It's been a minute since I laid out the @calmfund strategy for y'all so let's buckle up and talk about why now is the best time to build and invest in profitable capital-efficient calm companies that grow at a sustainable pace...

What are calm companies?

They are lean and capital-efficient.

They go after niche markets and build a micro-monopoly.

They maximize optionality for founders and all stakeholders.

They raise capital opportunistically but aren't dependent on it.

We've invested in ~70 calm companies, which you can view in our portfolio, but there are actually 100,000s of calm companies everywhere. In fact, it's pretty much the default approach of almost all entrepreneurs everywhere. calmfund.com/portfolio

If you give entrepreneurs a choice between (a) solid shot at generational wealth (7-8 figs per founder) and (b) 0.0006% chance of being a billionaire, ~almost all~ entrepreneurs are going to pick (a) unless they've already had a life-changing exit. review.firstround.com/Theres-a-00006-Chance-of-Building-a-Billion-Dollar-Company-How-This-Man-Did-It

So why is it that almost nobody is listening to these entrepreneurs, building investment tools and other products to help them succeed at their actual goals. Why are we trying to fit every single founder into the extremely narrow box that VCs want to fund?

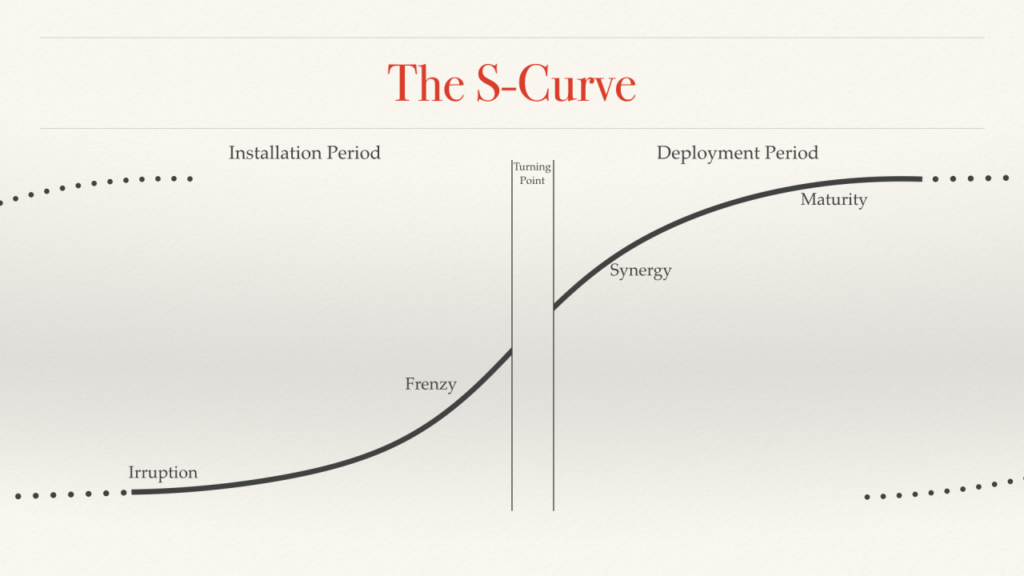

That's where our thesis comes in. As recently as 10 years ago, almost all software businesses were a great fit for venture capital. They had high upfront costs (it used to cost several million to ship a decent v1 app) & wide open markets for winner-take-all opportunities.

But we're now shifting into the Deployment Phase of software and software-enabled companies. Big markets are saturating and highly competitive without winner-take-all dynamics. The true frontier is in bringing the fruits of software innovation into every niche of the economy.

Why can you build software for tiny niches now? The Peace Dividend of the SaaS Wars: tons of improvements and building blocks that have brought down the cost to ship a real software business by a factor of at least 10.

When it's that much cheaper to ship & validate, you don't *have* to go after huge markets any more to generate a great return for investors.

But almost nobody in the investor/allocator community has caught on to this yet... why? calmfund.com/thesis

Funding for entrepreneurs is still culturally and intellectually dominated by venture capital, despite the fact that it only funds 0.1% of businesses.

A fundamental tenant of the VC mindset, so much that many consider it practically a law of physics, is the idea that startup outcomes follow a "power law" where most companies will fail & almost all your returns come from a few grand slam winners.

How did they arrive at this conclusion? Well historically the best performing venture funds have all followed this strategy, so it makes sense for new funds to try to optimize for those same kinds of outcomes: tons of failures, but we got into Uber/Airbnb/etc so the fund did well

The fundamentally heretical question we are asking at @calmfund is "is this the only way or just one way to invest in entrepreneurs?"

We think the answer is obvious. VCs who think the power law is immutable are in a self-fulfilling prophecy...

The failure rate of any given company is not static. Things like raising tons of capital, hiring very aggressively, spending heavily on growth, pushing out break-even, etc... they all might increase your chances of being a unicorn, but they also increase your chance of failing.

We believe that you can dial some of those back with a more calm approach to building companies. Yes you'll grow at a more sustainable rate than "hyper growth" but you'll also dramatically increase your chances of success. That's how we win and the founders we back win.

For founders, there's never been a better time to be building a calm company. The funding markets are in chaos, so not being dependent on raising more capital is a massive asset that will hugely increase your chances of success as well as your optionality: twitter.com/tylertringas/status/1527450430644666368?s=20&t=LV4WrE1O5F9jtOqj162k2Q

At our fund, we do everything we can to give the founders we back an unfair advantage in the form of mentorship and community. We have 200+ mentors, almost all of them very successful software founders, who provide support and advice along the way: calmfund.com/mentorship

If that sounds like a great fit for your company, you can start the conversation here (no warm intros needed). We are working through a huge spike/backlog of applications right now though so bear with us 🙏 calmfund.com/for-founders

For investors, now is the best moment in history to be investing in calm companies. They will thrive, grow faster, gain market share from flailing companies struggling to raise more, and come out of this phase with some monster successes. More here: calmfund.com/for-investors

I firmly believe a portfolio of calm companies will hugely out-perform almost any other asset class from here for the next 10+ years with top tier returns and far less volatility & risk.

If you'd like to join us, our Fund IV is now open to new LPs here: calmfund.com/writing/fund-4

Although with this fund we're opening up a vehicle for larger institutional investors, we're committed to keep our quarterly subscription fund structure with a low minimum that is approachable for individuals and entrepreneurs: calmfund.com/writing/for-investors-introducing-quarterly-subscriptions-to-the-calm-company-fund

Despite all the winds in our favor, it's still a tough fundraising environment for funds just as it is for startups. We're lucky to have a solid base of supportive LPs, but I would love to ramp up aggressively to meet this huge opportunity. I'd love it if you shared this widely.

Thanks for reading! If this piques your interest, we are radically transparent and there's tons more you can read at calmfund.com. Also follow @tylertringas & @calmfund and shoot us a DM with any questions, comments or ideas.