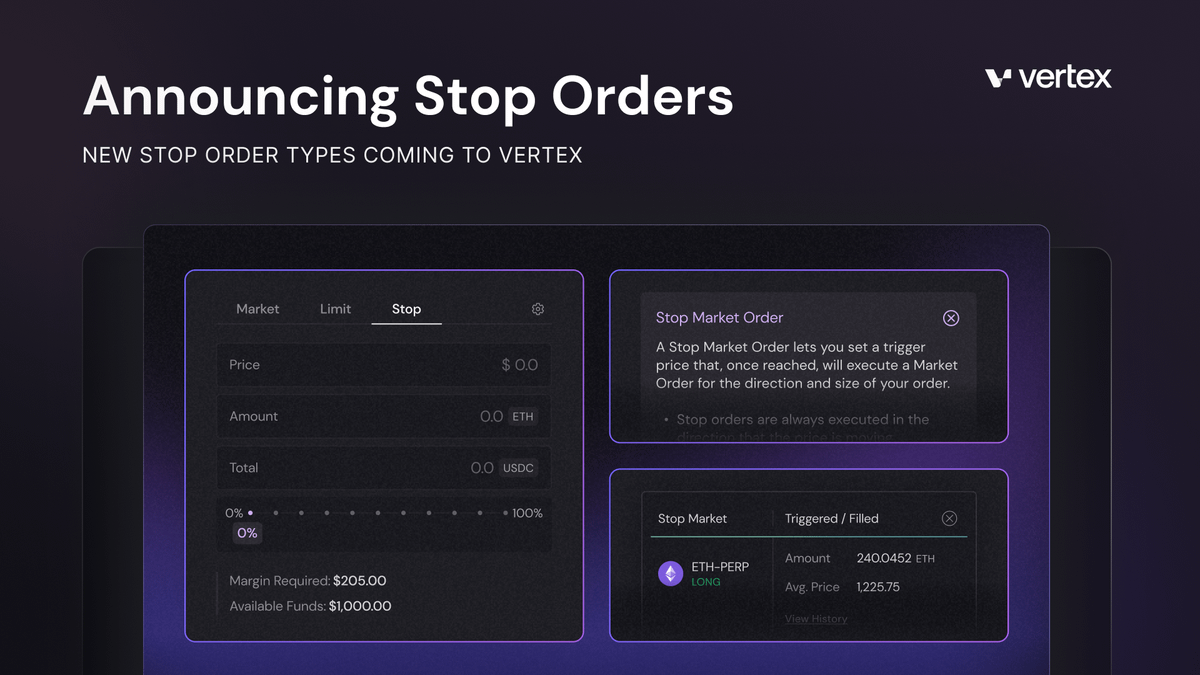

1/ Vertex now supports Stop Market Orders!

Order types & risk management have been a focus area of development - we are pleased to start rolling these features out over the coming weeks.

What are Stop Orders & how do they work? 👇

2/ What is a stop market order ❓

A stop-market lets you set a trigger price that, once reached, will execute a market order. Stop orders can be used to close existing positions (stop-loss) or to open new positions (stop-entry).

3/ What is a stop-market not? ❌

Stop-market orders are NOT conditional/linked to a position or order. Stop-market orders must be managed as individual orders.

Let’s look at an example 👇

4/ Sam is long ETH-PERP

Sam places a stop-market sell order with a trigger price

The trigger price is not reached

Sam closes ETH-PERP

In this scenario, the stop-market order will continue to exist. It must be canceled manually. If not, Sam could end up in an unwanted position.

5/ Please take care to cancel unwanted stop-market orders as you close and open positions.

6/ 🔒 What is needed to place & maintain a stop-market order?

One-Click Trading (1CT) must be enabled. Stop orders place an order on your behalf once the trigger price is reached, made possible by 1CT.

If you have existing stop orders and disable 1CT, they will be canceled.

7/ Up-coming order types 🔜

Vertex will soon support TP & SL, similar to other venues.

Additionally, Vertex will support stop limits that trigger limits rather than market orders, allowing traders greater control over execution.

8/ To learn more about placing and maintaining Stop Orders, please refer to the blog below or our docs 👇

blog.vertexprotocol.com/announcing-stops-orders/