Still wrapping my mind around the news that supermarket behemoths Albertsons & Kroger are planning to merge. If this deal goes through we should all just go Amish.

A thread about how private equity made:

-food deserts

-food hyperinflation

-$$$$

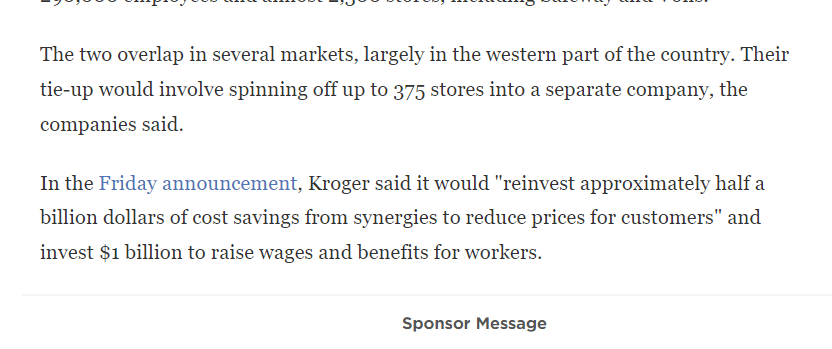

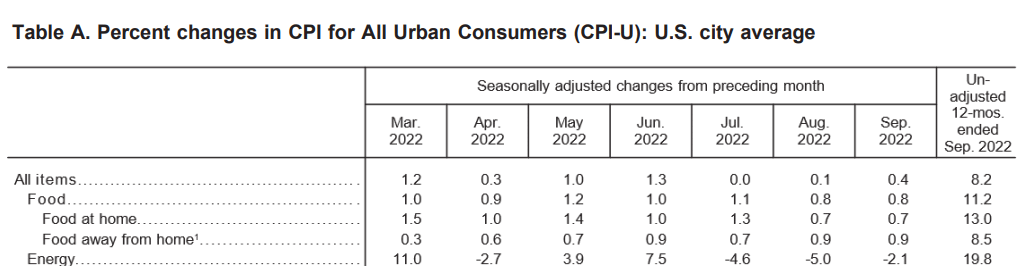

Some context: as we know from yesterday's CPI # the gap between the 13% inflation inflicted by grocery stores vs 8.5% imposed by restaurants is a staggering 4.5 points.

That is 100% because restuarants are a competitive business, and supermarkets are a depraved racket

Kroger fwiw

-has done $4 billion stock buybacks since Covid started

-closed 5 CA supermarkets solely to get out of paying $4-5 an hour "hero pay" bonus

-just narrowly avoided a strike in OH by conceding to raise cashier wages $1

-is somehow substantially LESS evil than Albertsons

Albertsons

-is a heaping pile of junk debt

-controlled by a cabal of private equity firms

-chiefly Cerberus, a fund named after a mythological three-headed dog that guards the gates of Hades

-that is also chaired by... Dan Quayle

Cerberus & Co

-sold Albertsons buildings to pay themselves dividends & now the stores owe $10 billion in rent

-tried to IPO but no one wanted the rotten stock

-until Covid; yay IPO!

-But $800m wasn't enough so they sold $1.75B "hybrid" stock to Apollo

-which now needs to get PAID

If you shop at Albertsons, Safeway or any of the other brands owned by this psycho grocer, you know what it means to be in ("hybrid") debt to Apollo.

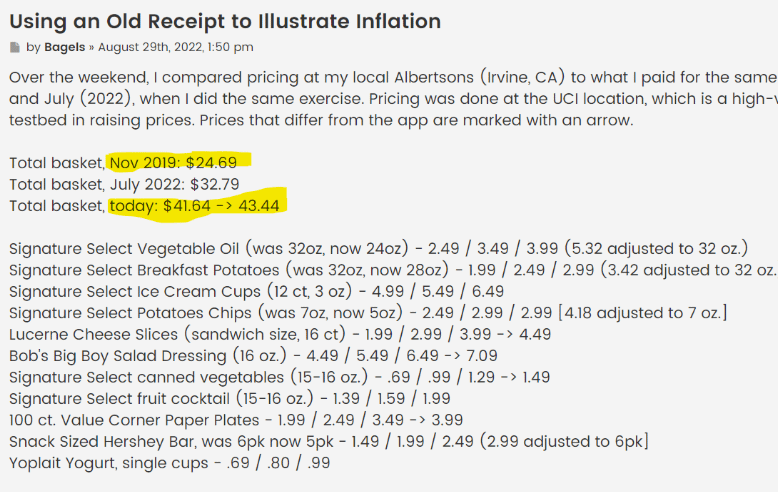

The food CPI may have risen 13% YTD; at Safeway that number is more like 76%

Here are the literal receipts retailwatchers.com/viewtopic.php?t=3382&hilit=old+receipt+inflation

But how can they story actually starts in 2006, when Albertsons went on sale. PE HellDogs bought 655 stores; Supervalu bought 1100

7 yrs later, Cerberus had QUINTUPLED their $ while Supervalu was begging for mercy. The difference?

Cerberus CLOSED 70% of the stores

The PE crew, led by Cerberus, would continue their "buy to close" strategy, acquiring Supervalu, Safeway & more than 3100 supermarkets in total over the next few years...

And closing nearly 1000 of them.

It gets scummier. A year after PE guys bought 877 more Albertsons stores for $100m cash ($114K per store!) they announced they were acquiring Safeway for $1.2 billion cash & $7.8 billion in debt.

Albertsons now had 2500 stores

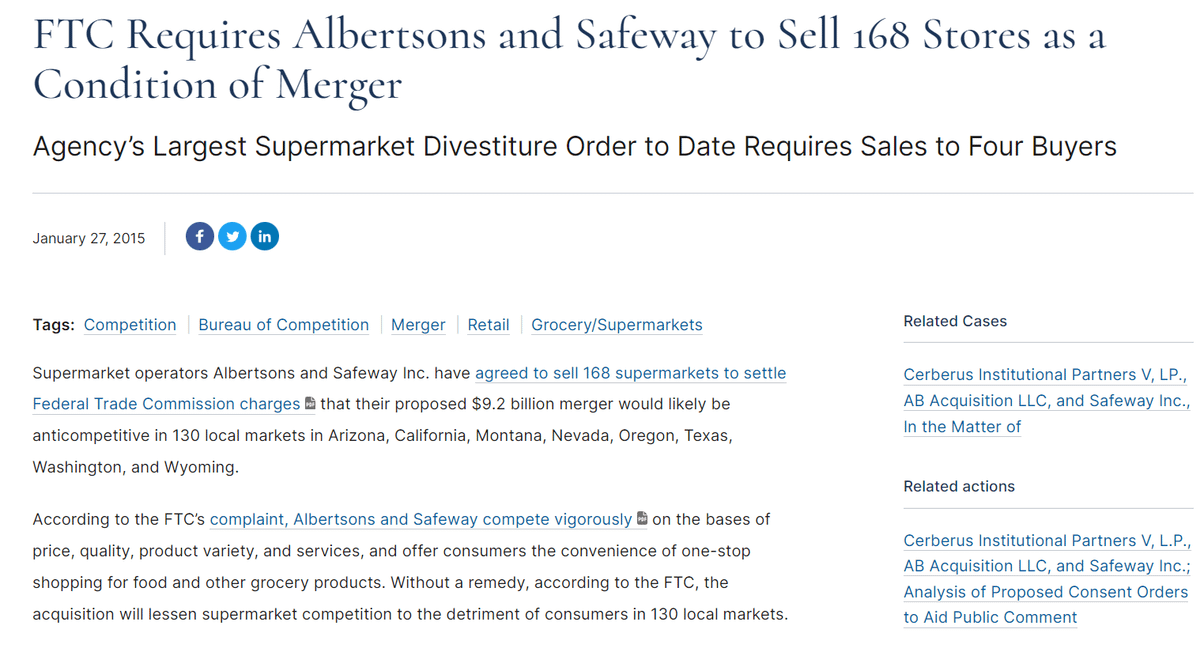

To appease the FTC, it agreed to divest 168

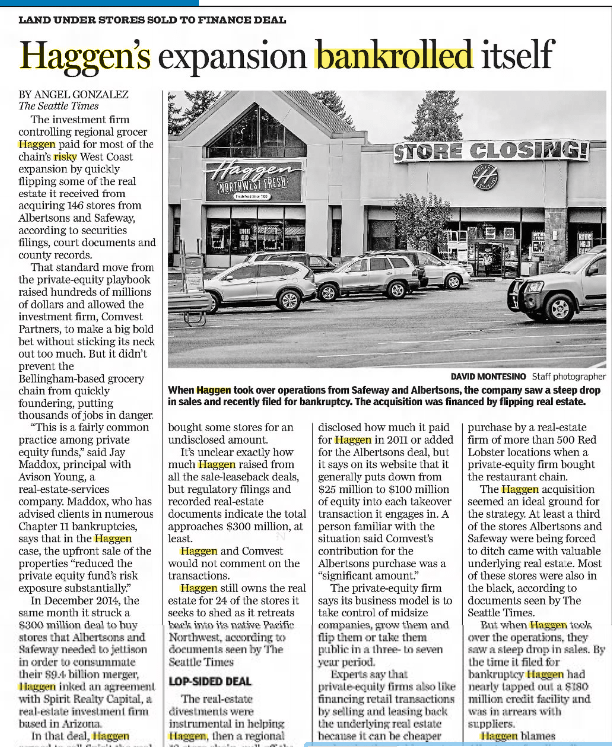

Anticipating the FTC action, Cerberus had already sold 146 stores to the regional chain Haggen for $300m.

Haggen then immediately sold the stores' real estate for..$300m.

Haggen owned 18 stores before this transaction.

Naturally, Haggen was also owned by a private equity firm.

The deal collapsed within weeks.

Haggen sued Albertsons claiming the bigger PE monster deliberately sabotaged their acquisition of the unwanted stores

But financing the transaction with 200% debt & leaving "execution" to a chain 1/10 the size was...also sabotage!

So anyway you'll be shocked to learn that.. the private equity HellDogs ended up buying back, dirt cheap in bankruptcy court, half the stores they'd just sacrificed for "competition"!

While the other half mostly just... closed!

A real Three Headed W for private equity!

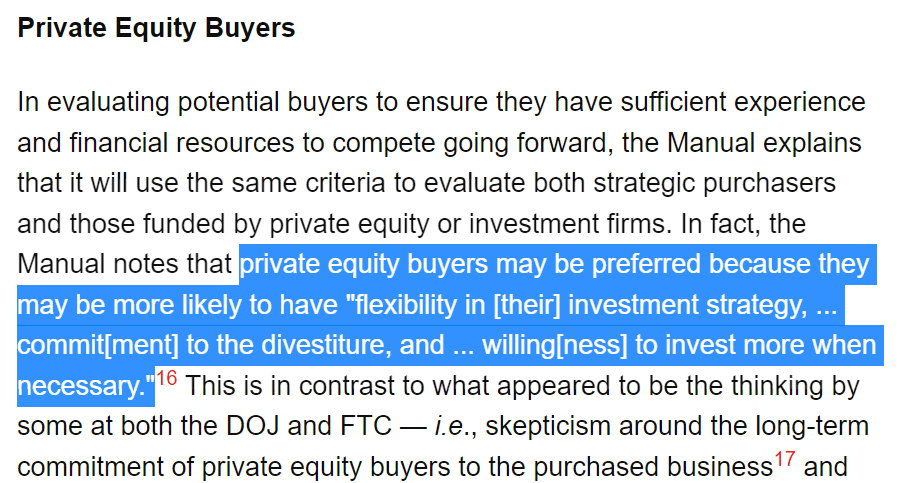

This is behavior you see a lot with hospital mergers.

Two scummy chains merge & the FTC "forces" them to "carve out" geographically overlapping assets and sell them off to "remedy" the blow to competition.

Scumbags pretend to be sad.

But IRL scumbags have a lot of power, esp if they divest assets to a thinly capitalized PE extraction vehicle, to sabotage their viability, leaving scumbags with EVEN LESS competition than they would have had w/o regulators

In 2020 the Trump DOJ advised antitrust regulators that

This is oc the tip of the iceberg of Cerberus's supermarket scumbaggery (to say nothing of Cerberus's hospital scumbaggery, or Apollo's non-Albertsons supermarket scumbaggery, etc)

They're also pension vampires, union busters & fee pigs. A great report:

pestakeholder.org/wp-content/uploads/2019/11/Private-Equitys-Biggest-Retail-Gamble-Albertsons-Safeway-UFCW-400-PESP-110619.pdf

What's mindblowing is how confident these guys seem that even with the most serious FTC in 50 yrs, regulators will ultimately prove to have learned nothing from their history of plunder, price-gouging and community-erosion

Here, look how they're addressing the "competition" thing