Beginner's guide to stock market investing.

A thread...

In this thread I will cover:

1. Difference between investing and trading

2. Prerequisites for stock market investing

3. Understanding your risk profile

4. Where to invest basis your risk profile

5. Risks involved

Investing is when you buy stocks of a company (or a portfolio of stocks) and take "delivery" of them.

Which means you wish to keep them for the long term and not necessarily sell them right away.

Trading is different.

Trading is when you bet on the price movements of a stock and thus buy/sell (usually) within the same day itself.

It is:

1. Highly technical

2. Research/model driven

3. Not recommended for a beginner

Delivery is a great way to get started on your long-term investing journey.

And if done in a way that understands your risk profile, it can be an immensely rewarding journey.

Pre-requisites for starting your investing journey:

1. PAN Card (for tax identification)

2. Brokerage account (for buying/selling)

3. DEMAT account (for storing your stocks)

Eligibility:

1. Anyone of any age can apply for a PAN card.

2. However, for Brokerage/Demat account...

...one needs to be above 18 years of age.

Note:

1. Demat account can be opened in the name of a minor.

The account will however be operated by a guardian till the minor becomes major.

2. Brokerage account can also be opened, but no buying/selling.

sebi.gov.in/sebi_data/faqfiles/may-2019/1558004460882.pdf

I use Zerodha as my Brokerage and Demat account (not a promoted post)

zerodha.com/open-account?c=ZMPHCY

PS: If you use this link to sign up, I get an affiliate fee, 100% of which is used to sponsor the education of kids who cannot afford it. Last year, 53 kids received Rs. 36L.

Understanding your risk profile

Your risk profile is essentially the amount of risk you are comfortable taking, while investing in the stock market.

There are 3 parts to it:

1. The stock market goes up and down, a LOT!

On a daily/weekly/monthly/quarterly/yearly basis - your stock investments will go up and down, which could be unsettling for you.

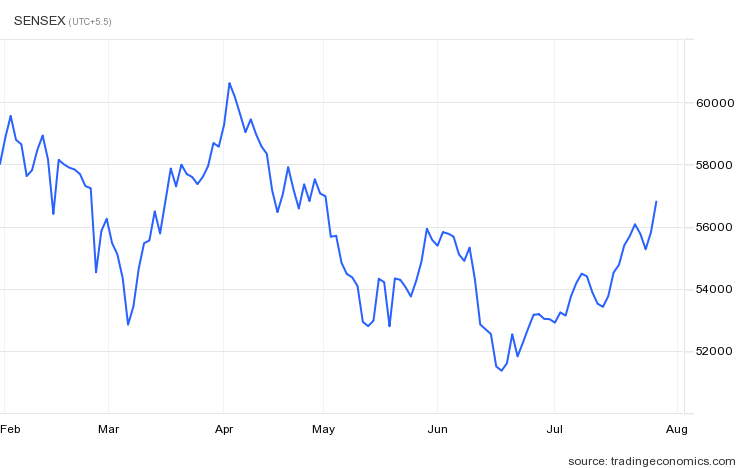

This is BSE for last 6mths

What does this graph mean?

That if you invested Rs. 100 in the Sensex on 2nd Feb, it would become Rs. 89 on 7th Mar, jump back to Rs. 102 by 4th April and today would be Rs. 96!

That is a LOT of movement in just 6 months.

Not easy for everyone to digest.

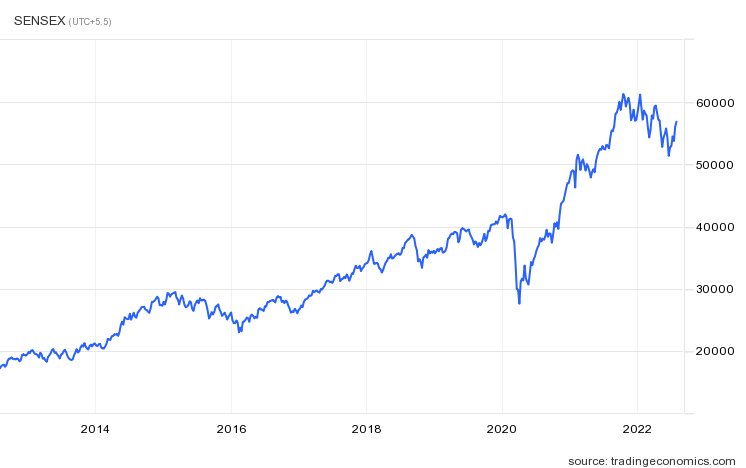

However, the same Sensex over 10 years would show a different story.

This says if I invested Rs. 100 in the Sensex in July 2012, I would have Rs. 331 today!

Same money in

FD: Rs. 179

Gold: Rs. 187

Not too bad, huh?

2. Ok, so the market goes up and down - does this mean you do not invest? NO!

It means you need to have a long-term horizon to investing.

A good approach for this is called the 100-X rule

If you are aged X, then (100-X)% of the monthly amount you invest, should be invested in the stock market (for the long term)

So if you are 25, you should invest 75% of your monthly investable amount in the stock market.

3. Do not reduce the money you invest in the stock market. Instead, change the way you invest in the stock market.

This is important.

Most people who are not comfortable with risk, reduce the amount they invest in the stock market.

That is the wrong approach.

If you are risk averse, you need to invest in such a way that the ups and downs of the stock market are minimal (called low volatility or low beta).

Not reduce the amount invested in the stock market.

Mid-way summary:

1. Stock markets WILL go up and down

2. But over long term deliver much better results than other investments

3. So if you do not like the risk, please don't reduce the amount you invest in stock market. Instead, change the way you invest in the stock market.

How do you change the way you invest according to your risk profile?

To make it simple, pick one of the 3 risk profiles

1. Low risk (I do not want a lot of ups and down, and for that I am ok with lower returns - around 11-12% annually, as against 5% FD)

2. Medium risk (ok with medium ups/downs, to get slightly better returns - around 13-15% annually)

3. High risk (ok with ups/downs as long as I get the best returns - around 15-18% annually)

These small percentages changes make a huge difference

1L invested for 20 years at 12% = ~8L

1L invested for 20 years at 15% = ~16L

1L invested for 20 years at 18% = ~32L

But the one getting 18% might see their value go down massively, before it rises up again.

Irrespective of your risk profile, a good way to enter the stock market is buying a portfolio of stocks (usually called Mutual Funds)

Buying individual stocks requires a lot of research, analysis, time, which a beginner may not have.

The stock market is divided broadly into 3 types of companies, based on their size.

Large Cap companies: Those valued at upwards of Rs. 20,000 Crores

Mid Cap companies: Between Rs. 5,000-20,000 Crores

Small Cap companies: Less than Rs. 5,000 Crores

How does this matter?

Large cap companies are far more stable, thus tend to not go up/down a lot.

However, because they are big, they tend to not grow as fast (in % terms).

Midcap companies: relatively more up and down, relatively better returns

Smallcap: significant ups/downs; better returns

Good news is that there are Mutual Funds for each of these segments

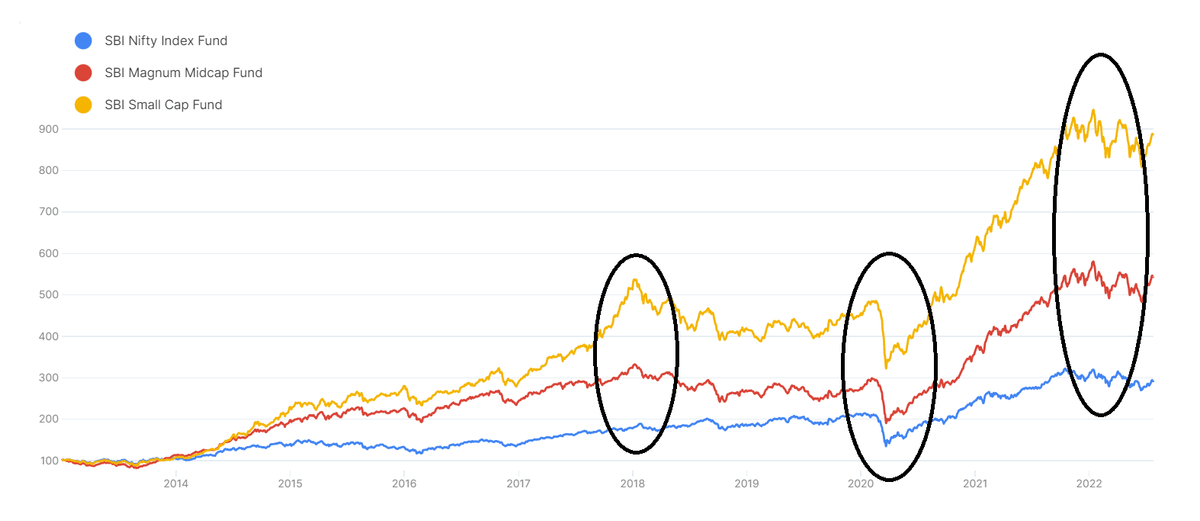

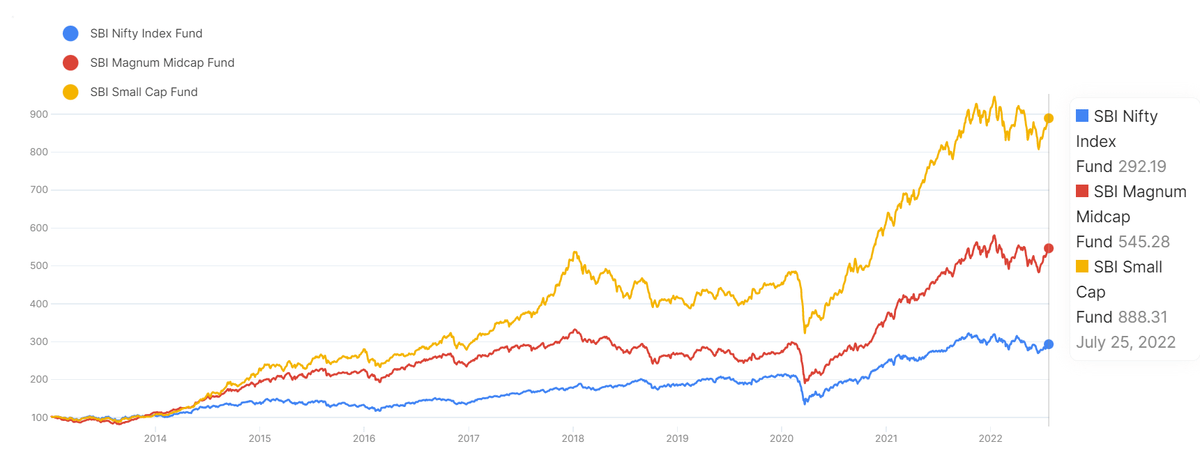

Ex: SBI Mutual Funds for all 3 (not promoted post)

Notice how when the market rises and falls, the large cap moves the least and small cap moves the most.

However, over a long period of time, small cap delivers more returns, while large cap delivers relatively lower.

Rs. 100 invested in 2013 would be today:

Large Cap: Rs. 292

Mid Cap: Rs. 545

Small Cap: Rs. 888

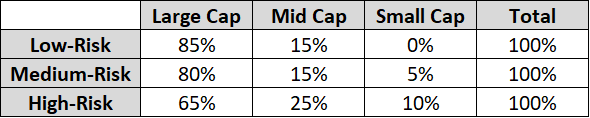

So depending on your risk profile, here is what I would suggest as the mix of your stock market investing.

What this approach ensures?

1. Relying on experts (Mutual Fund managers)

2. Done in the most economical manner (Index Mutual Funds are mostly low cost)

3. Manages your risk, while delivering returns

What are the risks involved in stock market investing?

1. Short term risk

If you wish to invest for less than 5 years, this may not be the right approach, because the market might give you poor returns

For ex: Rs. 100 invested in Sensex in 2017, would still be Rs. 100 in 2020!

2. You need stable income to invest

One-off or lumpsum investing might not work, basis when you invested.

Regular (ideally monthly investing, otherwise called SIP) ensures you average out the highs/lows of the market

3. Before you invest, ensure you have

> Emergency fund of min 6+mths and ideally 12mths

> Health Insurance for you and your family

> Life Insurance, for all earning members of the family

I hope this was useful.

If I missed out on anything, please point it out.

If you found it useful, please retweet the start of the thread so that it can reach as many people as you think it should.

Every Friday I write a thread on personal growth, failures, startups, organization building and more.

You can follow me on @warikoo to get them on your feed.

Here is a list of all the 100+ threads I have written

twitter.com/warikoo/status/1300042004810944513