This month a busy hospital shut down in Texas

Pondered the National Review:

If Health Care Is So Expensive, Why Do Hospitals Close?

The explanation, @nro warned, was "not sexy"

TLDR—it's poor people. How sick they all are, etc

But what if the problem is actually..rich people?🧵

Herewith, the saga of Medical Properties Trust, the company that bought the now-closed Texas Vista hospital from a PE firm & leased it to PE-owned Steward Health in 2017.

2 weeks later, a journalist investigating a Steward deal in Malta was murdered. prospect.org/health/2023-05-23-quackonomics-medical-properties-trust/

But I'm getting ahead of myself

The story starts in the early 2000s

For-profit hospital chains HCA & Tenet are embroiled in massive fraud cases & shedding "troubled" hospitals all over

But they don't want to sell to just anyone

They're looking for, shall we say, "kindred spirits"

Enter Prem Reddy & Ed Aldag.

Reddy owns a Victorville CA hospital. Sometimes comes to work drunk, assaults colleagues; employs a pedo in-law. But he knows how to make hospitals make $.

Aldag is an Alabama real estate guy.

He forms MPT to buy hospitals & rent them to Reddy.

Reddy wasn't the only hospital operator MPT backed ofc, there was also this Indiana anesthesiologist Kamal Tiwari, for whom MPT built a hospital in 2006. In 2007 the FBI raided Tiwari for running a top-shelf pill mill & sent him to prison; good times.

At some point regulators notice Reddy 's Prime Healthcare is sending $50,000 bills to Kaiser patients & billing Medicare for treating exotic forms of 3rd world malnutrition in overweight patients.

MPT is under pressure to reduce exposure to Prime.

Enter: private equity!

PE firms started plowing $ into hospitals with the Obamacare hypecycle. It was a bad idea destined to end in death & decay, but no one shilled the Private Equity Accountable Care "Revolution" harder than Boston cardiac surgeon/Republican turned Obama fundraiser Ralph de la Torre

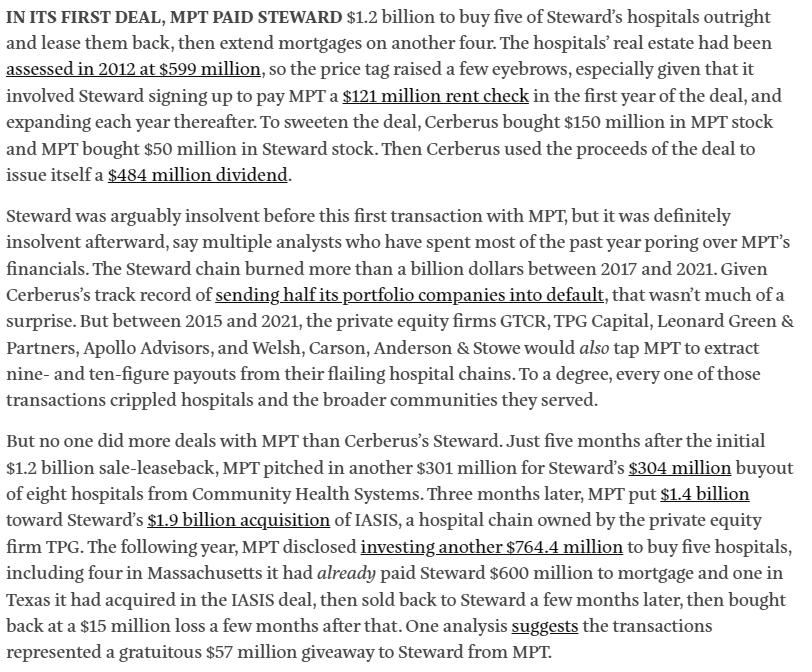

Ralph De La Torre ran a chain of Catholic hospitals. Cerberus invested 1/4 billion, renamed it Steward Health, loaded on debt, sold valuable assets, gutted everything.

Predictably this "strategy" failed; also predictably Ceberus wanted a big payout anyhow youtube.com/watch?v=tGha9CrstRE

Enter Aldag, who offered Cerberus $1.25 billion for the hospitals so long as Steward promised to send MPT a $121 million rent check each year.

(Aldag's son interns at Cerberus around this point.)

Cerberus takes a $1/2 BILLION dividend.

Only problem: how will hospitals make rent?

Glad you asked. Normally when PE firms overburden hospitals w/ interest & rent liabilities for the purpose of looting fat dividends, hospitals pay them off by overbilling & understaffing.

Ultimately patients die, as in this Apollo/MPT hospital in 2020

prospect.org/health/community-hospital-in-deep-red-wyoming

Steward, already shortstaffed, needed to get creative.

Hence Malta.

The Mediterranean microstate had 3 hosptials it wanted to privatize for €70m/year, but mafiosos in charge wanted some of that $ for themselves.

Ralph allegedly promised "brown bags of cash" to close the deal

Daphne Galizia, a Maltese investigative journalist, was hot on the case (and many others.) One of her sons worked for the Panama Papers nonprofit, & she'd uncovered LLCs Malta's ruling elite used to collect bribes & do crime

She blogged relentlessly about the shady hospital deal

Daphne was killed in a car bombing on October 16. Her last post was about Keith Schembri, the prime minister's chief of staff who awarded the contract to Steward.

An SEC whistleblower complaint claims Schembri plotted the assassination all year. He's not been charged in it tho

MEANWHILE back in the US Steward hoarded cash by not paying bills, stifging doctors, residents, travel nurses, landscapers, pizzerias, condo assn newsletters..

An NPR affiliate disclosed in a story about a dialysis provider that cut Steward off that it, too, was owed $ by Steward

Steward also collected $1/2 billion in CARES Act funds, squandered it paying off Cerberus, which cashed out with a BILLION dollar return, leaving Ralph alone to steer the ship

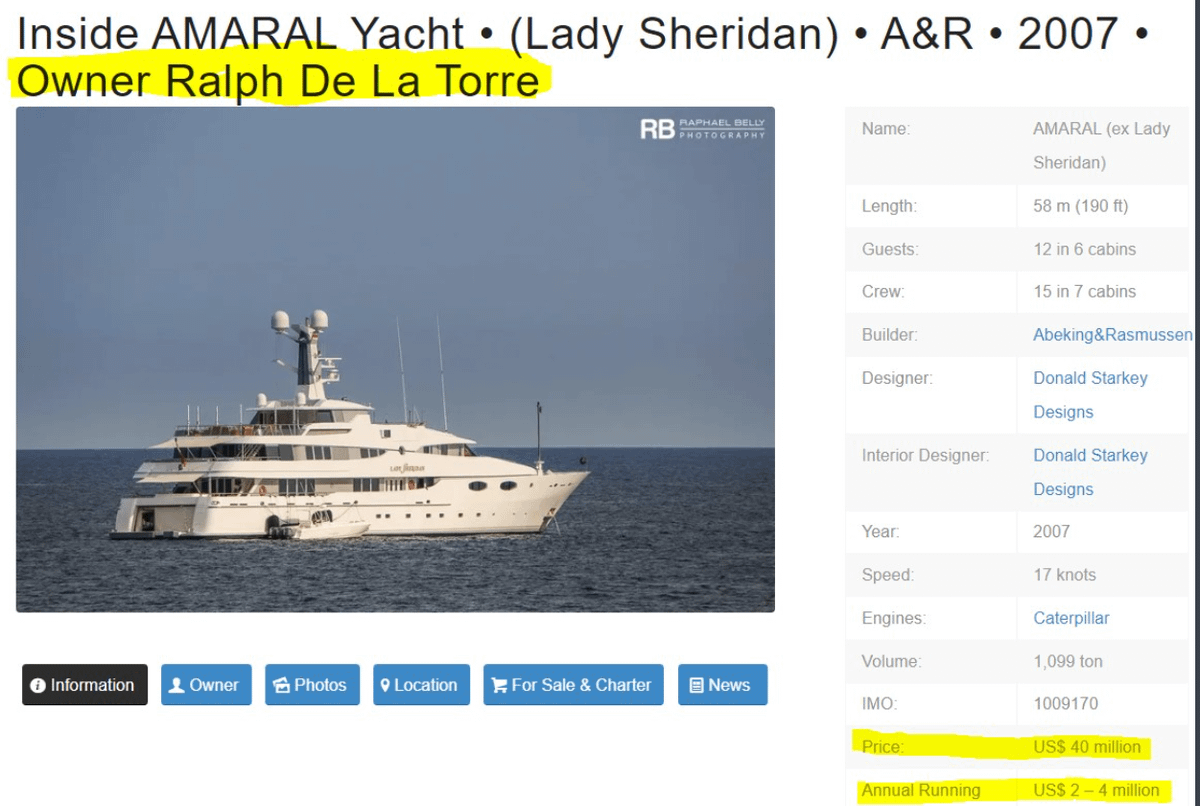

Whereupon, researcher @HedgeyeREITs discovered, he paid himself $100 million & bought a tasteful boat

Here's where I should probably address the state of the hospitals Ralph promised to "revolutionize":

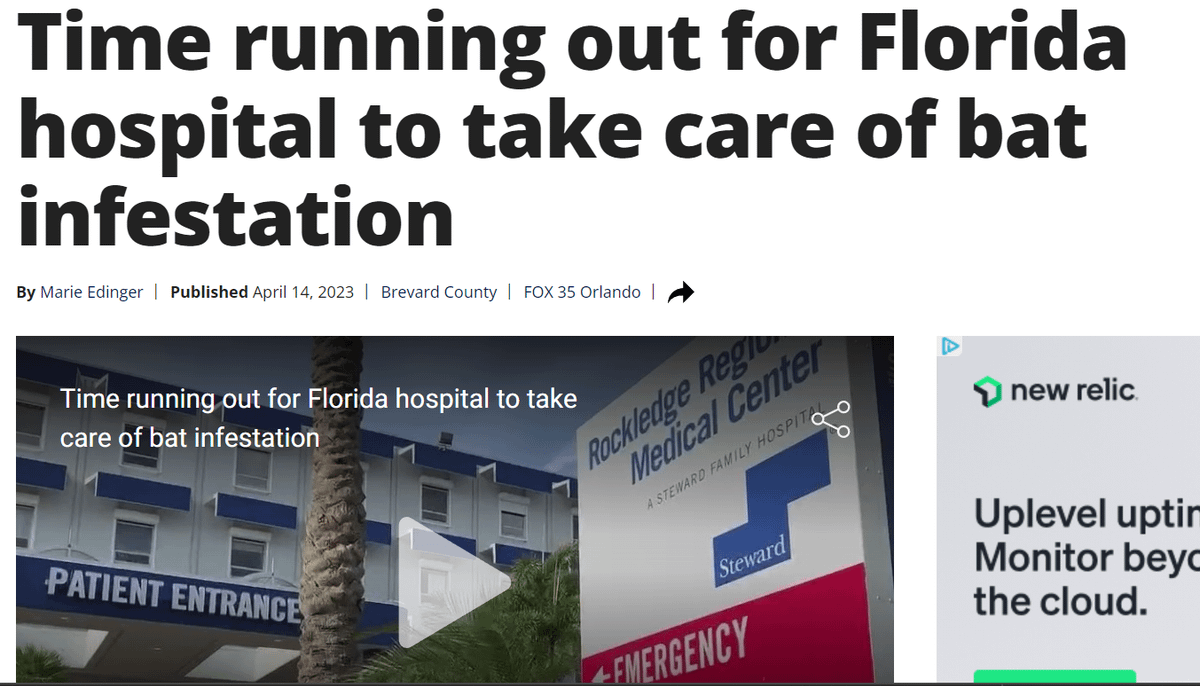

Florida's Rockledge Regional Medical Center had to move its ICU after it was infested with BATS. (Hospital claims the bats haven't invaded hallways; eyewitnesses beg to differ)

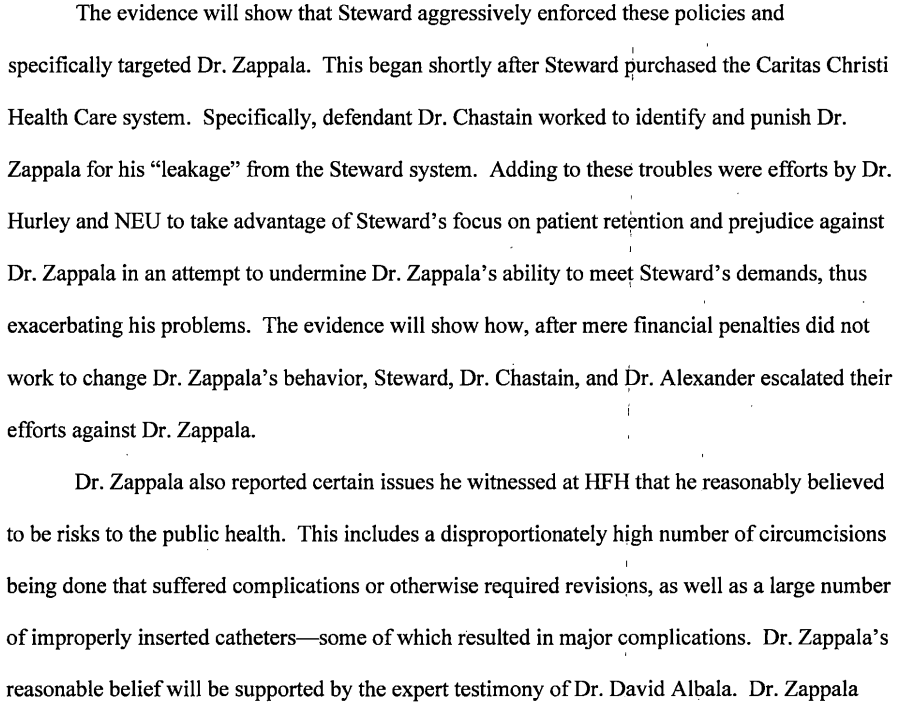

Holy Family Hospital, the MA hospital recently cut off by its dialysis vendor, is spending big to litigate a case against a urologist who says he was fired for blowing the whistle on an epidemic of botched circumcisions caused by Steward corner-cutting masslawyersweekly.com/2022/11/18/peer-review-materials-admissible-in-doctors-retaliation-case/

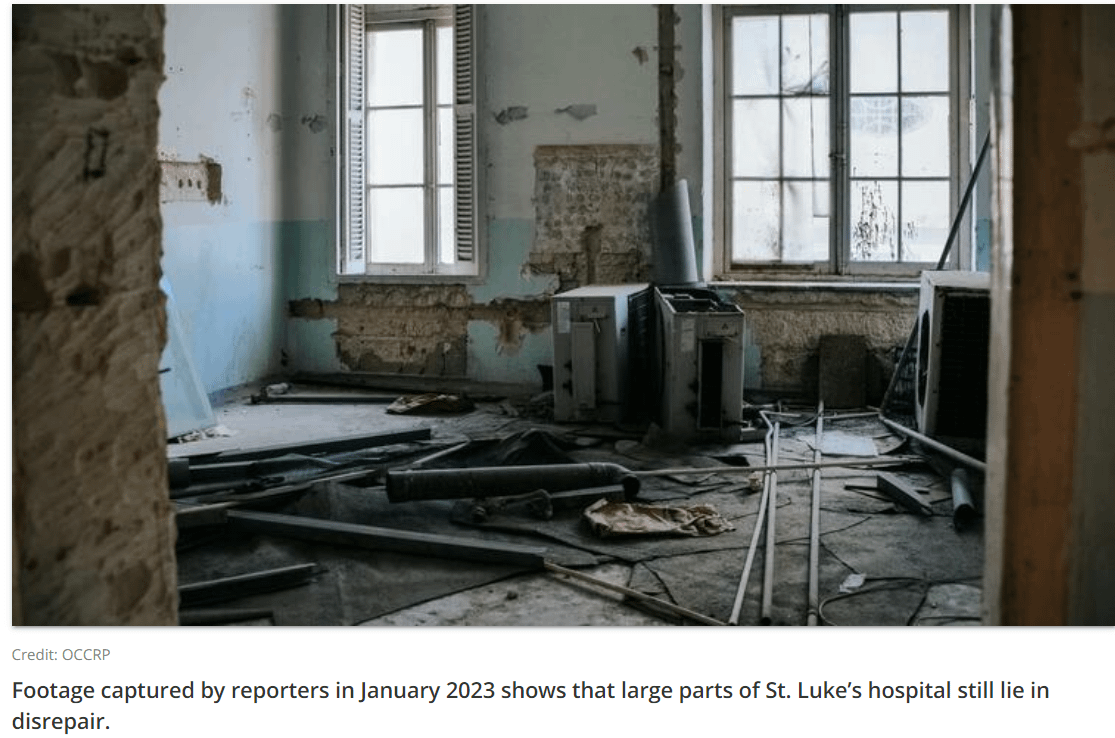

Here's a photo of one of the Malta hospitals, from which Steward allegedly collected a quarter billion Euros for doing... it's not entirely clear; the nurses and physicians were paid separately by the government

and I have no idea if Steward played any role in the recent murder-suicide of one of its Florida hospital CEOs by her husband, a health care entrepreneur whose note said he was stressed over the loss of his contract, but that also happened. chiefhealthcareexecutive.com/view/coral-gables-hospital-ceo-killed-in-murder-suicide-remembered-as-a-bright-light-

And here is photo of the $158 million new hospital MPT is building Steward in Texarkana as of fall 2022, at which point MPT said it had "only "spent $60 million of the total budget. I wonder if this hospital is paying its bills?

But if Steward is a conspicuously insolvent firm that exemplifies the failure of neoliberal institutions, what exactly is MPT?

The REIT has poured more than $5.5 BILLION into this basket case, buying new hospitals, financing "capex" & random loans, 3 hospitals in Colombia (?) etc

And it's not just Steward (though Steward is the deepest cesspool.) Aldag hysterically overpaid for hospitals owned by Apollo, Leonard Green, WCAS, Waterland & other PE firms. Why? Sure, the $16 million salary & 3 Gulfstreams obviously played a role, but..

wsj.com/articles/hospitals-private-equity-reit-mpt-steward-11644849598

If you're in the business of bankrupting companies for profit -- and most sources believe MPT is insolvent -- the #1 rule of pulling that off is "be a private equity firm." Not a publicly traded company!

This is the lingering mystery of MPT.

Some MPT shareholders, enticed by its 15% dividend yield, are betting on a federal bailout of the company, which seems .. delusional.

100s of hospitals have shut over the past 2 decades & not a single one has gotten a bailout.

But maybe I'm not being cynical enough.

After all, MPT isn't a hospital, it's a slumlord run by one of Birmingham's richest men that has dutifully lined the pockets of the world's most powerful PE firms.

And as I explain here, our legal system has granted impunity to FAR less impressive crooks

prospect.org/health/2023-05-23-quackonomics-medical-properties-trust/