When will Ethereum ($ETH) pump?

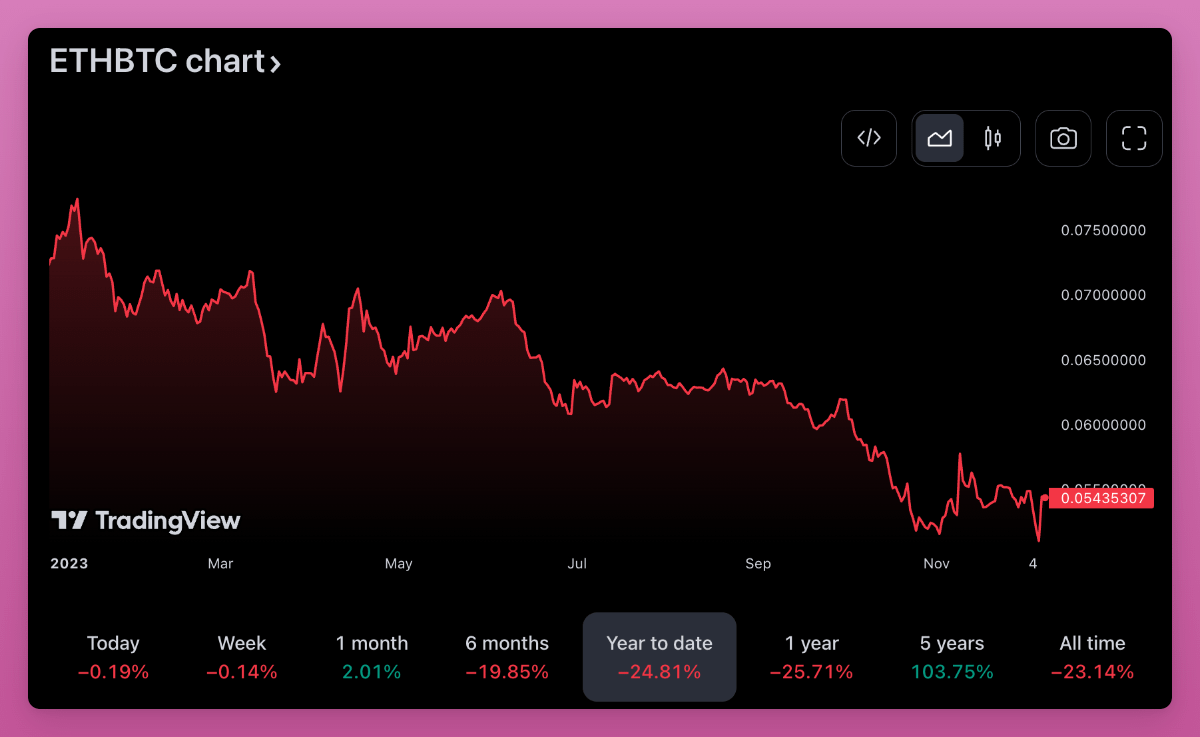

This year, it suffered a -24% drop against $BTC.

But here are four catalysts that could lead to ETH finally breaking out: 🧵

Money is actually flowing to Ethereum.

Yet, investors prefer to buy discounted Grayscale ETH, which is up 298% YTD compared to +98% for ETH.

The discount has reduced from -59% to -20% this year, and when it closes down, more money will flow to spot ETH.

BTC spot ETF is around the corner.

When it's live, attention, narrative, and speculation will turn to ETH Spot ETF.

Plus, Grayscale is vying to convert its Ethereum trust into an ETF, further increasing demand for ETH.

Cancun upgrade is coming in H1 2024.

It includes 5 EIPs such as EIP-4844 proto-danksharding to reduce gas fees associated with rollups.

Overall, the upgrade should bring faster transaction processing times, reduced transaction costs, and optimized data management.

Eigenlayer mainnet launch next year will make ETH the most productive asset in crypto.

Expect ~25% APY on ETH without accounting for initial airdr0ps.

• ~5% native staking yield

• ~10% Eigenlayer restaking rewards from AVS

• ~10%+ LRT protocol token emissions

More ↓

twitter.com/DefiIgnas/status/1725530139008581778

$ETH had lagged at the start of the previous bull market as well.

DeFi with liquidity yield farming was all the rage, but the tide shifted an ETH pumped by 1820% from $250 to $4800.

It's already showing some signs of reversal.