10 minute exercise

cmon, just pretend you died, like right fucking now

your spouse, okay wait nevermind, most of yall virgin incels

your family, can they retrieve it?

If not, read this:🧵

It's weird to talk about death when we're here to get rich and live happily ever.

But have you considered the fate of your crypto upon your death?

This is an area where we need to balance security with accessibility to ensure safe asset transfer.

According to a very scientific survey by DegenSpartan, 71% of you have no plan to transfer assets to their loved ones.

This lack of a plan can lock your crypto in a wallet or exchange that can't be accessed.

So, what's your plan?

twitter.com/DegenSpartan/status/1648886218187489280

Your asset recovery plan depends on where your tokens are stored:

• Centralized exchange

• Cold/hot wallet with a seed phrase/private keys

• Multi-sig wallet, etc.

Let's explore these scenarios.

By the way, you can read the full post on my blog for all the details.

Or continue reading this thread for a short summary.

ignasdefi.substack.com/p/what-will-happen-to-your-crypto-when

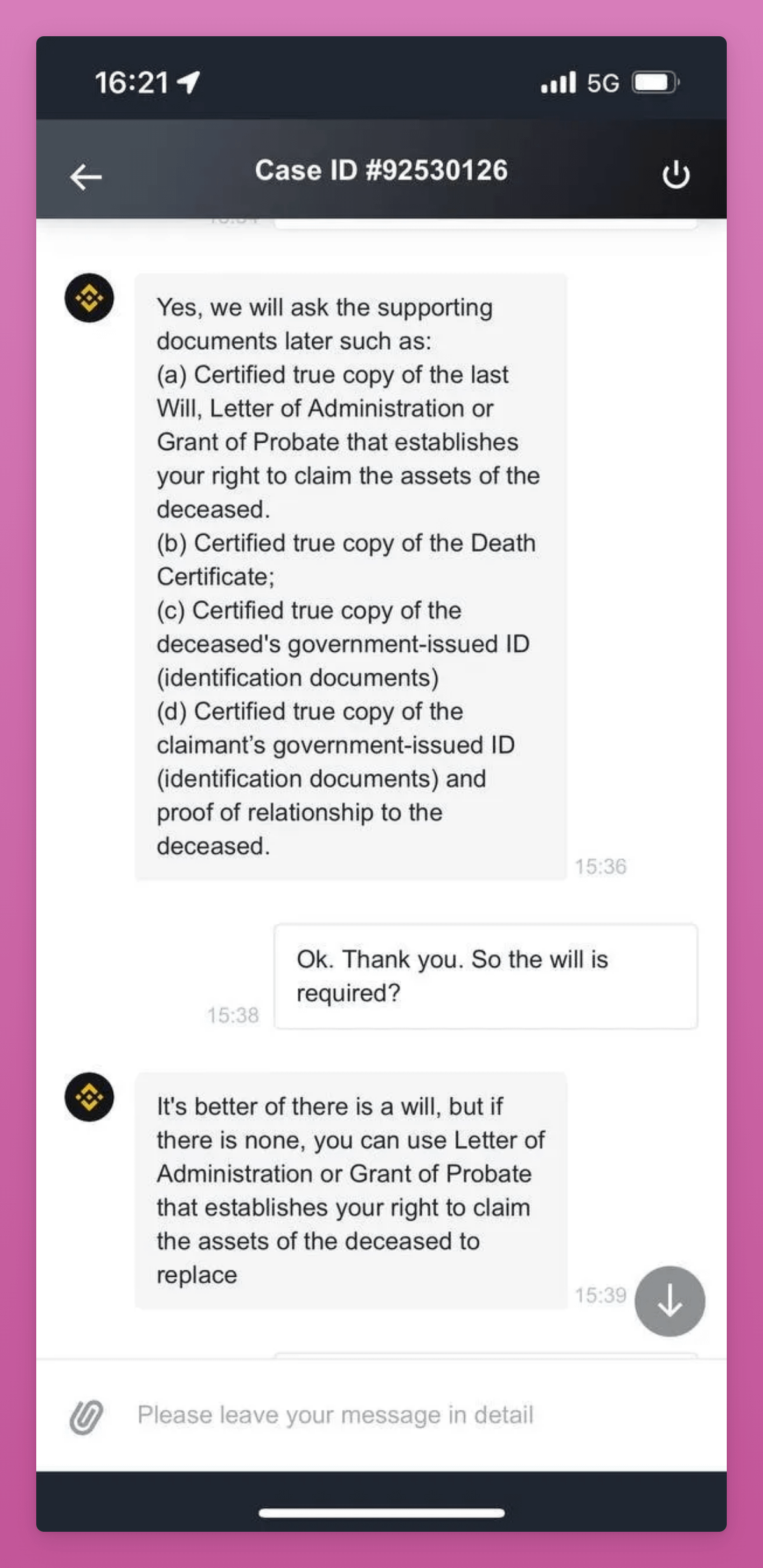

For centralized exchanges, you'll need a will.

Exchanges like Binance & Bitstamp require certain documents.

But remember to ask your exchange about their specific requirements.

Smaller exchanges might not even have a recovery plan!

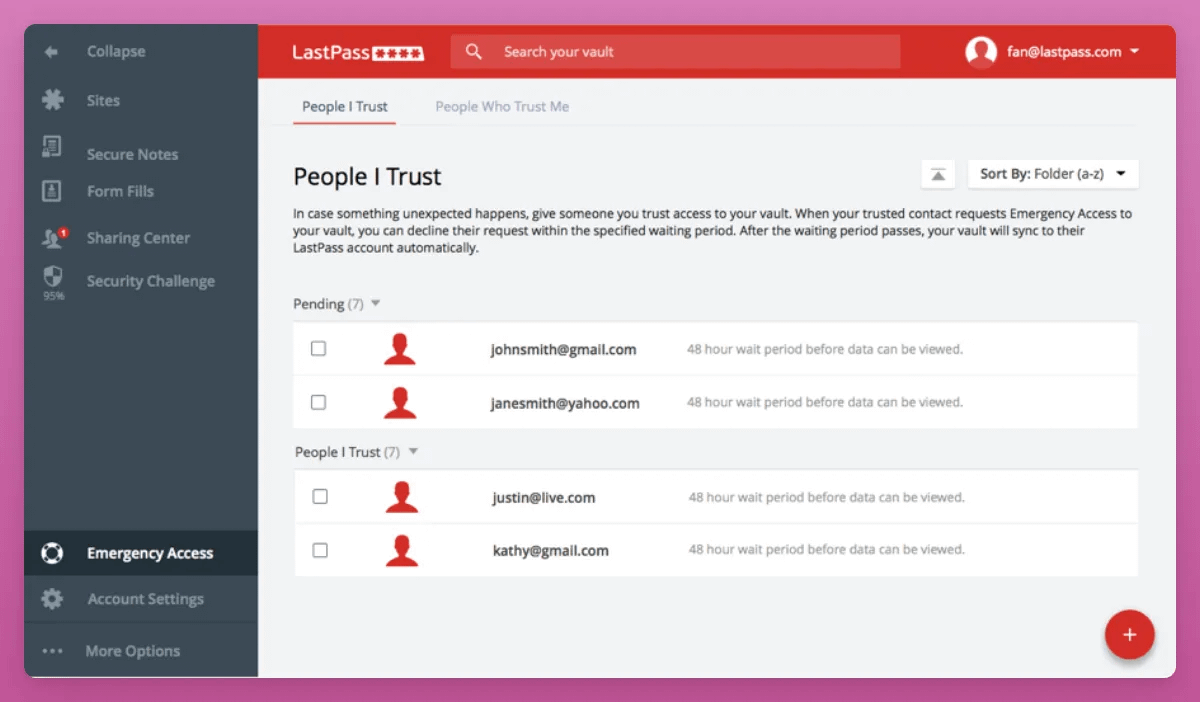

One solution is to transfer your exchange login data to your loved ones using password managers like LastPass.

It offers Emergency access to a trusted contact if you're inactive for a certain period.

Remember: NEVER store your private keys on a password manager.

If you control your private keys, you can consider multiple hardware wallets like Ledger or Trezor.

Give one to your loved ones.

Create a safe way to share your password so they can open it after your death.

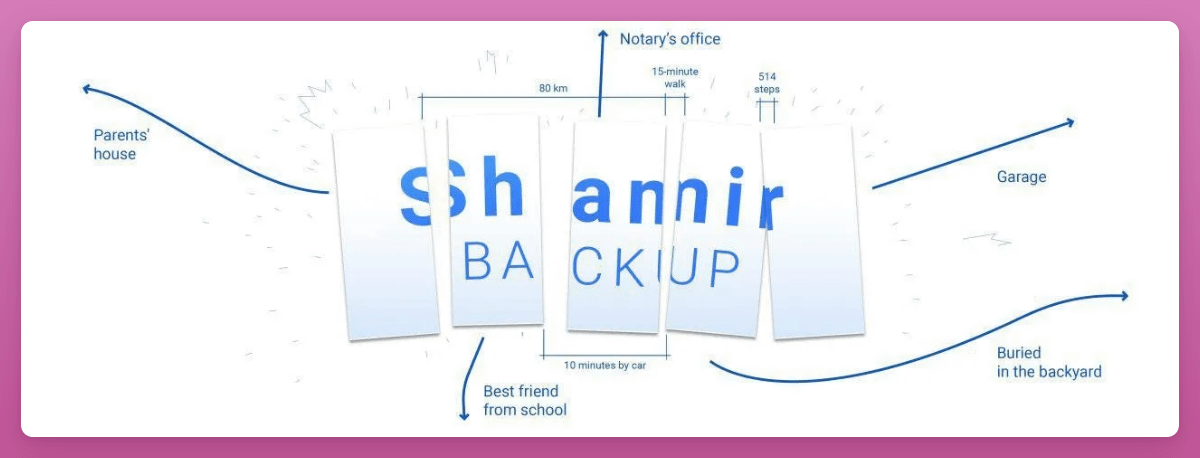

Trezor's Shamir backup offers a safer solution.

Generate multiple unique recovery shares & establish a threshold required for wallet recovery.

Distribute these shares among trusted family members or secure locations.

Check the details how it works in my blog post.

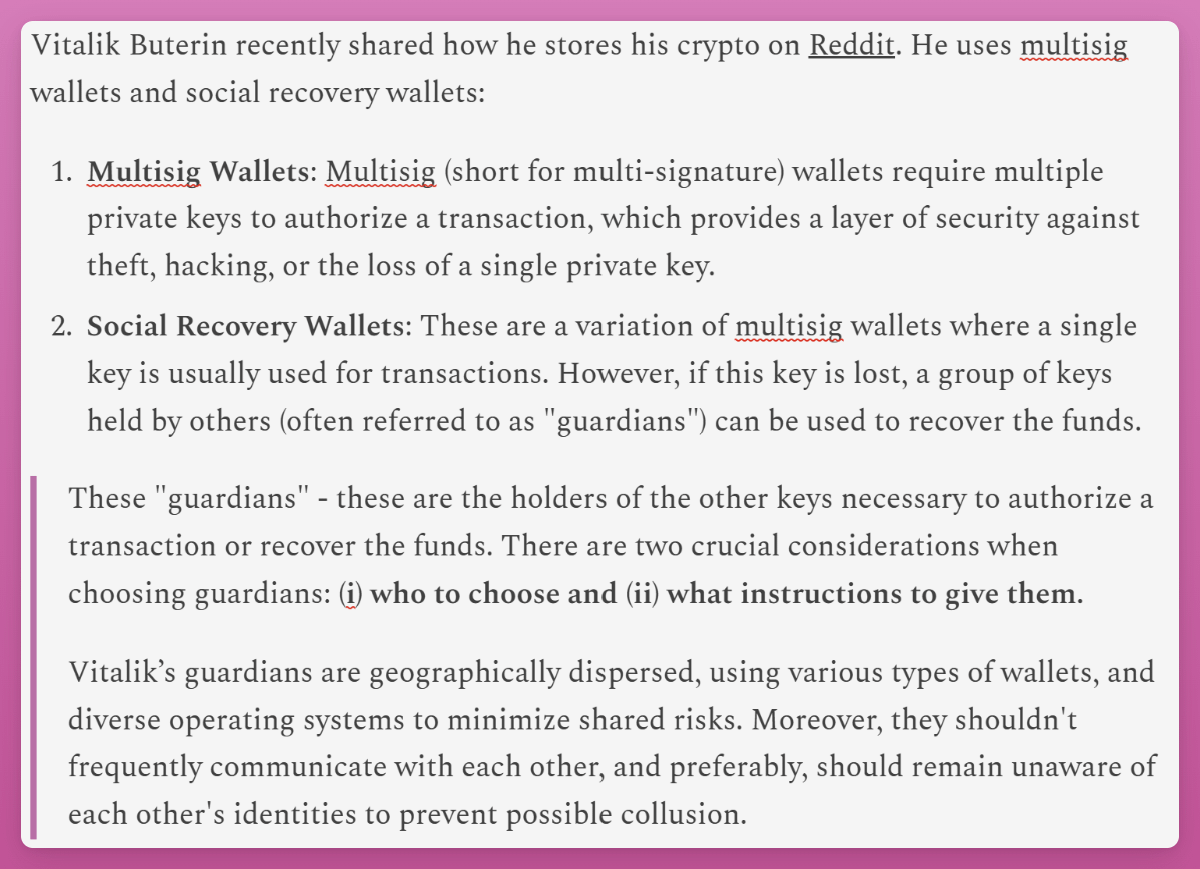

For even more security, consider multi-sig wallets and social recovery wallets.

Vitalik Buterin uses them.

They require multiple keys to authorize a transaction, providing a layer of security against theft, hacking, or loss of a single key.

"Guardians" hold the other keys necessary to authorize a transaction or recover the funds.

Choose them wisely and give them clear instructions.

Vitalik's uses geographically dispersed guardians, use diverse wallets and operating systems, and preferably, not know each other.

Despite having access to your wallets, your family needs to know how to use them.

Does your mom know how to unstake 3CRV from Curve?

Without a detailed guide, they could fall victim to scammers.

That's why a user-friendly interface and clear instructions are crucial.

An interesting possibility involves the use of smart contracts.

You could transfer your assets to a different wallet if you don't interact with them for a certain period.

A few solutions I found:

• @GuardMyFund

• @mywebacy

• @Inheriti_com

Multi-sig accounts are likely the most effective method for preparing token transfers after your death.

But this strategy requires a high level of technical knowledge and educating your loved ones.

To sum up:

• Plan ahead

• Prepare a will

• Learn how your exchanges handle death

• Teach your loved ones how to recover assets

• Enjoy life & live happily

We're in crypto to get rich, but let's not forget about the eventualities of life.