DAOs can be worth more dead than alive - but why?

"Rage quits" can lead to huge payouts for token holders.

ROOK's recent 5x token pump after shutting down is a prime example.

But ROOK is part of a much bigger play happening in DeFi right now: 🧵

I bet you’re very well familiar with rug pulls.

But then there’s the “slow rug.”

It happens when funds are siphoned off over time, disguised as operational expenses like salaries.

twitter.com/lemiscate/status/1656188167945347073

Take Rook as an example.

This DAO had 22 contributors receiving a total of $6.1M annually ($300k per contributor).

Yet, with a 78% decline in the protocol's volume over six months, they couldn't provide a roadmap or clear objectives.

So, it was shut down by token holders.

twitter.com/DefiIgnas/status/1658369858592190464

The Slow Rug is complex & DAOs face many issues:

1. DAOs exist in a legal grey area

2. Varying jurisdictions make managing global legal relationships complex

3. Token holders’ potential liability is a concern

4. Balancing efficiency with decentralization is a challenge

So how do we ensure accountability for teams that don't add value for token holders?

Some DAOs take responsibility by dissolving themselves.

For instance, Fei (Tribe DAO) decided to wind down and distributed $220M USD from its treasury to token holders.

twitter.com/DefiIgnas/status/1560794521977626624

Fei's token, $TRIBE, valued at just $66M at the time of the vote, is now trading at $128M.

In both cases of $ROOK and $TRIBE, the dissolution of DAOs turned out to be beneficial for token holders.

But what if the core team resists the governance vote?

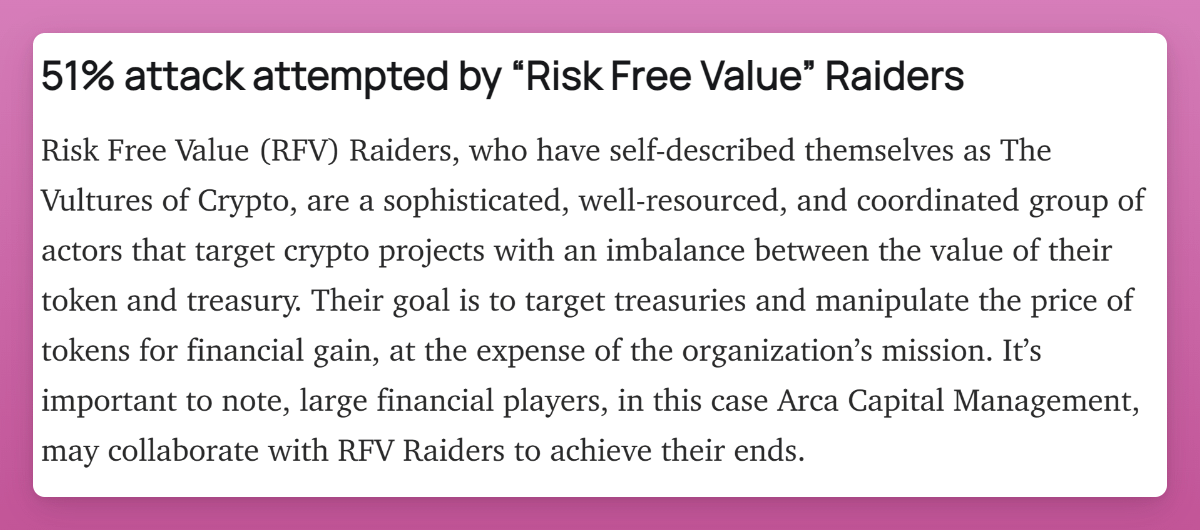

This brings us to the saga of Aragon and the so-called Risk Free Value (RFV) Raiders.

Aragon, with a mission to build tools for creating and managing DAOs, recently reported an alleged "51% governance attack" after new members inundated Aragon's governance forums.

twitter.com/AragonProject/status/1656028386307743748

Aragon's response was to "repurpose" the DAO into a grants program for emerging DAOs.

The association would now move the funds in batches instead of transferring the entire treasury funds all at once.

Aragon pointed fingers at RFV Raiders and hedge fund Arca...

They claim that RFV Raiders describe themselves as "The Vultures of Crypto" and are reportedly a sophisticated, well-resourced, and coordinated group.

But in the end, what matters is that they followed the rules of the DAO.

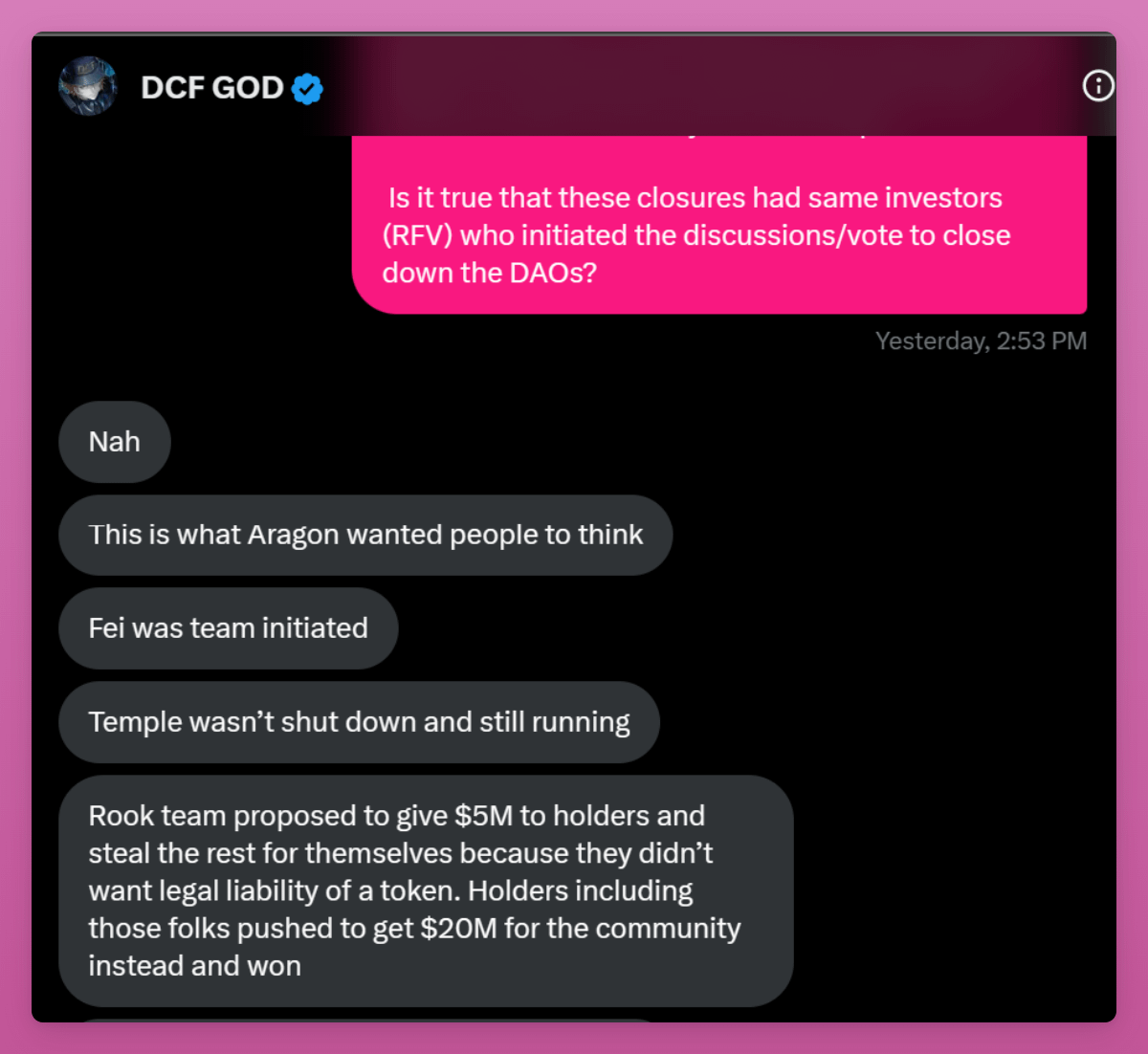

Aragon claimed that RFV Raiders and Arca are responsible for Rook DAO, Invictus DAO, Fei Protocol, Rome DAO, and Temple DAO.

Unable to confirm the claims, I asked RFV Raiders sympathizer, @dcfgod

This is what he had to say:

This situation is much more nuanced, and you can get a much better picture of what's happening in the full blog post with a link in the tweet below:

twitter.com/DefiIgnas/status/1659169873317236738

What's the strategy RFV Raiders are supposedly leveraging?

1. Find DAOs with a treasury value less than their token's market cap

2. Buy enough tokens to influence decisions

3. Vote to dissolve the DAO

4. Upon success, the treasury gets redistributed to token holders

Actually, that's how DAOs are designed, isn't it?

But pulling off a real takeover is trickier than it sounds...

You have to deal with price surges, slippage, liquidity, diligence processes, governance proposals, and run a PR campaign to get other token holders to agree.

It's definitely not a risk-free strategy.

But, as the 5x surge in ROOK price shows, it can be profitable.

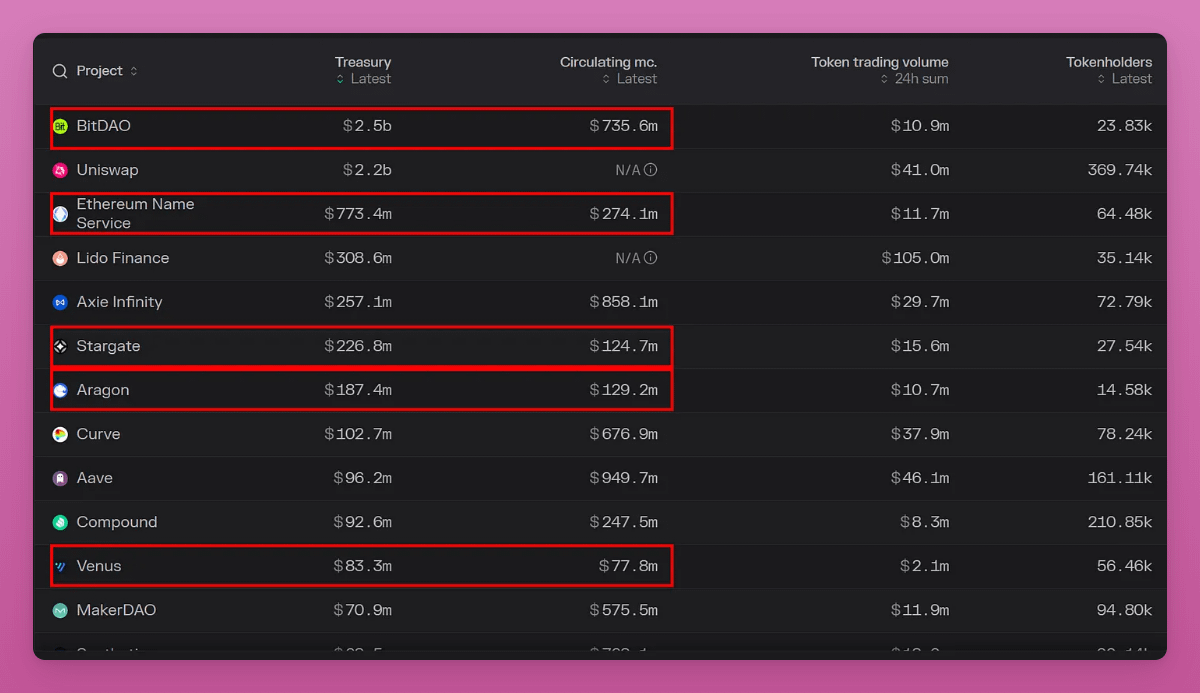

Now the question is, which DAOs might be at risk.

Using @tokenterminal and @DefiLlama, we can identify DAOs with treasury assets > token market cap.

Shockingly, out of 67 projects listed on Token Terminal, 23 have a higher treasury asset value than their respective token's circulating market cap.

The problem: TokenTerminal counts a project's own tokens in treasury value.

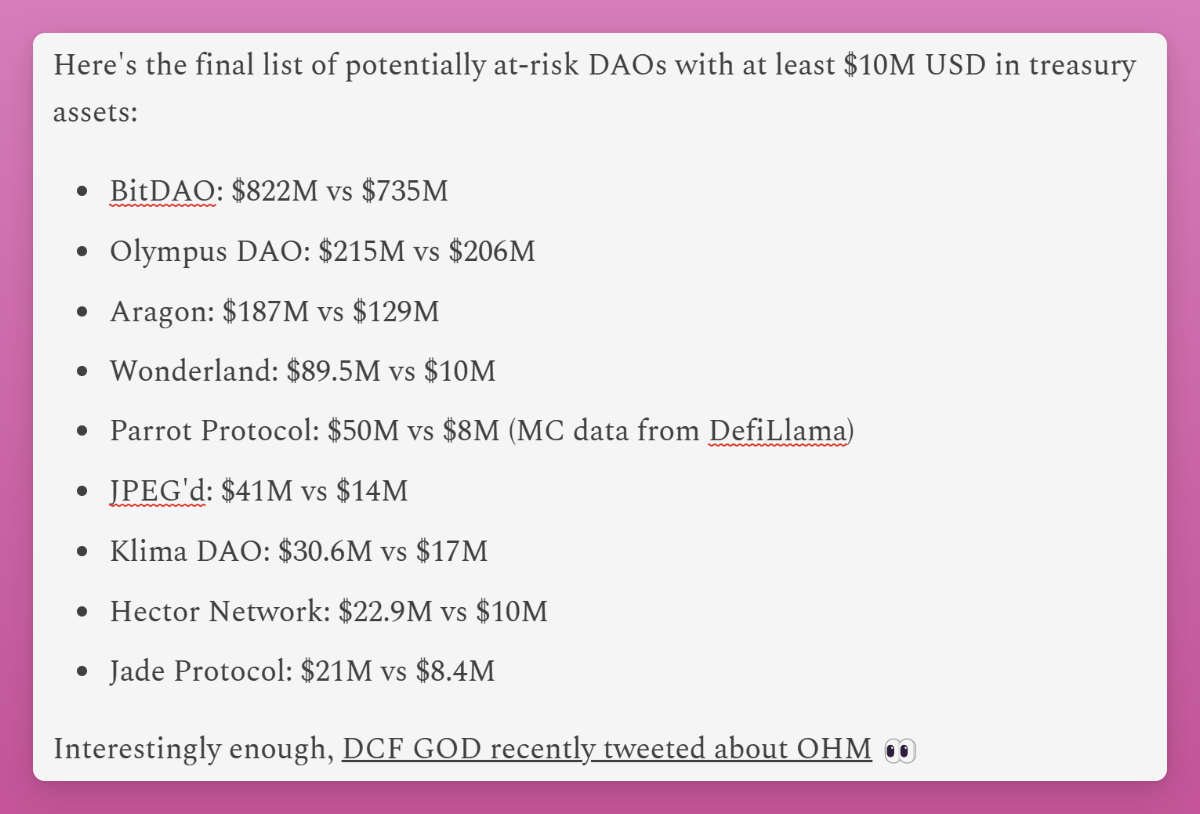

Using @DefiLlama's feature to exclude own tokens, I found a few DAOs at risk with $10M+ in treasury assets.

⚠️However, considering the ratio of user-owned to owed tokens (often skewed towards team/VCs), the final at-risk DAO list is even shorter.

So, please, DYOR.

Opinions on the takeover strategy may vary, and it's fair to say that the RFV Raiders have attracted a significant amount of criticism for their tactics.

However, it offers a unique arbitrage play in DeFi.

twitter.com/scupytrooples/status/1656201666872344585

In an interview with DL News, Arca's CIO, @jdorman81, pointed out:

If a DAO's treasury surpasses its market cap, “It’s the market’s way of telling that company or project, ‘We don’t think you are being a proper steward of those assets.’”

twitter.com/DLNewsInfo/status/1658046870600466432