Being early to a hot narrative is the simplest way to make OUTSIZED RETURNS.

Identifying this narrative is a bit more challenging...

I reviewed hundreds of pages in multiple crypto reports and made a list of 10 BIGGEST NARRATIVES for 2023 + related money making opportunities:

1⃣ ETH Withdrawals

Ethereum Shanghai upgrade (March) will finally enable ETH staking withdrawals.

This "derisking" event will eventually lead to higher staking participation and better competition between liquid staking protocols.

ETH Withdrawals Opportunity

Liquid Staking Protocols may have a good year.

Watch:

- @LidoFinance $LDO

- @Rocket_Pool $RPL

- @fraxfinance $FXS

- @stakewise_io $SWISE

I believe $RPL may outperform $ETH over the long term (a comprehensive thesis soon).

twitter.com/TheDeFinvestor/status/1610619795925254144

2⃣ EIP-4844

EIP-4844 (Proto-Danksharding) is Ethereum upgrade that will reduce rollup fees by 10x-100x.

This level of scalability unlocks many new use cases and deprives "Ethereum killers" of their low-fees selling point.

Planned go-live date: Q3.

twitter.com/rayzhueth/status/1585753237688197120

EIP-4844 Opportunity

Activity on rollups can grow massively.

Watch:

- @arbitrum

- @optimismFND $OP

- @MetisDAO $METIS

Arbitrum seems to be winning users' & devs' mindshare.

It has been thriving with activity and innovation.

No doubt next blue chip projects are built here.

3⃣ EigenLayer

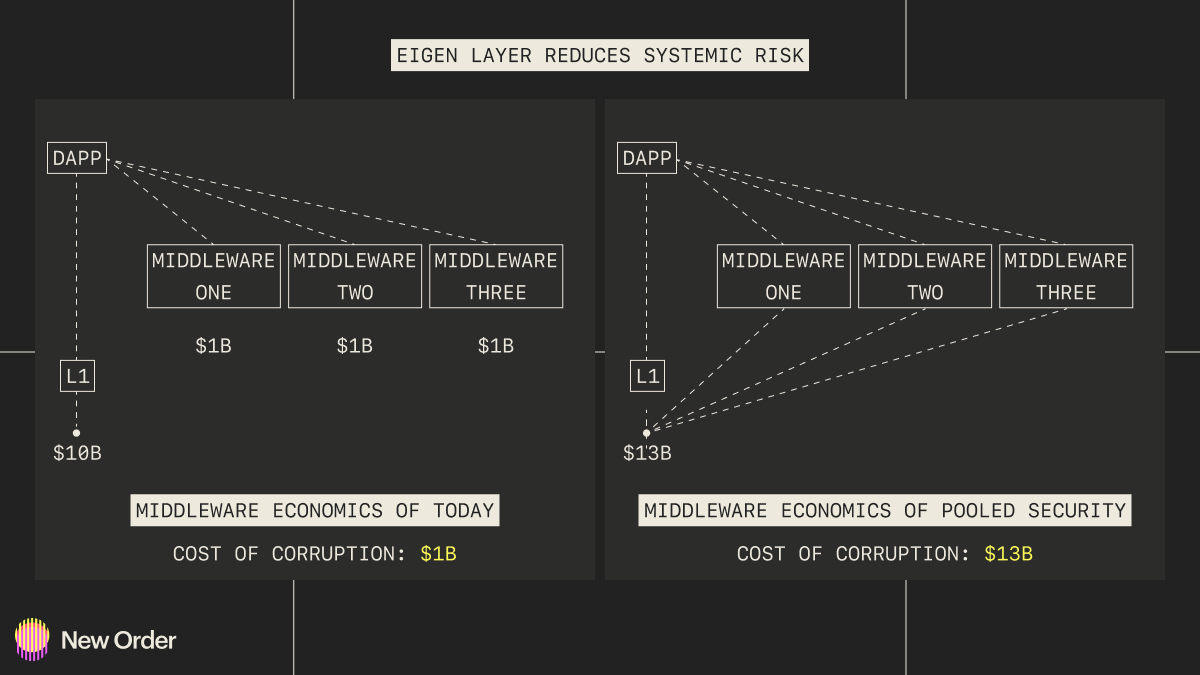

Through re-staking solution EigenLayer allows the same staked ETH to be used not only to secure the Ethereum network but also other apps and services.

Win-win:

- ETH stakers earn extra yield

- Infrastructure gets greater & cheaper security

twitter.com/OlimpioCrypto/status/1610013655311212544

EigenLayer Opportunity

No info on $EIGEN token yet but we know almost every project will have a token eventually so stay informed.

The main beneficiary of EigenLayer technology is $ETH.

Re-staking gives it even more utility and makes Ethereum ecosystem more valuable.

4⃣ zkEVM

zkEVM stands for Ethereum Virtual Machine powered by zero knowledge technology.

zkEVMs are Rollups like Optimistic Rollups but with fewer security assumptions due to cryptographic magic of zkProofs.

They are the Holy Grail of Ethereum scaling.

twitter.com/JackNiewold/status/1550600243888144384

zkEVM Opportunity

Plenty of teams compete to deliver zkEVM.

Watch:

- @0xPolygon $MATIC

- @Scroll_ZKP

- @taikoxyz

- @zksync

They raised capital at high valuations so airdrops may be substantial.

Participate in testnets, be active in Discords, provide feedback, etc.

5⃣ Layer 3s

L3s are aplication-specific chains built on L2s.

If L2 gets 100x cost reduction vs L1, L3 receives 10,000x vs L1 while still being secured by L1.

L3s can be customized for specific purposes which makes them serious competition to Cosmos.

twitter.com/ThorHartvigsen/status/1601925264656588800

Layer 3s Opportunity

Many rollups will develop technology for customizable L3s.

Time will tell which one attracts the most apps.

Which apps will want to become sovereign chains?

- Perp protocols following @dYdX's lead?

- Uniswap?

See app-chain thesis:

twitter.com/delitzer/status/1575497730343899136

6⃣ Account Abstraction

AA turns every account into a smart contract with its own logic.

It unlocks many use cases that were impossible before, e.g. social recovery, 2FA or batching txs.

Benefits:

- Better UX

- Greater security

- More flexibility

twitter.com/argentHQ/status/1582742559470014464

Account Abstraction Opportunity

AA will onboard new wave of blockchain users due to UX improvements.

Watch:

- @StarkWareLtd - zkRollup with native AA

- @zkSync - zkEVM with native AA

- @argentHQ - user-friendly wallet building on zkSync

No tokens so prepare yourself for 🪂

7⃣ Modular Blockchains

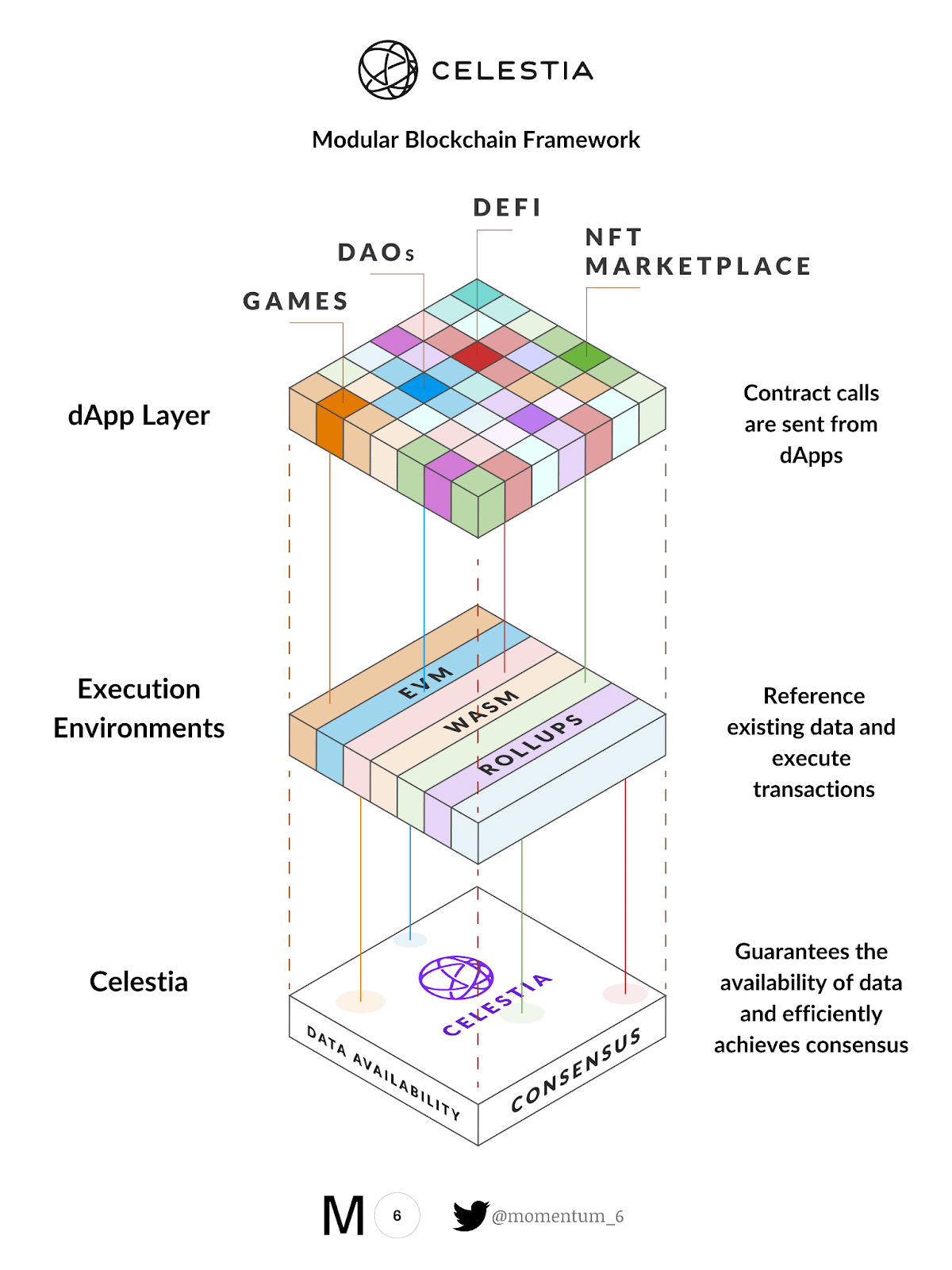

L1 blockchains do everything now: settlement, execution and data availability.

They have monolithic design and, thus, are subject to the blockchain trilemma.

Modular architecture splits the layers to achieve scale without sacrifizing decentralization.

Modular Blockchains Opportunity

Modular blockchain architecture is built by multiple teams.

Watch:

- @0xPolygonAvail $MATIC - modular data availability

- @CelestiaOrg - modular blockchain network

- @fuellabs_ - modular execution layer

Position yourself for potential airdrops.

8⃣ Omnichain

Bridges and wrapped assets proved to be highly vulnerable.

The future is omnichain.

With LayerZero technology assets can be moved between chains without bridges.

Benefits:

- Greater security

- More composability

- New DeFi usecases

twitter.com/Rightsideonly/status/1610498320480505856

Omnichain Opportunity

LayerZero technology is used by many protocols.

Watch:

- @StargateFinance $STG - liquidity transport

- @Tapioca_DAO - money market with leverage

- @InterSwap_io - AMM with unified liquidity

There is still no $ZRO token but...

twitter.com/OlimpioCrypto/status/1580543897222070273

9⃣ New DeFi Primitives

2021 was full of ponzis with little innovation.

True tech is built in bear markets, e.g.:

- Undercollateralized borrowing by @sentimentxyz

- Impermanent loss hedging by @GammaSwapLabs

- Borrowing with no liquidations by @VendorFi

twitter.com/korpi87/status/1602274664373329920

🔟 NFTFi

The new asset class requires its own financial ecosystem.

DeFi for NFTs (NFTFi) is built now, e.g.:

- Perpetual futures by @nftperp

- Fractionalized exposure to NFTs by @insrtfinance

- NFTs as collateral for a loan by @JPEGd_69 @NFTfi @BendDAO

twitter.com/0xminion/status/1562495502377431040

➡️ Bonus Narrative: AI

AI is a hot trend now that will only get hotter in 2023.

Many crypto projects will position themselves as AI-friendly.

Most of them are money grabs.

But there may be some true AI gems in crypto waiting to be discovered.

@bittensor_ $TAO - is that you?

Final Thoughts

A lot of innovative solutions are built now.

But we are still in a bear market so prices may not reflect that for a long time.

Be patient, stay focused and you won't miss the next big thing when bull market is back.