1/ In the fast-changing world of DeFi, Vertex is emerging as a game-changer - a new DEX that doesn't compromise on capital efficiency, UX or self-custody.

But how does it compare to current market leaders; Binance, dYdX & GMX? You'd be surprised...

Lets dive in 🧵👇

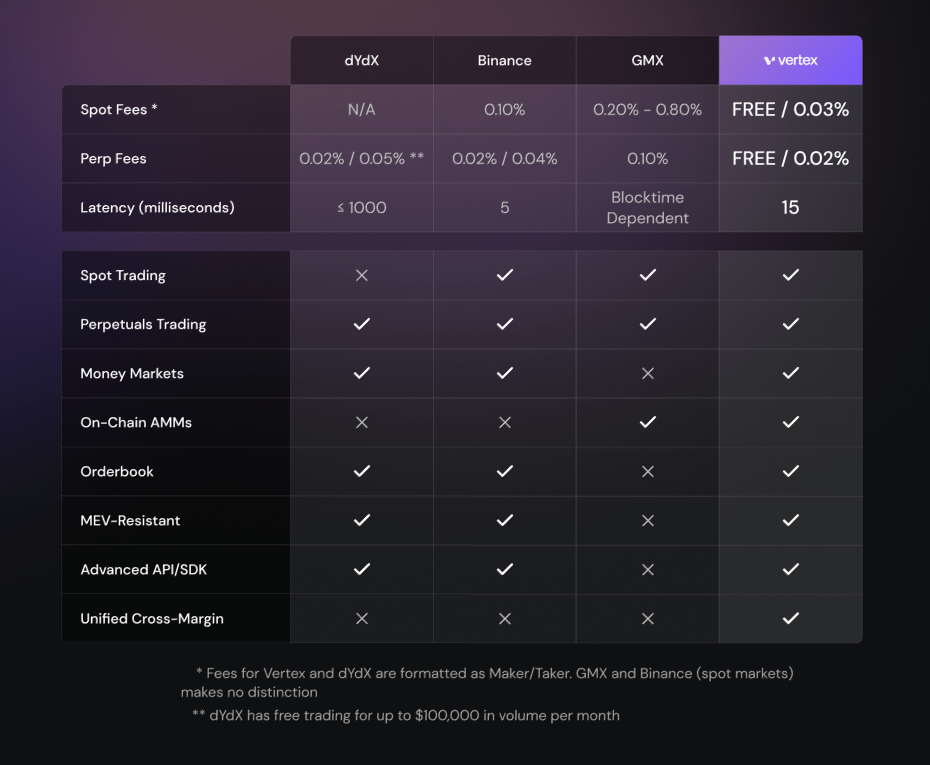

2/ When evaluating an exchange, we consider several metrics:

- Fees (cost of trading)

- Infra (AMM, CLOB, Markets, API etc)

- MEV & Frontrunning Resistance

- Cross-Margin & Capital Efficiency

So how do the competitors stack up?

3/ Binance (1/2)

Offering robust security, an array of markets, low fees, low latency, a CLOB, and API.

💸 Fees:

- 0.10% for Spot.

- 0.02% / 0.04% maker/taker fees for Perps & Futures.

The downside? The above comes at a cost to self-custody and transparency 😞

4/ Binance (2/2)

Binance's latency is fast, just 5 milliseconds, faster than all other exchanges.

Cross-margin trading is also available, although for perps only, or spot only - but not both. Therefore, it falls short of universal cross-margin.

5/ dYdX (1/2)

A leading perps DEX, offering an off-chain CLOB, MEV resistance, and an API. V3 is built on Starkware, with V4 to release as a Cosmos appchain.

💸 Fees:

- Free for the first $100,000 of 30 day volume.

- 0.02% / 0.05% maker/taker

This is cheap for a DEX!

6/ dYdX (2/2)

dYdX’s latency is about 1000 milliseconds. These are extremely low latencies for a DEX.

However, spot trading is unavailable on dYdX, so it does not support universal cross-margin.

7/ GMX (1/2)

A DEX on the Arbitrum & Avalanche.

While it stands out for zero-price impact trades, it falls short on a few fronts... no defense against MEV, lacks cross-margined accounts.

💸 Fees:

- 0.2% to 0.8% for Spot

- 0.1% for Perps

Relatively high fees, ouch!

8/ GMX (2/2)

Despite this, GMX attracts traders with its high leverage, zero-price impact, and real yield opportunities.

However, its scalability is limited, and without an order book, API, or SDK, traders aiming to execute automated strategies face significant challenges.

9/ Enter the DeFi solution - Vertex 🏔️

This newcomer in the DeFi space seems set to disrupt the current landscape by aligning itself with the principles of decentralization, without compromising on efficiency, user experience, and self-custody.

10/ Vertex brings:

- Universal cross-margin accounts

- The lowest fees out of all exchanges presented here

- 15 millisecond latency (faster than any other DEX).

- API and SDK for automated traders

- Hybrid AMM and CLOB to get the best of both worlds

11/ Keep an eye on Vertex as it holds the potential to shift the status quo.

In a rapidly evolving world of DeFi, innovative platforms that truly embody the spirit of decentralization without sacrificing efficiency are the need of the hour.

blog.vertexprotocol.com/uncovering-the-ultimate-exchange-a-comparison-of-vertex-competitors/