You must've seen 200-300% (or higher) trades posted here on CT, and I bet at some point you thought of giving it a go, because it almost seems too easy, right?

This brings up a valid question, which one is better, trading options or leveraging?

Both ways are riskier than just holding the asset itself and waiting for it to appreciate in value, but they also offer the ability of “shorting” assets or basically to bet they’re going down.

Unfortunately, to answer this is a bit more complex than just choosing one over the other, and we will need to understand a bit of how both strategies work, and the pros and cons of each, this is why I’m writing this thread but don’t worry, I promise I won’t make it boring.

Leveraging:

Leveraging lets you borrow money from the protocol and use that to trade, either boosting your profits or losses, and here is where the danger lies.

Profits can turn into losses and sometimes make you in debt with the protocol itself.

On gTrade for example, you can leverage your capital up to 150x, meaning that by depositing $100 you can trade with $15000!

This is good for traders with low capital, giving them more exposure to market movements and if executed correctly, can make a lot of money from it.

Unfortunately, we’ve seen plenty of study cases worldwide showing some truly remarkable data exposing that less than 20% of day traders are profitable after 1 year and from that number, only 3% make more than minimum wage.

So for you to become a profitable trader, you need time, knowledge, and emotional discipline.

I’m sorry to break it to you, but just buying a course won’t give you all the knowledge and know-how you need to be a good trader.

Options:

I talk a lot about options, so before sounding like a maxi, I wanna say that options aren't the superior strategy here.

options trading requires an understanding of not only the underlying asset but also of options themselves

twitter.com/vincesector/status/1566089601164447746

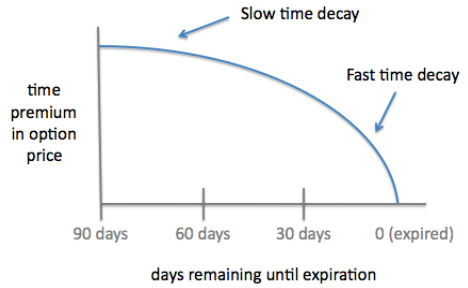

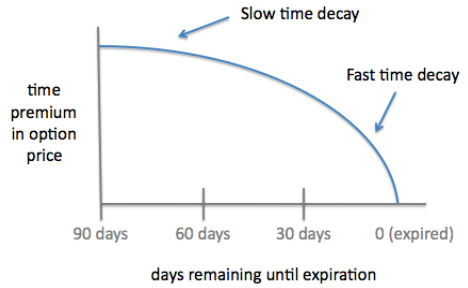

When buying options, time is never your friend and it directly affects your PnL.

Theta is the indicator that shows time decay of your options' prices.

So you need to get the direction right and also how fast will the asset move in that direction.

So while this adds another level of complexity to the trade, options come with a few indicators called Greeks, that if utilized correctly can increase one's success rate.

Learn more about greeks here: tinyurl.com/Ogreeks

That being said, options traders do have a higher win rate than day traders and after 1 year, plenty of them still frequently trade while it can’t be said the same for day traders.

If this was helpful to you, it might be helpful to someone else.

If so, could you share this thread?

Thanks, friend. twitter.com/vincesector/status/1569380930405408768

Let’s run a quick simulation:

The current price of ETH is $1725 and you believe that it will go up to $1900 in the next few days, which strategy is the most profitable for you?

I ran the numbers, and let’s assume ETH in 2 days blasted up to $1900 as you predicted, assuming you bought a $1750 ETH call expiring 2 days later, you would’ve been very ITM, you could have a 410% gain if you closed your position.

How does that compare with a leveraged trade?

If you had bought ETH at $1725 and just held it to $1900, that would’ve been a 10,5% gain without leverage.

So for you to achieve the same profit as the call option, you'd need to leverage 39x your position, while also assuming the risks that come with leveraging

Conclusion:

All of this is not meant to tell you which one to go for, the main point here is to prove that with enough knowledge and preparation, one can profit with multiple strategies.

Just be smart and take calculated risks.

I personally don't leverage and hardly buy options, my most profitable strategy is to sell crypto options, if you want to learn a bit more, check this thread: tinyurl.com/SOCTT