Runes Protocol launches in 2 days: Ready to FOMO in?

Hold up.

There are few reasons to stay bearish for now:

Pre-rune token market is hot.

Runestone, RSIC, and PUPS are already pumping, promising holders shiny new Rune token airdrops.

And FOMO threads keep coming...

But, like the NFT frenzy post-JPEG reveal, the market could soon cool off.

Here's why:

• As Bitcoin transaction fees skyrocket, small traders may struggle and get disillusioned

• Runes might not initially revolutionize BRC20 trading experience as UTXOs and BRC20s trade similarly to NFTs.

For example, Unisat and Ordinal Wallet Rune UIs are same as BRC20s.

twitter.com/udiWertheimer/status/1779635860083704313

Also, dozens or even hundreds of Rune tokens will hit the market:

This dilutes:

1) trader attention

2) money inflows per token.

And Rune 0 (UNCOMMON•GOODS) set by Casey Rodamor is no easy pump – it's freely mintable for 4 years, limited to just 1 mint per transaction.

Finally, utility-wise runes will trade as memecoins like BRC20s.

At least at first, so the excitement of “new” will fade away.

Especially if no rune token manages to sustain the pump and degens lose money.

Sure, some Runes will do great; you'll see success stories on CT.

But will you managed to be the one?

If I'm right the real opportunity comes after the hype cools down post the Rune protocol launch.

I'm bullish on Runes long-term.

Notice that narrative speculation comes in waves:

First wave: Fueled by shiny newness and hype, often from tech innovation or meme potential.

Recent examples: Friend tech, ERC404, Telegram bots...

Meme tokens can feel like a gamble, with most one-hit winners fading fast.

twitter.com/DefiIgnas/status/1757029397075230846

But narratives rooted in technical advances stand a better chance post-hype.

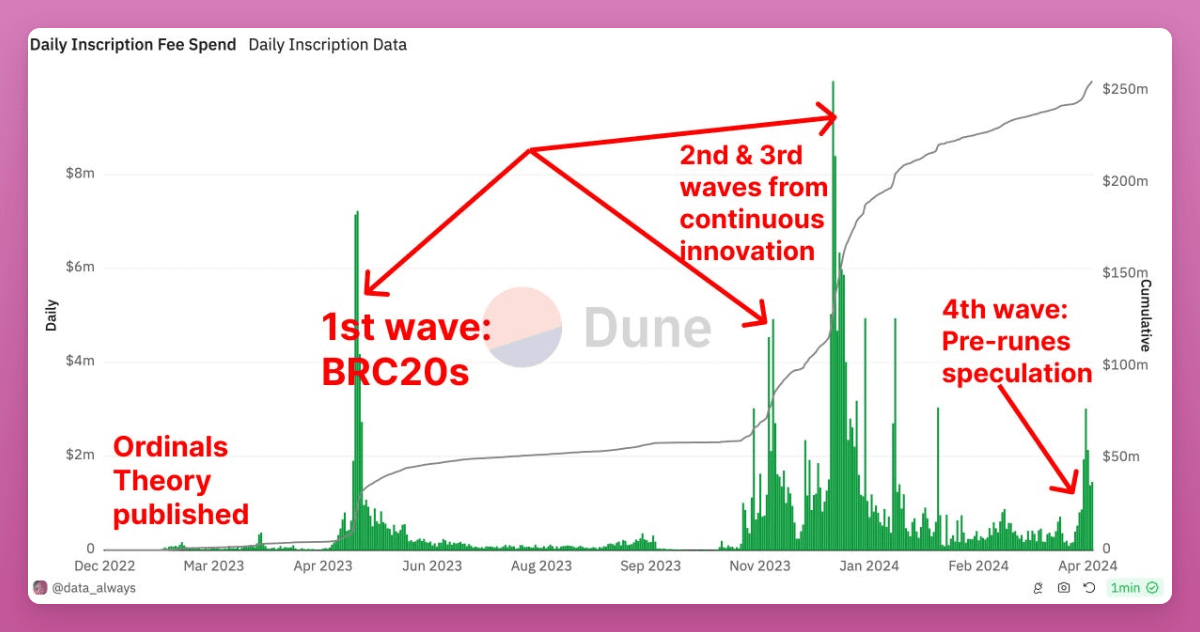

Ordinals debuted in December 2022.

But BRC20's launch in May 2023 sparked the 1st wave. While initial hype waned, ongoing development led to 2nd and 3rd wave surges in late 2023.

4th is Runes.

Runes is here to stay – not just for one more wave, but many more to come.

Why?

• Runes aims to unify the BTCFi industry with a single standard, akin to Ethereum's ERC20.

Before Runes, the dev attention was scattered across BRC20, CBRC-20, ARC20s, and more.

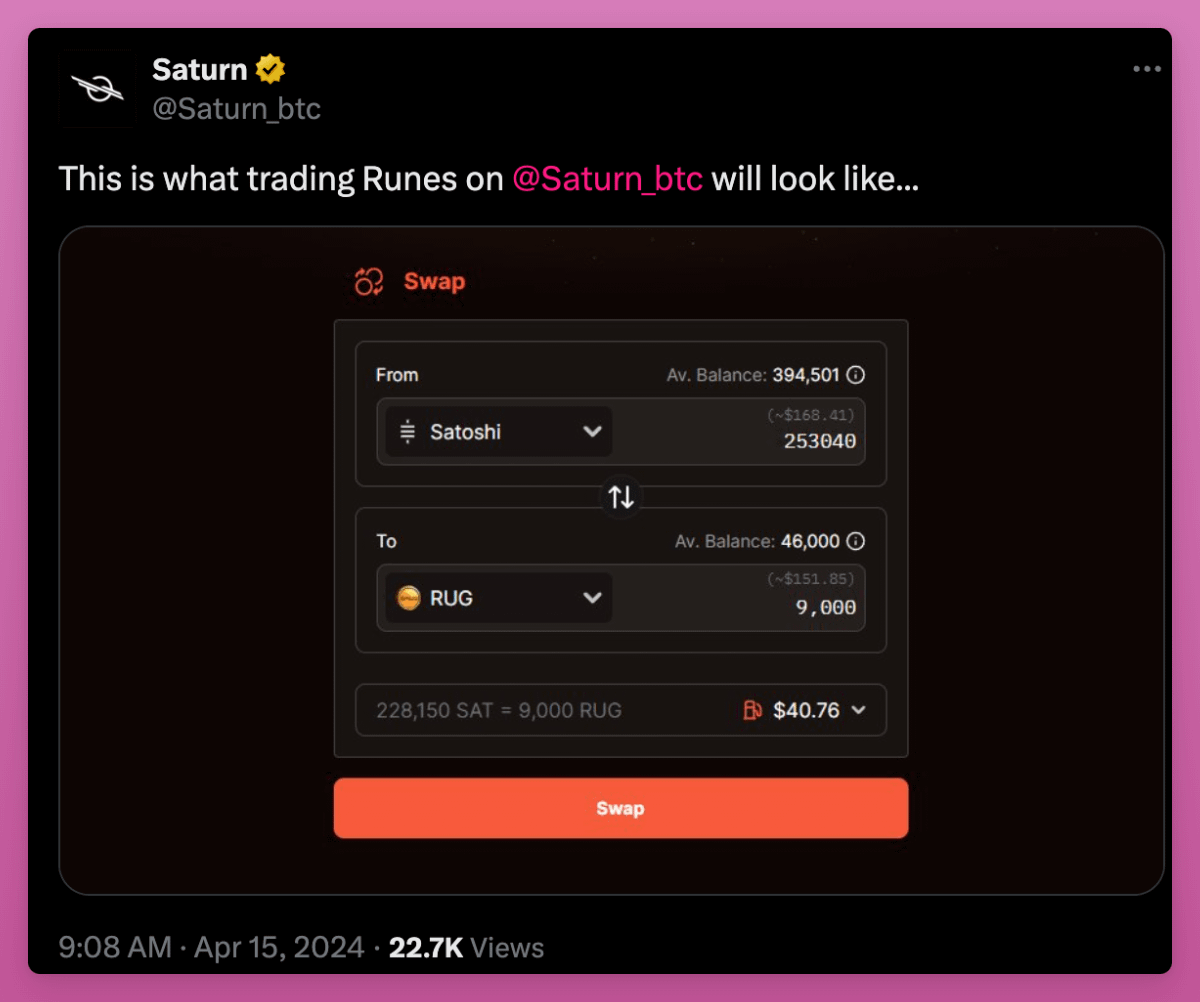

• Runes is paving the way with multiple protocols and infrastructure for Rune tokens.

Like Saturn is building a familiar looking DEX or @LiquidiumFi a lending/borrowing market for Runes.

But perfecting the user experience takes time.

And Runes won't be just memecoins.

Finally, there's a more fundamental reason I'm long-term bullish on Runes and BTCFi in general:

In every bull market, new tech emerges.

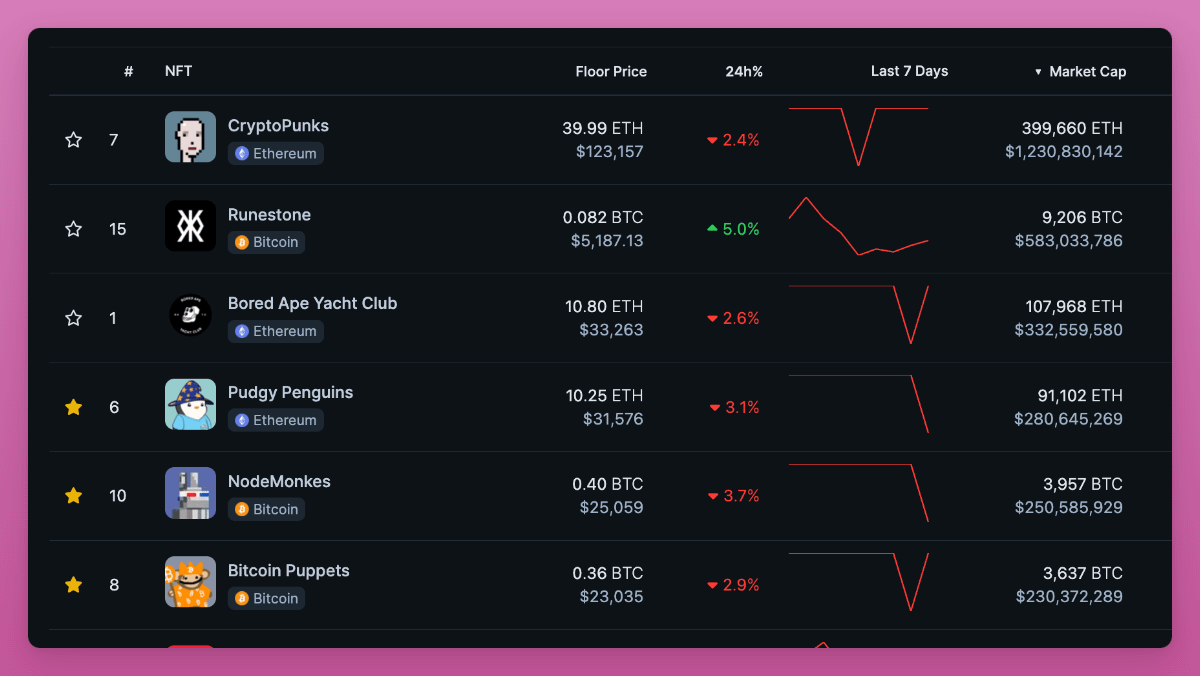

Bitcoin was said to be 'unfit' for NFTs or tokens. Yet, Bitcoin NFTs are outperforming Ethereum NFTs.

This innovation of Ordinals gave Bitcoin the extraordinary privilege of printing new tokens out of thin air and assigning crazy valuations.

It was reserved for smart contract blockchains like Ethereum/Solana.

Until Ordinals inadvertently gave rise to BRC20s and now Runes.

twitter.com/DefiIgnas/status/1726598420368871860

Finally, BTCFi's storytelling potential is off the charts!

Storytelling breathes life into technical innovation turning it into something people can relate to and join.

Bitcoin Ordinals as immutable NFTs on the most secure & decentralized blockchain is a sexy story.

twitter.com/DefiIgnas/status/1748317085954924682

And memecoins on boomer Bitcoin? Cooler than Solana or Ethereum!

The good thing is that we're truly early: Everyone is playing a catch-up with the tech and story.

With devs flocking to Bitcoin and more BTC degens joining in, the future looks bullish.

If you want to learn more, check out yesterday's blog post on Runes.

You'll find:

• Additional Rune protocols and tools to explore

• A more in-depth explanation of my Runes thesis.

twitter.com/DefiIgnas/status/1780193878689386887