This is a deep dive on Signature, the "other" bank failure of March 2023. Barney Frank & the WSJ editorial board have called it an "Execution"

Appropriately, Signature's origins date back to an assassination.

The year was 1999, dateline Monte Carlo prospect.org/economy/2023-03-23-rich-bank-dumb-bank-signature/

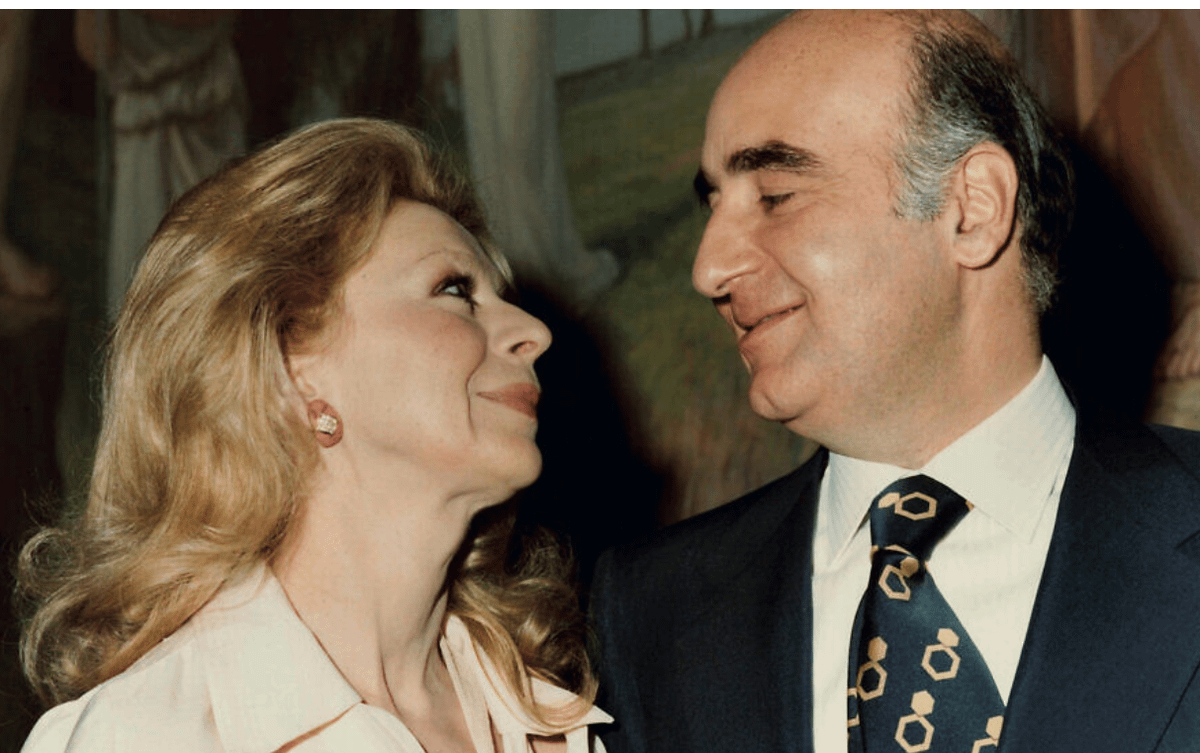

Edmond Safra was a banking legend & 1 of the world's richest men. Born in Beirut (famliy financed the Ottoman Empire caravan trade) & raised in Brazil, he jetsetted between NY, Geneva, Fr. Riviera & a Monaco compound built to withstand nuclear war. For when shit got too real

In August 1998 a $4.8 billion emergency IMF loan to Russia never makes it there. Instead, it lands in 1 of Safra's accounts at his Republic Bank. 3 days later, ruble collapses, with the dollar exchange rate plunging from 6 to 21 theguardian.com/world/gallery/2014/dec/16/russian-rouble-crash-1990s-in-pictures.

Safra freaks, calls the FBI & starts telling them what he knows about the oligarch embezzlement of IMF funds responsible for devastating the country. DOJ concocts cover story abt a "suspicious activity report."

Spring 1999 Safra makes a deal to sell Republic bank to HSBC. Analysts say he's leaving billions on the table by selling too cheap

Safra has Parkinson's, says he's tired

Also one of Republic's big clients sold Japanese companies $1 billion fake bonds, but that's another story

Fall 1999 Safra gets a visit in France from oligarch Boris Berezovsky, an early backer of Putin. (That would change!) Meeting lasts 3 hours, involves "raised voices." Safra departs for the Monaco fortress & turns up dead in a fire a couple weeks later. vanityfair.com/culture/2000/12/dunne200012

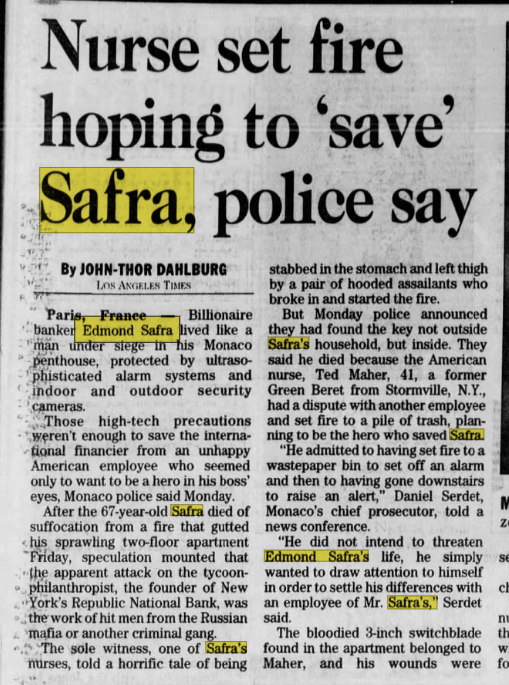

Obviously it's a Russian Mafia hit sparked by Safra's whistleblowing. Duh, right?

But wait! What if what REALLY happened, is that Safra's ex-Green Beret nurse staged the whole thing in an elaborate ruse to get closer to the billionaire by "saving" him from a gang of masked bandits? That's obviously what actually happened, Monaco prosecutors decide.

Back in NY, Republic managing director John DePaolo hatches "Project Normandy." He thinks HSBC will ruin Republic's vibes, so he & 65 colleagues plot a new bank called Signature. They get seed investment from an Israeli bank, also an oligarch fave. occrp.org/en/daily/12251-israeli-bank-laundered-fifa-bribes-aided-billions-in-tax-evasion

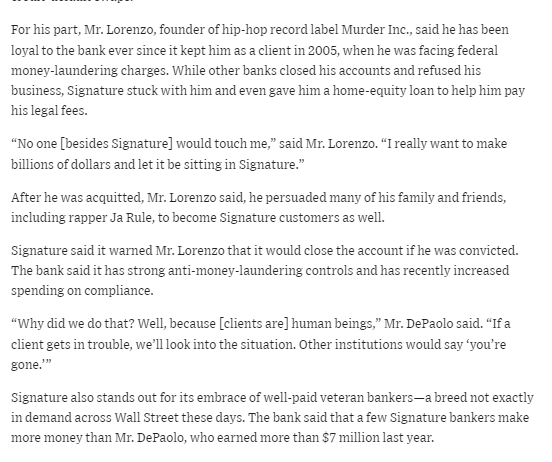

One of Signature's first clients for life was Irv "Gotti" Lorenzo, viceroy of Def Jam's Murder Inc., accused in 2005 of laundering drug money. "If a client gets in trouble, we'll look into" it, DePaolo says. "Other institutions will say, 'You're gone.' wsj.com/articles/the-only-bank-this-hip-hop-mogul-will-use-1440978447

There was evidence Signature did not look too hard, however. One lucrative client Bill Landberg, later indicted for stealing $66 million, was suspected by bankers of variously "check kiting" & running a "Madoff Ponzi." Perhaps unsurprisingly, no one went to the FBI.

We know this bc the month before it was failed, Signature was sued by a British Virgin Islands hedge fund that lost $2 million to Sam Bankman-Fried's crypto ponzi. The fund accuses Signature of knowing FTX was a "Madoff Ponzi" & abetting his robbery courtlistener.com/docket/66791627/1/statistica-capital-ltd-v-signature-bank/

Back in 2019, Signature had made a huge push into crytpo following the collapse of another Ponzi-like business model, the New York landlord biz. Housing activists had dug into Signature's relationship with notorious junior slumlord Raphael Toledano therealdeal.com/new-york/2022/02/01/toledano-banned-from-ny-real-estate-for-5y/

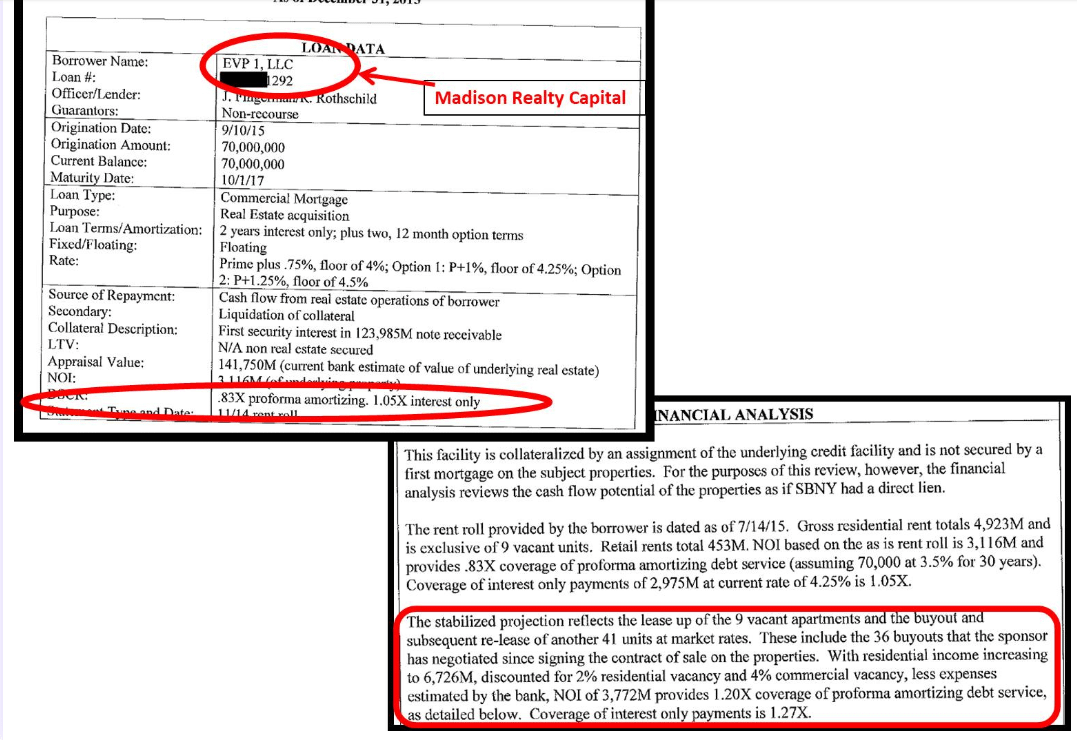

What they found was that Signature had been originating mortgages on Toledano's properties to a private equity firm with a coverage ratio of 0.83, meaning rent payments would not cover the mortgage. The only way to pay the mortgage was to massively hike rents: which, illegal.

But there were loopholes in rent stabilization laws. Vacant units cld be deregulated; households making $200K cld be deregulated; landlords cld use loopholes + threats + bribery to kick out tenants & hike rents by $1000s.

PE firms used straw landlord Toledano to do this.

Signature met with tenant activists, agreed to change its ways.

NY state & city closed loopholes.

Multifamily values crashed, banks were left with billions in inflated mortgages.

The average Signature mortgage is 161% of underlying property's value.

Enter: CRYPTO:

A guy I call "Ben" thinks he maybe inadvertently introduced Signature to crypto when he helped open account there for his old company Block Chain Terminal, which (like every crypto startup?) turned out to be a ponzi scheme. prospect.org/economy/2023-03-23-rich-bank-dumb-bank-signature/

In any case Signature went all in. It built a "private blockchain" so crypto exchanges and stablecoin issuers could exchange funds with one another 24/7.

A dossier compiled by famous short seller @AlderLaneEggs amusingly highlights the insanity of taking on such clients.

One Signature client was Genesis Block, an FTX subsidiary that ran Bitcoin ATMs. People in Hong Kong lined up around the GB office with "bags of cash" to trade for crypto.

The JP Morgan of his generation, folkshttps://www.ft.com/content/68dbe10a-fa38-443a-9790-dc96f2d8979a

Signature did one TRILLION dollars in 2022 volume on the private crypto blockchain CEO DePaolo called a "walled garden." Crypto skeptics have called it a "Walled Garden Full of Snakes." dirtybubblemedia.substack.com/p/a-walled-garden-full-of-snakes-the

And @AlderLaneEggs has likened Signature to Wirecard, a massive German "fintech" fraud suspected of being a front for drug cartels & Russian intelligence. Its fugitive Austrian founder's grandfather was also suspected (by Nazis) of spying for Russia. ft.com/content/ebbc0fab-9969-493a-815c-782085ca1651https://www.ft.com/content/ebbc0fab-9969-493a-815c-782085ca1651

Speaking of Russians & Germans, Signature also opened an account for famous Russo-German non-fugitive Anna Delvey Sorokin, of "Inventing Anna" fame. Her bankers were called to testify at her grand larceny trial.

Delvey opened up an account at Signature in 2017, explaining that she intended to open a Soho House-inspired club in a $135 million Bryant Park building. Instead she deposited $15K in bad checks & withdrew $8K.

But at her trial, Delvey Sorokin's Signature reps admitted they made up a story for internal bank purposes about how actually she was going to convert the building into a hotel, for reasons that remain a mystery.

(Thanks @jpressler for the status!)

Later when Delvey sold her story and tried to pay back Signature the 8 grand, they literally wouldn't take her money, they were too embarrassed.

Ofc, Delvey bounced far bigger checks with other banks, withdrawing $89,000 from perpetual TBTF Zombie Citigroup

Far richer & more powerful institutions also backed FTX, Tether, Bittrex, Voyager & 100 other crypto ponzis prospect.org/economy/2023-03-23-rich-bank-dumb-bank-signature/

It's possible Signature is a lowkey Deep State nerve center of global money crime, a Riggs/BCCI of our time.

Or maybe they learned from the best that snitching to Feds is not a sustainable biz model jamestown.org/program/newspaper-scandal-over-imf-diversion-expands/

As @AlderLaneEggs told me, you have to choose your battles. For example, he explains, "You can't short Tesla because Elon Musk is a protected person." But you CAN make $ shorting midsized banks w. long lists of dubious clients who've suddenly all at once been outed as frauds

...IF, that is, the clique of billionaires who engineered those frauds in the 1st place orchestrates a run on the banks that processed their payments?

Actually, one short told me, no one anticipated the run.

"Peter Thiel, all of them, need to be subpoenaed for that."

A girl can dream.

In the meantime, in lieu of a Peter Thiel indictment, please feast on this elegy for Signature Bank, faithful Blockchain of Crooks & Criminals & Fake German Heiresses, 2001-2023.

prospect.org/economy/2023-03-23-rich-bank-dumb-bank-signature/

It's my first piece as the official "Investigations Editor" of @TheProspect whose tireless leader David Dayen recently had his Twitter account hacked in apparent retaliation for some gentle trolling of David Sacks. Follow @david_dayen in the interim for more wild stories