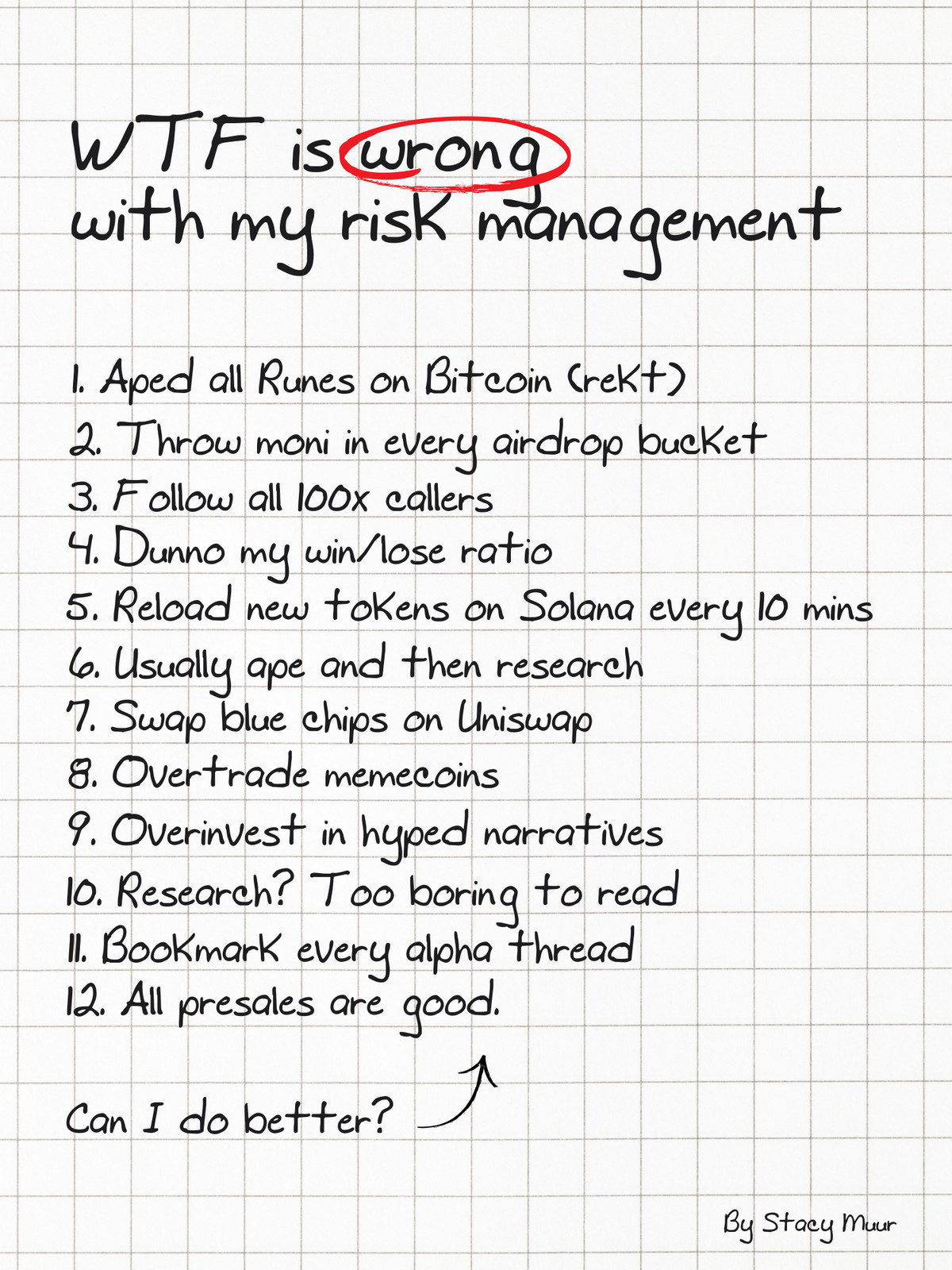

Want to know if something is wrong with your risk management?

Take a look at this degen's checklist + 10 quick tips ↓

#1: GET YOURSELF A PORTFOLIO TRACKER

No, seriously, it's the basics.

I've even built a spreadsheet template for you so you could track the profitability of your deals.

Just use it, please ↓

docs.google.com/spreadsheets/d/1Hn81eEjNvmb7sKr0kBAy9u5K7JRkLQlhxkE0gXLX0Fw/edit?usp=sharing

#2: USE LIMIT ORDERS

Isn't it obvious? Why bother checking prices daily on DEXScreener, CoinGecko, or Coinmarketcap when you can simply set up a limit order on a CEX/CLOB DEX and let it execute automatically?

I don't know.

#3: AVOID OVERTRADING MEMES / NARRATIVES

Allocate a specific percentage of your portfolio to memecoins, runes, or any other hyped narrative.

Stick to the maximum allocation limit no matter how much your greedy soul is tempting you to exceed it.

#4: START USING DEBANK

@DeBankDeFi is a part of my daily grind of tracking changes in my portfolio, including passive yield pools.

It's just very convenient and very informative.

Time machine can even partially replace a portfolio tracker.

#5: RE-ENTERING IS OK

When it comes to high-conviction plays, re-entering a position is perfectly acceptable and healthy. Just make sure it’s not your small greedy soul pushing you to buy more of that 1000x potential memecoin.

Re-entering = lower position entry.

#6: STOP CONSUMING 100x THREADS

Believe me as a seasoned content maker, 99% of threadooors who post '100x hidden gems' don't buy these coins themselves.

It's just engagement farming.

There's no secret pill.

#7: CALCULATE APR OF AIRDROPS

Many airdrops aren't a treasure trove of free money.

They are akin to traditional DeFi yield pools with slightly higher APR, but the returns come in the form of airdropped tokens (but no one knows when these yields come to you).

twitter.com/stacy_muur/status/1776184133183566029

#8: CREATE DEXSCREENER WATCHLISTS

This is a great exercise for every degen.

Aping memes? Get yourself a watchlist with your plays and mark your entry and exit levels right on the chart.

Planning to start aping? Use this thing as a demo trading.

#9: DIVERSIFY

Diversify everything: Chains you use, stables you hold, wallets you keep funds on.

On Metamask alone, I have 6 different accounts, each with a specific purpose.

PS: Just write down your wallet diversifications, I sometimes forget about wallets lol.

#10: STUDY RESEARCH

We are in an age where valuable insights from top-tier investors are readily available on the web, for free.

While this research may not give 100x calls, it equips you with the knowledge of how and why investments work.

Just don't be lazy.

twitter.com/stacy_muur/status/1772203047135199344