Are VCs getting FOMO?

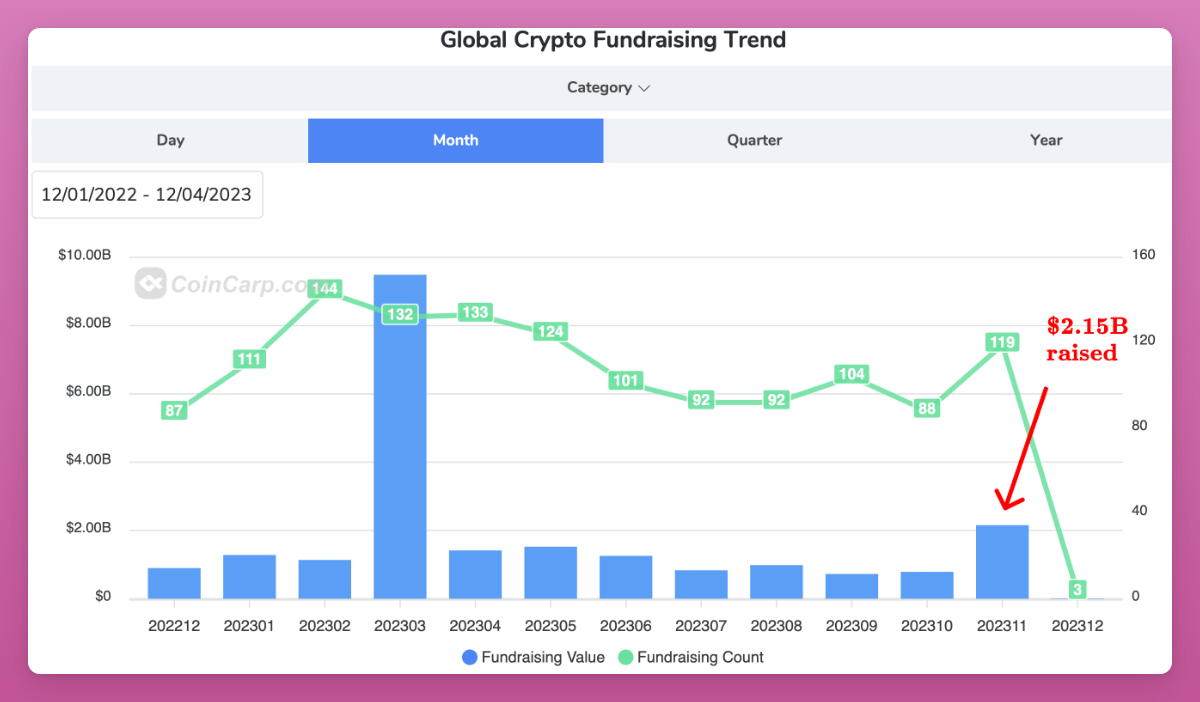

Fundraising amounts have finally picked up, reaching $2.15B in November.

The flow of VC money helps to identify the newest trends.

Here's where all that cash went: 🧵

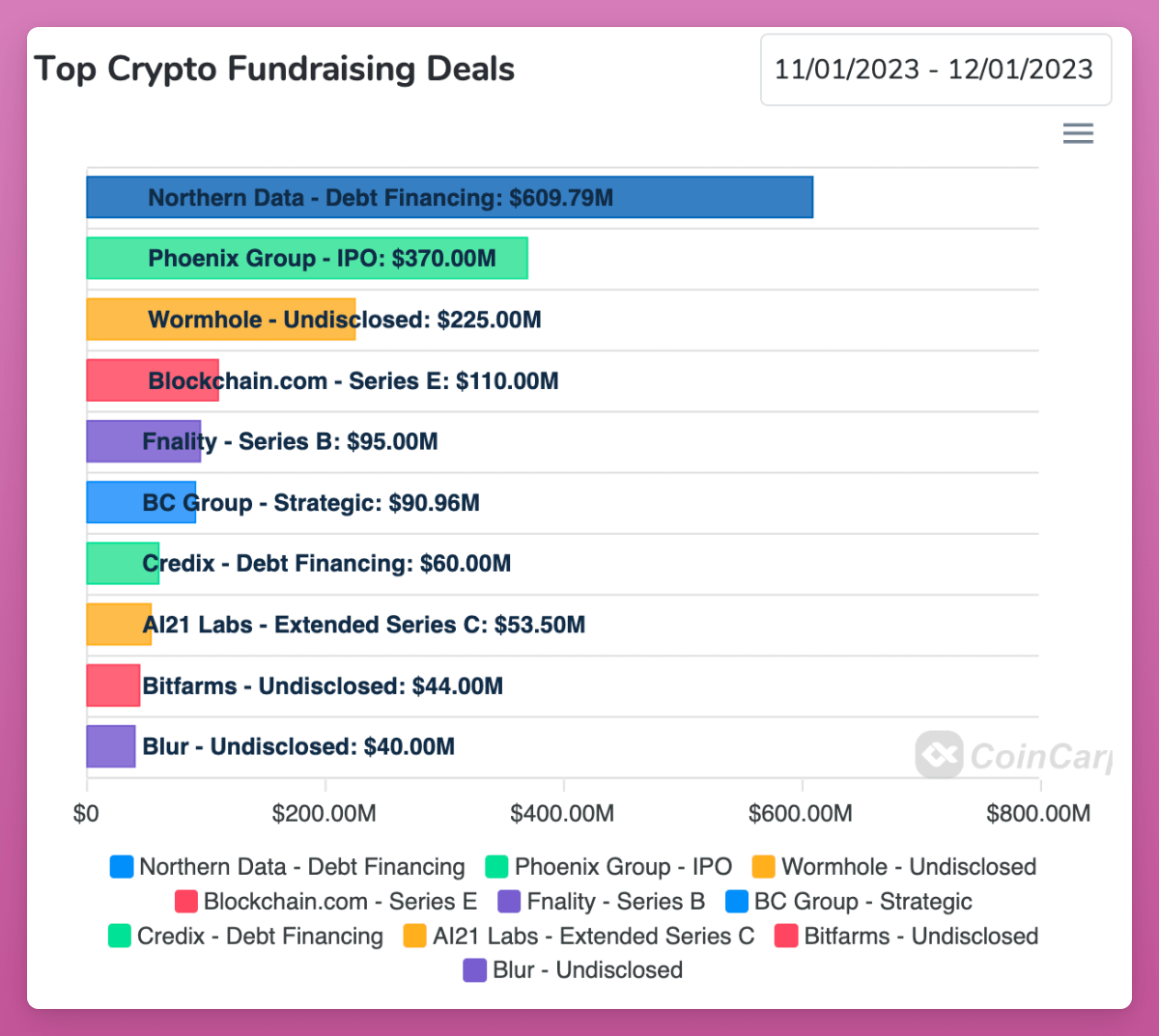

Wormhole's $225M raise at a $2.5B valuation is the most prominent one.

Then there's @ritualnet - sovereign execution layer to integrate AI into any protocol on any chain for monetization.

@blur_io raised additional $40M to build an Optimistic Rollup L2.

Note that these raises might have been made months ago.

As the market picks up, projects make announcements when it makes more sense for them for maximum effect.

I wrote more about it in my AMA with 4 VCs 👇

twitter.com/DefiIgnas/status/1717130990055743655

BTCfi is attracting capital:

- Taproot Wizards raised $7.5M for its Ordinals project to bring the ‘magic’ back to Bitcoin

- @unisat_wallet raised undisclosed amount for Ordinals & BRC20 wallet & marketplace

Expecting more VC money to flow to BTCfi.

twitter.com/TaprootWizards/status/1725163116059627761

@privy_io is a cool one, raising $18M.

dApps can now onboard users with email, social profiles to only require a wallet from a user only once it’s needed.

It's user friendly way to onboard a new wave of crypto users who might not even know they are using crypto.

twitter.com/privy_io/status/1726967584472576157

@Panoptic_xyz raised $11.5 million in two rounds since Dec 2022 to build oracle-free perpetual options platform on Uniswap.

Panoptic is expected to launch on mainnet in Q1 2024 and Q4 2025 for V2.

Is option trading finally going to pick up?

@NapierProtocol raised $1M for fixed-term asset trading.

Napier splits yield-bearing assets like stETH into principal tokens (PT) and yield tokens (YT).

You can trade yield between PT, YT, and their underlying assets on Napier AMM.

Complicated? Yes. Interesting? Also yes.

twitter.com/NapierProtocol/status/1723985187422564381

Two perp DEXes:

• @IntentX ($2.5M) an OTC DEX leverages LayerZero, account abstraction, and intent based architecture.

• @MYX_Finance ($5M) offers zero slippage through Matching Pool Mechanism to match long and short positions for capital efficiency

twitter.com/MYX_Finance/status/1729479613674590224

In general, an active fundraising market is great news.

With new money flowing into the ecosystem, we can expect the launch of innovative protocols that will drive the industry forward.

And some airdr0ps on the way...