Want to know where to hedge your bets this year?

Here's my list of protocols to keep your eyes on heading into 2023.

A mix of established and upcoming projects from real yield to NFTfi.

🧵 👇 (Part 1)

@vela_exchange $DXP

A perpetual DEX focused on putting the trader first, Vela has actively spoken about their second movers advantage.

• Will offer granular control for traders

• Beta coming in January

• Extremely good tokenomics

twitter.com/LouisCooper_/status/1586667640965058561

@takepile_ $TAKE

Another perp DEX but with a completely custom liquidity system.

What they need:

• Better liquidity

• Go multi-chain

If they can make it off $FTM, they could start to compete against the best.

Dive into their liq. system below

twitter.com/LouisCooper_/status/1586304305564291072

@Buffer_Finance $BFR

A binary options trading platform which will profit off the human desire to gamble

• Releasing their NFTs soon with unique perks

• Brand new BLP pool live = higher max trades = more yield

dune.com/defimochi/buffer-finance by @defi_mochi

twitter.com/LouisCooper_/status/1603360341022629888

@HegicOptions $HEGIC

A decentralized options protocol brought to my attention by @CryptoKaduna

• Much more trading volume with a smaller mcap than competitors like Dopex.

• Established protocol 2+ years

• Provide liquidity to receive yield, become the house

twitter.com/CryptoKaduna/status/1607693933101957121

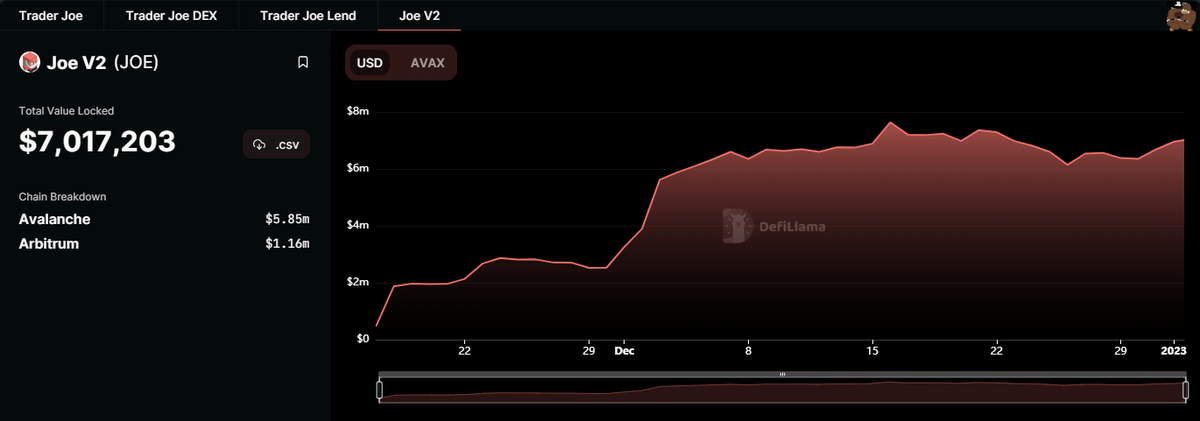

@traderjoe_xyz $JOE

The #1 DEX on Avalanche, that just moved to Arbitrum, known for it's zero slippage trades.

Going multi-chain put them on my radar to compete against upcoming DEXs like Camelot.

1m+ TVL in under a month on Arbitrum with steady growth.

Learn more 👇

twitter.com/traderjoe_xyz/status/1609249218543091712

Competing with $JOE is @CamelotDEX $GRAIL.

Native Arbitrum DEX with unique bribery layers.

• Amazing partnerships with virtually every top project on Arbitrum.

• Almost $4m raised

• Over 15m+ in Liquidity since launch

twitter.com/LouisCooper_/status/1584922760173670400

@UmamiFinance $UMAMI

Risk-hedged real yield with an emphasis on institutional money

• Goal of 1B TVL

• One of the first Arbitrum projects

• Vaults + portfolio coming

• Based tokenomics

@teaandcrypto how this is possible.

twitter.com/teaandcrypto/status/1600918947427020803

@nftperp $NFTX

Longing NFTfi, nftperp is a perpetual DEX for NFTs.

People want to speculate on NFTs, they're bringing it.

• Confirmed that's true with over 20m in volume 👇

• Real yield from NFTs, wtf

• gives NFT traders leverage + less fees

twitter.com/nftperp/status/1608923729849122819

@NFTYFinance $NFTY

A liquidity solution for the NFT space, founded by @DigitalLawrence

Aim is to allow borrowing / lending of NFTs through liquidity shops

• Real Yield component with 1% fee in $NFTY

twitter.com/NFTYFinance/status/1555335113076101120

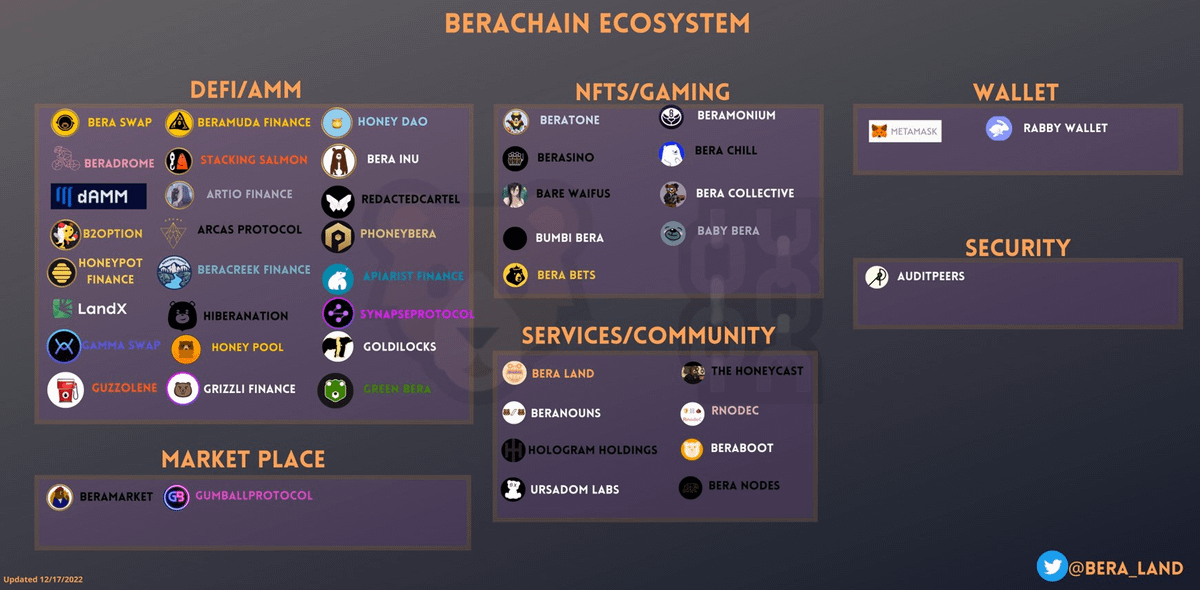

@berachain

An EVM compatible L1 powered by PoL, meaning it's liquidity focused.

So this is me being bullish on the ecosystem, not a particular project.

Definitely will have it's season 🐻

Amazing breakdown 👇

twitter.com/0x_Umeshu/status/1608782611857707009

@UniDexFinance $UNIDX

Claiming to be the 'meta-aggregator of everything in DeFi',

Why settle for a single option, when you can decide from all of them?

Too complex to explain in a single tweet, so I will release an in-depth thread on them shortly

twitter.com/UniDexFinance/status/1608922527514132480

@riskydotlol $DICE

$dice is an on-chain gambling protocol created by @SerecThunderson.

I'm still bullish because they released their V2, which is trending towards providing users yield from the gambling if they stake their $dice.

It's gambling in it's rawrest form.

@Treasure_DAO $MAGIC

A decentralized gaming ecosystem, and the backbone of Arbitrum PFPs like Smols.

Incredibly rich ecosystem which got listed on Binance and others late last year.

I encourage you to checkout @smol_thots breakdown as he does it better than anyone I know

twitter.com/smol_thots/status/1605009133974986753

@GetBlockWallet $BLANK.

A competitive Web3 wallet with a super smooth UI.

Been testing them out as a competitor to MM and have to say, first impressions are good.

50% Fees from in-wallet swaps & other activities are used to burn $BLANK.

twitter.com/AltcoinFlipper_/status/1607727293513826304

@GMDprotocol $GMD

Is a yield aggregator built on-top of @GMX_IO $GLP pool to provide real yield.

Bullish because of their stability & innovation.

See their announcement on $GNS vaults coming soon 👀 👇 twitter.com/GMDprotocol/status/1609576370035728386

@GainsNetwork_io $GNS

A perpetual DEX offering crypto, stocks and forex.

Really great team that recently launched on Arbitrum 👇

Curious to see how they compete with $GMX now they're on the same chain.

Expect a volume battle, that $GNS might win 👀

twitter.com/GainsNetwork_io/status/1609330146699272192

@chainlink $LINK

A decentralized oracle network powering many of the projects I've mentioned above.

Betting on any of those projects means betting on chainlink technology.

twitter.com/TheDeFinvestor/status/1609154703887314944

I don't want to overload you, so that's where I'm stopping for now!

I'll be releasing part 2 in a week or so from now, to give you time to digest and research the projects mentioned above 🤝

In the meantime, drop me ones that I should include next below ↓