The Ethereum Merge has finally happened.

Is $ETH ultra sound money now?

What is projected inflation / deflation?

A short thread and a few simple graphs to understand ETH issuance, burn and ultra-soundness.

🧵👇

WHAT DOES ULTRA SOUND MEAN?

$BTC is considered as sound money because of the capped supply.

If $ETH has a decreasing supply, we can call it ultra sound (🦇🔊).

HOW CAN $ETH SUPPLY DECREASE?

- ETH is created via issuance to block producers.

- ETH is destroyed via fee burn mechanism.

If more $ETH is destroyed than created, the supply will decrease.

ISSUANCE VS BURN

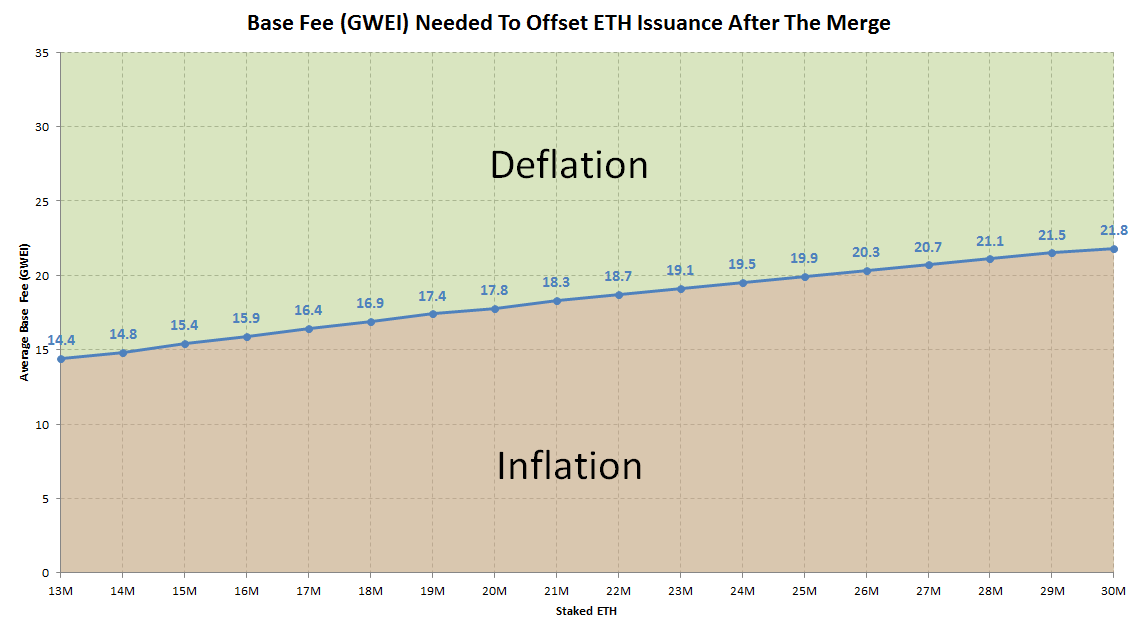

- ETH Issuance depends on the amount of staked ETH.

- ETH Burn depends on the activity on Ethereum.

The blue line shows the gas price (Base Fee, BF) which offsets ETH issuance for different amounts of staked $ETH.

Higher BF => Deflation

Lower BF => Inflation

WHERE ARE WE NOW?

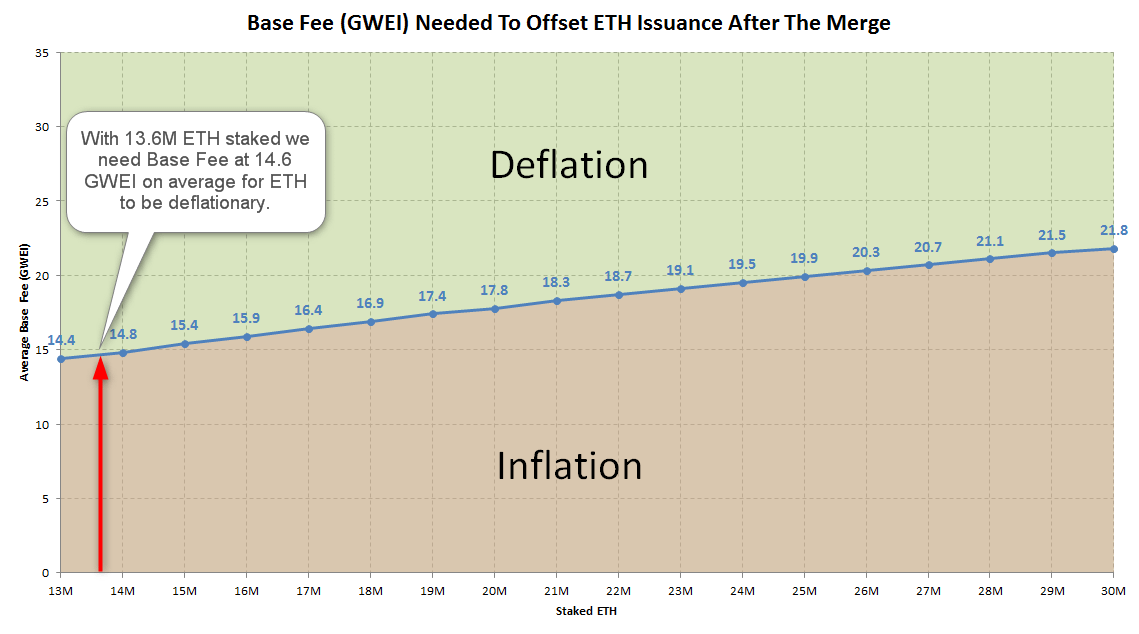

Currently 13.6M $ETH is staked.

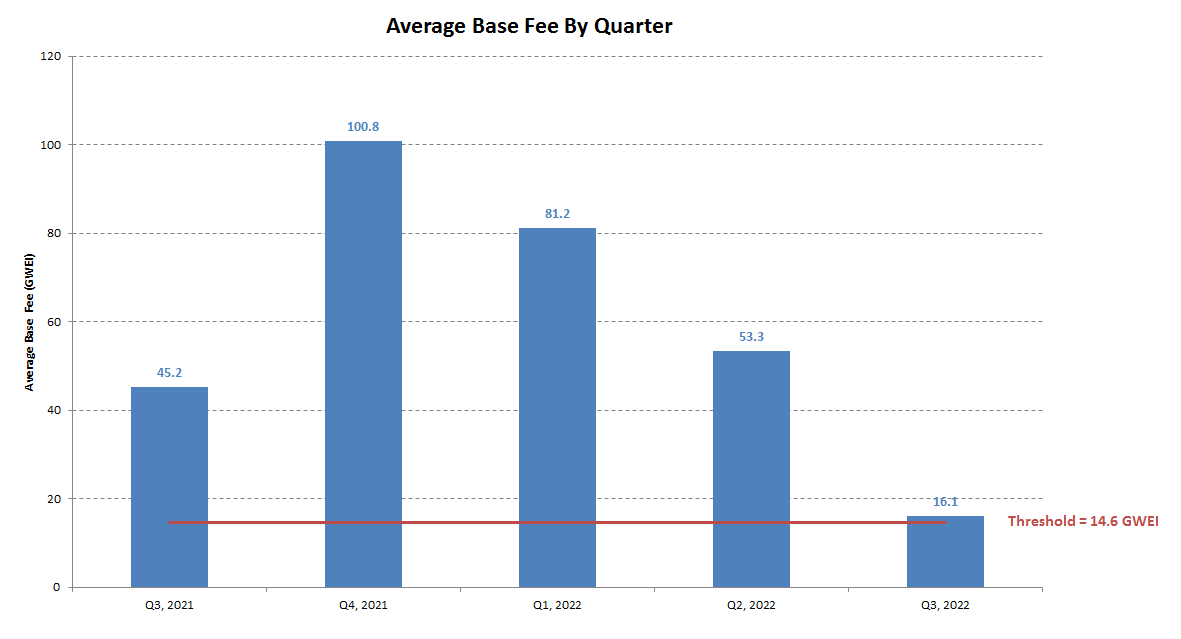

Base Fee should be at least 14.6 GWEI on average to offset the Proof-of-Stake issuance.

"On average" is a key term here.

It doesn't have to be higher than that all the time...

AVERAGE BASE FEE

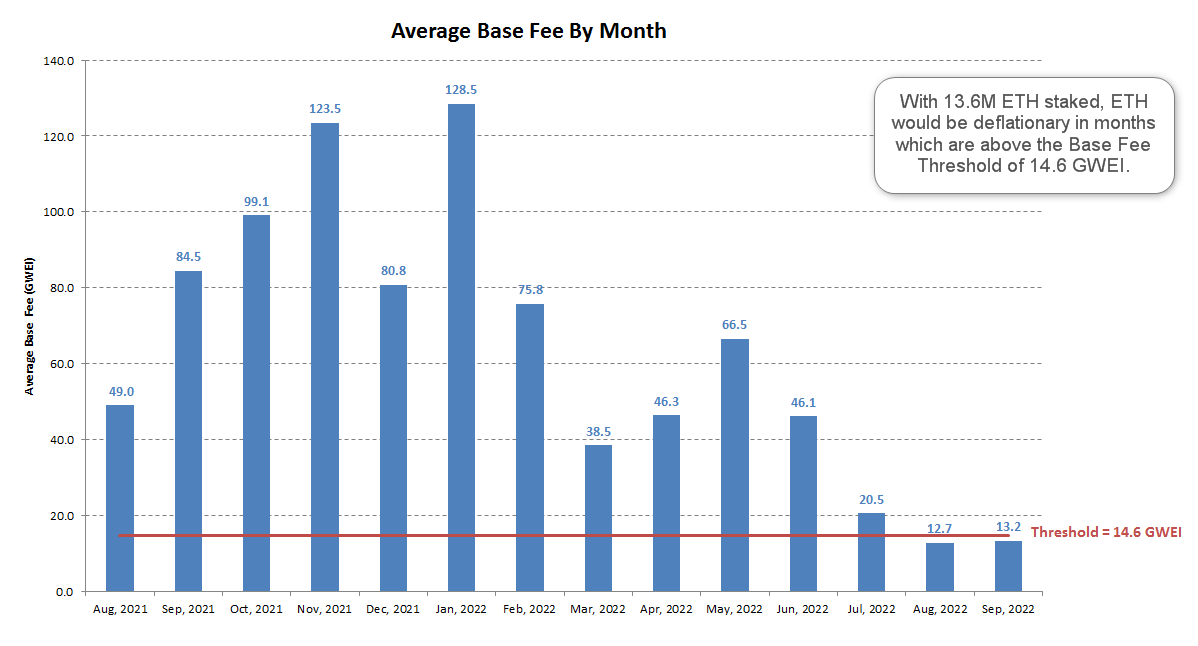

The Base Fee is volatile.

Sometimes it sits at single digits.

Sometimes a hyped NFT mint sends it to the stratosphere.

Average Base Fee by month tells us more:

- ETH would be inflationary in Aug & Sep, 2022.

- ETH would be highly deflationary in other months.

AVERAGE BASE FEE BY QUARTER

Inflationary days when we hear crickets on Ethereum are offset by deflationary days of peak fomo.

By aggregating data at quarter level, $ETH would be deflationary in all the quarters.

That's why we should only focus on the long term.

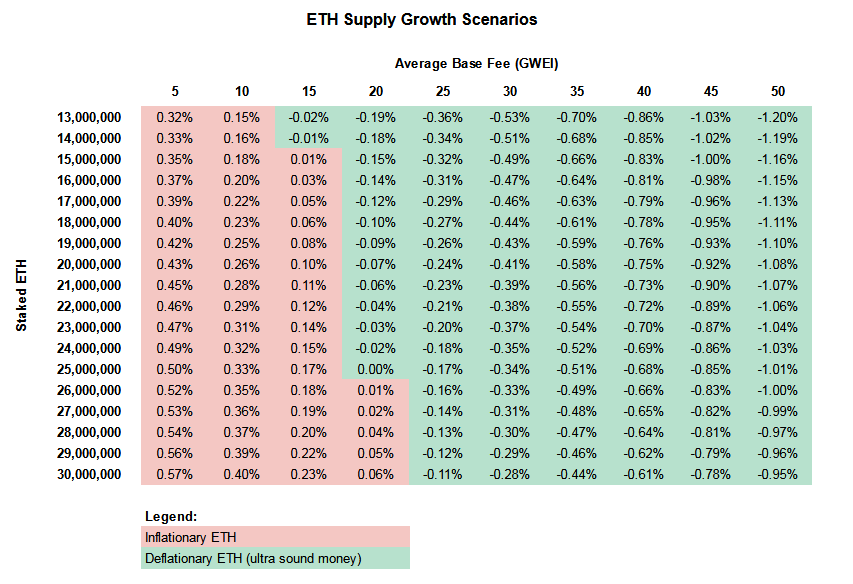

INFLATIONARY / DEFLATIONARY... BUT HOW MUCH?

Inflationary / deflationary are meaningless terms without figures.

The below table shows the annual $ETH supply growth for different levels of staked ETH and Average Base Fee.

Green cells represent ultra sound scenarios.

INFLATIONARY ETH STILL OUTCLASSES THE COMPETITION

Even if:

- Staked ETH more than doubles to 30M and

- Activity on Ethereum almost dies to 5 GWEI Average Base Fee,

$ETH inflation will be only 0.57% annually.

This is still much lower than $SOL, $AVAX, $ADA or $BTC.

CURRENT SUPPLY GROWTH PROJECTION

Annual inflation is projected now at 0.1%.

This is based on the last 30 days of low activity on Ethereum.

If we included the whole history of ETH burn, projected supply growth would be negative at -1.5%.

ULTRA SOUND OR NOT?

$ETH may not be 🦇🔊 now when activity on Ethereum is low.

But it's not far from it.

Anyway, does it really matter?

Even in the most inflationary scenarios ETH has lower inflation than other coins.

And when activity returns, 🦇🔊 is programmed.

The Merge has been the most significant Ethereum upgrade ever.

If you still have doubts, read this:

twitter.com/korpi87/status/1513459657381068812