🧑🌾 #RealYield Week Project #1

To kick off the week, we're taking a look at $USDR by @tangibleDAO.

$USDR is their real estate backed stablecoin, the first of it's kind.

How is yield generated, and is it sustainable?

Let's dive in 🕵️♂️

What I'll cover in this thread:

1️⃣ Overview

2️⃣ Tokenomics

3️⃣ Yield generation

4️⃣ Personal Conviction

Let's begin 🔎

1️⃣ Overview

The tangible platform encompasses more than their stablecoin.

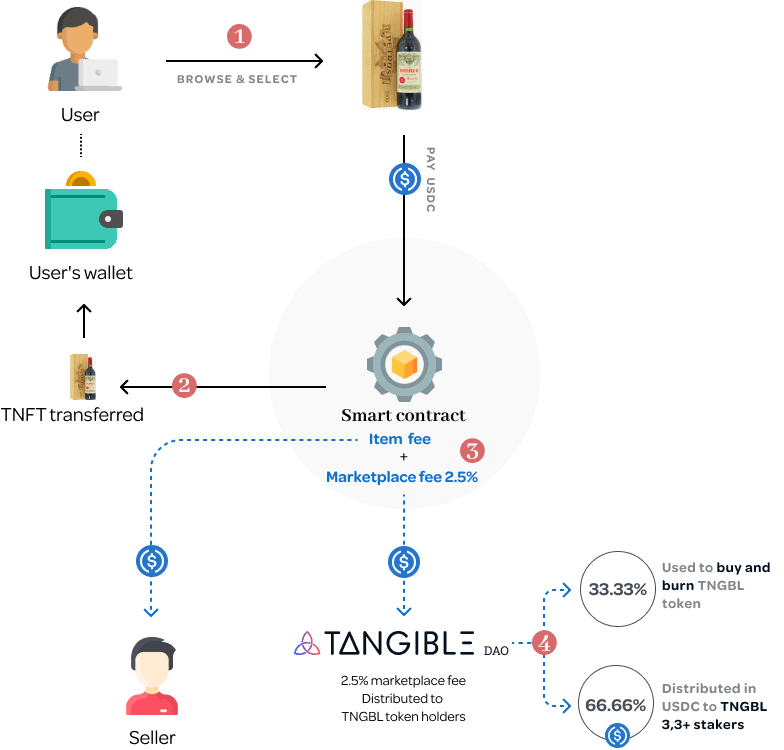

They are a TNFT marketplace creating redeemable NFTs for physical products.

Items range from Wine to houses.

There is a simple marketplace fee which provides yield, but that's not the main source ⬇️

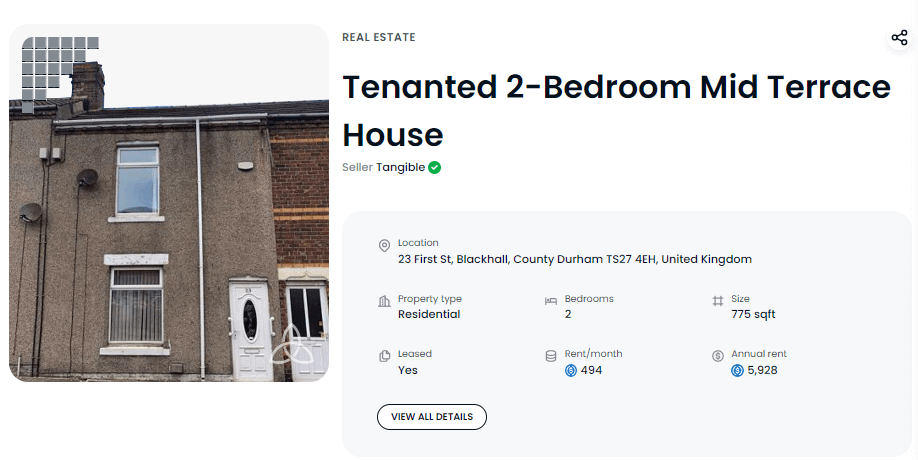

$USDRs yield comes from rented properties. (Each property their own TNFT)

Properties are fractionalized so retail investors can earn a % of the properties yield.

The transparency about fees + yield is a great start.

See for yourself ⬇️

tangible.store/product/0x29613FbD3e695a669C647597CEFd60bA255cc1F8?tokenId=0x0100000000000000000000000000000002&fractionId=0x01

2️⃣ Tokenomics

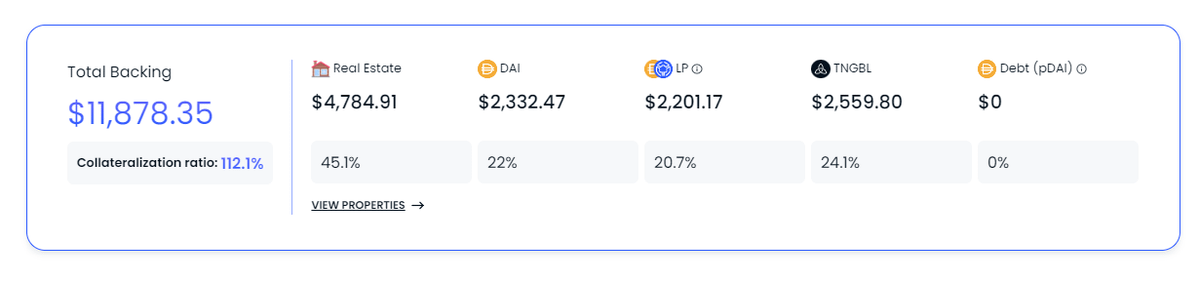

$USDR currently has a tiny Mcap of $10k backed by:

• Real Estate (45%)

• $DAI (22%)

• $DAI / $USDR LP (20%)

• $TNGBL (5%)

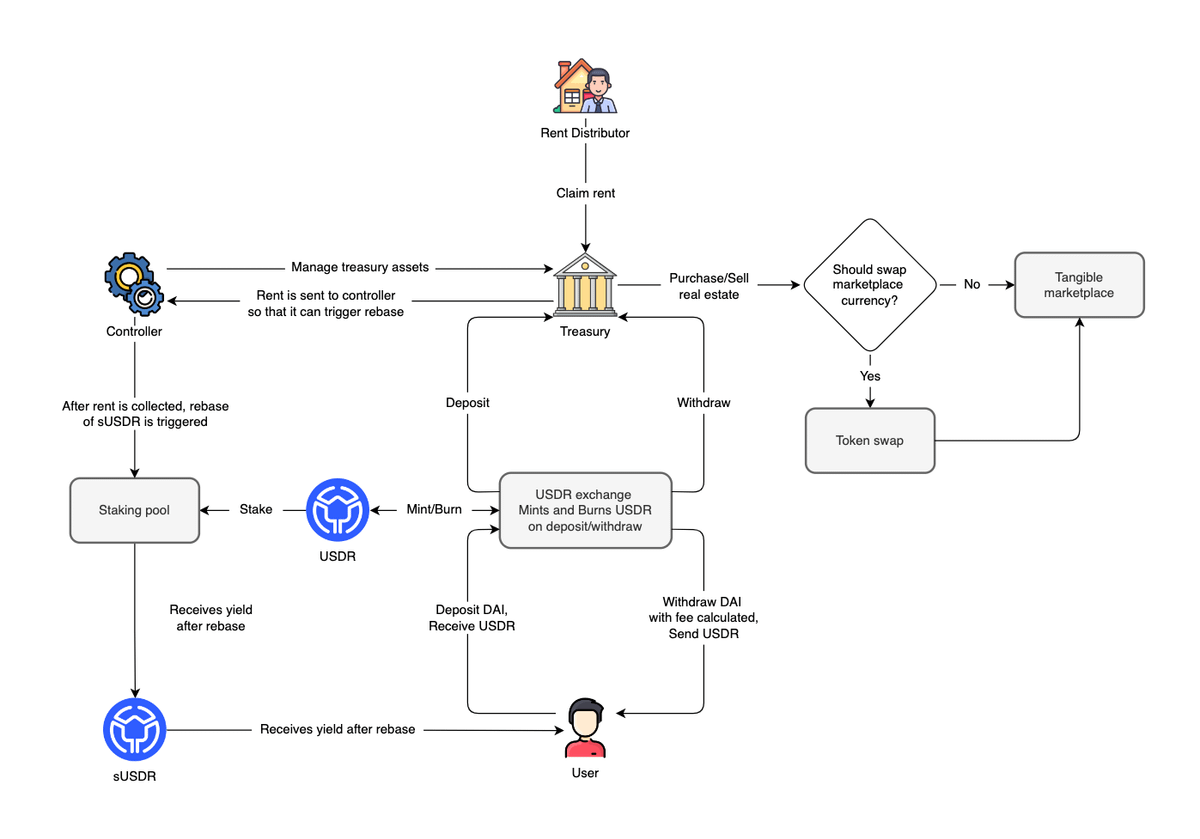

$USDR can be minted through $DAI, $TNGBL and $USDC

It's a USD-pegged stablecoin aiming to provide a store of value through property

The main way $USDR is minted is through $DAI, a popular decentralized stablecoin @MakerDAO.

By having a mix of real estate, other stablecoins and their own volatile assets, you have a safer peg for your own stablecoin.

3️⃣ Yield Generation

So how is yield generated through $USDR?

To become eligible for yield, users must stake their $USDR in return for uUSDR.

Yield is distributed daily, so USDR can be staked or unstaked instantly. (No lockup)

Yield rewards are based on the collateralisation ratio.

The aim of @tangibleDAO is for $USDR to be over-collateralised

This means:

Backing > $USDR Market cap

Remember: Stablecoins marketcap is the same as it's circulating supply

$USDR on-chain 👇

polygonscan.com/token/0x9008740cef60ad6ac6b89986fb2200d3faf12c7a

$USDR planned yield is:

• 4.5% (Static)

• 8.5 % Property yield

Their team have stated that 4.5% won't gain traction, so they will subsidize yield % through $TNGBL until $500m - $1bn mcap.

Personally, I don't agree with this ↓

docs.tangible.store/usdr/yield-derivation

As a crypto investor, you shouldn't expect high yields for the first 1-5 years.

However, $TNGBL has it's own utility + revenue stream, which makes it a great choice.

As property TNFTs increase, internal subsidization will decrease.

The aim: Get collateralisation above 130%

Why?

After 130%, any increase is instantly added to the daily rebase, ultimately benefiting the $USDR staker.

Over collateralisation means:

• Instant redemptions

• Higher yield

• Sustainable protocol

4️⃣ Personal Conviction

I love the current yield narrative we are in, but locking up capital for 1-5 years is tough.

$USDRs no lockup is a huge plus.

One thing I'd love to see them do is:

Create a 'litepaper' in layman terms.

For people to invest, they MUST understand

@tangibleDAO has a multitude of planned yield strategies including:

♦️ $USDR Bonds

🔸 NFT Marketplace fees

♦️ Fractionalized rental income

For an upcoming real yield protocol, it's important that all yield methods are objectively sound

Otherwise you might just be the yield

@tangibleDAO and $USDR is just getting started!

Here are accounts you should be following to keep up to date on $USDR & #RealYield

@tangibleDAO

@robertdtyoung

@thedefiedge

@milesdeutscher

@CosmosHOSS

@TraderDefi

@landxfinance

@Ceazor7

@thedailydegenhq

@CryptoBlooom