New Airdrop Opportunity in Restaking 🪂

• @a16z invested $100M in EigenLayer

• 1M EigenLayer points Rewards for this underfarmed Protocol

• Earn 5x more EL points than with other Restaking protocols

An underfarmed LRT Protocol 💎

𝗔𝗹𝗽𝗵𝗮 + 𝗔𝗶𝗿𝗱𝗿𝗼𝗽 ↓

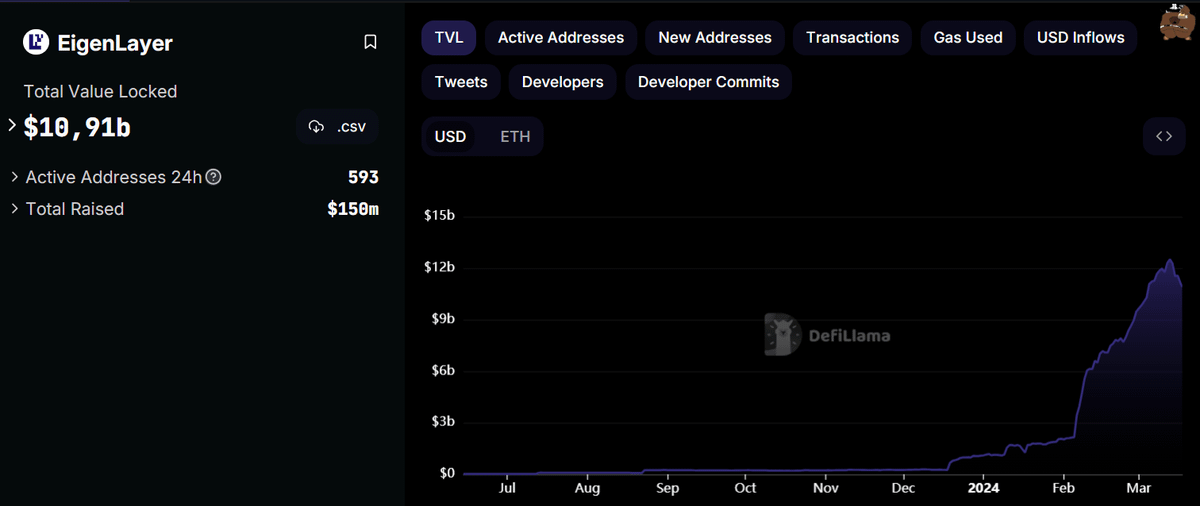

It's no secret that Restaking + EigenLayer is one of the biggest Narrative in 2024, it is:

• The Fastest Growing sector in DeFi

• Catching TradFi Attention

• Attracting a huge amount of $ETH

• Seeing the emergence of LRT protocols ontop of it

Many big actors in this space believe EigenLayer will be huge.

EigenLayer, the initiator and leader of the Restaking Narrative, raised $164M in total in 3 rounds.

With investors such as Blockchain Capital, Polychain Capital, Coinbase Ventures, and most recently a16z.

twitter.com/eigenlayer/status/1760666731859833048

Maybe you don't understand yet what Restaking & LRT are about?

It starts with Ethereum & LST

LST: Liquid Staking Token, a receipt token to evidence ownership of staked $ETH.

Example: $OETH by Origin.

You can then use these receipt tokens in DeFi.

You can also Restake them ↓

EigenLayer was one of the first to position itself on the Restaking Narrative.

Restaking enables staked $ETH to be used as cryptoeconomic security for protocols other than Ethereum, in exchange for protocol fees and rewards.

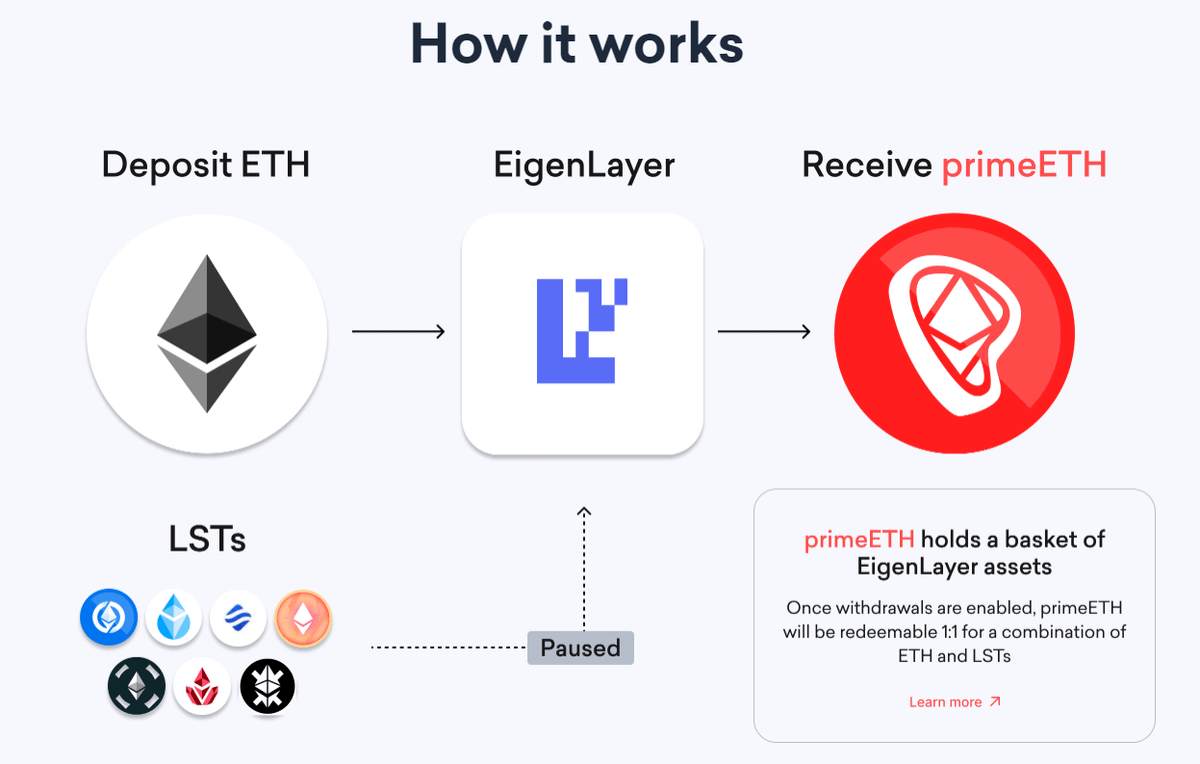

However, LST Restaked are locked & illiquid.

This is where LRT, Liquid Restaked Token, comes into play.

LRTs are receipt tokens to prove ownership of Restaked tokens.

Example: $primeETH by PrimeStaked.

By holding $primeETH you earn Staking & Restaking Rewards.

You can then use these tokens in DeFi to earn even more Yield

So if you understood correctly:

Instead of Restaking on EigenLayer and having your $ETH locked,

You can Liquid Restake your $ETH on PrimeStaked and use them in DeFi to earn more yield.

Your $ETH will still be Restaked on EigenLayer, via PrimeStaked.

In addition to participating to decentralization and earning yield, by using PrimeStaked you're also qualifying for some of the biggest Airdrops in 2024.

EigenLayer, first of all, and a PrimeStaked Airdrop as well.

✦ What's PrimeStaked

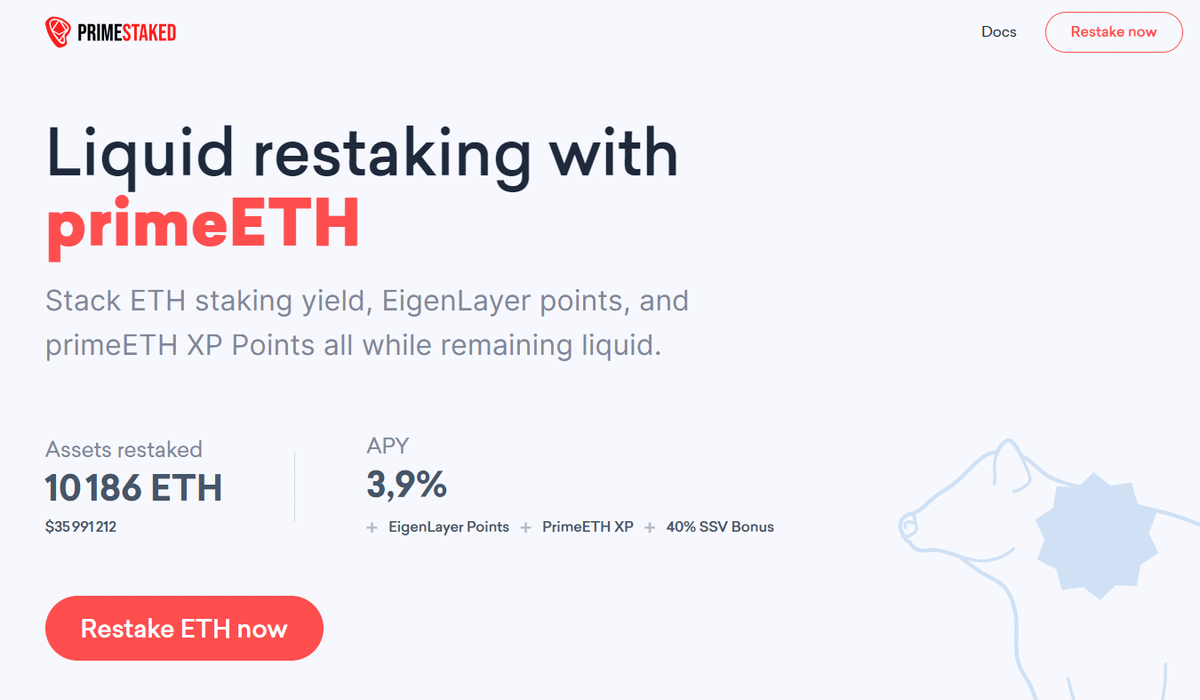

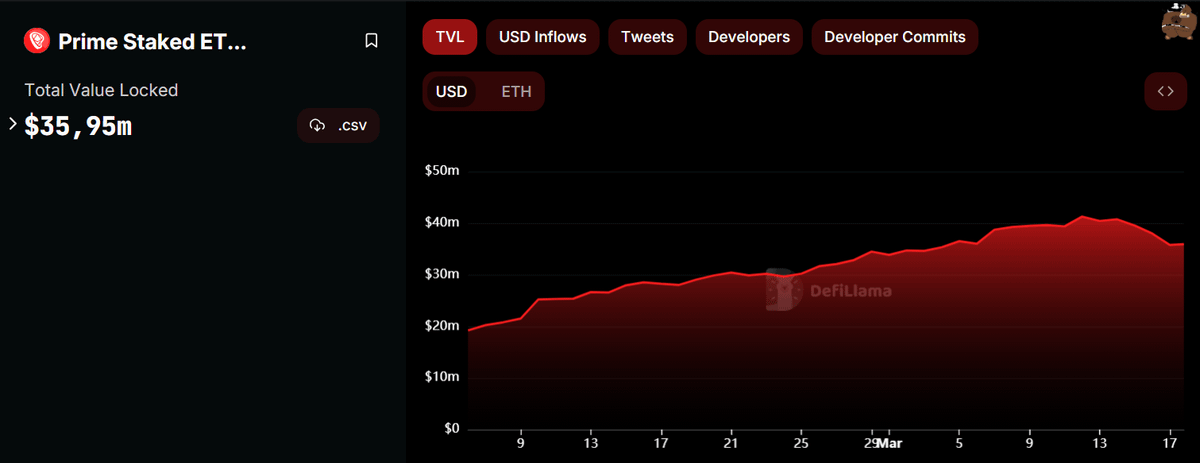

@PrimeStaked launched its LRT earlier this month to align with EigenLayer’s LST deposit window.

During the first 4 days of launch over 10,000 ETH assets were deposited to PrimeStaked.

Now, PrimeStaked is launching Native ETH restaking with new incentives.

What's Native ETH Restaking?

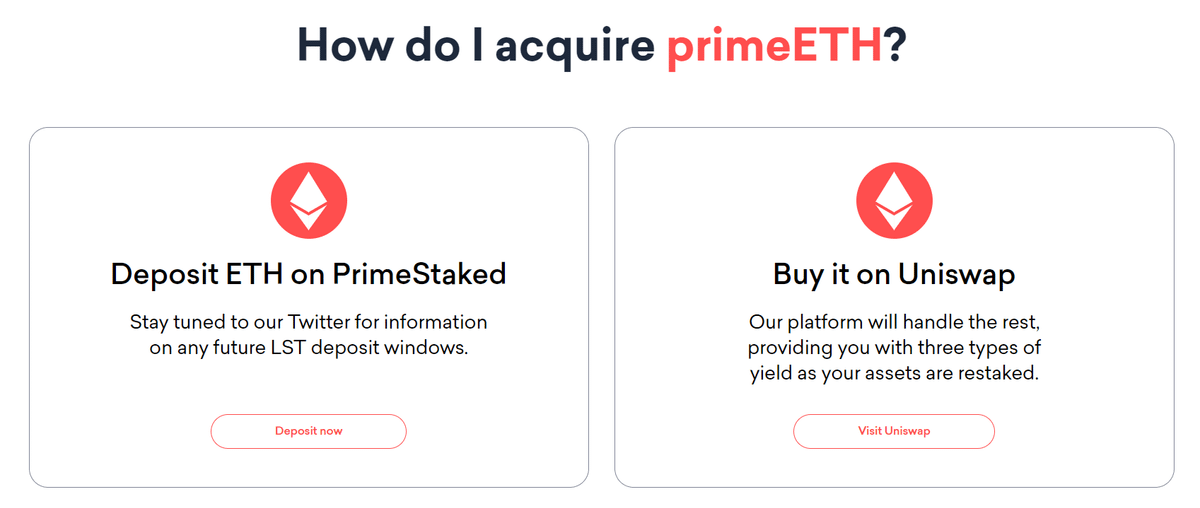

You can Liquid Restake $ETH directly on PrimeStaked without the need to go through an LST first.

Native Restaking allows users to earn EL Points regardless of EigenLayer caps, so you'll earn EL Points all the time your $ETH are Restaked.

PrimeStaked users enjoy higher staking yields than other LRTs, thanks to OETH being the primary LST deposited to PrimeStaked.

OETH earns higher than market yield as an LST aggregator.

OETH & PrimeStaked are both @OriginProtocol Products.

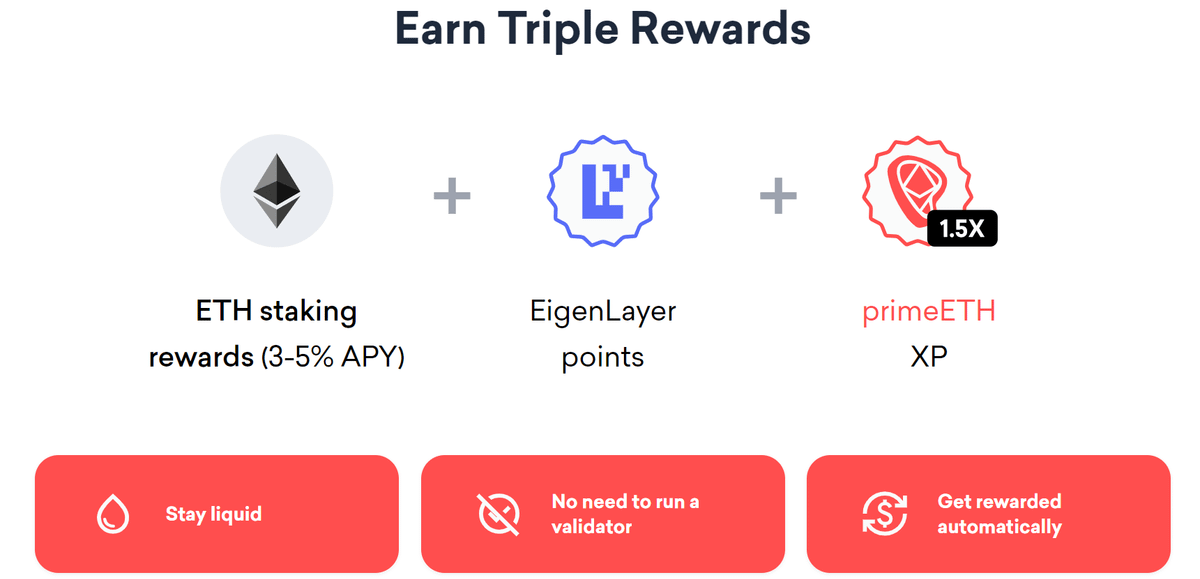

So primeETH holders continuously earn:

• EigenLayer points

• primeETH XP

• Staking Rewards

While keeping their assets liquid.

✦ Airdrop Opportunities

PrimeStaked Deposits are now open!

By depositing on PrimeStaked you're qualifying for EigenLayer Airdrop + PrimeStaked Airdrop.

With 1M EL Points for grab & 1.5x primeETH XP Bonus.

And today (03/18) the Eigen Bonus Week is starting.

twitter.com/PrimeStaked/status/1767265161876824362

This will be the highest per ETH offer for bonus Eigen Points.

• 4.20x EL Points on day 1

• Earn up to 156 EigenLayer Points per ETH Deposited, 5x more than other LRT Protocols

• More treasury EL points reserved for future campaigns

twitter.com/PrimeStaked/status/1768349007913333142

How to Participate ↓

Deposit ETH on PrimeStaked or Swap for primeETH to qualify for multiple airdrops, token rewards, and boost your EigenLayer airdrop: primestaked.com

✦ Conclusion

This Thread was made in collaboration with @PrimeStaked.

An underfarmed LRT Protocol with bigger rewards than other LRT Protocols.

And a potentially big Airdrop, because less diluted 👀

Airdrop Farmers & Restaking Enjoyers:

@0xFastLife

@DeFi_Taha

@Hercules_Defi

@eli5_defi

@wacy_time1

@CryptoGideon_

@Deebs_DeFi

@poopmandefi

@hmalviya9

@0xelonmoney

@0xAndrewMoh

@Slappjakke

@CryptoNikyous

@ayyyeandy

@0xCrypto_doctor

@arndxt_xo

@dontbuytops

@matrixthesun