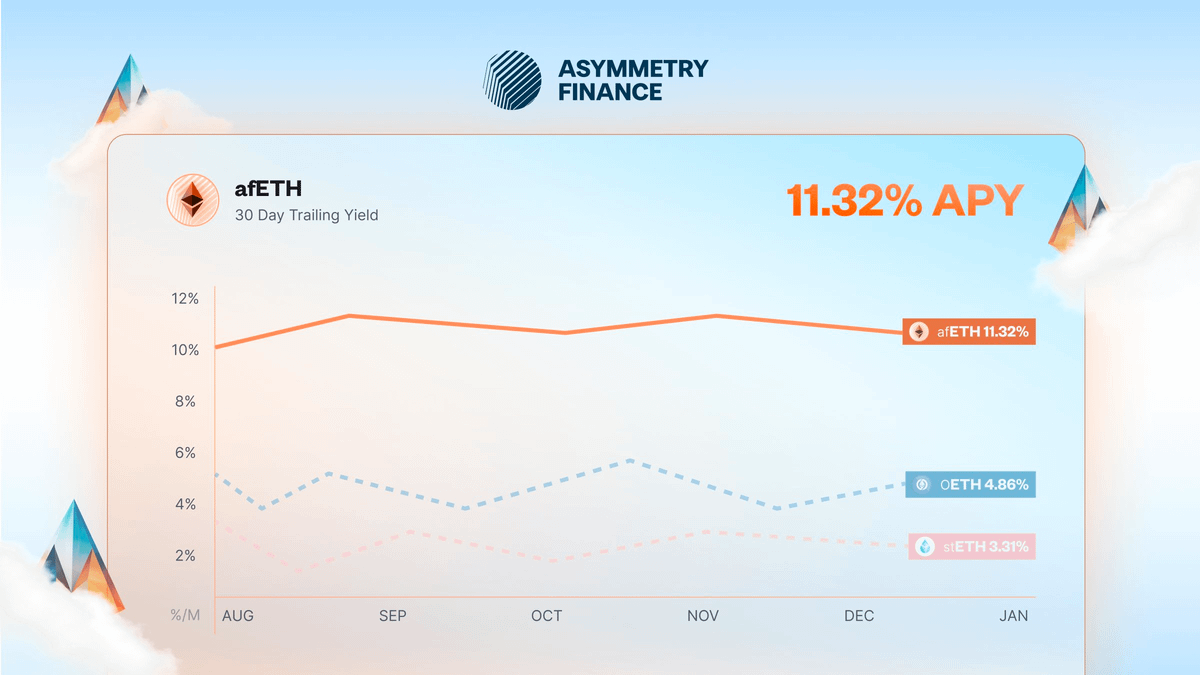

The $vlCVX votes for $afETH LPs to bootstrap liquidity and also provides extra yield so $afETH staking earns 10%+

Experimental and Innovative.

asymmetry.finance/dapp/gemrush?referral=pJwH7jC

They managed to raise $3M from ANKR, Ecco, GMjP, Republic Capital and other sources.

The team is also doxxed with @Macro_Justin and @hannahjojo_ as co-founders.

coindesk.com/tech/2023/05/16/asymmetry-etf-for-liquid-staking-tokens-raises-3m-round-from-ecco-capital-ankr-and-others/amp/

Within a few hours, they already have nearly $600k staked into $afETH.

For those of you doing the math at home...

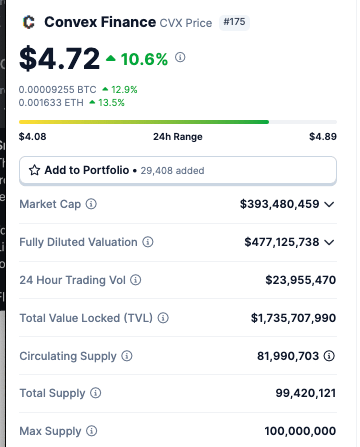

$600k x 30% = $180,000 of $CVX

Every deposit leads to $CVX not only being market-bought but also vote-locked for 16 weeks. Bullish $CVX 📈

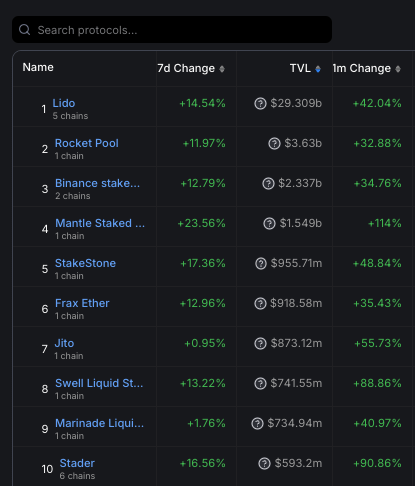

This has the potential to steal market share due to paying double-digit yield which destroys the competition.

The yield is also very real and sustainable due to the underlying $vlCVX position being incentivized.

x.com/asymmetryfin/status/1755021510987932130?s=20

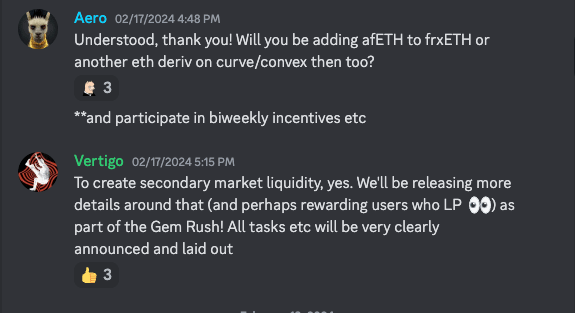

On top of the additional yield, the 30% $vlCVX also helps bootstrap liquidity on Curve & Convex.

These end up being their biggest differentiators...

1. Their liquidity layer is built directly into the product

2. Liquidity scales directly with growth/contraction

From an outdated whitepaper..

$ASF will likely be deflationary from the buyback + burns. $veASF receives 25% of revenue paid in $safETH distributions.

I'd assume 20% going to "Protocol Owned Liquidity" means they will redirect 20% of profits toward afETH bribes 👀

Flywheel...

Time to speculate a bit..

Lets say that $afETH becomes a top 5 LST and hits $1B in TVL..

$1B x 30% CVX = $300,000,000 in $CVX buy pressure

The current CVX market cap is only $400M and there is only $25M of onchain liquidity. CVX could easily go to $100+

If we use the same example we can speculaste on bribes...

$1B TVL x 10% Yield x 20% Perf Fee = $20M Earnings

$20M Earnings x 20% toward PoL bribes = $4,000,000 in bribes

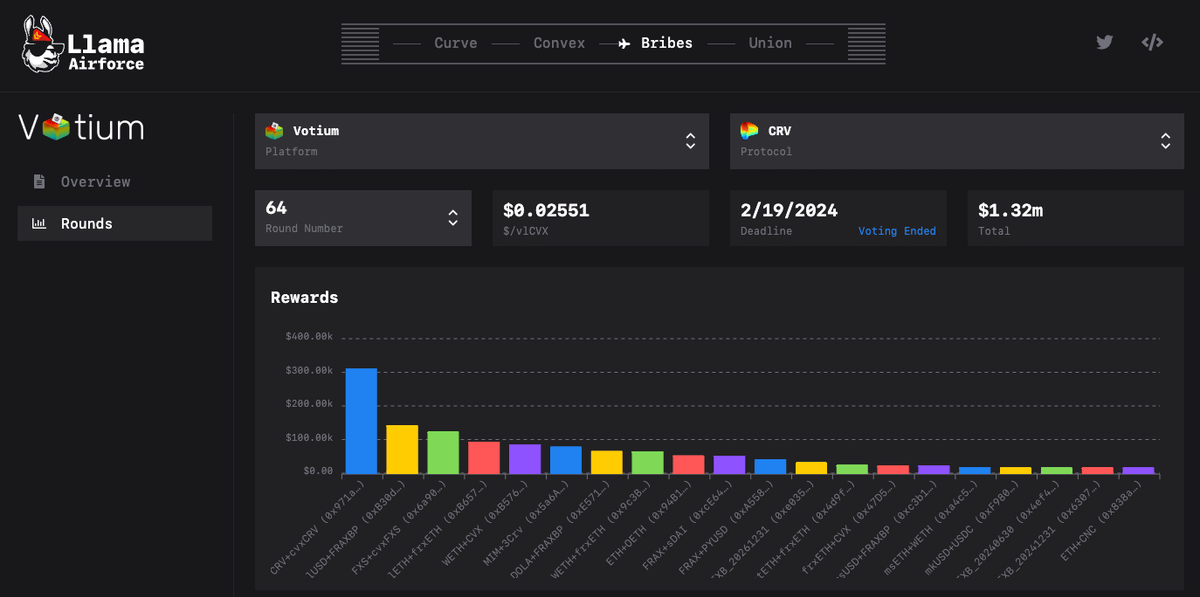

$4M means ~$150k per round in bribes for $vlCVX holders.. last bribe round was $1.3M total... significant.

$CVX buy pressure on deposits and increased bribe income means $CVX should moon as Asymmetry grows.

@ConvexFinance APRs will skyrocket which gives CRV, PRISMA, and FXS users more reason to LP on Convex.

The CVX TVL and influence over these ecosystems will moon due to this...

I'm sold, now I need $ASF token exposure.

Their Gem Rush distributes $ASF

Deposit into $afETH, LP on Curve/Convex, and referrals are ways to earn tokens.

Worth noting that it looks like @hannahjojo_ has a tokenomics background giving me high hopes.

x.com/asymmetryfin/status/1755021538250895611?s=20

The protocol is in bootstrapping mode for the first week.

Based on the below tweet, the first 7 days are double gems for $afETH staking until yield kicks off on March 4th.

x.com/asymmetryfin/status/1757768834071892006?s=20

They also announced that @eigenlayer integration is happening and will go live next time the caps are raised.

Double Digit Yields on ETH x ASF Token Airdrop x Eigenlayer Points

Rewards are coming from all angles...

x.com/asymmetryfin/status/1755021529547743238?s=20

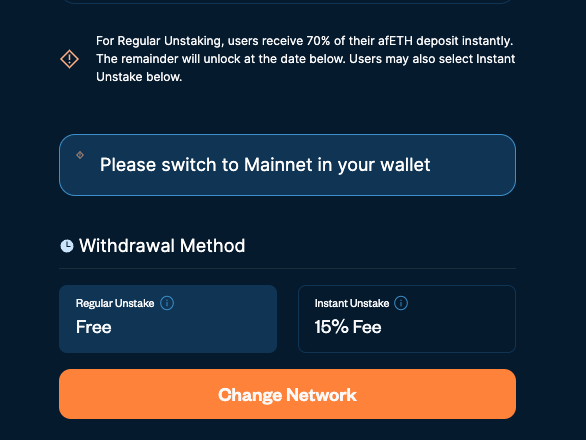

The most common question is "How do unlocks work?"

The 70% of the position that is backed by $ETH is liquid but the 30% of the position backed by $CVX has 16 weeks to unlock.

15% penalty to immediately exit the full position, wonder if these fees will go to $veASF?

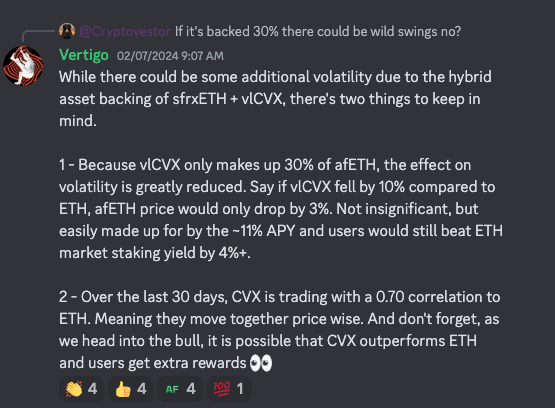

Due to $CVX being 30% of your position, it pays to be early because afETH isn't 1:1 with $ETH.

If $CVX is bottomed vs. ETH, then $afETH price skyrockets while printing a 10%+ yield.

The downside price risk is also limited due to the higher yields and deeper exit liquidity.

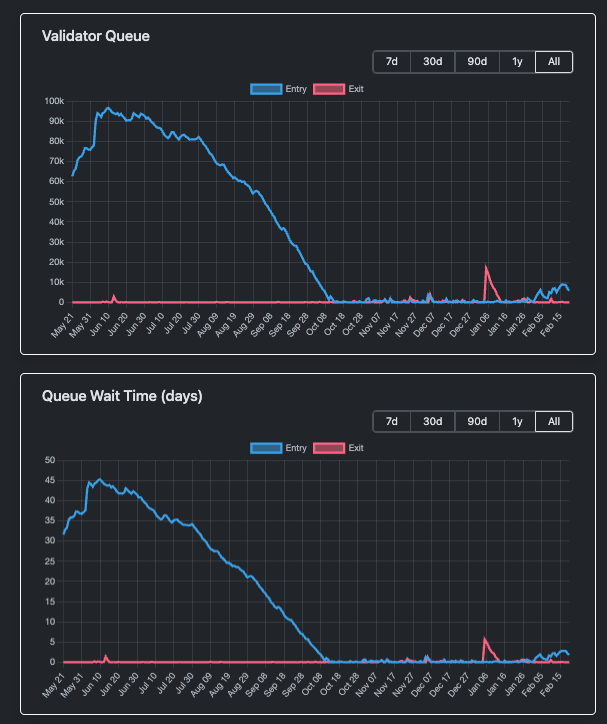

The biggest issue I have with most LST/LRTs long-term is there isn't enough liquidity for users to exit if the validator queue gets backed up.

Imagine $ETH prices falling like Luna/FTX and users needing to wait 30+ days to exit. Yikes.

x.com/SmallCapScience/status/1754744595236241740?s=20

Staked $ETH will eventually have outflows and the LST/LRTs like @asymmetryfin with deep liquidity will be able to capitalize.

Liquid Wrappers are easy when capital is flowing in, but once liquidity dries up they get ugly.

Most LSTs have less than 1% of their TVL in liquidity...

Do I think LST/LRTs are going to zero? No.

Do I think in the future there will be a decent amount of them trading at a discount? Absolutely.

Think of assets like $GBTC, $ETHE, $stETH, and $wBTC who have caused countless issues when liquidity dried up. LSTs won't be different.

I think both @vectorreserve & @asymmetryfin have positioned themselves very well to take market share when there is an eventual shift toward deeper liquidity.

I'm happily earning stacks of their governance tokens now and will be patient as things shift in that direction.

If you enjoyed the post, I'd appreciate you using my referral.

They have a sick program:

1. Earn 16% worth of your friend's deposits in Gems.

2. When their friends deposit, you then get 8% of the Gems they earn

Thank you to anyone who uses the link ⬇️

asymmetry.finance/dapp/gemrush?referral=r6KPmJr