Estimating rent growth incorrectly could put you in a serious financial crisis.

Still 90% of investors I talk to do it wrong.

Here is a data-driven step-by-step method you can use.👇🧵

First, why is it important?

Rent = Revenue in Real Estate. And revenue is the most important indicator of growth in any business.

So right off the bat, this makes rent the most important data point in Real Estate.

I noticed many picking a random 3% growth rate number in their projections and on the surface it looks like it worked out fine.

But that was a function of the bull cycle we have been in for the last 14 years.

And bull runs make everyone feel like they are correct.

If you are projecting wrong rent increases and the rents don't track per your projections, needless to say, it can start the death spiral especially when expenses > revenue.

This is the main reason I believe real estate deals go south.

So personally, it's the one variable I want to be most sure of.

So here is how I go about it:

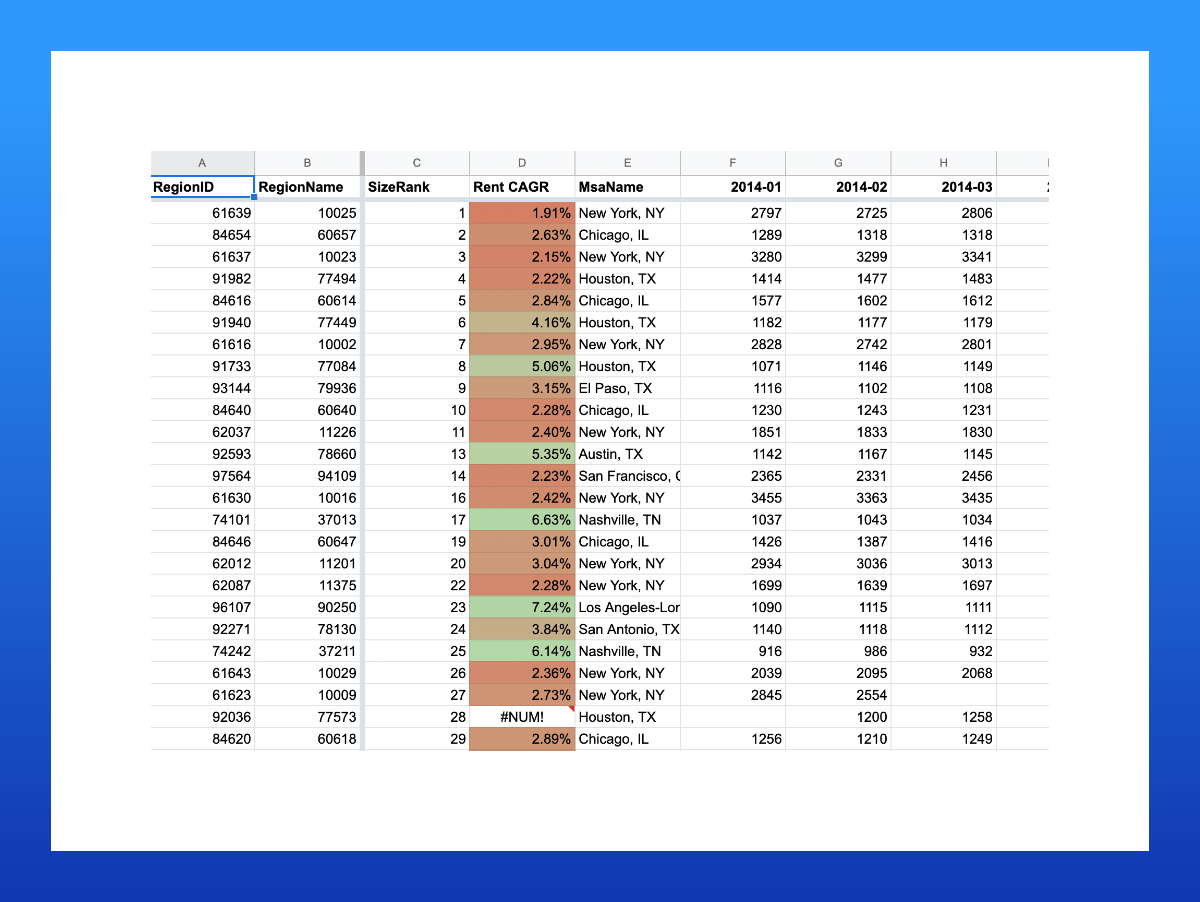

1) I download the rental data set from Zillow

2) I then analyze the CAGR(Compound Annual Growth Rate) of rents for the last 8 years for major areas across the USA

Caveat: The data is normalized across different property types but I am only looking to be directionally correct.

This way, you can base the projections on actual past trends.

Now history is not always right but it's way better than randomly picking a #.

I suggest being safe and maxing it out at 4% even if the growth was 10%

But avoid putting 3 or 4 % when the CAGR is really 1 or 2%

You won't be in good form if the economy turns and rents decline.

Now to use my analysis:

Go to the tab: "Rent Growth Trends"

Just do CMD + F(Mac) or CTRL + F(Windows) and type in the city

or area or zip code you are looking for.

Column D is the growth rate per year taking a sample of the last 8 years from 2014 January to 2022 January.

When you are projecting your returns you can use this number as a reference:

To re-iterate, be safe and max this number out at 3 or 4 % even if it is 10%.

But if it's actually been 2%, then just use that.

You can get my rent data set till January 22 here.

rehacks.io/file-cabinet

But if you are a data nerd like me and want the latest raw data set, it can be found here: zillow.com/research/data/

Just use the CAGR formula from my sheet or google it online.

Hope this helps.

If you want to know how I recession-proof my strategy from all angles,

Join >3,000 subscribers here:

rehacks.io