The present & future of Ethereum staking:

• Market leaders

• Best yields

• Trends

• Future catalysts

And a few thoughts on financial freedom 💭

Ethereum's $ETH has the best tokenomics in crypto.

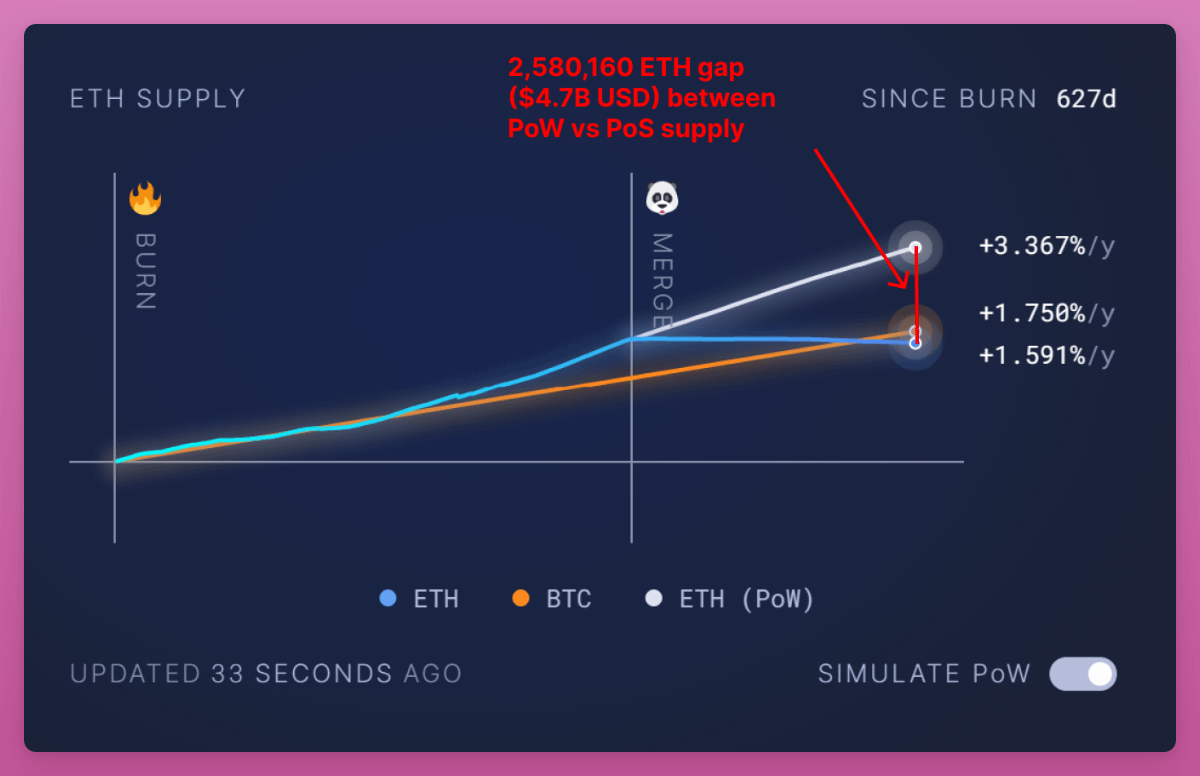

If it had remained on PoW, $4.7B USD worth of ETH would have been issued - more than the entire market cap of $UNI at $4B.

ETH supply isn't increasing; it's deflationary.

And all this in a bear market!

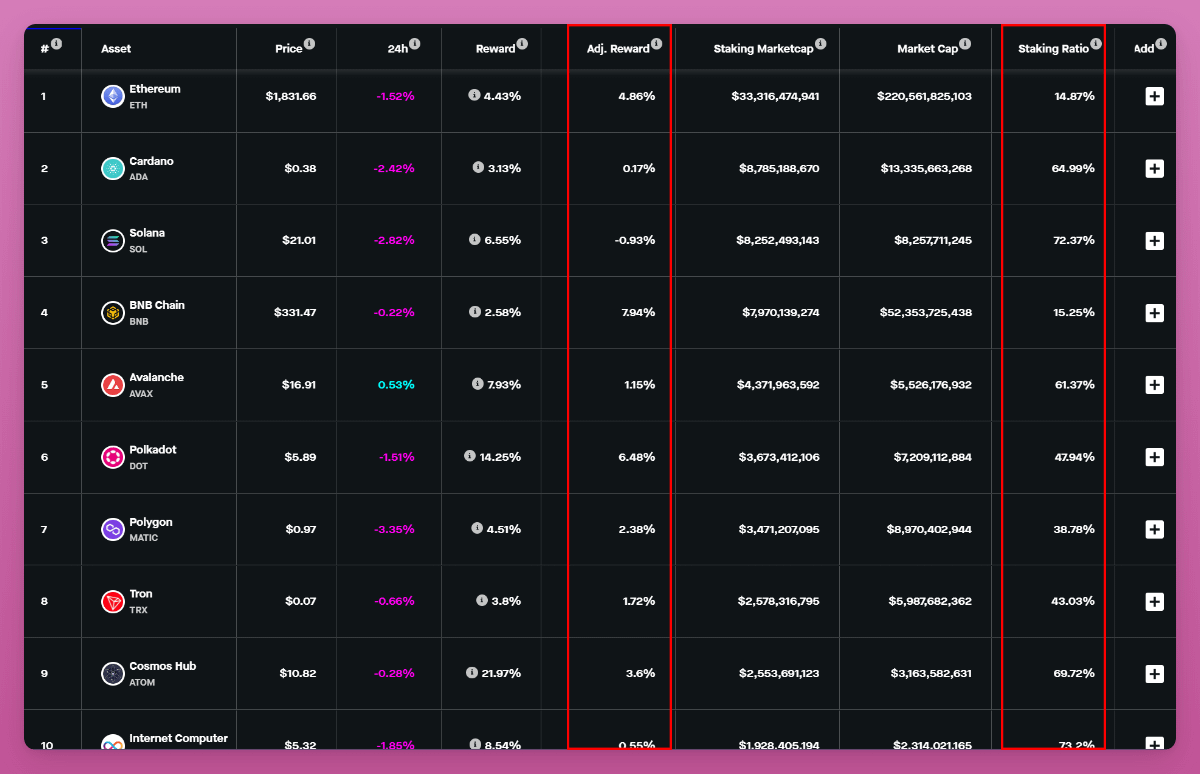

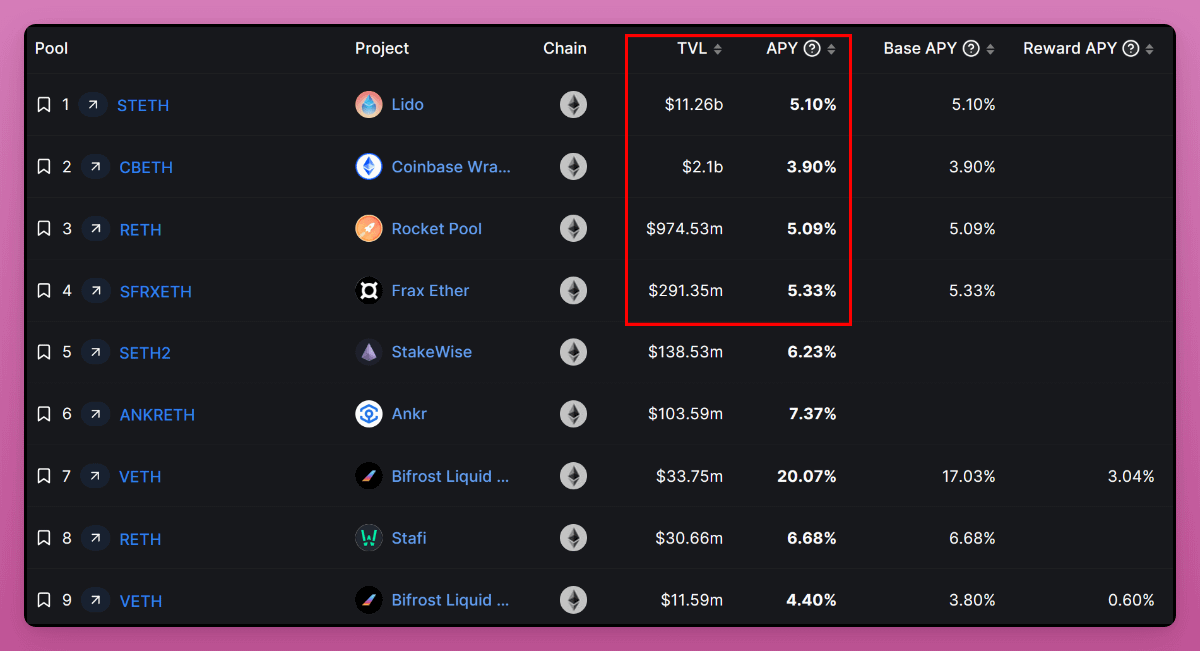

ETH has the lowest staking ratio (14.8%), while offering a competitive ~4.5% APR.

Other blockchains have much more concentrated token distribution, with insiders, team, and early investors actively staking for rewards.

It also means much more ETH can (and will) be locked.

Ethereum's young staking infrastructure partly explains the low ratio.

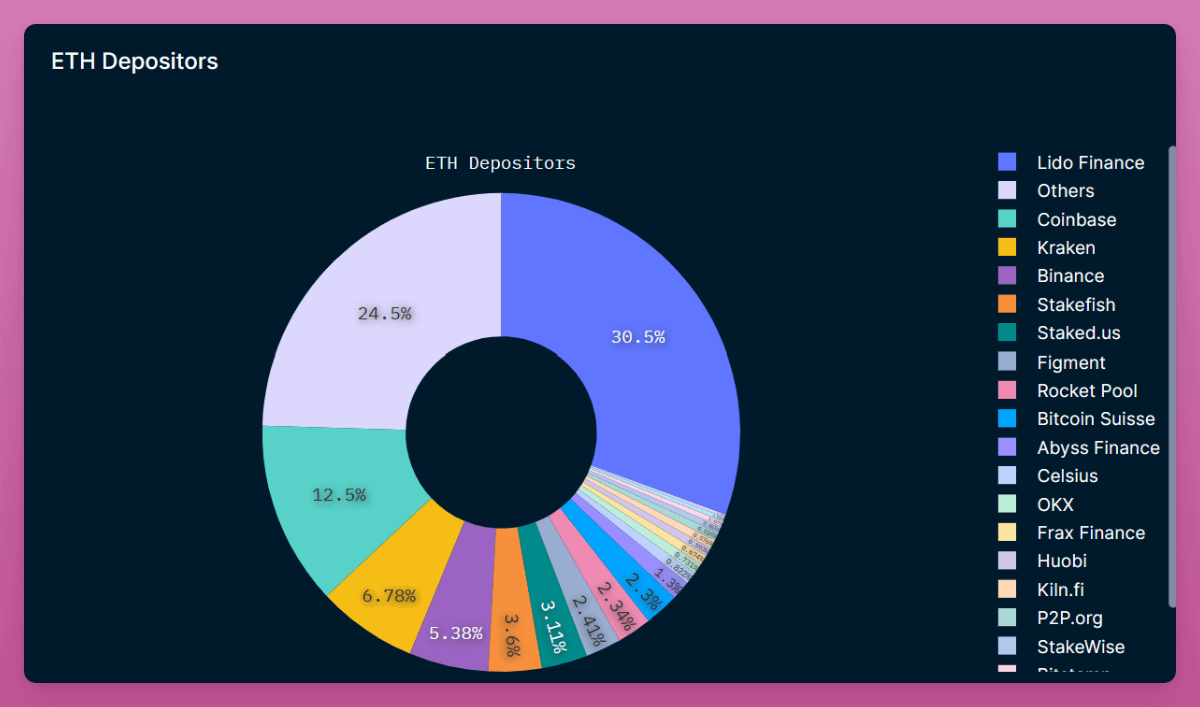

Lido leads with 30% staked, followed by centralized exchanges:

• Coinbase - 12.5%

• Kraken - 6.8%

• Binance - 5.4%

For $ETH's future, I hope staking becomes more decentralized.

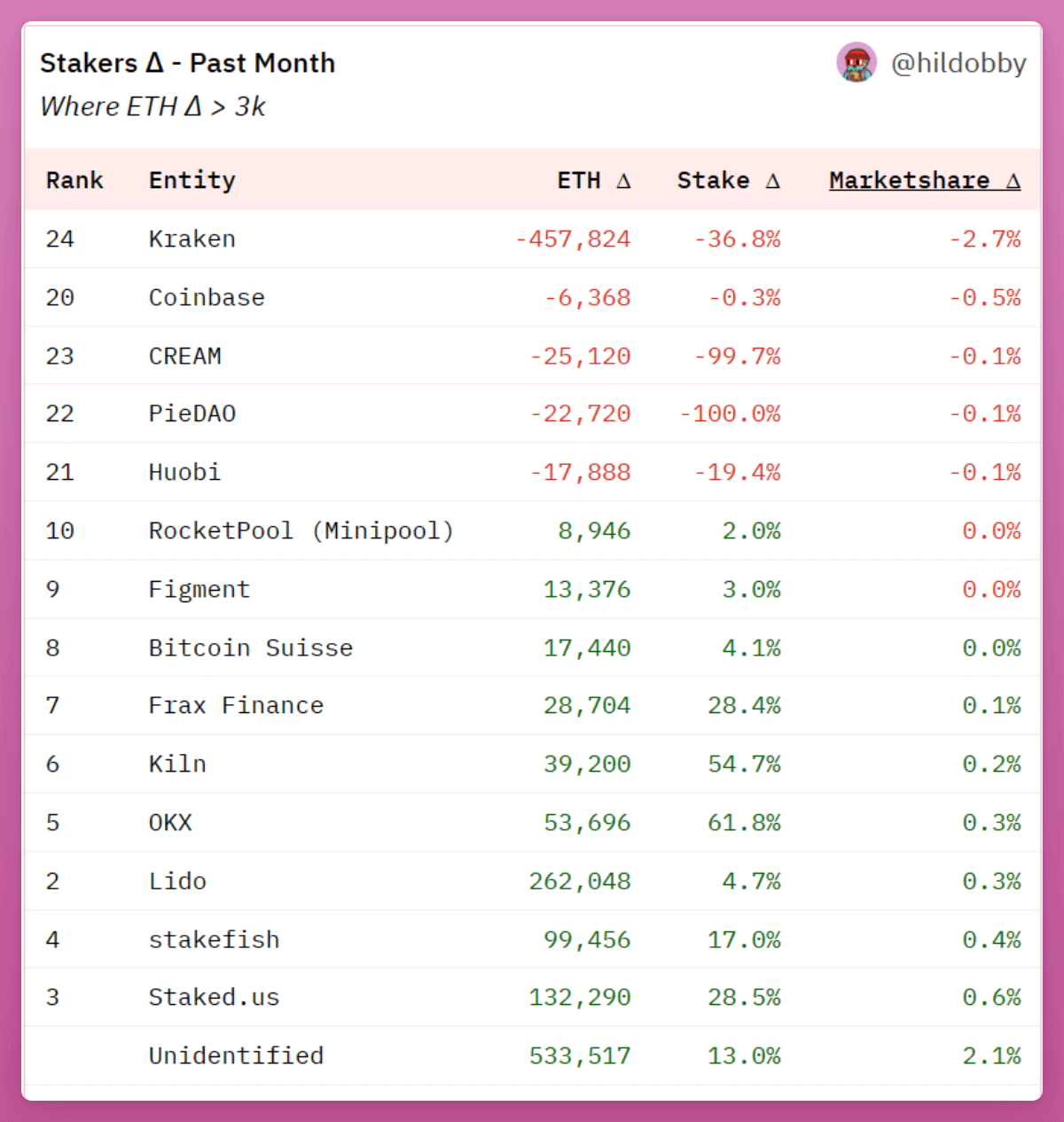

That's exactly what's happening.

In the past month, Kraken, Coinbase, and Huobi have lost market share.

In fact, 36% of all ETH staking withdrawals originate from Kraken.

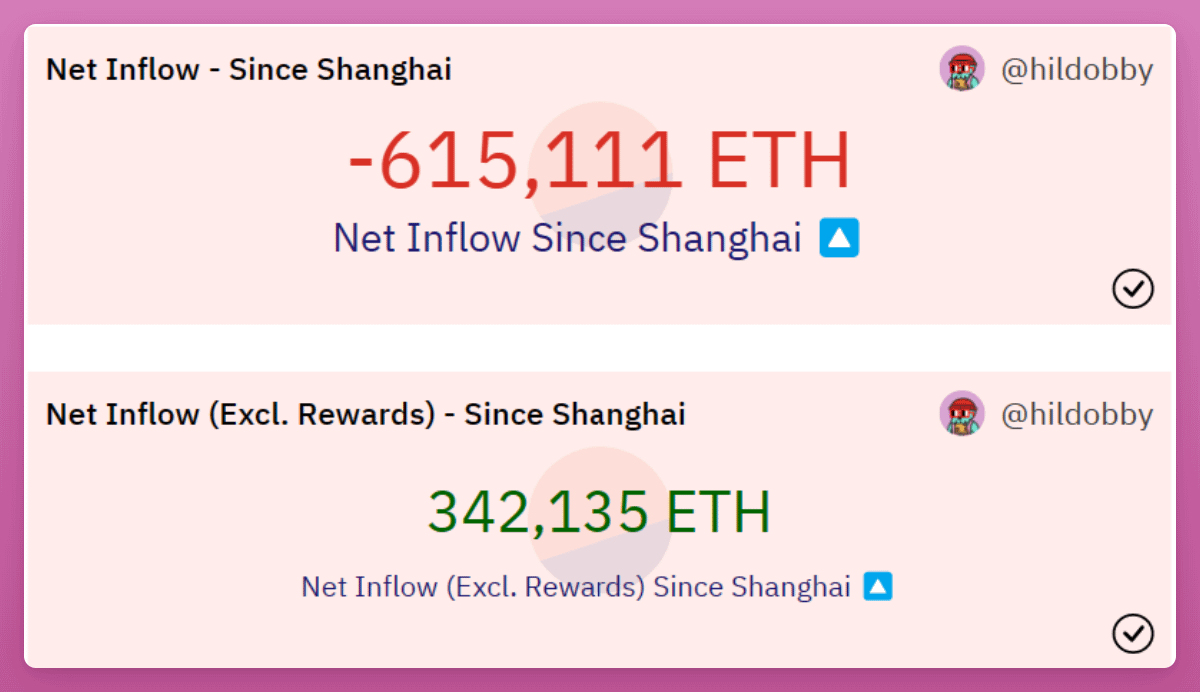

Staking withdrawals are considered bearish for ETH.

More withdrawals than deposits mean long-term holders are selling.

Indeed, the net inflow since Shanghai has been negative.

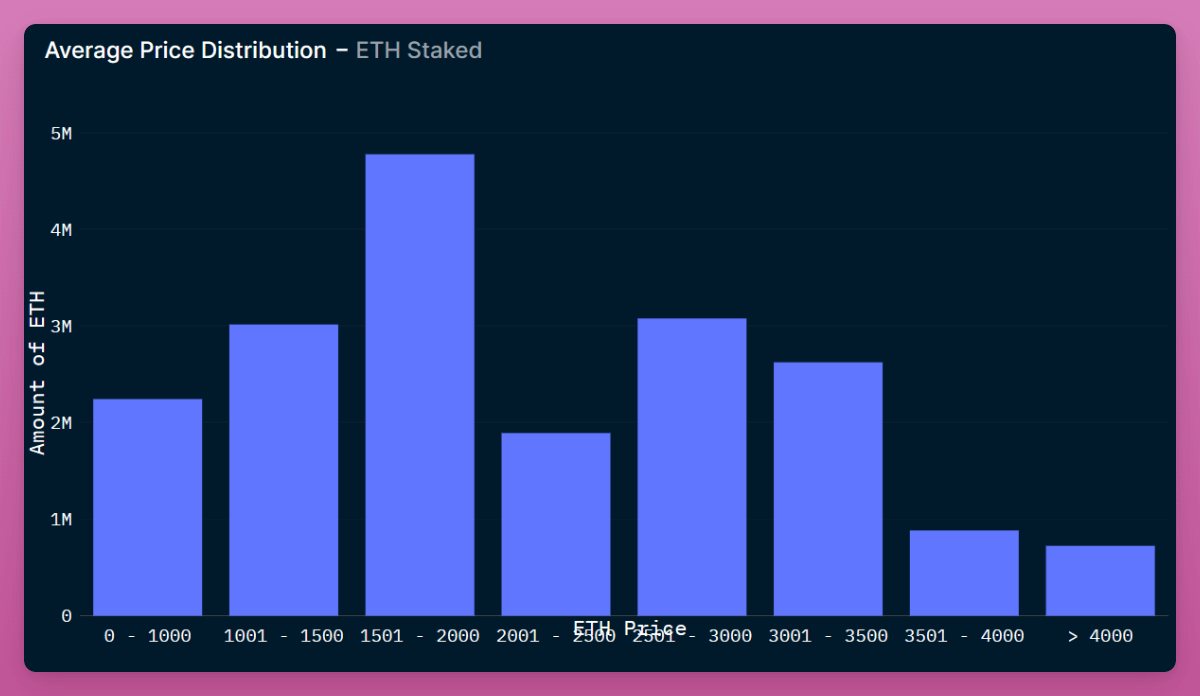

Currently, around 40% of all ETH stakers have a negative ETH PnL.

29% have staked their ETH at the current price.

Correct me if I'm wrong, but it looks bullish to me.

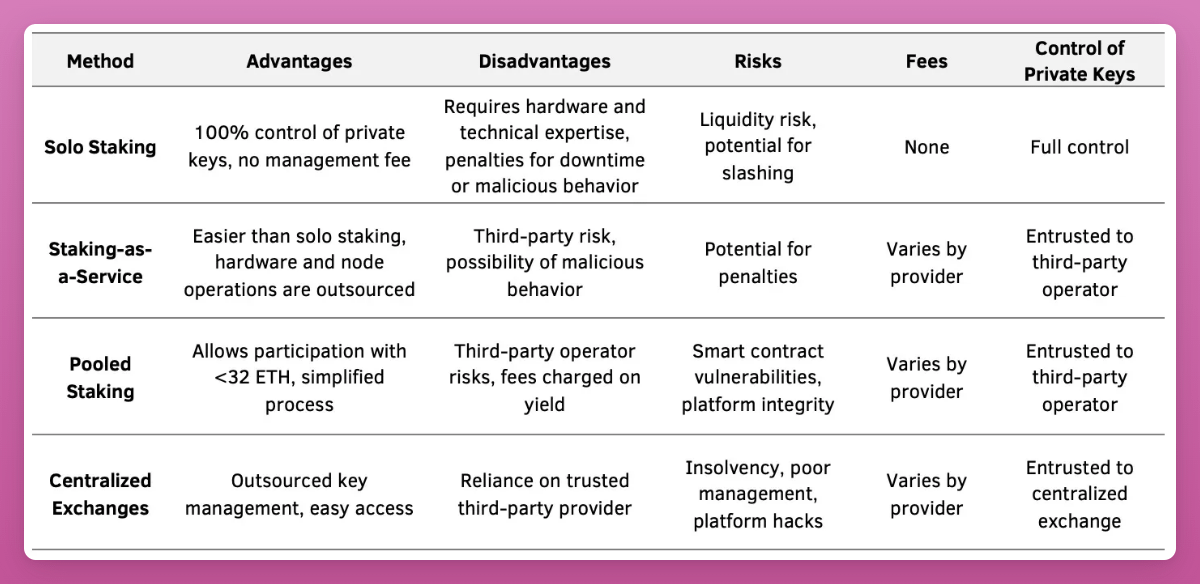

$ETH staking is the best risk and reward-adjusted shot at financial freedom.

My priorities to achieve it are (in exact order):

1. Protect ETH deposit

2. Sleep well

3. Maximize yield on ETH

Don't chase the highest yields; protect ETH principal against hacks and exploits!

Protecting principal means using blue-chip DeFi protocols or top CEX.

Controversial opinion: If you have less than $10k, you're better off staking with CEXes or not staking at all.

On-chain transaction fees for staking will eat up all your yield.

Pic source: @mrjasonchoi

Liquid staking derivatives are the best way overall to earn yield.

I'd pick stETH or rETH for their adoption in DeFi.

You could lend stETH/rETH, borrow stablecoins to pay for daily needs, and let yield repay your debt.

You'll probably average 4-5% APY.

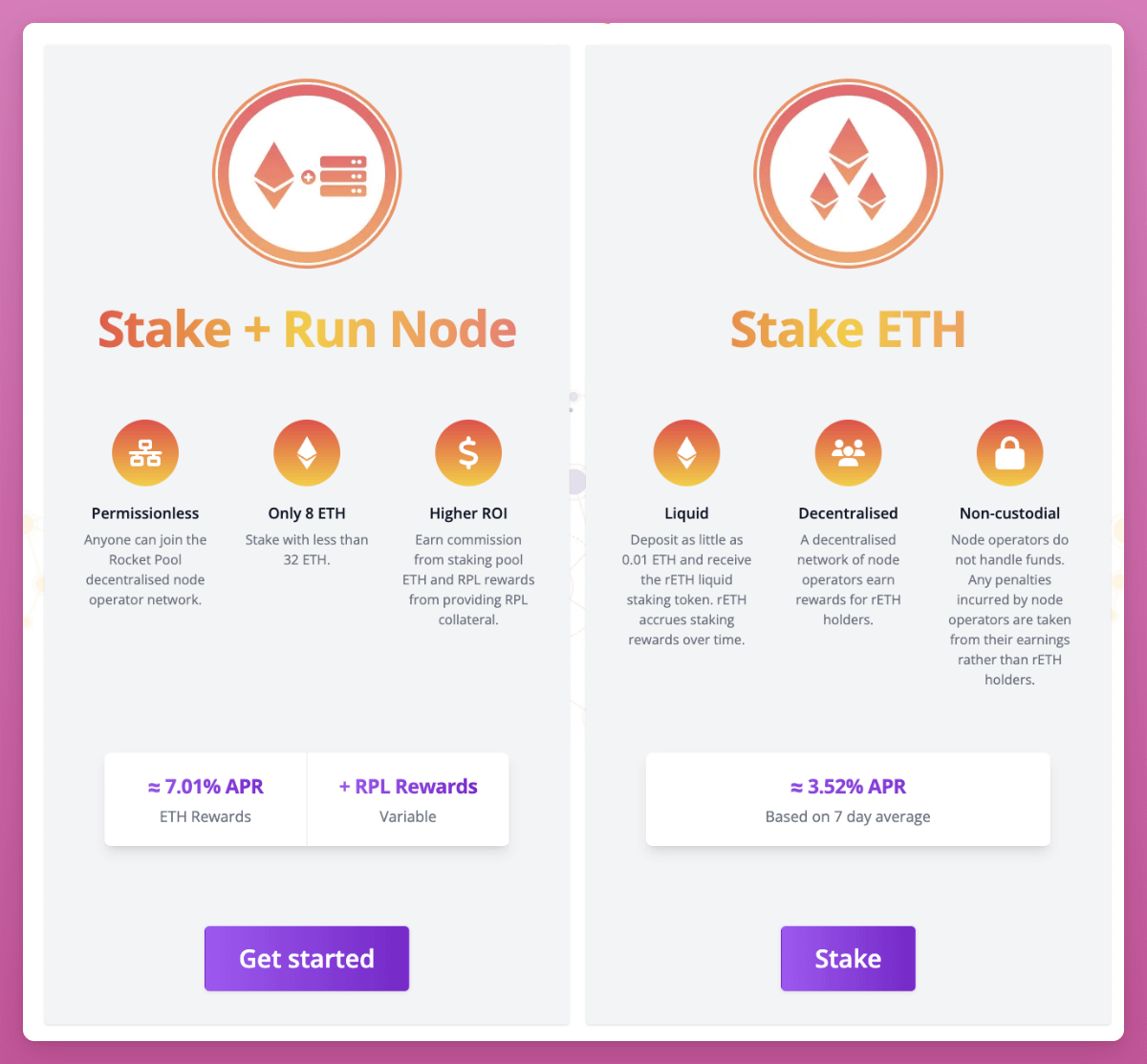

With Rocket Pool, running your own node earns 7.01% APR + RPL rewards.

It's great for individuals seeking low-risk node operation, but you need some technical skills.

The risk depends on the staker - penalties apply if the node goes down.

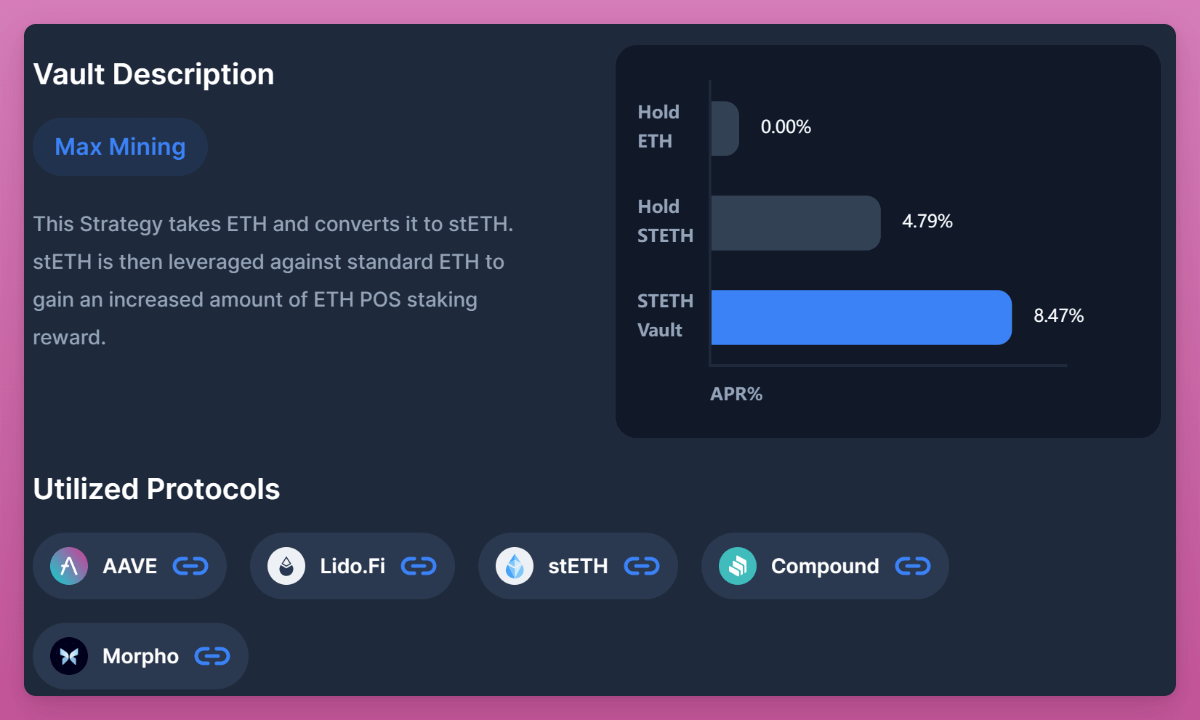

You can push yields higher with leveraged staking, yield aggregators & farms.

For example, Instadapp Lite offers an 8.5% APY.

It converts ETH to stETH, leveraging it against standard ETH for higher PoS staking rewards.

Btw, I'm an ambassador for Instadapp, so DYOR!

ETH staking with just 83 protocols is about to flip DEXes by TVL.

With just 15% of all ETH staked, the LSD industry is larger than lending, bridging, and CDP stablecoins.

It will continue to grow.

There is a new generation of staking protocols, with many more to come.

You can get 50%+ APY if you like taking risks.

My humble advice:

Bet on their growth by investing in their tokens and not by risking your best chance at financial freedom - ETH principal.

twitter.com/intocryptoast/status/1649178340392316929

Eigenlayer's re-staking to increase security of other networks is probably the most hyped protocol.

It will increase demand for ETH staking, but risks will also compound.

twitter.com/0xsalazar/status/1631626392059166722

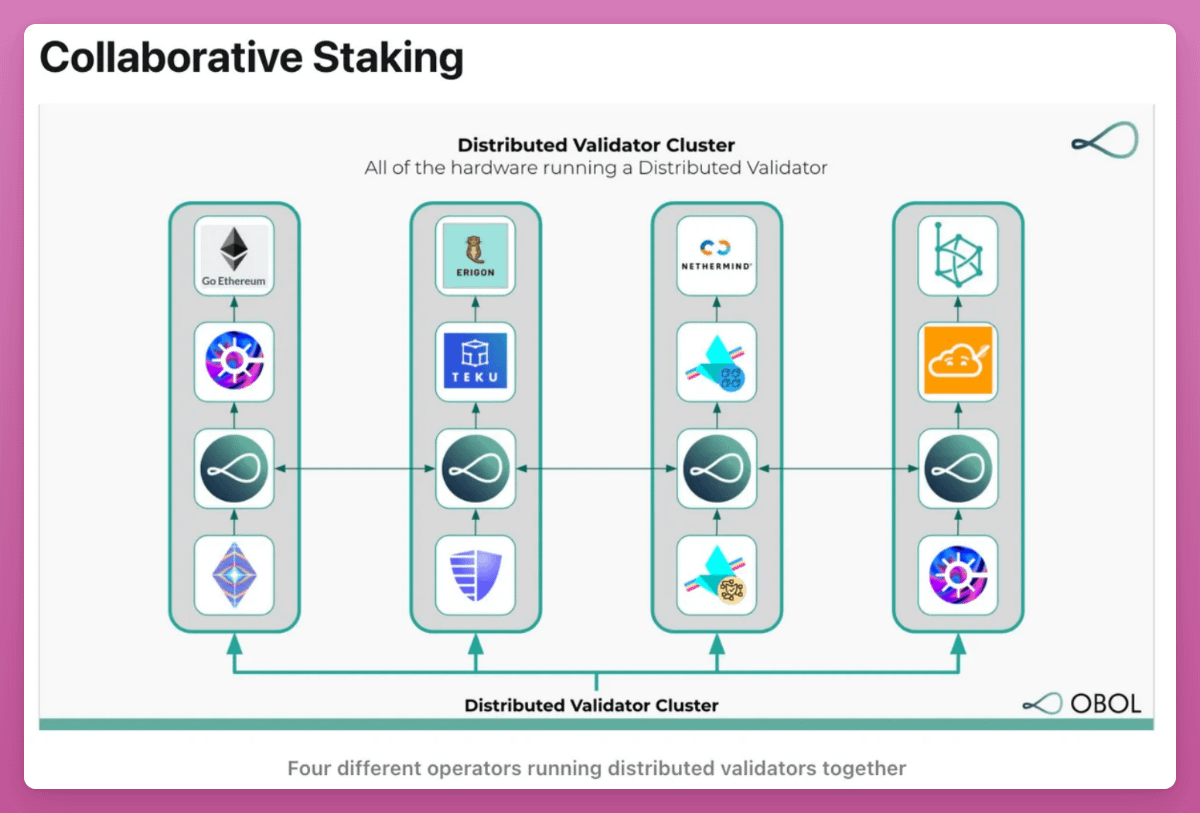

Distributed Validator Technology (DVT) is another growing narrative.

Currently, running an Ethereum node requires 32 ETH and is technically burdensome.

DVT simplifies this by enabling "squad staking," allowing groups to stake different amounts of ETH collectively.

DVT should increase decentralization and security while simplifying staking.

A few protocols working on it:

• @divalabs

• @ObolNetwork

• @ether_fi

• @stakehouse_BSN

• @ssv_network

Final thoughts: Ethereum is the best bet for financial freedom in crypto.

Currently, you can get safe 5-9% APY on ETH, but it's a bear market and on-chain activity is low.

When the bull market comes, gas usage will skyrocket.

This will increase staking yield & ETH burning.

Higher yield boosts ETH's passive income appeal, driving the price up.

My aim is to protect ETH's principal, even if it means sacrificing some % of yield.

I'll bet on LSD/DVT tokens for max upside while reducing risk.

The best bet token? That's a thread for another day.