The past year or two for me has been all about Curve and Curve derivatives, so much so that I coined the term CREAM (Curve Rules Everything Around Me).

And no I don't mean the hackfest dumpster fire that is CREAM the protocol.

But primarily, I'm talking about @Curvance!

Now like I said, I like anything curve related. Convex, Concentrator, even the way mine curves to the left! Uhm, I mean, Conic. Yeah that's what I meant.

Member curvature aside, @Curvance just really started ramping up the info and it really got my attention so let's ride

So Curvance is an Omnichain Yield Optimized Stablecoin Lending Protocol.

Big words to say that it can be accessed from any chain, and is optimized for yield tokens like LP tokens, that can be used for lending and borrowing.

They are starting out w/ Curve, Frax, Convex, and Aura LPs.

The goal is to give users greater capital efficiency through peer-to-peer lending while optimizing yields.

So assets like $cvxCRV, $auraBAL et al, could get better yields while being collateral for stablecoin loans.

How is Curvance creating value for users?

__

Decentralized Lending - A peer-to-peer lending contract that lets users provide liquidity and borrow stablecoins with fair market rates.

They'll do this using a multi-pool lending market model loosely based off of Compound's model

Curvance's model is an inbetween of @AaveAave V2 and @compoundfinance V2 and the completely isolated pool model of Compound V3.

This model makes sure the risks and potential flaws of those models, are no longer present in @Curvance's version.

How does this work in practice?

Well Yung Padawan, when you deposit in Curvance's smart contracts redirect the supplied assets back into their respective protocol to earn a yield while you borrow against it.

For ex, $cvxCRV would be sent back to Convex and u get a cToken

This cToken is representative of your share of the pool and can be used as borrowing collateral if you wish.

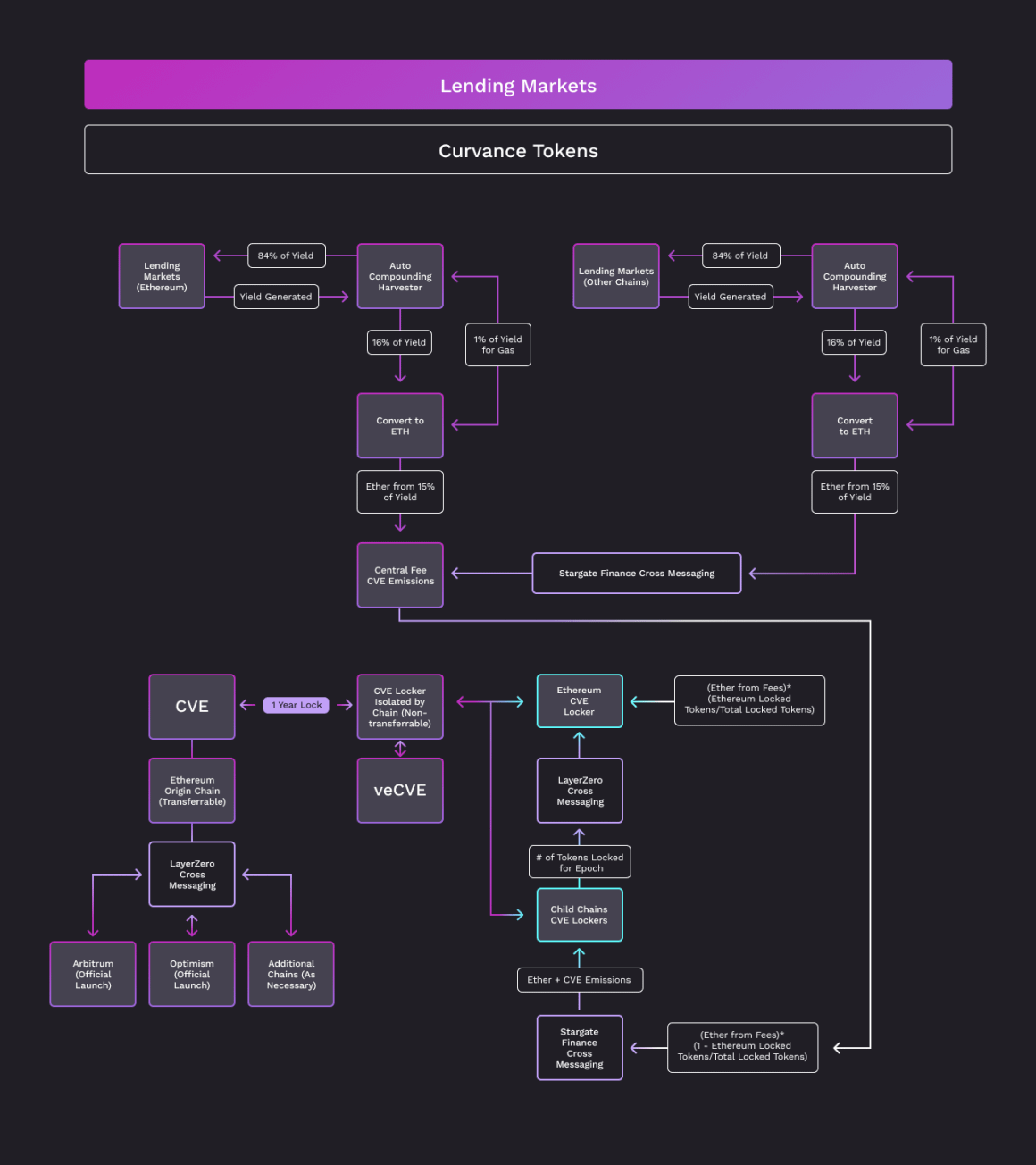

Curvance also applies a fee for all collateral deposits on the platform.

This fee goes towards the protocol reward flywheel by distributing it to $veCVE token lockers!

The next value driver is their token, CVE. CVE is obvi a governance token that will have voting on things like pool gauge weights, collateral eligibility, lending assets, and platform fee rates/distribution.

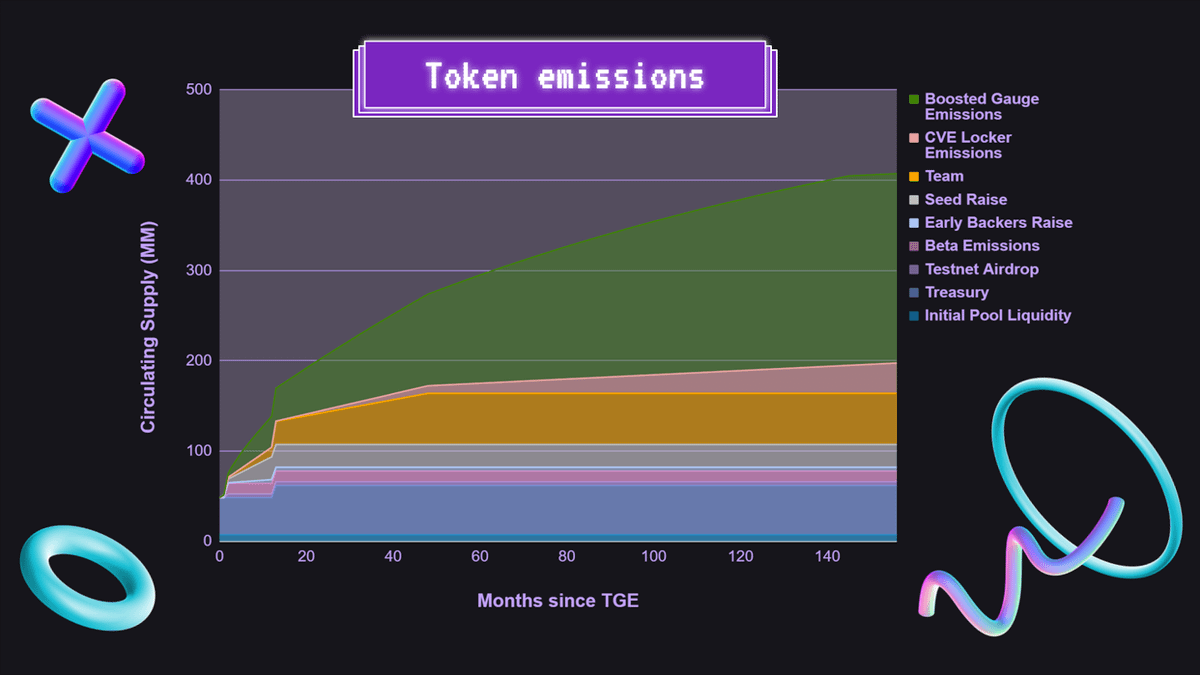

Circ supply on CVE will be 72,670,369.60

Max supply is 420,000,069 lol

$veCVE will also receive real yield in the form of $wETH.

Worth saying that veCVE will have a lock time of one year.

To combat the issue of re-locking, veCVE will come with a continuous locking function to keep yourself at maximum voting power.

There is also bribe potential ;)

But the real value driver here, the coup de grace if you will, is their leveraging of @LayerZero_Labs's Messaging and @StargateFinance's tech.

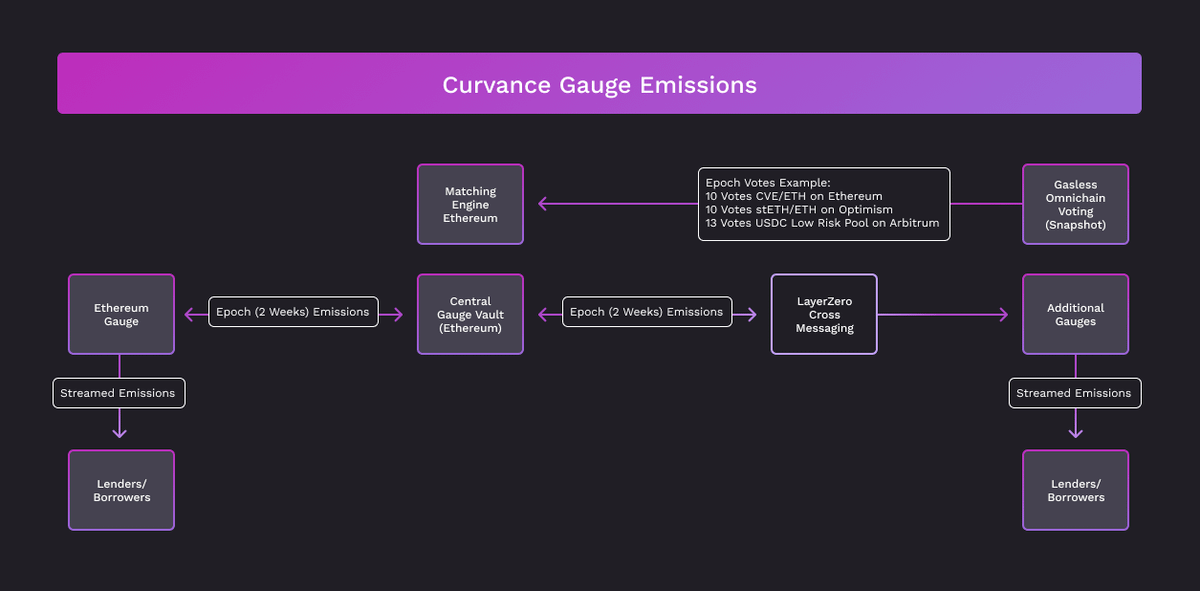

Curvance has both their vote escrow system and their gauge system leveraging this tech.

This is important. But, why?

Because this means you can lock CVE as veCVE on any chain (yes, **ANY**) and vote for any pool on **ANY** chain.

Especially cause you have to consider how many people are Gas poor so they exist exclusively on L2s. Now they have a chance to earn mainnet fees with less gas fees 🔥

As if Curvance wasn't doing things a bit different anyways, they're joining their Omnichain brothers-in-chad at @tapioca_dao in doing a Call Option #Airdrop.

To receive the airdrop (aka the call option) you have to deposit capital or skin in the game, to receive the tokens.

To explain this mechanism would involve much more coffee than a heart is allowed so I must redirect you to their docs for my safety:

docs.curvance.com/cve/cve-token/tokenomics/cve-call-options

There was also a partnership announcement to be cognizant of and that's the one with @Entanglefi!

Entangle tries to solve liquidity fragmentation and to make sure liquidity is most efficiently used!

Perfect partner for @Curvance!

blog.entangle.fi/resolving-liquidity-1-curvance/

Wanna get involved?

Seems like they have an incentivized testnet occuring in June with an estimated Beta Launch of August, and then full launch shortly after that.