I analyzed the top 10 crypto wallets to understand what they’re doing.

Here are the takeaways, insights, trends from the top 10 crypto wallets.

June Edition

I analyzed the top 10 wallets on DeBank to gain insights.

This thread contains an overview & takeaway from every single one of the top 10 wallets.

If you want to look at the common trends & holdings across all of them, skip to the end (link to substack version below)

2/

Some disclaimers.

• These are the top 10 wallets according to Debank’s ranking

• These only include ETH & EVM chains

• These wallets represent 1 hot wallet. Whales have multiple wallets & spread them out. This won’t include all their holdings.

3/

This may be easier to read as an article.

Here's the same thread on my substack

covduk.substack.com/p/i-analyzed-the-top-10-crypto-wallets

4/

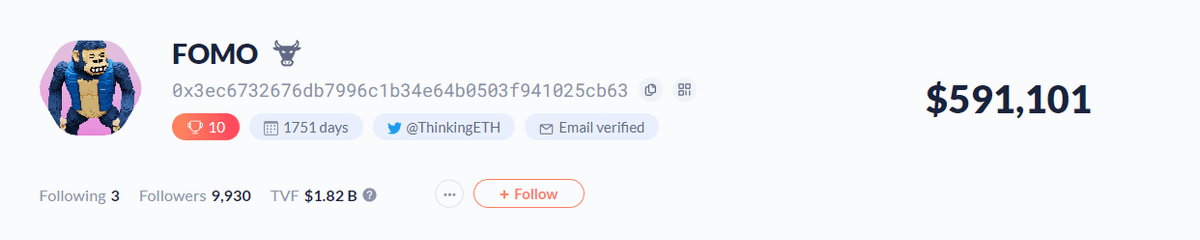

10. FOMO @ThinkingETH

• Wallet size: 590K

• NFT portfolio: 80K

Chain breakdown:

• 340K on ETH (58%)

• 239K on Optimism (41%)

Wallet holdings:

• sUSD - 230K

• CTX - 55K

Protocol Deposits:

1. Lido - $127K

• Staked 104 ETH

2. Temple DAO - $90k

• Staked 134K TEMPLE

5/

3. ETH2

• Staking - 32ETH

4. Euler - 11k

• lending 1.1k ENS

1. Synthetix - $5.3K

• supplied 2.5K SNX

• Borrowed 1.2K sUSD

2. Convex - $3.3K

• FXS + cvxFXS pool

3. Charm - $3K

• WBTC + USDC

6/

Takeaways:

• Primarily on ETH & Optimism ( betting on ETH ecosystem in this market)

• FOMO was primarily on Cronos & Aurora 1 & half months ago, now primarily on ETH.

• Stables heavy (liquid)

• Staking ETH ahead of ETH merge

debank.com/profile/0x3ec6732676db7996c1b34e64b0503f941025cb63

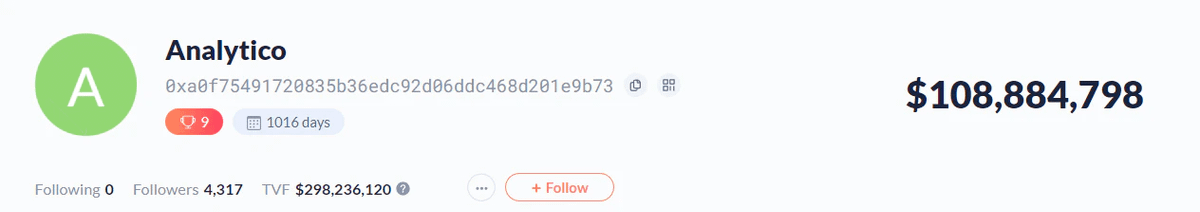

9. Analytico

Wallet Size: 108M

Chain Breakdown:

• 108M on ETH (100%)

Wallet Holdings

• USDC - $10.8M

• USDT - $7M

• ETH - $6.5M (5.2K ETH)

• rETH - $4.4M (4k rETH)

• WBTC - $1.07M (50 WBTC)

• WETH - $1.05M (853 WETH)

• FRAX - $690K

• SWISE - $400K

8/

Protocol Deposits

1. Maple Finance - $20.58M

• Farming USDC & ETH

2. Aave V2 - $17.79M

• Lending USDC (16M) & ETH (3.7k ETH)

• Borrowing $3M sUSD

• Staked Aave

3. Convex - $14.9M

• ETH + stETH ($12.4M)

• CRV + cvxCRV ($637K)

• cvxCRV ($15.7K)

• Locked CVX ($1.8M)

9

4. Bancor - $5.4M

• DAI + USDT + USDC

5. ANKR - $4.66M

• Staked ankrETH

6. Alchemix V2 - $3.43M

• Staked alUSD

7. Saddle - $2.9M

• Farming sUSD + DAI + USDC + USDT

• tBTC + WBTC + renBTC + sBTC

8. RAILGUN - $2.6M

• Staked RAIL

10/

9. Uniswap V3 - $1.6M

• LP rETH2 + sETH2

• LP ETH + sETH2

10. Armor - 979K

• arNXM + ETH

Takeaways:

• All in ETH

• Wallet has large amount of stables (~18M). Stables are diversified (USDC, USDT, FRAX)

• Big in blue chip defi protocols (Convex, Aave)

11/

Takeaways

• Holding & staking large amounts of ETH

• Primarily earning yield on stables & ETH

• Seems to be playing it safe & staying liquid while earning yield on low risk plays. Must be looking to buy huge positions at a discount soon.

debank.com/profile/0xa0f75491720835b36edc92d06ddc468d201e9b73

12/

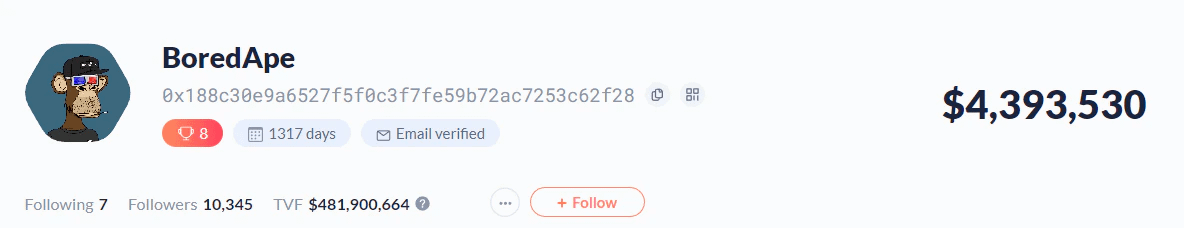

8. BoredApe

Wallet size - $4.3M

Chain breakdown:

• $4M on ETH (91%)

• $153K on Arbitrum (4%)

• $129K on Avax (3%)

• $80.7K on Optimism (2%)

Wallet Holdings ($4M)

• USDC - $3.2M

• ETH - $441K (328 eth)

• APE - $111K

• XMON - $87K

• PAXG - $85K

13/

Deposits:

1. GMX - $156K

• Staked GLP, GMX, esGMX

2. Aave V3 - 88K

• supplied WAVAX

3. Uniswap V3 - 52K

• LP WETH + USDC

4. Hop Protocol - 24k

• LP WETH + hETH

5. 0xmons - 11K

• XMON + ETH

6. LooksRare - $10K

• LOOKS

7. TreasureDAO - $10K

• Staked MAGIC

14/

8. Curve - $8.9K

• locked CRV

Takeaways:

• Primarily on ETH

• Stables heavy ( holding & farming them)

• Primarily just holding assets. Most assets are in the wallet (4M/4.3M in wallet)

debank.com/profile/0x188c30e9a6527f5f0c3f7fe59b72ac7253c62f28

15/

7. fewture

Wallet size - $1.29M

Chain breakdown

• 991K on ETH (77%)

• 300K on Optimism (23%)

Wallet holdings ($42.6K)

• ETH - $25K (20 ETH)

• AGLD - $4.6K

• OP - $4.3K (7.3K IOP)

• ETH on OP - $2.5K (2 ETH)

• WETH on OP - $1.2K

• SDL - 1K

16/

Protocol deposits

1. Curve - $433K

• Locked CRV

• LP DAI + USDC + USDT

2. Convex - $356K

• Staked CRV + cvxCRV & cvxCRV

• Locked CVX

3. Synthetix - $203K

• Supplied SNX

• Borrowed sUSD

4. SharedStake - $166K

• Staked 135 ETH

debank.com/profile/0x1d5e65a087ebc3d03a294412e46ce5d6882969f4/nft

17/

Takeaways:

• Primarily on ETH & OP

• primarily in stables, ETH & blue chip protocols like convex

• Earning yield on stables

• Playing it safe.

• Fewture seems to like ETH & ETH L2s a lot. Even the last time I looked over this profile, it was heavily in ETH & OP.

18/

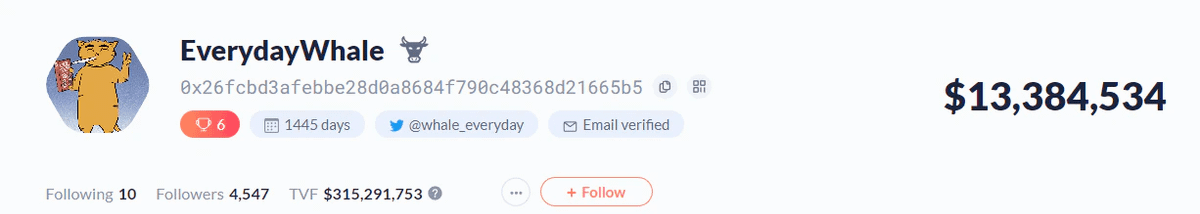

6. EverydayWhale @whale_everyday

Wallet size: $13.3M

NFTs Net Worth: $266,738

Chain breakdown:

• $12.3M on ETH (92%)

• $484K on polygon (4%)

• $231K on BSC (2%)

• $225K on FTM (2%)

Wallet holdings - $1.26M

• WBTC - $904K (42 WBTC)

• MKR - $81K

debank.com/profile/0x26fcbd3afebbe28d0a8684f790c48368d21665b5

• WBTC on OP, polygon, Arbitrum - $42K on each

• WETH - $38K (31K WETH)

• BADGER - ($24K)

Protocol Deposits:

1. Maker - $5.1M

• Supplied wstETH

• Borrowed DAI

2. BadgerDAO - $3M

• earning yield on ibBTC + renBTC + WBTC + sBTC, BADGER, CVX, DIGG

20/

3. Uniswap V3 - $1.8M

• WBTC + USDC

• rETH + ETH

• ETH + CRV

• CVX + ETH

• 1INCH + ETH

• & more

4. Babylon Finance - 433K

• Staked ETH & BABL

5. Aave - 334K

• supplied ETH, UNI, YFI, LINK

• Borrowed USDT

6. Ellipsis - 230K

• farming BTCB + renBTC

• Locked EPX

7. Curve - 430K

• farming BTC + renBTC ( on fantom)

• LP WBTC + renBTC (on polygon)

8. Balancer - 430K

• LP WBTC + renBTC ( on polygon)

• LP WBTC + renBTC + sBTC

Takeaways:

• Primarily on ETH

• Lots of WBTC

• Farming eth, btc & stables and eth & BTC backed assets

22

5. Miyazaki @miyazakiweb3

Wallet size: $2.9M

Chain breakdown

• $1.6M on Polygon (55%)

• $940K on Fantom (32%)

• $244K on Cronos (8%)

• $98K on ETH (3%)

• $20k on Metis (1%)

Wallet- $118K

• USDC - $55K

• ETH - $43K (34 eth)

• Qi - 17K

debank.com/profile/0xdb9d281c3d29baa9587f5dac99dd982156913913

23/

Protocol deposits:

1. QiDAO - $806K

• Locked Qi

2. Giddy - 761K

• Farming DAI

3. Beefy - $900K

• Farming beFTM & BIFI (on FTM)

• Farming BIFI (on Cronos)

4. SpookySwap - 216K

• farming WFTM + beFTM

• Beethoven X - $75K

• farming WFTM + beFTM

24/

Takeaways

• Primarily on Polygon & Fantom

• When I analyzed Miyazaki’s wallet in April, the wallet was heavy in Fantom (85%) & had 17% of the portfolio is Polygon.

While still mainly in FTM & polygon, the breakdown changed to 45% & 55% respectively.

• Big on QiDAO

25/

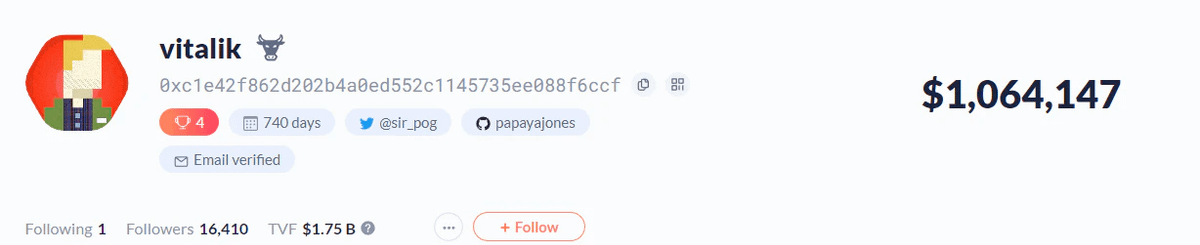

4. vitalik @sir_pog

Wallet size: $1.06M

Chain breakdown:

• $874K on ETH (82%)

• $157K on Arbitrum (15%)

• $31K on Optimism (3%)

Wallet Holdings - $60K

• MAGIC - $42K

• HOP - $8K

• sUSD (on OP) - 6.9K

• MATIC - $686

26/

Protocol Deposits:

1. Convex - 635K

• Staked rETH + wstETH

• locked CVX

2. Inverse - 143K

• Supplied WBTC, ETH, SUSHI, YFI

• Borrowed WBTC

3. GMX - $71.8K

• staked GLP, esGMX

4. Llama Airforce Union - $43K

• yield on FXS + cvxFXS & cvxCRV

27/

5. TreasureDAO - 37K

• staked MAGIC

6. Synthetix (on OP) - 23.7K

• Lending SNX

• Borrowing sUSD

7. LIDO - 23.6K

• Staked stETH

8. Rari Capital

• lending MATIC

28/

Takeaways:

• Primarily on the ETH ecosystem

• Holding large position of MAGIC

• Staking ETH & eth backed coins

• There haven’t been too many changes since my last analysis in April

debank.com/profile/0xc1e42f862d202b4a0ed552c1145735ee088f6ccf

29/

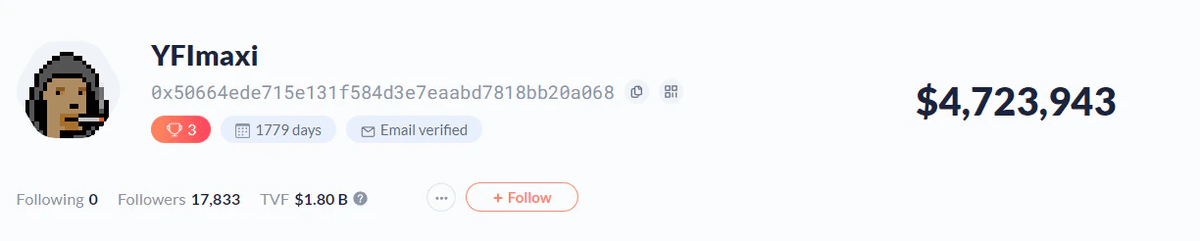

3. YFImaxi

Wallet size: $4.7M

Chain breakdown:

• 4.05M on Eth (86%)

• 307K on Harmony (7%)

• 90k on DFK (2%)

• 87k on Polygon (2%)

Wallet holdings - 3M

• LDO - 1.028M

• ETH - $272K (223 ETH)

• 1USDC - $248K

• FRAX - $215K

• SYN - $141K

• WETH - $138K

• XMON

30/

Protocol Deposits:

1. Across V2 - $490K

• LP ETH (400 ETH)

2. Balancer V2 - $468K

• Farming LDO + ETH

3. Fixedforex - $413K

• locked KP3R

4. Curve - 138K

• Locked CRV

5. GMX - 72K

• staked GMX

6. DeFi Kingdoms - 71K

• Farming CRYSTAL + AVAX, CRYSTAL + USDC

31/

Takeaways:

• Primarily on ETH

• Has a p big position in Harmony (7% of wallet)

• Lots of ETH staking & big position of LDO

• Haven’t been too many changes since my last analysis

debank.com/profile/0x50664ede715e131f584d3e7eaabd7818bb20a068

32/

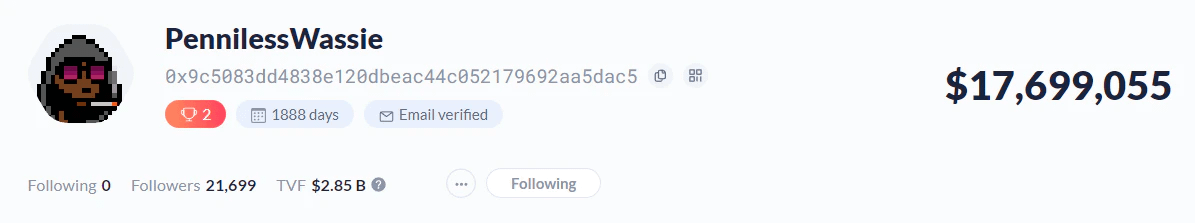

2. PennilessWassie

Wallet size: $17. 7M

Chain breakdown:

• 17M on ETH (96%)

• 400K on Arbitrum (2%)

• $258 (1%)

Wallet Holdings - $83K

• sUSD (OP) - 39K

• sUSD - 37K

Protocol Deposits:

1. Frax - $6.7M

• FXS locked

• farming FXS + FRAX

debank.com/profile/0x9c5083dd4838e120dbeac44c052179692aa5dac5

33/

1. Convex - 5.06M

• locked CVX

• PUSd + DAI + USDC + USDT

2. Liquidity - 3.09M

• lending ETH (3K eth)

• borrowed LUSD

• farming LUSD

• Staked LQTY

3. Curve - 1.67M

• Locked CRV

4. Vesta Finance - $384K

• supplied gOHM

• borrowed VST

34/

5. Synthetix - $430K

• lending SNX

• borrowed sUSD

Takeaways:

• Primarily on ETH (96% of wallet)

• Most of the wallet is being put to work (17.6M are deposited in various protocols)

• Big on Frax ( 5.5M locked in FRAX)

• Farming stables on blue chip platforms

35/

1. Ethereum @bizyugo

Wallet Size: $21.5M

Chain breakdown:

• $9.8M on Eth (46%)

• $9.4M on Avalanche (44%)

• $1.16M on Arbitrum (5%)

• $600k on BSC (3%)

• $375K on fantom (2%)

Wallet holdings - $811K

• VOLT - 332K

• BIT - 46K

• SHIB - 43K

• BNB - 41K

• WXT - 38K

36/

Deposits:

1. Yeti Finance - $3.57M

• Farming YUSD + USDC + USDt, YUSD & YETI

• lent WBTC.e , USDC

• borrowed YUSD

2. Vector - $2.85M

• farming USDC, USDT, YUSD, USDt + WAVAX, WAVAX

3. Aave V3 - $2.57M

• Lent WBTC.e, WAVAX, LINK, AAVE, USDT

• Borrowed USDC

37

4. Convex - $2.4M

• staked USDT + WBTC + ETH, ETH + CVX, Silo + FRAX, ETH + CRV

• Locked CRV

5. Aave - $1.2M

• Supplied LINK, WBTC, REN UNI, SNX, CRV

• Borrowed USDC

6. Liquidity - $873K

• Farming LUSD

• supplied ETH

• Borrowed LUSD

3. Maple - $804K

• farming USDC

Takeaways:

• Primarily on ETH (46% of wallet) & AVAX (44% of wallet)

• Large positions in a bunch of alt coins

• Putting stables to work. Borrowing farming them on various protocols

• Back in April, this wallet had 20% in fantom. Now it’s only 2%

debank.com/profile/0xbdfa4f4492dd7b7cf211209c4791af8d52bf5c50

Overall Takeaways & trends

1. Ethereum is the chain of choice.

In April, when I looked over the top 10 wallets, the chain of choice ( where they’ve a majority) was distributed.

6/10 wallets were primarily on ETH. But wallets had sizeable positions on different chains.

40/

Things are looking different now.

9/10 wallets are primarily on Eth. Additionally, these whales have significantly increased their holdings of Arbitrum & Optimism.

In this bear market, ETH seems to be what everyone trusts. In the last cycle, a lot of ETH killers came up.

But now, everyone is moving to ETH.

The ETH killer narrative may die with this cycle & only ETH & a few other L1s may survive.

42/

Increase in Eth L2s

I’ve noticed an increase in ETH L2s. A lot of these whales now have positions in Optimism & Arbitrum.

4/10 wallets have positions on Optimism. #10 wallet FOMO has 41% of assets on OP. #7 wallet Fewture has 23% of assets on OP.

43/

4/10 wallets have positions on Arbitrum. #4 Wallet Vitalik has 15% of assets on Arbitrum

With ETH being everyone’s pick in the bear market, it makes sense that ETH L2s are gaining more attention.

Additionally, there seems to be a narrative shift to ETH L2s.

44/

3. Less Fantom

In April, an interesting observation was that 6/10 wallets had position on fantom.

Now, there isn’t as much fantom. Only 3/10 wallets have position in Fantom.

Of these 3, two wallets only have 2% of their portfolio in Fantom.

45/

However, #5 Miyazaki is still big on Fantom.

In April, 85% of Miyazaki’s portfolio was on Fantom. Now, 32% of the wallet is on Fantom.

Overall, there is definetely a lot less Fantom.

46/

4. Stablecoins

All of the wallets have significant stablecoin holdings. A large portion of each wallet is in stablecoins.

This is presumably to be liquid & earn low risk yield.

When the dust settles, these guys will likely get great discount

47/

Being liquid is key for anyone - Whale or not.

Stables are a great way to do this.

These guys are also diversified in their stables, the most popular being USDC, USDT, FRAX

48/

5. Top Tier protocols.

Most of the whales are almost solely in the top tier defi protocols ( Aave, Curve, etc). This is to minimize risk of the protocol blowing up & earn some yield.

In April, I saw some more degen stuff.

49/

6. ETH staking

In anticipation of the merge, every whale is holding & staking ETH.

Common plays:

• Lido staking

• Rocketpool

• Maximizing yield through putting staking rewards on Curve

While eth staking was prevalent last month as well, it has increased significantly.

50/

If you want to read my top 10 analysis from April, here it is:

covduk.medium.com/i-analyzed-the-top-10-crypto-wallets-here-are-the-insights-takeaways-bffdecac3005

Disclaimer: things have changed since!

And that's it. Hope top 10 wallet analysis was insightful!

• Pls give this a retweet (took a long time 😩)

• Follow me @Cov_duk

• Read this & follow me on my substack covduk.substack.com/