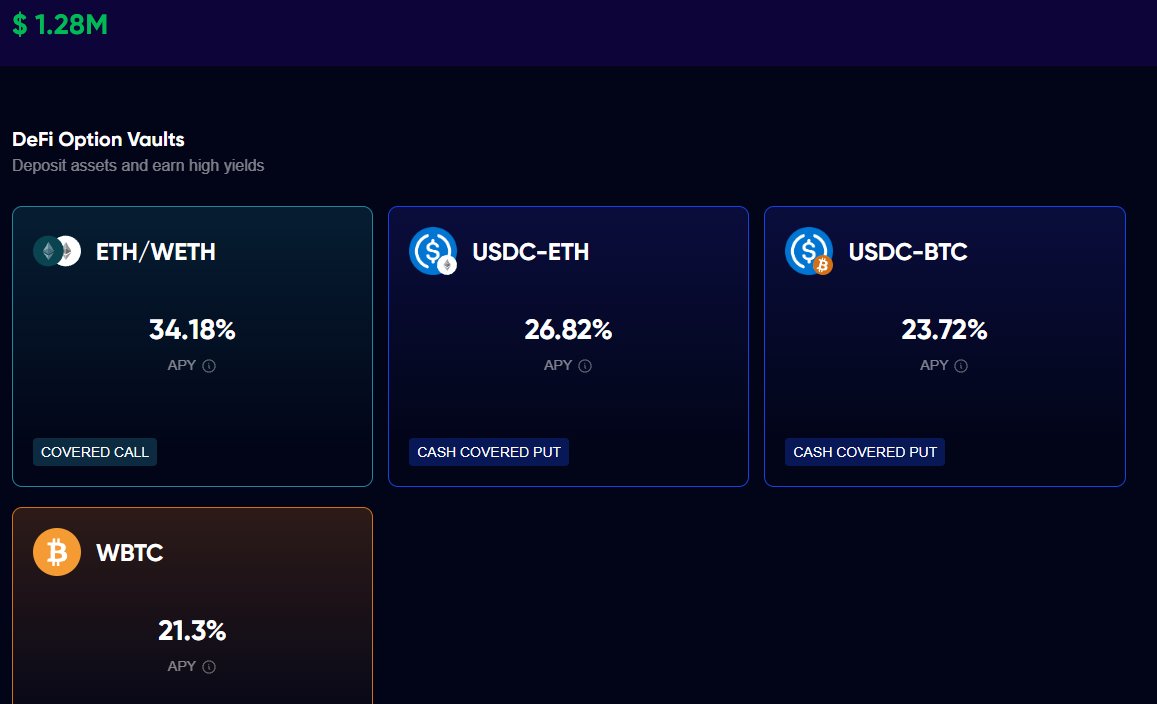

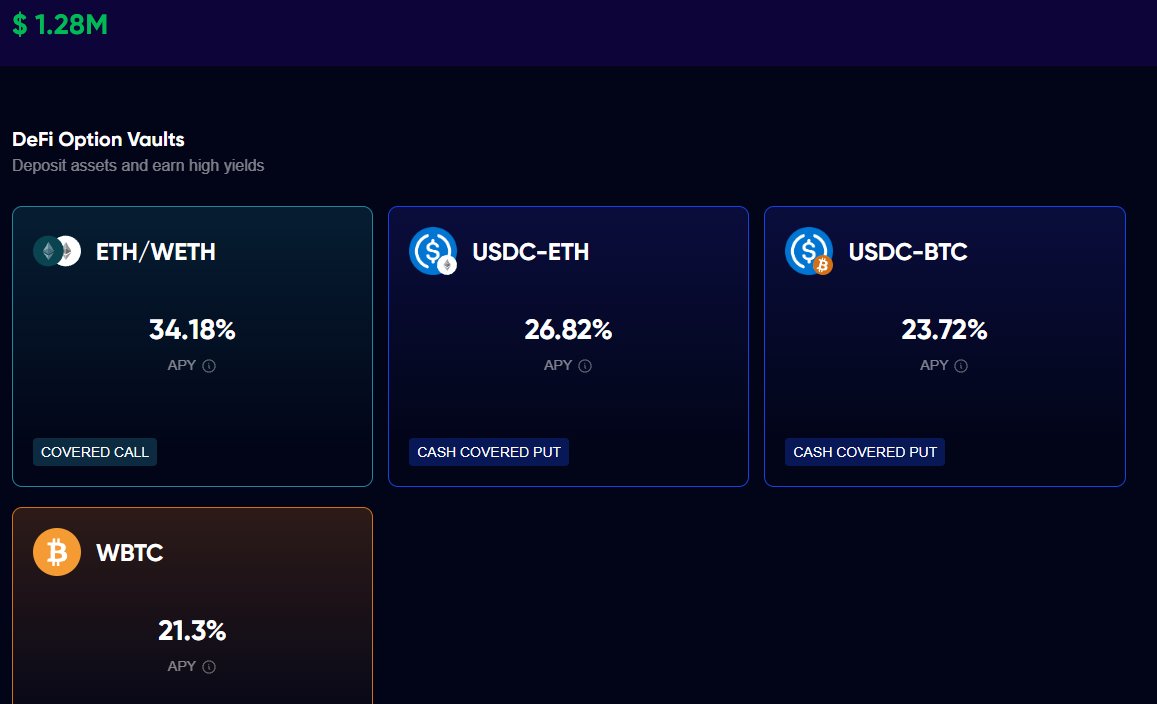

You probably have heard of protocols like @ThetanutsFi, @ribbonfinance, @friktion_labs, @Katana_HQ, and @dopex_io, but what do these protocols actually do?

DOVs (DeFi Option Vaults) are protocols that make it easy for inexperienced users to profit from selling options (CCs and CSPs)

In simple terms think of these vaults as coin pouches, where users collectively deposit their money into and let the protocol do the rest.

If these options expire OTM (in the user's favor), then the premium collected - protocol fees will be added to this pouch and users can withdraw.

If the option expires ITM (against users) then the protocol will withdraw part of the users' funds to pay the losses.

DOVs are VERY DIFFERENT from crypto option protocols like @lyrafinance and @DeribitExchange

DOVs: Users don't choose strike (less risk but less yield)

@lyrafinance and others: Users can choose strikes and expiration dates (more risk but more yield)

Now here are 5 DOVs I'm keeping an eye on that you probably haven't heard of (sorted in random order)

@PsyOptions

PsyFinance reminds me of early thethanuts, a very simple design. Their risk tab on the other hand is something all DOVs should have.

Really small TVL.

On solana

@0xPolysynth

As the name might suggest, they're on Polygon (and ETH mainnet)

Not a fan of the UI, but it doesn't affect negatively my experience with it.

Really good "overview" and "how it works" tabs.

Low TVL and not many asset choices (MATIC, ETH, BTC)

@PolynomialFi With the cleanest UI among these 5.

On Optimism (you know I like that) built on top of @lyrafinance if I'm not mistaken.

They have a very interesting GAMMA vault, I'll be keeping tabs on the performance.

@PremiaFinance

One of the highest ones in TVL and it is multichain (ETH, ARBITRUM, OPTIMISM, and FTM)

Other than that, really bad User experience, very confusing, and from the little I understand, these vaults are buying options and not selling them.

@DAOJonesOptions

The highest one in TVL.

Built on top of @dopex_io.

I personally would like more token variety, other than that I don't have much to say.

Very simple and friendly dapp.

These 5 are the smaller competitors that I think have a chance to succeed if they keep improving.

Out of the 5, I personally like @PolynomialFi and @PsyOptions the best, will be testing them to see how their vault performs.

My plan is to eventually build a DOV myself, offering vaults not only with simple selling strategies but also more complicated strategies for different market conditions.

still nothing more than a dream, as of yet.

Anyways that's today's drop of knowledge.

If all of this was helpful or insightful, consider being a homie and sharing this thread so other homies can see this.

twitter.com/vincesector/status/1566089601164447746