A few weeks back, @1kxnetwork released an insightful research report on the history of memecoins, current trends, and potential opportunities.

Is there a 2024 playbook for memes?

Let's delve into it ↓

+ Bonus: A list of must-read studies on memecoins.

The first PoW memes emerged from the depths of Bitcointalk (OGs remember). They aimed to attract miners, but their actual value was limited, and only @litecoin has stood the test of time.

Then came the era of Reddit and 4Chan, with @dogecoin leading the way as a flagship meme.

Next came the ICO boom. That was when I truly began my Web3 career. It was a time of countless token launches, many of which lacked value.

One notable example was the Useless Ethereum Token, launched in June 2017. It humorously mocked the ICO frenzy and managed to raise 310 ETH.

Later, we experienced the DeFi summer and the NFT boom with Rare Pepes, expensive collectible socks, and numerous meme coin liquidity farms offering high APYs. We also saw a rise in dog memes inspired by the $DOGE trend.

And then came $PEPE, making memes great again.

Every cycle features various forms of memecoins, each with its unique manifestation. A new narrative → A new meme riding it, be that AI, RWA, Bitcoin DeFi, or L2s.

Btw, wallets paying the most in @base fees potentially belong to trading bots engaged in memecoin trading.

Why do people love memes?

Here are several key factors:

• Memes have a low price (psychological allure).

• High volatility and millionaire legends.

• The culture of gambling and degening.

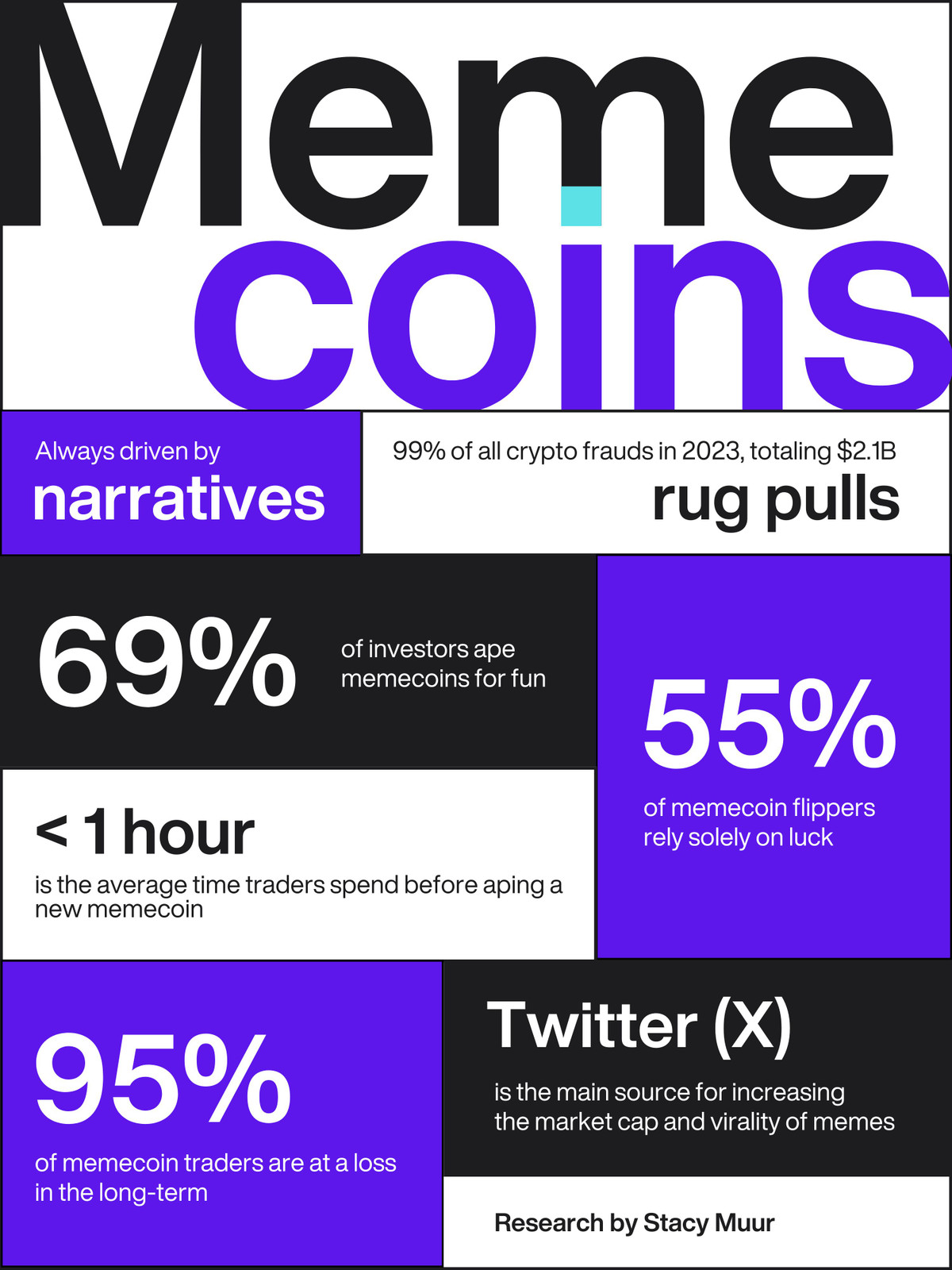

Here are some intriguing findings from another study conducted by @Chainplaygg:

• 51% of meme flippers spend <60 mins on research before investing.

• 55% rely solely on luck when making financial decisions.

• Scams and rugpulls dominate meme coin worries at 64%.

The key factors memecoin flippers take into consideration include:

• Meme virality / narrative

• Social and community activity

• Contract scanning

• Tokenomics, renounced ownership, locked LP

Although the first memes emerged on Bitcointalk, Reddit, and 4chan, Twitter is the new meme hub in 2024.

A recent study by researchers at Yeungnam University indicates that Twitter is now the primary source to boost the market capitalization and public visibility of memecoins.

This leads me to another thought.

When funds or KOLs profit, retail buyers suffer.

Nowadays, many successful memes are not fair launched.

They rely on shilling for their go-to-market strategy, with the cost of shilling being KOL allocations.

Check this chart from @pyorxyz ↓

In other words, if you're on the retail side, you have to spin the roulette twice: First, to choose a coin that doesn't exit scam right away, and then to sell before the team, KOLs, or funds take their profit.

Not even a binary option, imo.

As promised, here are a few excellent research reports on memecoins that are worth a read:

mirror.xyz/1kx.eth/RgbEQvn1vgfzrE6GDTwk3rrNYQmyuwVgejtR0-6okRc

chainplay.gg/blog/state-of-memecoin-2023/

researchgate.net/publication/377603881_Identifying_Networked_Patterns_in_Memecoin_Twitter_Accounts_Using_Exponential_Random_Graph_Modeling

And for more research, make sure to check my Notion with the most insightful reports from the industry leaders.

Ape wisely!

twitter.com/stacy_muur/status/1772203047135199344