It's time for pre-seed startup valuations for Q1 2023. Thousands of startups applied to @HustleFundVC this quarter, and we want to share it with all of you.

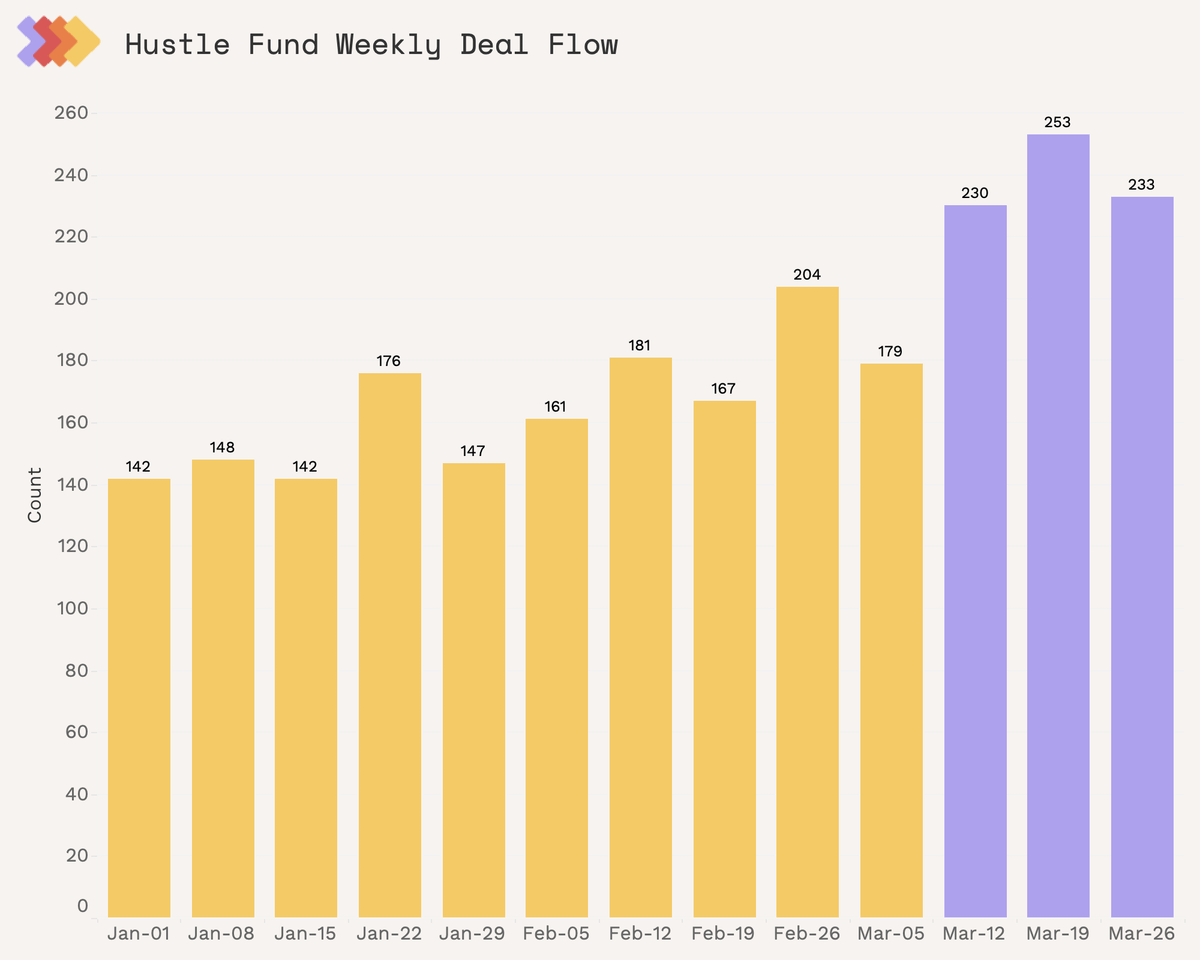

First interesting tidbit – we have seen a pretty significant uptick in volume. In March, we had 1k deal submissions!

Also of note – the increase was mostly post SVB.

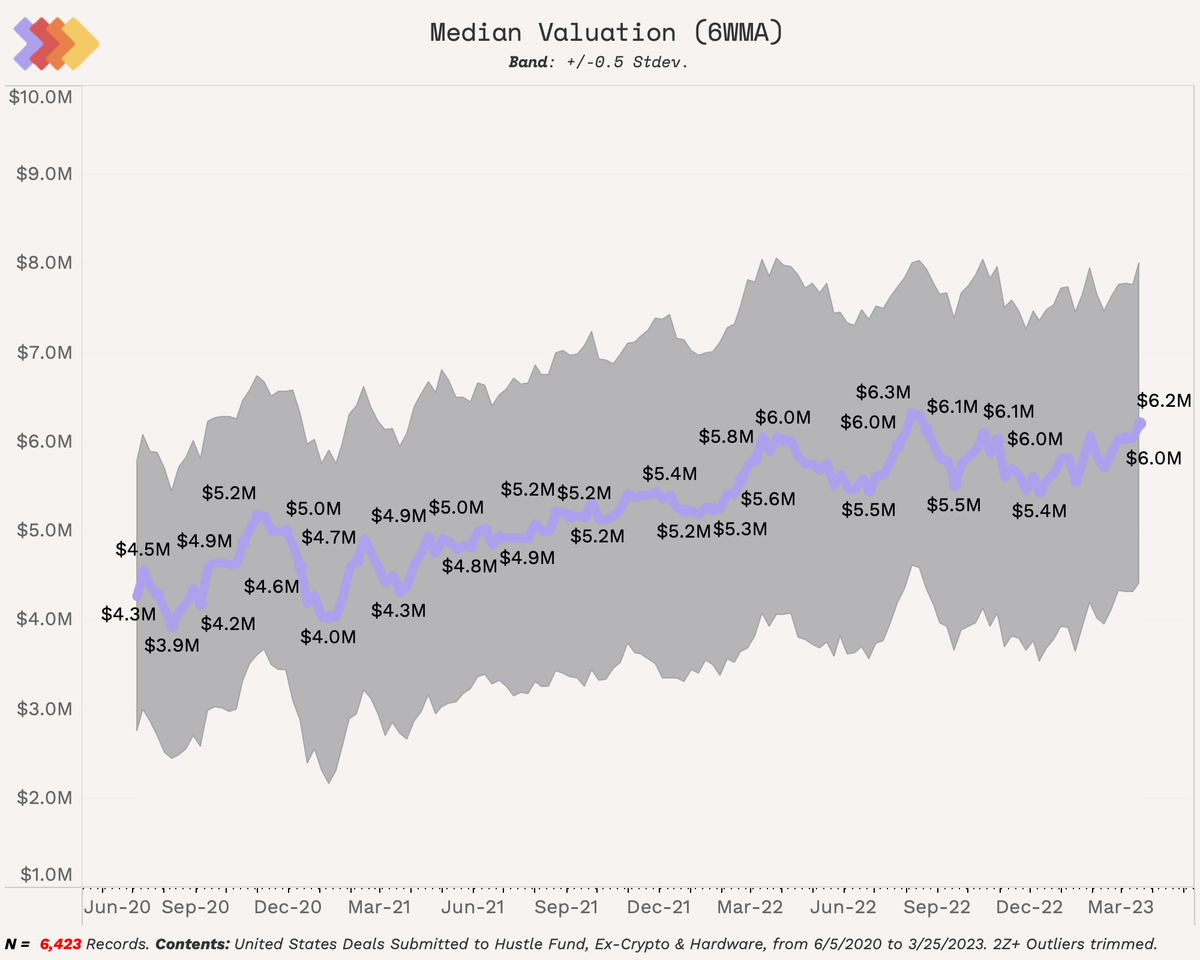

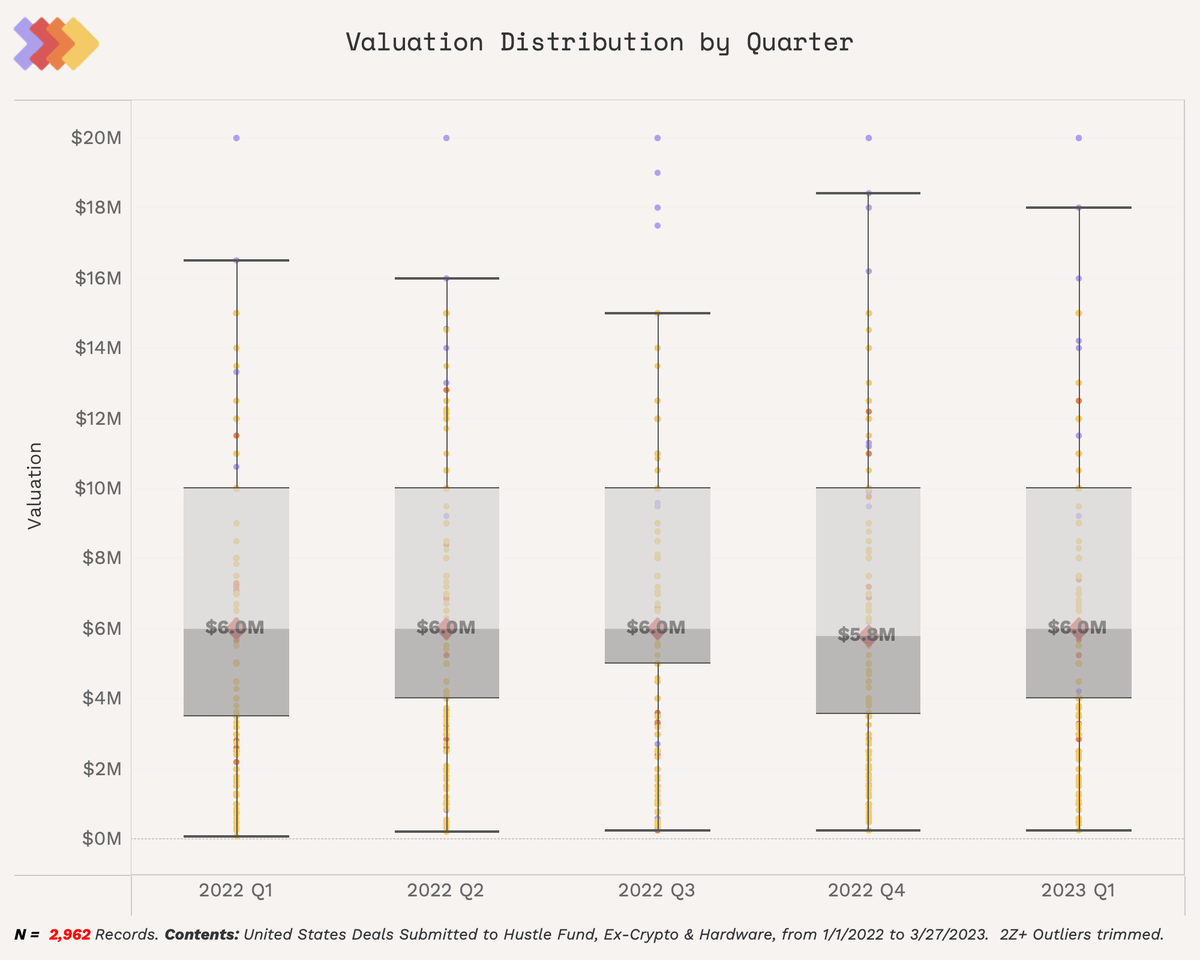

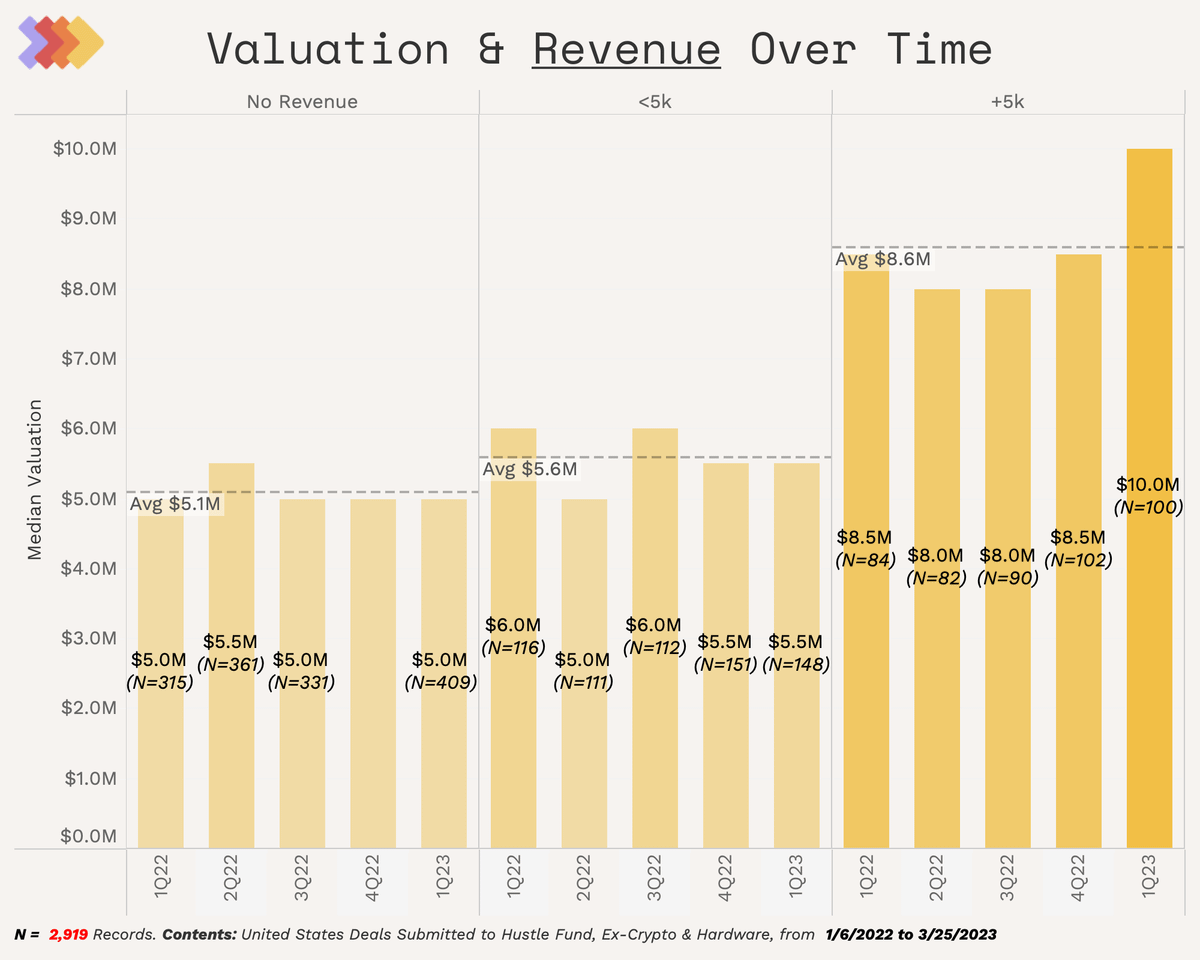

In terms of overall valuation trends, we have seen a general rebound vs 4Q22 - median pre-seed valuations are again firmly above $6M USD

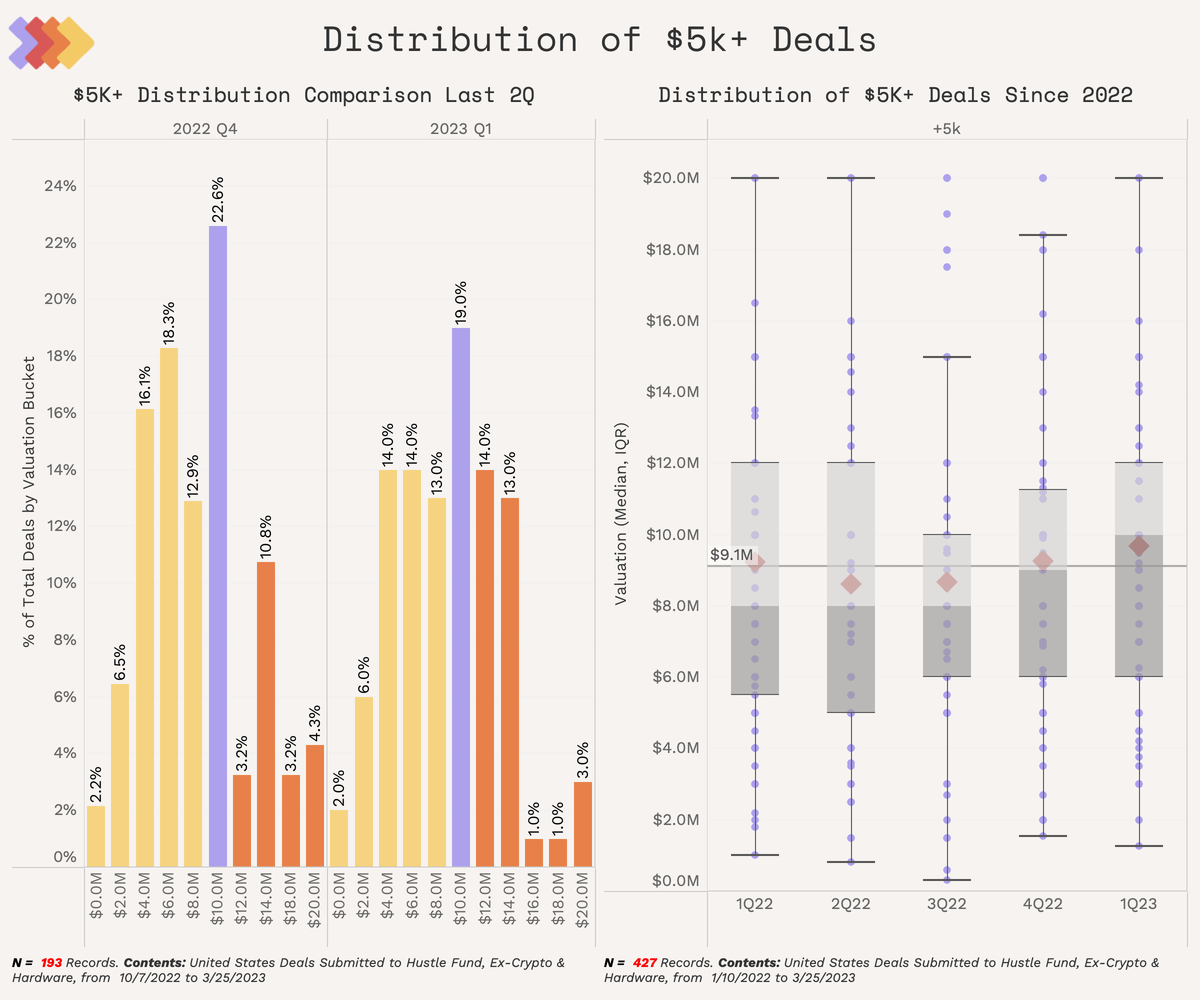

However, the increased variation in valuations we saw in 4Q222 persists - especially to the upside. Valuation is sometimes just as much about what you can get as where you are.

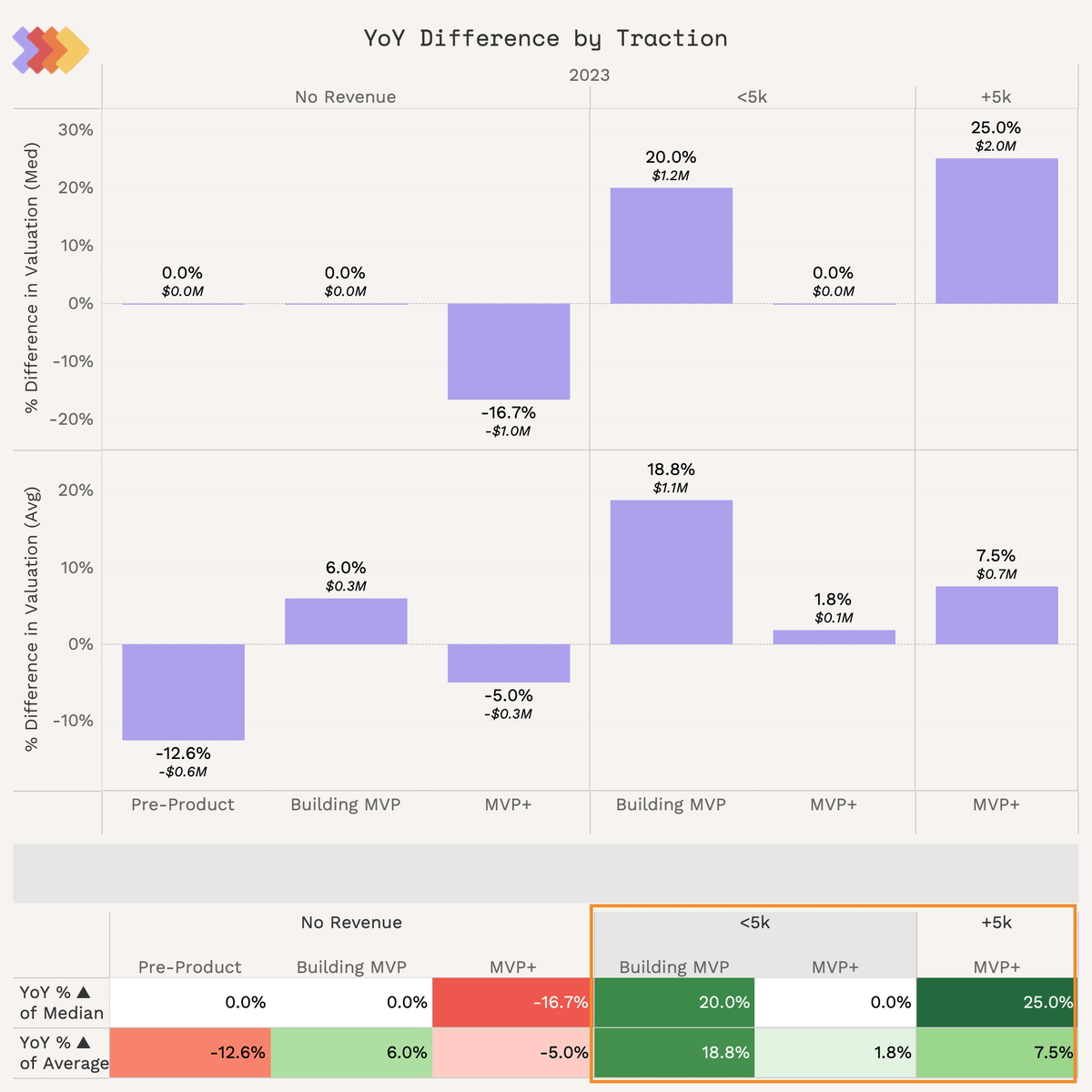

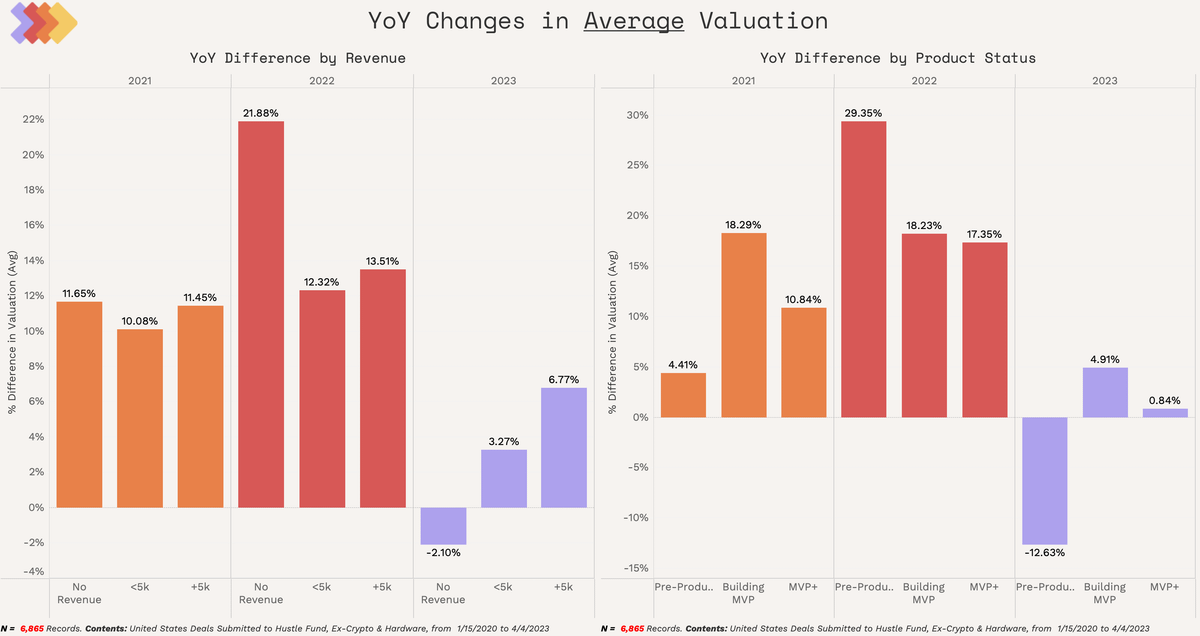

What's driving the rebound? A flight to quality. Startups with higher revenue (and, to a lesser extent, product) are seeing higher valuations, while startups with less traction are seeing declines.

This premium for traction is in pretty stark contrast to the YoY changes we have seen in 2021 and 2022.

One of the more interesting changes is for startups with $5K+ MRR. This cohort saw a valuation increase of $1.5M - one of the highest I've seen.

This big change is driven by a holistic shift in valuations for the cohort - In math terms - We have seen more outlier startups at the higher end of the valuation spectrum (AKA more startups in Orange on the left graph, and Avg<Median in the right graph.)

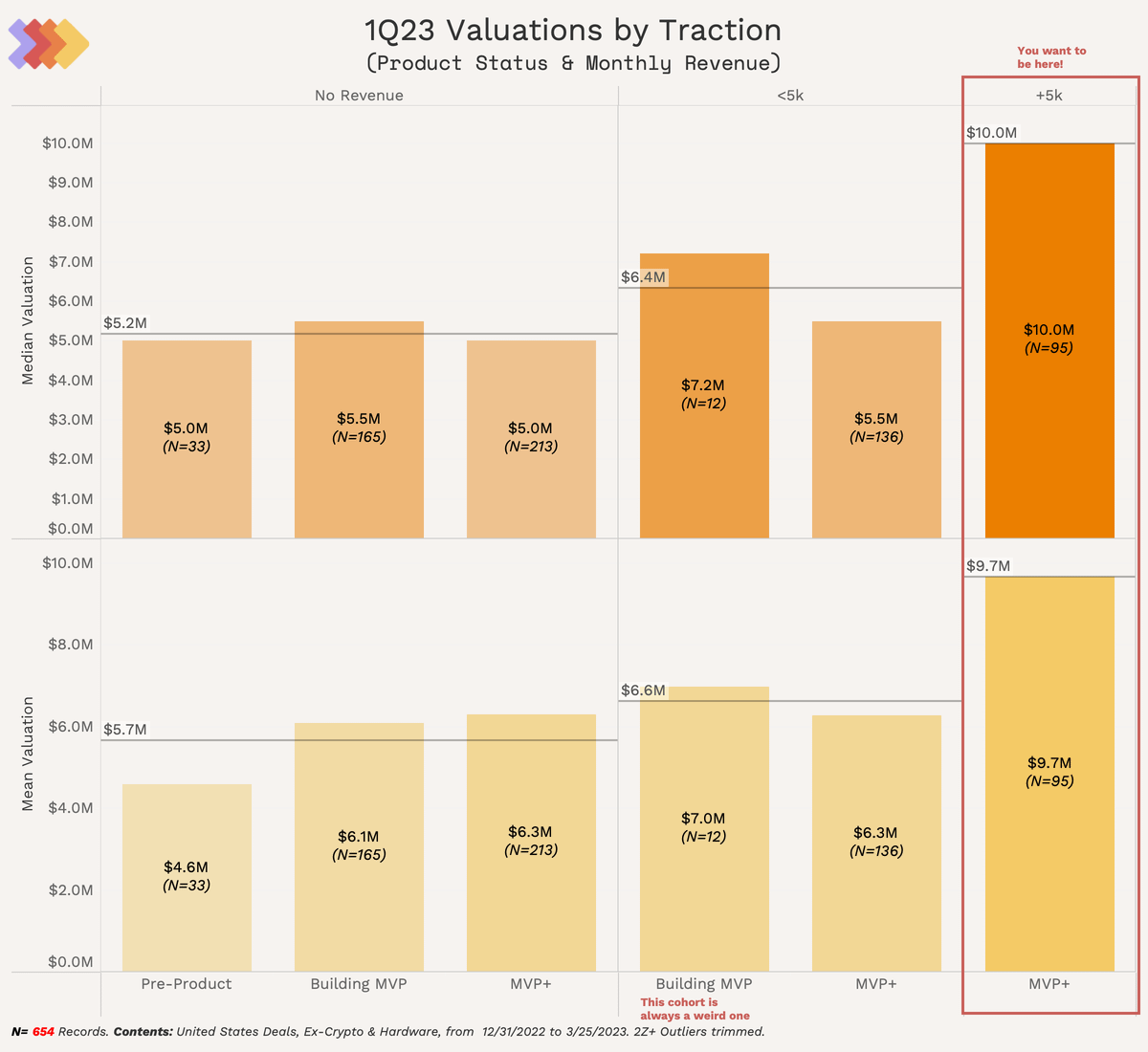

So where does that leave our rough benchmarks for valuation based on traction? With a significant premium on valuations for startups with $5k+ MRR! Definitely, something founders should keep in mind

As always - Would love to hear your questions, thoughts, and feedback. I would also love to hear what you use!

You can read the unrolled version of this thread here: typefully.com/will_bricker/D4T178q